Yes, the Cannabis Market is Growing Beyond Wildest Expectations Cannabis Industry 2021 – Explosive Growth…

Wow. 2020 was indeed a boon for cannabis sales, aided by the demand increase brought on by coping with the pandemic. Besides literally winning the 2020 national election, legal cannabis product sales in the U.S. were predicted to reach as high as $15 billion last year. Instead, Leafly, a major cannabis industry information resource, reports that 2020 legal cannabis products sales exceeded 2019 sales by 71%, for a total of $18.3 billion.

At the beginning of the pandemic last year no industry was more concerned about a mass shutdown than the cannabis industry. Instead, 28 states where it is legal declared cannabis an essential business. Dispensaries responded by making a number of COVID-safe options for pick up and delivery available to customers. And, customers responded by setting new consumption records. This was not just a case of new states opening up and new consumers and patients accessing medical and recreational marijuana for the first time. A primary driver was the fact that existing users increased the size of their average purchase by 33%. In fact, according to Leafly, nine legal states – Arkansas, Connecticut, Florida, Illinois, Maine, New Jersey, North Dakota, Ohio, and Pennsylvania – actually doubled their sale volume in 2020 over 2019. Cannabis Industry 2021 – Explosive Growth…

As we reported in last week’s issue of the EDGE Briefing, while COVID-19 shuttered many traditional businesses, more cannabis than ever before was consumed in the U.S. in 2020 – a record $17.5B in legal sales – a 46% increase from 2019, according to a recent report cited in Forbes published by BDSA, a cannabis sales data platform. This was aided by the unprecedented step taken by 28 of the legal cannabis states where dispensary operations were classified as “essential businesses.” Cannabis Industry 2021 – Explosive Growth…

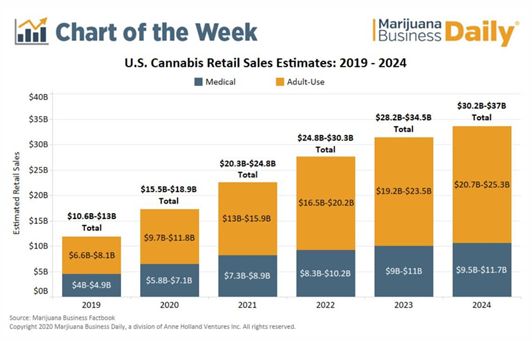

Marijuana Business Daily tracks/projects the growth of the industry in this manner…

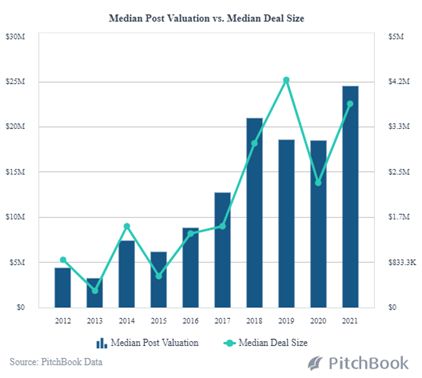

While Pitchbook is seeing dramatically rising median post valuations and deal sizes in privately owned cannabis companies backed by VC or PE investment as we progress into this very active year…

What’s Driving This Accelerating Market Growth?

Overall in 2020, capital flowing into the cannabis industry dropped to $4.2 billion from $11.6 billion in 2019, and the even higher level of $14.2 billon in 2018, as reported by Viridian Research. Yet, just in the first two weeks of January cannabis companies in North America raised over $619 million. All indicators point toward a record year in capital flowing into the industry.

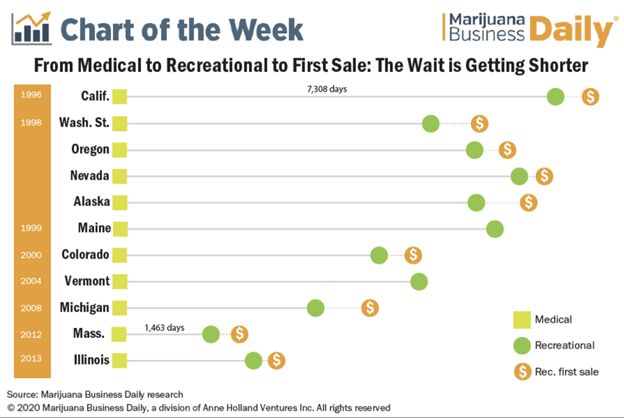

While Gallup found that 68% of the U.S. population favors legalization, Marijuana Business Daily calculated that the time a medical marijuana state expands to recreational adult use is becoming shorter and shorter:

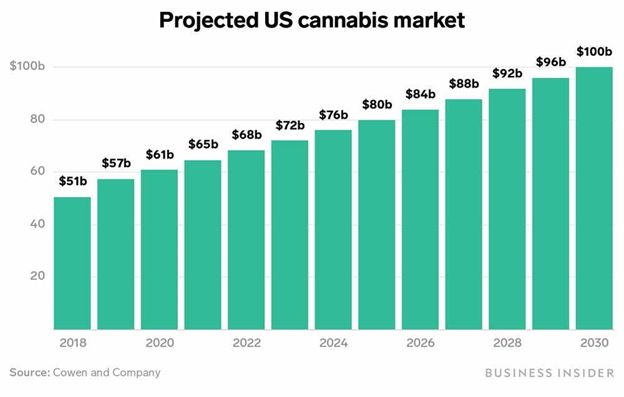

Reinforcing the Business Insider statistics that put the worth of the total cannabis market in the U.S. in 2020 at $61 billion:

Vaping – A Case History of Industry Versality

There remain reasons for caution as our investors seek guidance from us regarding entering the industry. After all, there was the Vape scare in 2019 that looked like a substantial industry setback. The following provides insights on how the industry responded and what may still be another unforeseen challenge likely to test the versatility and affect the value of your investment in a cannabis entity. Cannabis Industry 2021 – Explosive Growth…

Vape Stumble and Recovery

Keeping up with the trend of the cannabis industry’s hockey stick trajection, vaporizers – battery powered devices for aerosolizing THC and CBD oils – are setting a record pace into 2021. According to TMCNet.com:

Indeed, the vape industry’s growth has been so emphatic, that by 2027, the global e-cigarette industry is predicted to be worth an enormous $67 billion. The impressive growth of the industry has been largely driven by the public’s enthusiasm to quit smoking, with around 54% of vapers being ex-smokers in 2019; it’s expected that this figure will have risen since then. Cannabis Industry 2021 – Explosive Growth…

The vaping industry, according to Grandview Research, has formed various associations such as the American Medical Association (AMA), Consumer Advocates for Smoke-Free Alternatives Association, and Food and Drug Administration (FDA), to combat the policies against vaping products and to regulate the industry. Cannabis Industry 2021 – Explosive Growth…

Why does Vaping Maintains its Popularity?

Vaping is, of course, a consumer-inspired creation to the problems related to smoking combustibles. Advocates promote vaping as an alternative to smoking because:

- Vaping involves no combustion, or burning. Users exhale vape aerosol completely free of the carcinogens found in cigarette smoke.

- Vapes do not create the harmful tar that causes cigarettes to be so hazardous to public health.

- Vape liquids do not contain the wide range of dangerous chemicals present in traditional cigarettes.

- In terms of pesticides, for instance, Raw Garden claims their vape cartridge is cleaner than organic strawberries.

Legal Vape Guilt by Association

Statistics from BDSA show that sales of THC vape cartridges peaked in the summer of 2019. Then, however, the VAPI crisis hit and sales plummeted, while public and regulator outrage sky rocketed. During that summer 68 users were reported killed as a direct result of the lung damage from vaping and over 2,800 others were severely injured. The CDC intervened and labeled the problem an epidemic. VAPI, though, turned out to be non-infectious. And, after a thorough investigation by the cannabis industry information resource, Leafly, it was substantiated that toxic cutting agents in vape cartridges sold on the illicit THC market was to blame. THC oil had been diluted with high amounts of cosmetics creams, vitamin E oil and squalene. Testing vapes manufactured in legal states proved them to be ten times safer than those available in illegal states. Cannabis Industry 2021 – Explosive Growth…

Once the vapes from the illicit markets were identified as the root of the problem, the legal industry responded to the consumer demand that no additives or cutting agents be used in the manufacturing process. This has calmed the fears of established vape customers and does not appear to be a deterrent to the new customers coming into cannabis use.

Today, though, existing and new customers are demanding safer, higher quality products as they are more conscious about what they will be ingesting. More rapidly now the old standard, cannabis flower, is giving way to products made from distillate and oils – all designed, by the way, to avoid smoking. The three fastest growing product categories now in cannabis: Vapes, Edibles, and Beverages. And, these vape pens have resurfaced as the fastest growing segment in the industry. Edibles, like other alternatives in the concentrates category increased in sales by 40% in 2020, YOY 2019. They are advancing on the heels of vapes and appear to be the preference of the non-smoking customers, primarily female, who make up the majority of the new customers coming to cannabis. According to the industry research resource, Headset, women now have caught up with male cannabis users and make up 50% of all cannabis users.

To this point in time cannabis beverages are trailing both vapes and edibles but may gain ground as they become a replacement for alcohol drinks. Flavor quality, for now, remains a key challenge, although estimates are that cannabis beverages surpassed $200 million in sales in 2020, as they also become known for being healthier than sugary energy drinks and provide a quicker kick than edibles.

Is There Another Challenge Ahead for Cannabis Vapes?

Beginning in the ‘70’s, Big Tobacco ignored warning signs that a crisis of far-reaching proportions would shake their industry to its foundation. That crisis, the specter of secondhand smoke. The tobacco industry has paid a high price for not addressing the issue effectively. Now, consumer advocates are beginning to put vapes under the same microscope – to determine any potentially harmful effects of secondhand smoke from the use of vaporizer devices.

The Secondhand Smoke Issue

There are, of course, major differences between vape “smoke” and cigarette smoke. Primarily, vape smoke is not smoke, since there is no combustion. More properly, vape smoke can technically be classified as an “aerosol.” Vaping devices produce clouds of vapor, which is generated by heating the e-liquid with an atomizer. The atomizer has a small metal coil which turns it into vapor. Cannabis vapes contain none of the tars, nicotine, carcinogens emitted by cigarettes; none of the nicotine contained in eCigarettes. Consumer studies have found, nonetheless that vape aerosol may contain minute particulate that could be inhaled by others. A study reported by Molekule concluded that secondhand vape in public places and inside your home can affect the air you breathe.

The same pollutants from vaping that you will find from everyday activities like cooking or burning a candle. For better indoor air quality, you can prevent the source of pollution and ventilate your home during activities like cooking or painting.

AA Pain Management clarifies that:

The vapor you see comes from the lungs and mouth of the vaper. To produce smoke, the individual has to inhale to release it. When they release into the air, the least amount of particles are present since the individual itself absorbs the majority of the substances. Secondhand vaping isn’t as dangerous as second-hand smoking because the bystanders get exposed to a minimal amount. Studies revealed that secondhand vaping had shown the levels of the chemicals much less than the exposure limits.

There is at the present time no conclusive evidence that, as opposed to eCigarettes that contain nicotine, vape aerosol has any significant harmful effects. Nevertheless, with public sensitivity aroused, the stigma of secondhand smoke, makes many vape users feel uncomfortable in public settings. And, advocacy groups like the American Non-Smokers’ Rights Foundation are carefully examining the issue.

Filtration Technology Provides a Solution

A potential solution for vape users are a variety of filter devices that are designed to reduce the amount of aerosol emitted. While these devices vary in size and ability to reduce the amount of the cloud of aerosol, one company claims to contain all smoke and any potential particulate completely. Philter Labs offers a series of vape filters that are compact, fit any vape pen and are said to reduce exposure of others to vape aerosol by up to 97%.

The vapor is filtered as the user inhales it. Users also exhale into the device, which is what cuts down on the odor and exposure to secondhand vapor. The company, Philter Labs, has created several filtering devices for vapes (which applies, by the way, to both nicotine and cannabis vapes). All the filters use nanofiltration technology to cut down the particulate matter that may be contained in vape clouds.

While the cigarette industry in the ‘70’s chose to downgrade the issue, the vape segment of the cannabis industry now has the capability to effectively address an issue every bit as threatening as the crisis encountered in 2019. If, in fact, vape sales are a vital revenue stream in your cannabis investment, it is critical that the due diligence you have done comprehends any looming setbacks, like the secondhand smoke issue, that your company may face.

Investor Takeaway

As we reported in last week’s issue of the EDGE Briefing, while COVID-19 shuttered many traditional businesses, more cannabis than ever before was consumed in the U.S. in 2020 – a record $17.5B in legal sales – a 46% increase from 2019, according to a recent report cited in Forbes published by BDSA. Overall, in 2020, capital flowing into the cannabis industry dropped to $4.2 billion from $11.6 billion in 2019, and the even higher level of $14.2 billon in 2018, as reported by Viridian Research. Yet, just in the first two weeks of January cannabis companies in North America raised over $619 million. All indicators point toward a record year in capital flowing into this formerly cash-restrained industry. While the industry is booming and evincing signs of even being inflation proof, due diligence is the watchword. Where, as an example, the vape segment of the industry is challenged to lead the self-regulating shift in the way new products are manufactured and marketed.

How We Can Help

The critical factors in assessing the potential of the array of opportunities in the industry still rely on careful execution of the basics of investment analysis:

- Due diligence for understanding the full scope of the business in the industry segment being targeted.

- Analyzing the preemptive nature of the target’s business model.

- Determining the soundness of the financial statements, particularly in cases where they are yet to be audited.

- And assessing the zeal of the team charged with the task of growing a company into a multimillion-dollar operation.

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.