The SaaS Market Investing in AI in SaaS

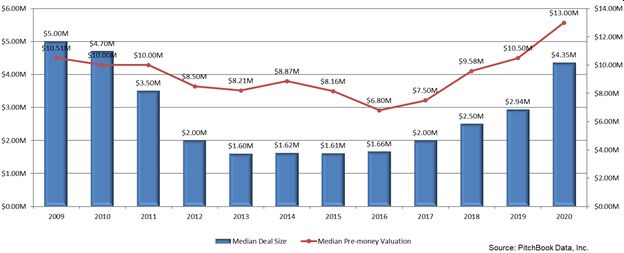

The high tech research firm, Gartner, projects SaaS industry growth to reach a market size of $143.7 billion by 2022. Finances Online makes the aggressive assertion that the percentage of companies running their operations strictly on SaaS will reach 86% by 2023. And private and VC investment in the industry as measured by Pitchbook continues to expand the size of SaaS deals and the size of pre-money valuations.

Investing in AI in SaaS

SaaS, providing customers the cost-effective capability of hosting their business operational applications over the cloud, dominates the cloud-computing market. Even though challenged by Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS), Software-as-a-Service (SaaS) retains its market leadership for a number of reasons:

- Cost effectiveness – Customers pay for only the service applications needed not expensive customized, enterprise software development and costly hardware.

- Accessibility – Mobile and internal access on any company device is basic to all SaaS platforms.

- Scalability – SaaS platforms are built to accommodate the growth of a company without incurring IT CAPEX.

- Increased collaboration: Inter-departmental communication and collaboration is facilitated by use of a common system for file sharing.

- Security – A company’s data is secure in Cloud SaaS, free from on-premise system failures and data breaches.

Major changes, however, are ahead for the pervasive SaaS industry. Disruptive factors are the unbundling of services, flexible usage-based pricing policies, and the impact of new technology advancements. Among the advancements coming to the industry are Blockchain, that can bring an added measure of transparency and the additional security of decentralized rather than traditional databases, Vertical SaaS, with a smaller total addressable market for more specific targeting than Horizonal SaaS, and Mobile First SaaS, for the companies running their businesses almost entirely from their smartphones.

There is one disruptive factor, though, that stands above all the others coming to SaaS. That is, Artificial Intelligence (AI).

The impact of AI on SaaS holds the promise of changing everything in the business process from HR and operational procedures to CRM.

Artificial Intelligence and Machine Learning in SaaS

AI, itself, is an industry several sources report being worth $15.7 trillion already. Yes, that’s “trillion,” as AI optimizes business processes and combined with Machine Learning, increases productivity and efficiency of repetitive tasks – presenting innovative options that enhance the speed and creativity of the human decision-making process.

In SaaS, AI can optimize solutions for business operations with high-speed automation to improve processes throughout the operations of a business. Personalization and responsiveness are the hallmarks. AI goes beyond the capabilities of SaaS to:

- Tame the complex – Performing tasks otherwise difficult for humans to handle.

- Enhance the level of customer service – AI chatbots enable companies to enhance the level of customer service.

- Provide hyper-personalized customer experiences – never before seen experiences now, with the promise of even more extreme personalization to come.

- Perform predictive analysis – Beyond recognizing data patterns to predictive modeling of future events.

- Speed up processes – Faster answers to customer questions/orders, make quicker forecasts. Generally, speed up the company’s level of responsiveness.

- Enhance SaaS Security – With the ability of machine learning to recognize patterns, threat identification/remedy and self-recovery are built-in.

Guidance Into This Fast-Paced Territory

The basis of our vetting process before making recommendations to our clients about seed or Series A, B rounds in AI/SaaS companies, we subject a prospect to our internally vetting process, in order to set investor expectations, ensuring they are not overpaying, and ensuring the AI company has validated data in the data lockbox. Key issues examined are:

- The Right Playing Field

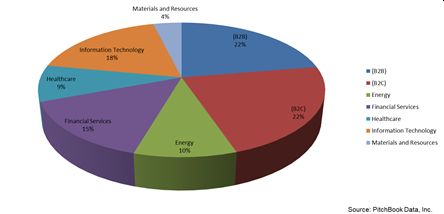

The first step is an assessment of the SaaS services a company intends for the industry segments attracting the largest share of capital. One useful measure can be found in Pitchbook in terms of the segments attracting the most VC and Private Equity funding. An investor should be aware of where a prospect intends to market relative to where the smart money is going.

From Private Investment and VC’s

- A Proven Revenue Model

For the critical metric of Customer Acquisition Cost (CAC), we would expect payback in less than two years. AI-powered SaaS services are going to be more costly than traditional SaaS products. So, a strong value equation must be evident supporting long-term ROI on the basis of KPIs like Customer Lifetime Value, Customer Retention (the opposite of a high Churn rate) and positive results reflected in the basic financial models – gross revenue, EBITDA and Cash Flow. Other key metrics in SaaS company evaluations: Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), Annual Contract Value (ACR), as well as Customer Funnel Metrics. Critical in an assessment is how quickly and effectively a company acts upon key metric findings.

- Data collection advantage

Can proprietary data be accumulated fast enough to preempt well-funded competitors from getting to market sooner with a better algorithm?

- Key IP Owned…

…From patents to trade secrets and domain names. Is the IP secure? Has the source code been thoroughly documented?

- The Competitive Landscape

What is a company’s understanding of the competitive landscape, their place in it, their differentiation?

- Voice of the Consumer

As you can imagine, listening to the target consumer is critical in the SaaS industry – not only for initial product development, but also for on-going product improvement as AI in SaaS becomes more commonplace.

- Product Positioning

Product lifecycle analysis and management is particularly critical in SaaS, in general, as it is in AI-powered SaaS. This is due to much shorter time frames for new releases as well as upgrades and fixes to stay ahead of intense industry competition. How management is handling/is prepared to handle this is a critical factor in an effective investment opportunity analysis. Investing in AI in SaaS

- Pricing Policy

Traditionally, the business model of SaaS companies was to offer flexible pricing structures focused, though, on adequately covering their own development and design costs as the foundation of the model. Today, however, competition, industry saturation and the rapidity with which SaaS platforms can be developed has caused the shift for pricing models to be based on the needs of the customer. We look for pricing structures that are based on customer metrics for more customer-centric pricing solutions.

Summary – Takeaway

The future of SaaS is clearly in improving not only business procedures, but also creating customer intimacy along their journey toward brand loyalty. AI-optimized SaaS provides new automation solutions that are ushering in more responsive internal operations and more personalized customer services. In the final analysis, of course, we are looking for risk mitigation and value for the money in assessing the emerging opportunities in AI in SaaS. Value that is best represented by the software solution that meets customer needs on a sustainable basis and has the potential of being the most sustainable return until exit for our investors. Investing in AI in SaaS

How We can help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in SaaS and other IT segments as well as our core expertise with highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Cannabis and CBD/hemp companies. These are thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client