In a recent article in the EDGE Briefing we reported a potential looming problem for the vape industry, the issue of secondhand smoke. Now cannabis indoor cultivation is facing a challenging and complicated issue – Greenhouse Gas (GHG) emissions. Should Greenhouse Gas Emissions

As previously reported in the EDGE Briefing, while COVID-19 shuttered many traditional businesses, more cannabis than ever before was consumed in the U.S. in 2020 – a record $17.5B in legal sales – a 46% increase from 2019, according to a recent report cited in Forbes published by BDSA. All indicators point toward a record year in 2021 as capital is flowing more readily into this formerly cash-constrained industry. Yet, there is an elephant-in-the-room issue – the problem of GHG emissions that requires industry action for the immense revenue projections to be realized.

The Conundrum

States and Cities all across the county are counting on being revived by the taxes on the billions of dollar that are generated by cannabis legalization. What they have not been willing to face, however, is that cannabis production generates a size extra-large carbon footprint. These state and cities are sacrificing their goals of drastically reducing their GHG emissions. Big Think harshly sums up the conundrum with the quip: “Hippies finally got their legal weed at a high cost to the environment. How Faustian!” Should Greenhouse Gas Emissions

The challenge facing the cannabis industry was brought out in a detailed research report issued by Colorado State University (CSU). The study, first published in Nature Sustainability on March 8th of this year, states that indoor cannabis cultivation is a major generator of GHG emissions. In just the state of Colorado alone the researchers at the university estimated that indoor cannabis grows emitted 2.6 million tons of GHG emissions annually. That is the equivalent of the annual tailpipe emissions of 520,000 motor vehicles. Another way to look at it is that cannabis indoor cultivation accounts for 1.3 per cent of the state’s total GHG emissions. For context coal mining in the state accounts for only 1.8%.

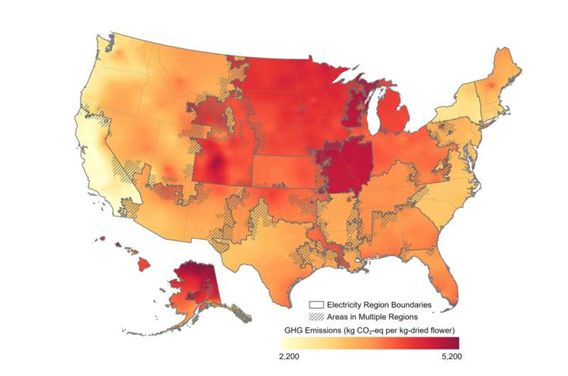

General concern about the growing carbon footprint of the cannabis started to appear in the press as early as 2013, but the CSU research put numbers to the facts that the cannabis industry already knew. Beyond just the State of Colorado, the study analyzed energy consumption by over 1,000 warehouse cultivation locations all around the country in order to pick up the regional differences that exist within the industry. The energy consumed by indoor cannabis grows in each area surveyed was compared against a grid mix of local electricity generating sources; which range from or included electricity from coal or nuclear generation, from natural gas to hydroelectricity. And, to paint a complete picture, “upstream” elements like the use of fertilizer, transportation, distribution were included in the calculations.

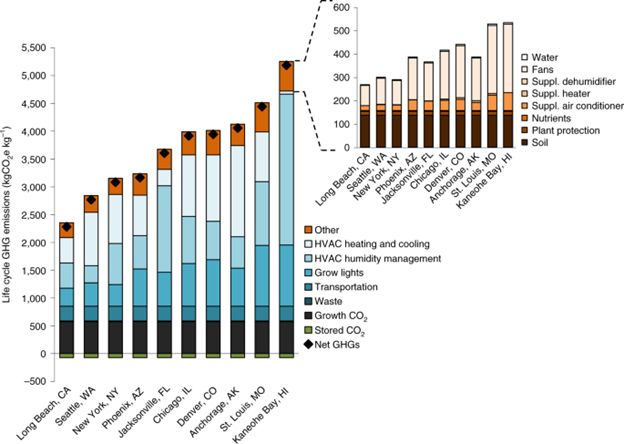

The study found that one kilogram of cannabis flower, dried and ready for distribution, produces between 2,283 and 5,184 kilograms – depending on the region in which it is grown – lowest in Long Beach, CA, the highest in Hawaii – of CO2. Smithsonian Magazine translates this into the equivalent of burning 7 to 16 gallons of gasoline. And, CannabisTech states that in comparison, beef production, which is primarily considered one of the worst foods for the planet in terms of greenhouse gases, produces only 60 kg of emissions per kilogram.

Last year the marijuana seed bank organization, Dinafem, estimated that cannabis cultivation consumed 1.1 million MWh of electricity and produced 472,000 tons of CO2 emissions – enough to power 92,500 homes or 92,660 cars for a year.

Like most states where cannabis is legal, the majority of cannabis cultivators in Colorado operate either entirely or partially indoors. Like most other legal states, Colorado has no regulations requiring energy efficient practices for warehouse cultivation. And, compounding the problem, cannabis cultivators in Colorado do not qualify for state programs that benefit other industries by offering assistance to reduce carbon footprints, as the Colorado Commercial Property Assessed Clean Energy program does. This is because that state program is underwritten by the federal government, which still officially considers cannabis a Schedule I narcotic. Should Greenhouse Gas Emissions

The CSU study measured GHG emissions levels across the country by equating it to the power demands of indoor cannabis grows, showing the fluctuations related to local climates.

The study found that greatest contributor to the problem of such high CO2 production was Heating, Ventilating and Air conditioning (HVAC) and lighting systems. These two systems, absolutely vital to growing cannabis indoors, account for 89 per cent of the energy used in the cultivation process. The HVAC is required to process a high air exchange rate because large volumes of fresh air need to be brought into the warehouse grow to maintain oxygen levels for healthy plants and to moderate humidity. High intensity indoor grow lighting systems are on 24/7 in the various grow rooms with controlled lighting based on the stages of plant life.

Then, Why Not Outdoors?

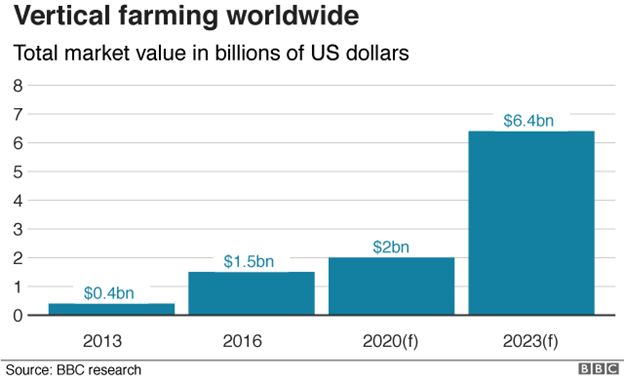

Preliminary investigations into shifting indoor cannabis cultivation to greenhouse and outdoor grows indicate that GHG emissions could be cut by anywhere from 42 to 96% respectively. So, isn’t simply moving cultivation outdoors a no-brainer? Well, not so fast. There are hurdles that would have to be overcome in the form of regulation revisions, scarcity of suitable land, water shortages, climate, quality control and consumer preference. In fact, land and water scarcity are what has led to the move of agriculture cultivation indoors in the first place. Using soilless systems for “vertical (indoor) farming” is now a USD 2 billion industry and projected by BBC Research, New York, to reach > USD 6 billion in 2023.

Control of product quality over the course of the increased amount of harvest cycles indoors is a major advantage over outdoor cultivation. Indoors suffers from no vagaries of the weather. Temperature, humidity, light, water, fertilizer, insect control, even security issues are regulated for the maximum efficiency of the crop. And, consumer preference is more likely as indoor flower has a more counter appeal.

Indoor v. Outdoor is not an apples-to-apples comparison either. Researchers don’t actually know the GHG emissions attributable to outdoor growth. Moving cultivation outdoors creates new environmental concerns from water diversion and pesticide runoff to soil depletion with crop rotation. Nevertheless, the biggest problem remains the vagaries of state and federal regulations. Many states require cannabis production to be in the proximity of its dispensing/retail location. And, the most efficient farmland across the country cannot be utilized for the benefit of optimum commerce since federal law does not allow transportation of a Schedule I narcotic (still the classification of marijuana) across state lines.

What’s Ahead?

Where is this headed relative to your cannabis investment? States are taking actions to require and to aid the process of more energy-efficient cannabis cultivation. In Colorado the governor has placed addressing the environmental impact of cannabis production as a priority of his administration this year. The direction he is taking is the enforcement of reduced energy use with the implementation of energy-efficient upgrades for cannabis cultivators. California is the first state to require cannabis growers to operate all indoor facilities using LED grow lights by 2023. Illinois limits the intensity of lighting systems and requires indoor grows to use only high-efficiency HVAC equipment. At the federal level, the industry is still anticipating the day when full legalization is granted so that cannabis growing locations can be concentrated in locations of the highest crop efficiency, then transported across the country.

The CSU study says that three players in this drama are key to providing a path toward an environmentally sustainable industry: cannabis businesses, governments, and consumers. The report calls for governments be more willing to draft legislation that allows cannabis operators to adapt and benefit from the implementation of energy-efficiency best practices. And, consumers should become more cognizant of the issue, shifting preferences to producers active in seeking to lower GHG emissions. While that is not easy for consumers to ascertain now, the more widespread the use by manufacturers of consumer-facing CO2 labels on branded products becomes, the more emphasis will be placed on cannabis products stepping up to the course-correction the industry is facing.

The Impact on Your Cannabis Industry Investment

Making sure the cannabis company you are investing in has an active plan to reduce GHG emissions is vital to prepare as the debate over the carbon footprint of the cannabis industry intensifies. The chart below enables you to trace just how vital the carbon footprint issue is likely to become in key areas across the country. The full range of GHG emissions results is shown – the minimum in Long Beach, CA, the maximum of Kaneohe Bay, HI.

Energy Saving Alternatives

In looking for answers for the ways indoor cultivation can mimicking the outdoors here are developments in energy saving alternatives as reported by Dinafem that are intended to mitigate the GHG emissions problem:

- Renewable Energy Sources – In addition to solar and wind power new technology from startups like Scale Energy Solutions are creating hybrid systems with proven energy-savings results. The Scale Energy system combines solar energy with natural gas for a potential electricity bill reduction of up to 35 per cent. They also have the capability of using excess heat from generators to power chillers.

- Vertical Grow Farming – maximizes the indoor growing area by stacking plants in tiers. This in combination with more efficient LED lighting, can reduce electricity use by up to 75 percent compared to the use of high pressure sodium lamps.

- Dehumidification Systems – Dehumidifiers and fans are the second highest offenders in terms of energy use in indoor cannabis production. Now, specially designed dehumidification systems are designed not to release heat into the grow space. Before the HVAC had to work harder to handle this heat. Energy savings between 30 and 65 percent can result.

- Water Recycling – even though a single adult cannabis plant may need up to 23 litres of water per day, watering indoors is not as big a challenge as it is outdoors. Water used indoors can be recycled using innovative methods like reverse osmosis. Another sustainable agriculture resource, GrowX has developed a hydroponic system that incorporates sensors to adjust nutrient doses through the fiber irrigation system that are measured to the specific needs of each individual plant.

- LED lamps – can be up to 60 per cent more energy efficient than other lighting systems. And, while high pressure sodium lamps are comparatively efficient, their initial purchase price can be prohibitive. Heat reduction is another advantage of LED lighting which reduces the need for ventilation.

- Enhancing Artificial Light – using natural light with infrared polyethylene covers, which absorb and retain infrared energy ensuring higher night temperatures through natural light contributes greatly to energy saving in greenhouses. Advances like this could coax more indoor growers to venture outdoors.

- Harnessing Sunlight – On the issue of more efficient production of cool lighting, experts agree that utilizing the sun as much as possible is the ideal. That is because of the exorbitant cost of powering high-intensity grow lights. The Energy Policy report by ELSEVIER finds that Lighting intensities for cannabis plants can be 50–200 times higher than a typical office setting and are run for 12, 18 or 24 hours, depending on the stage of the plant life cycle.

About Harnessing the Sun

To the many advantages of indoor agriculture – providing the ultimate year-round crop production and quality while using only 1% of the water, crop acreage, and transportation energy – there is one major obstacle. All prominent systems are dependent on electric lighting. This affects the optimization of both lighting and temperature control in grow facilities. The increasing demand from indoor farming for long-lasting, energy-efficient and economical grow lights has led to government and private sector initiatives to support technological advancements in LEDs. To this point, however, even the most modern LEDs consume massive kWhs of electricity relative to crop economic value and require huge upfront CapEx investment per square foot. In search of alternatives a World Wildlife Fund study revealed that the agriculture industry could shrink its carbon footprint substantially by using fiber-optic technology that can bring sunlight indoors as a renewable energy source.

One such company in the fiber optics field, SunPathTech.com , has developed a patented daylight delivery platform that harnesses the power of pure spectrum sunlight indoors. The technology startup claims a higher yield per plant/per square foot at a lower running cost than traditional LED and HPS lighting while producing healthier and higher quality yielding plants. The company is collaborating with several groups to implement this breakthrough technology. As emphasized by Joseph DiMasi, CEO of SunPath, “Both sustainable crop production and sustainable energy production are critical technologies to meet the 21st century challenges of population growth and climate change.” Indoor agriculture has becoming a prominent factor in meeting that challenge and is currently attracting tens of millions of dollars in VC, private investor, and M&A support.

The report issued by CSU that has garnered so much attention lately was not intended to be a damning criticism of the cannabis industry. Instead, the researchers intended it to be a tool from which policy could be enacted and best practices could be established for a more energy-efficient industry in the future. Should Greenhouse Gas Emissions

Finding The Right Fit for Your Investment Strategy

Given these considerations, here are key factors we examine in order to guide the investors from our network as they examine cannabis investment opportunities:

Getting Down to Business Goals

The goal is always to thoroughly understand the investment needs and objectives of both buyer and seller to develop productive relationships that lead to successful transaction outcomes.

Real Value in the Marketplace

We determine ROI potential with well-substantiated valuations. We guide operators through the vetting process our investors expect for the best opportunities from potentially high rates of return while saving time and creating valuable investor-operator relationships. Should Greenhouse Gas Emissions

“Choke Point” Advantage

As legalization at the federal level becomes more likely, strong brands with protected IP and a scalable leadership position in the market will win. These “winners” will be differentiated from a growing list of cannabis companies licensed under the current patchwork of state-by-state regulations who will be forced to compete as a commodity and ultimately be marginalized and pushed out of the market.

Expert Management Team

The nascent legal cannabis industry is moving at high speed toward professional management with the expertise to build unique IP and brands that dominate the market. Survival tactics employed by managers who have operated in the gray market often do not translate well in the openly competitive legal marketplace. How well management is preparing for the future challenges facing the industry, such as the pressing GHG emissions issue is a key consideration.

The Right Time / Most Advantageous Cash-Infusion Partner

The trend of increasing legalization will continue to attract more sophisticated competition and investors. Our systematic process is designed to match the right investors and M&A partners with the right operators whose objectives and scalability are a fit for their portfolios.

Investor Takeaway

With record sales in 2020 the cannabis industry is growing well beyond all expectations. With that growth the debate over the environmental impact of GHG emissions will only grow in intensity. In an industry where cannabis cultivation consumed 1.1 million MWh of electricity and produced 472,000 tons of CO2 emissions – enough to power 92,500 homes or 92,660 cars for a year, major improvements in energy-efficiency must now be a top priority. The issue has surfaced anew after a study by Colorado State University put numbers to the problem with indoor cultivation that the industry has known existed all along. What can be done about it to protect/enhance your cannabis investment? The use of energy in production accounts for over half the price of wholesale cannabis. Energy efficiencies are vital to maintain profitability as market prices for cannabis products fluctuate with the market. It would likely translate into lower consumer prices making the industry more competitive as it matures. And, in the final analysis, reducing the industry’s carbon footprint will not only reduce production cost, but will also have a positive impact on the planet as well. Should Greenhouse Gas Emissions

Next Step – Category Expertise NeededWith capital finally flowing more freely into the cannabis industry there is no better time to establish your position and get your targeted business to come out a winner among those destined to struggle for survival. A talented deal team with direct experience in cannabis is essential. Expectations for performance are important to clarify at the beginning of the process along with a clear understanding of the compensation the advisors will receive for the extensive services rendered. At Highway 33 Capital Advisors we stand ready 24/7 to provide the guidance our clients seek. Should Greenhouse Gas Emissions

How We Can Help

We excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.