Investor Takeaway The CSE – Promoting U.S. Cannabis Industry Liquidity

The lack of clarity and slow pace around the reform of federal cannabis legislation has shackled the industry performance due to the limited ability of U.S. cannabis operators to attract capital from institutional investors. The major change coming to cannabis strategic investing this year that we forecast is the increase in liquidity coming to this capital-constrained industry. Institutional debt providers are getting more comfortable that asset backed debt is a manageable risk to fund real estate and equipment. The Canadian Securities Exchange (CSE), is making changes that will allow “Venture Issuers” on that exchange to “uplist” within the Exchange to a “Senior Issuers” tier. This establishes more stringent reporting requirements that are more consistent with exchange oversight expected by institutional investors. Achieving this designation will potentially make it easier for cannabis operators to raise private capital, both debt and equity, making their stock worth more when used as currency for growth and for M&A transactions. Exchange C.E.O., Richard Carleton, states: “With the Senior Tier, we can create a level playing field in which all of our issuers will have access to the same benefits that they would receive on other Canadian exchanges.”

Innovation Prompting Market Liquidity The CSE – Promoting U.S. Cannabis Industry Liquidity

Canadian Securities Exchange

As we have reported in previous EDGE Briefings, the anomaly of the U.S. cannabis industry is that even with explosive growth, it is performing far below potential. This is due to the limited ability of U.S. cannabis operators to attract capital from institutional investors, caused by the absence of federal de-scheduling. However, we have forecast that there is major change coming to cannabis strategic investing this year. That is, the increase in liquidity coming to this capital-constrained industry. In our research we have found that leading the charge in this process is the Canadian Securities Exchange (CSE). The Exchange is pursuing changes that will allow “Venture Issuers” to “uplist” within the exchange to a “Senior Issuers” tier. This will establish more stringent reporting as required by institutional investors, leading to the potential of more investment from these sources – increased liquidity through larger market caps. To learn more about this action by the CSE we were able to speak with the C.E.O. of the Exchange, Richard Carleton. Here is our takeaway from that conversation.

The CSE and the Nasdaq Parallel The CSE – Promoting U.S. Cannabis Industry Liquidity

The CSE, based in Toronto, was founded in 2003 to focus on working with entrepreneurs to access the public capital markets in Canada and internationally. The Exchange is dedicated to entrepreneurship and has evolved since 2016 to become the leading securities exchange for U.S. plant-touching cannabis companies. Those companies, of course, are unable to join the Nasdaq or the NYSE because of the lack of reform of federal cannabis legislation. In fact, the largest contingent in the CSE has become the U.S. cannabis operators in their Life Sciences sector.

Sector Weight

| Sector | Weight |

| Life Sciences | 78.97% |

| Mining | 8.53% |

| Technology | 7.45% |

| Diversified Industries | 3.58% |

| CleanTech | 1.08% |

| Oil and Gas | 0.39% |

There is an analogy here to the early days of the high-tech industry when as a leader in trading technology from the outset, the world’s technology small cap startups chose to list on the Nasdaq in their early days. As the technology sector grew in prominence in the 1980s and 1990s, the Nasdaq became the most widely followed proxy for this sector. And those small cap techs that have now grown into industry giants have stayed with the Nasdaq to this day. This is indeed a similar role the CSE is playing today for the cannabis industry. By having become the proxy for that industry, Mr. Carleton expects that segment to be a source of growing and on-going business.

Why is Market Liquidity so Important?

As summarized in Investopedia, a liquid market is generally associated with less risk. In a liquid market, a seller will quickly find a buyer without having to cut the price of the asset to make it attractive. And conversely, a buyer won’t have to pay an increased amount to secure the asset they want. Investopedia says that high liquidity means that there are a large number of orders to buy and sell in the underlying market. This increases the probability that the highest price any buyer is prepared to pay and the lowest price any seller is happy to accept will move closer together – the bid-offer spread will tighten. And MJbizDaily confirms that liquidity results in greater access to capital at a lower cost which, in turn, means higher valuation. The more liquid a public company’s stock, the smaller the discount applied by investors compared to fair value.

Regarding the cannabis investment marketplace, Highway 33 Capital Managing Partner, Cam Horan, expresses the situation this way:

The impact of greater liquidity on a capital starved industry will be increasing the money larger MSO’s and Pubcos have to spend on expansion including M&A. This will drive prices higher for assets in attractive limited license states and for targets that have significant revenue and profits in those markets.

What’s Constricting Cannabis Industry Liquidity Now? The CSE – Promoting U.S. Cannabis Industry Liquidity

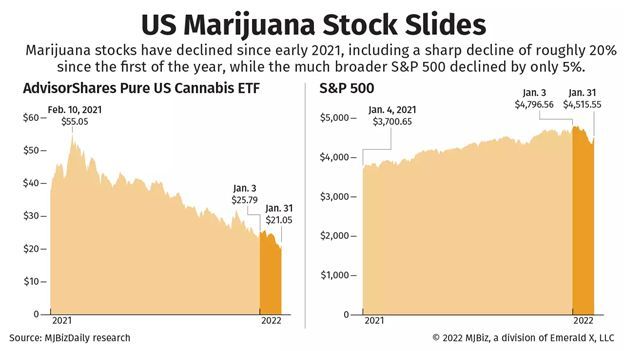

We all know that it has not been a pretty picture for investors in cannabis publicly traded companies for several quarters. Since Q1 2021 stock prices as measured by the performance of the S&P 500 have continued their slide, while the general trend of that index has been upward. Cannabis stocks, by their measure, have declined by another 20% since the first of the year compared to only a 5% dip in the index in general.

While not as severe, the CSE has experienced the volatility of the performance of the stock of its U.S. cannabis issuers. According to Mr. Carleton, “Every time we see positive movement, a setback in public expectations about the timing of U.S. federal de-scheduling is reflected in stock performance – most often unrelated to actual company financial performance in the marketplace.”

Why that matters is that the cannabis industry will continue to have constrained liquidity, limited address to capital market, higher taxes and higher costs of debt than our issuers in more traditional business segments.

CSE Taking Action on Liquidity

The CSE is making changes that will allow 60 to 80 companies to “uplist” within the Exchange. The uplisting will mean more stringent reporting requirements for issuers that are more consistent with exchange oversight of issuers expected by institutional investors. This means that as cannabis companies achieve this designation they will potentially receive more investment from these sources resulting in increased liquidity through larger market caps. That will make it easier to raise private capital, both debt and equity, and their stock when used as currency for growth and for acquisition transactions will be worth more.

Mr. Carleton points out that under existing securities law, these companies are classified as “Venture Issuers”, strictly by virtue of their listing on the CSE. In practice, this means that they have not been able to access certain benefits available to companies of comparable size on other exchanges. They are not currently eligible for margin relief, which reduces the cost of trading for individual investors and dealers and thus enhances liquidity. They are also prohibited from certain institutional investment accounts and stock indices, which may limit visibility for investors, negatively impacting liquidity and access to capital.

This proposed uplisting will create a ‘Senior Issuer’ tier that would remove the ‘Venture Issuer’ designation, a primary reason why CSE-listed shares were prohibited from certain institutional investment accounts and stock indices, such as the MSCI and FTSE U.S. indices.

Bloomberg Agrees – Calculates What this Uplift Would Mean to Liquidity

In analyzing this potential Bloomberg found in their analysis recently that the Senior Tier would have a huge impact on U.S. MSOs. Given the fact that U.S. cannabis companies make up nearly 80% of the C$40 billion (US$31.6 billion) in market value hosted by the Exchange, with headliners including Curaleaf Holdings Inc., Green Thumb Industries, and Trulieve Cannabis Corp., the uplift calculation would look like this:

- 80% of the CSE market cap is cannabis companies most of which are U.S. based.

- Estimating that the total CSE market cap is US$31.6B, 80%, US$25.8B is the estimated CSE cannabis market cap.

- Assuming 80% of that market cap would uplist to the Senior Issuer tier, if that uplisting doubled the market caps of those companies that would add an additional $20B in liquidity.

Bloomberg concludes:

More favorable conditions for such companies would also make the CSE more competitive with the TSX – and eventually the Nasdaq and NYSE, should rules change – as a venue for cannabis companies to list.

Who will Qualify?

Senior Issuer parameters – the firm must have a minimum 300 shareholders, and at least two of the four following standards must be met:

- Equity standard: S/H Equity of $5M and Public Float value of $10M

- Net Income standard: $400,000 + S/H equity of $2.5M

- Market Value Standard:$50M market value of all securities (Market Cap)

- Revenue + Asset Standard: $50M revenue & 50M Assets

There is also a special provision for SPACs in requiring light initial costs, and low ongoing CAD fees, which the CSE feels will make a CSE-listed SPAC more appealing to U.S. cannabis businesses looking for both capital and liquidity.

CSE Action Underway

Early last month the CSE announced that the Ontario Securities Commission (OSC) and British Columbia Securities Commission (BCSC) have initiated a 60-day comment period on the CSE’s key proposal to materially revise its listing policies. That is, to create the Senior Issuers tier for the CSE’s larger and more advanced issuers, and to update listing requirements for earlier stage companies. It is anticipated that the Senior Issuers tier would then receive benefits available to comparable issuers on other Canadian stock exchanges.

Now, Mr. Carleton reports: “Following a record year in 2021, the Canadian Securities Exchange is off to a solid start in 2022, with continued strength in trading and financing activity. In addition, the comment period on the proposed revision of our listing policies was highly productive. We received detailed feedback as we move forward with our plan to create a Senior Issuer tier on the Exchange, implement important amendments to issuer regulation on the Exchange and enable the listing of ETFs and SPACs. We believe these measures will significantly benefit our issuers and the entire investment community.”

Mr. Carleton concludes by saying: “Over the past three years, our team has achieved unprecedented success in attracting larger issuers with more advanced business plans to the Exchange, particularly from the global cannabis industry. With the Senior Tier, we can create a level playing field in which all of our issuers will have access to the same benefits that they would receive on other Canadian exchanges. In addition, we can introduce exciting new products for investors that should drive significant growth and interest in the CSE, to the benefit of all of our stakeholders.”

How We Can Help

With the prospect of greater industry liquidity creating enhanced value for our strategic investors, the approach we take with our clients for risk mitigation prior to presenting them with investment opportunities: evaluating the prowess and the passion of the executive team, assessing the competitive advantage of the company and how quickly they can scale for growth, and determining how well they are ready for the regulatory regimen in their home and target growth markets. We take these steps before presenting the company to our extensive network of pre-qualified investors and preparing them for some future liquidity event.

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2022 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.