Investor Takeaway Considerations for Canadian Cannabis Strategic Investment

Recreational marijuana sales reached 4.8 billion Canadian dollars (US$3.8 billion), which is 19% more than 2021’s estimated figure. For every dollar in revenue or capital expenditures, the industry adds about $1.09 to Canada’s GDP from legal cannabis purchases. Yet the stock of publicly traded Canadian cannabis LPs continues a precipitous decline. Major Canadian LPs continue to miss anticipated positive EBITDA target dates. This week’s issue of the EDGE provides our perspective on the inevitable consolidation on horizon as strategic investors assess the Canadian market, and what steps are to be taken in the evaluation process.

The Canadian Cannabis Market Considerations for Canadian Cannabis Strategic Investment

Often maligned for being a market still struggling due to fragmentation and price competition – being the first, but far from being the most efficient – Canada’s cannabis sales exceeded expectations in 2021. According to New Cannabis Ventures, recreational marijuana sales reached 4.8 billion Canadian dollars (US$3.8 billion), which is 19% more than 2021’s estimated figure. Yet the stock of publicly traded Canadian cannabis companies continues the precipitous decline that started in Q1 last year.

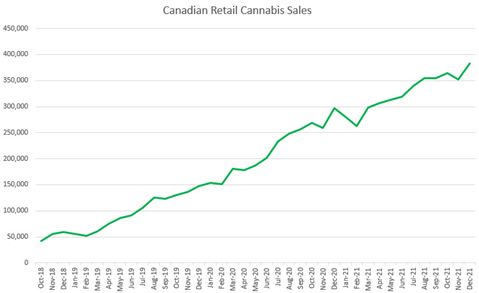

Based on Statistics Canada numbers released for December retail sales, Cannabis sales increasing from November by 8.5% to C$382.4 million. The sales were up 28.5% from a year ago, down from 35.8% in December’s growth rate:

Hifyre IQ, Canada’s leading real time data analytics provider for the cannabis industry, attributes this growth to: “An increase in the number of stores as well as falling flower prices that bring consumers from the illicit market have been boosting sales.” That store count is up over 2,000 now across the country.

A report recently released by Deloitte Canada finds that cannabis has contributed $43.5 billion to Canada’s gross domestic product and $13.3 billion to Ontario’s since recreational cannabis was legalized in October 2018.

- For every dollar in revenue or capital expenditures, the industry adds about $1.09 to Canada’s GDP and $1.02 to Ontario’s from legal cannabis

- The report found that the industry is responsible for 151,000 jobs. For every million dollars in revenue or capital expenditure, the cannabis sector sustains about four jobs in Canada and Ontario each.

- The research also estimates that the industry has generated $15.1 billion in Canadian tax revenues and $3 billion for Ontario. Consumer purchases alone generated $2.9 billion in sales and excise taxes.

Market Performance Not Mirrored by Stock Performance Considerations for Canadian Cannabis Strategic Investment

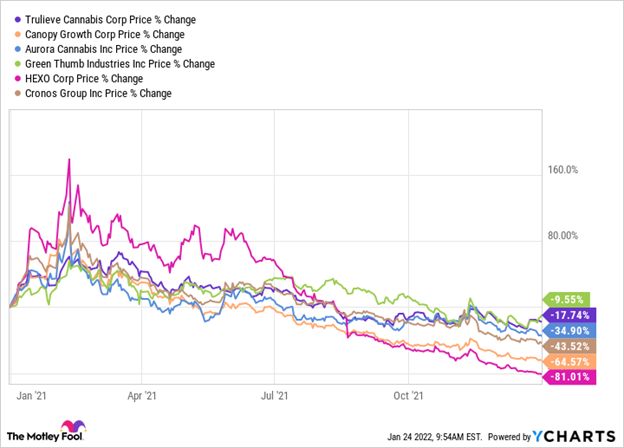

Yet the stock of publicly traded Canadian cannabis companies continues the decline that started in Q1 last year. Current sell-off is driven substantially by the delayed de-scheduling of marijuana by the U.S. government. This frustration was expressed in a recent interview with Richard Carleton, C.E.O. of the Canadian Securities Exchange (CSE). According to Mr. Carleton, “Every time we see positive movement, a setback in public expectations about the timing of U.S. federal de-scheduling is reflected in stock performance – in many cases unrelated to actual company financial performance in the marketplace.”

While the U.S. Multistate Operators (MSOs) listed on the CSE had a very productive year in 2021, with revenue growth and attainment of positive EBITDA, this was not the case for their Licensed Producer (LP) Canadian counterparts. New Cannabis Ventures is still projecting an overall revenue growth rate in 2022 for the top 10 largest U.S. MSOs of 61%. Lately this forecast has been slipping downward for those with sluggish sales in many states and delays in the beginning of adult-use sales in New Jersey. The earnings reports and guidance of the U.S. operators are due out shortly for further evaluation.

For the mega operators in Canada, however, stock prices continue their steep decline.

What is the 2022 Outlook for These Canadian Market Leaders? Considerations for Canadian Cannabis Strategic Investment

- Aurora Cannabis – although benefiting from the sale of the launch last year of cannabis “derivatives – additional recreational products such as vapes, edibles, and beverages – the company has not yet reached a positive EBITDA. It is cleaning up its balance sheet to now reach its revised profitability target in the first half of 2023.

- Canopy Growth – similar to Aurora has pushed its target date for positive EBITDA – to the end of fiscal 2022. Analysis by Bloomberg expects Canopy to post $137 million in revenue while booking a $65 million adjusted EBITDA loss. The Motley Fool reports that the company did post a $115 million net loss in the quarter, while its cash reserves further declined by $900 million to $1.4 billion. “Analysts appear to be still waiting for more positive signs of Canopy’s turnaround as they note Canopy’s ongoing cash burn remains an issue.”

- Hexo – while generating record revenue toward the end of last year the company’s losses deepened in the fourth quarter to CA$116 million versus a loss of only CA$4.1 million in the same quarter the previous year. Tilray Brands Inc. has stepped in, as you probably know, to acquire up to US$211 million of Hexo’s senior secured convertible notes, currently held by New Jersey-based hedge fund High Trail Capital LP at 90 cents on the dollar, that would give it the right to own 37 per cent of the company. The deal is subject to Tilray shareholder approval which is predicted to happen within the next 90 days.

Daniel Fontaine, C.E.O. of Globe-Cann Inc. (www.globe-cann.com) remains skeptical after reviewing the company’s financial statement released last week. With $72 million in revenue, $52 million in gross profit, 690m in loss, accumulated deficit of $1.6 billion, and a burn rate in Q3 last year of $37 million, he doesn’t see how they can make their target date for positive cashflow in January, 2023. It’s our view that they need a more effective turn-around plan with aggressive cost cutting, shedding non-performing assets and re-negotiating their debt.

- Cronos Group – we are still awaiting Q3 results after the company reported in an SEC filing that it will have to restate it financial statements of the second quarter.

What Do We See on the Horizon for Canada?

Besides the continued, albeit, slow implementation of Health Canada rule changes and updates to lift limitations from the cannabis industry, there will be the rise of up-and-commers. Among the cloudy picture painted by the recognized giants in Canada, the company High Tide (NASDAQ: HITI) (TSXV: HITI) (FSE: 2LYA), continues to accelerate sales though its 113 retail locations claiming: “revenue of $72.2 million in the first fiscal quarter of 2022, which is the second-highest quarterly revenue figure ever reported by a Canadian cannabis company that reports in Canadian dollars.” This was attributed to the innovative discount club model at its retail stores, proprietary operational efficiency software, expansion of international CBD sales, and to opening other retail locations with branding innovations.

Consolidation and the divestiture of distressed assets will highlight 2022 in Canada. According to Forbes:

There are over 800 companies licensed to sell or process cannabis in Canada. According to some industry analysts, the surplus contributed to the oversupply of cannabis in the market. While that figure may also demonstrate a successful transition from the illegal to the legal market, some experts see the industry’s current state as unsustainable and leading to heavy consolidation.

BNN Bloomberg reports that:

The over 2,000 legal cannabis stores across the country that have helped erode the significant presence of the illicit market, which is now operating online.

Interestingly, the biggest Canadian companies’ market share is declining, while smaller companies are gaining, despite merger and acquisition (M&A) deals and record sales in 2021.

And Canadian investment dealer, ATB Capital Markets, concludes that the market still presents a compelling long-term growth opportunity for select LPs and retailers.

“While the industry continues to struggle due to fragmentation and price competition and limited marketing due to the Canadian regulation, we believe that players with a lean cost structure, a robust capital position, and operational efficiency can successfully navigate this environment.”

How We Can Help

With the continued growth of investment prospects for strategic investors in the Canadian cannabis industry on the horizon, the approach we take with our clients for risk mitigation prior to presenting them with investment opportunities: evaluating the prowess and the passion of the executive team, assessing the competitive advantage of the company and how quickly they can scale for growth, and determining how well they are ready for the regulatory regime in their home and target growth markets. We take these steps before presenting the company to our extensive network of pre-qualified investors.

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2022 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.