Investor Takeaway MSO Transformation Strategy

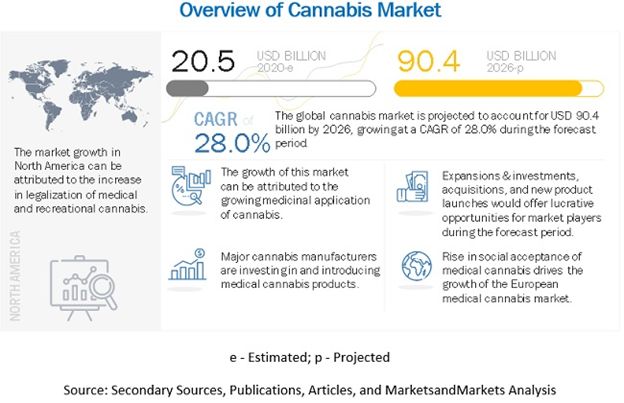

In spite of industry growing pains, lack of regulatory consistency, poor stock performance of public Multistate Operators (MSOs), and a long list of other complications, cannabis is on a fast track to become THE leading consumer products industry – in the world. MarketsandMarkets projects a $90.4 billion worldwide market size by 2026, with a 28% CAGR along the way. Still in its Growth phase, consolidation continues to be the watchword in the industry into 2022. At the recent Benzinga Capital Conference in Miami we found that the most prominent MSOs while bullish on consolidation opportunities, regardless of the pace of federal re-scheduling, have transformed from a Plant-the-Flag headlong race for accumulating licenses and gaining market share to pursuing EBITDA within a more manageable footprint. And we spell out a careful, due diligence multistep process for selecting the right targets for the right fit for an investor’s strategic investment portfolio.

The Market MSO Transformation Strategy

While the cannabis market experiences struggles, particularly with stock volatility of the public MSOs, there remains no denying the upside opportunity. According to MarketsandMarkets, the global cannabis market was valued at USD 20.5 billion in 2020 and is projected to reach USD 90.4 billion by 2026, recording a CAGR of 28.0%,

And, as previously reported in The EDGE, capital creation through M&A will continue to increase in 2022. In fact, New Frontier Data shows that through M&A and aggressive statewide retail rollouts, MSOs are gaining higher market share in the newer legal markets than in the established market in the West.

Yet MSOs certainly did not evince this strength in their M&A and operational strategies in the past. Indeed, according to comments made by Matt Darin, President of MSO giant Curaleaf U.S. at the recent Benzinga Capital Conference, 2018 was the Plant-the- Flag stage of the cannabis business. That period was characterized by how many states a MSO was in. How many licenses acquired. This was before the days now of EBITDA as the laws of economics and gravity have come into play.”

The Turnaround of Acreage Holdings MSO Transformation Strategy

The transformation of MSO strategy can be no better exemplified than by the evolution of Acreage Holdings. Also a speaker at the Benzinga Capital Conference last month Peter Caldini, CEO of Acreage, related common themes that other prominent MSO executives at the conference expressed. The Acreage turnaround has been driven by these factors:

- A new leadership team with commercial experience – experience in scaling businesses in highly regulated industries.

- Operational and financial disciplines requiring divesting underperforming assets.

- A portfolio strategy focused around core markets.

- That strategy now positions Acreage to take advantage of significant opportunities in the 8 core states of their 10 state portfolio.

- A portfolio that includes key states New York and New Jersey. Acreage is one of 10 licenses in NY, with adult use anticipated for the first half of 2023.

- Their 3rd priority state, Ohio, is medical now with an adult use initiative anticipated on the ballot in the fall.

- In Tier 2 markets, such as Massachusetts and Pennsylvania, Acreage is positioned in the premium segment of those markets.

- The reason they are not seeking to open in the Florida market is that they feel there is limited ability to scale there without eating up a disproportionate share of resources.

- Rightsizing by reducing as much as a 50% staff reduction has improved the overall efficiency of the organization.

- The primary growth objective now is to compliment organic growth with M&A opportunities within their existing footprint.

And, another common theme echoed by other major MSOs at the conference is that restructuring the company places Acreage in the position to take advantage of debt financing.

The “Goldilocks” Footprint of Ayr Wellness

Also at the Benzinga conference Ayr co-COO, Jen Drake, emphasized the two key components of their “Goldilocks,” or Optimized, footprint – talent and flower. She stressed that great accomplishments require great people to implement them. And, that the root of the entire cannabis industry is the cultivation of consistently superior flower. People, Process and a Culture of cultivation. Ayr has optimized the diversification of their 8-state footprint by no one state accounting for more than 20% of their revenue. They remain nimble enough to pivot between wholesale and retail depending on the dynamic of each of their markets.

Curaleaf Goes National MSO Transformation Strategy

With over a $4 billion market cap, Curaleaf is by far the largest MSO in the cannabis industry. Their strategy was discussed at the conference by Matt Darin, President of Curaleaf U.S. With a footprint covering 23 states, the objective of Curaleaf is to be dominant nationally. Darin stated that the roots of their business are in the limited license states in the Northeast, states where the company can have vertical integration opportunities and solid margin profiles. They look for similar profiles in the mid-west, and feel they must maintain a strong presence in the more mature markets of California, Colorado and Michigan. Even though these markets don’t offer the margin profiles or the supply and demand dynamics of markets such as Illinois and New Jersey, Curaleaf watches the tends coming out of the West Coast that they could apply to the East Coast.

Growth Through Debt Financing and M&A

We will be providing more insights from the Benzinga Capital Conference on the two basic growth strategies of the most successful MSOs, debt financing and M&A. Looking at M&A, at Highway 33 Capital we scrutinize these aspects of M&A deals as summarized by MJBizDaily:

- The Purchase Price – With deals being primarily cash, stock, and some takeback notes, sellers need to perform due diligence on the stock they are receiving in the transaction.

- If the buyer is public, the seller should know when (under securities laws) and how the stock may be sold (will a chosen broker even execute a trade in a cannabis stock?).

- If the buyer is private, it is the seller’s responsibility to perform due diligence on the buyer.

- Change of control – In cannabis this means that most state and municipal regulatory agencies will require some sort of vetting and approval.

- Legacy Liabilities – in an M&A transaction, unlike a simple asset acquisition, a buyer does not have the luxury of picking and choosing assets. In cannabis the acquirer needs to conduct due diligence into the true nature of the seller’s finances, which can often be unaudited.

- Handling Debt – in the case of the cannabis industry a distressed company cannot file for bankruptcy protection in order to restructure its debt to become an acquisition target. This puts additional pressure on the buyer to avoid creditor lawsuit entanglements.

What’s It Really Worth?

Once it is confirmed that the legal/compliance requirements are met, then the next major step is to calculate a realistic valuation of the target. The investment banking intermediary in the transaction will develop financial models to include the most important fixed and variable financial factors that will be the most important components in determining the value of a company. There are, of course, significantly different financial factors to consider for different companies, particularly complex in the highly regulated cannabis industry. In cannabis your advisors must positively understand the idiosyncrasies in this marketplace in order to identify a valuation range that ensures the buyer is not overpaying and that the seller’s proformas are verifiable.

What it Takes to Make It Over the Finish Line

- The Vision of the Parties – All stakeholders to the M&A transaction must have a clear vision as to the direction toward profitability the marriage of the parties will take. This requires good advice about the fundamental legal and business issues that will arise and the judgement calls that will have to be made during the process to keep a clear vision for the post-closing entity.

- Commitment – Once the decision is made that a buyer’s objectives are better served by acquiring rather than taking the path of organic growth, all key management team members must buy into that direction regardless of hurdles that will arise along the way.

- Culture Comprehending ESG – a critical component of the very essence of the deal is the shared values and the behaviors in the Environment, Social, and Governance (ESG) that shape employee experience, interaction, and morale within an organization. Understanding the Culture Equation avoids differences that are likely to become too hard to manage after the transaction is complete.

How We Can Help – Finding the Right Fit for Your Investment Strategy

What we conclude from the perspectives provided by the largest of the MSOs at the Benzinga Capital Conference is that 2022 offers an array of opportunities in M&A transactions, of all sizes, and in non-dilutive debt financing. What we advise our investors as they assess the market in which they see as the most advantageous boils down to clarifying the investment needs and objective of all parties, determining the real value in the business by calculating a well-substantiated valuation, and matching the right investors with the right funding opportunity; the right operators whose objectives and scalability are a fit for investors’ portfolios.

At Highway 33 Capital we excel at structuring deals to meet client investment strategies in emerging 2022 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.