Investor takeaway Cannabis Industry Mid-Year Access to Capital Report

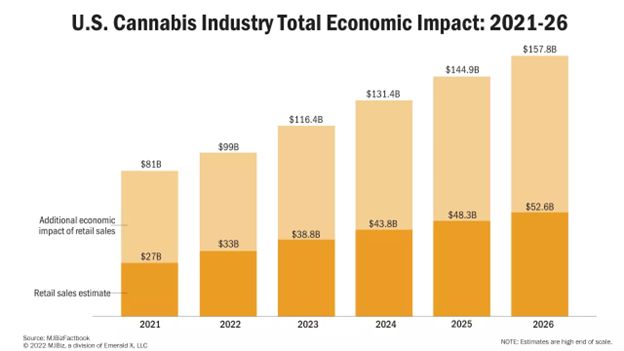

With a U.S. market size of $33B projected this year, the potential of contributing $100B to the size of the U.S. economy, and 91% of the population favoring legalization in some form, the cannabis industry still has the major problem of access to capital.

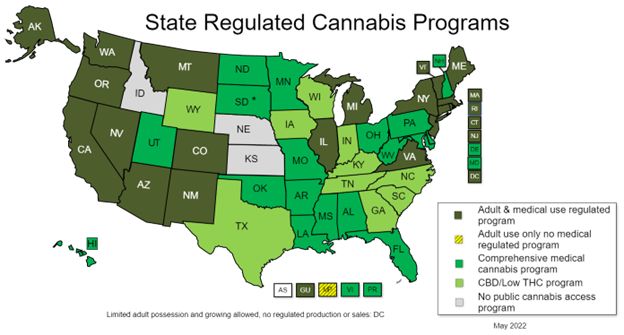

- Medical-use cannabis is now legal in 37 states, District of Columbia and three territories: adult-use in 19 of those states, D.C. and two territories.

- Although progress is still slow in Congress, this rapid pace of legalization across the nation has opened up entirely new financing options.

- Non-dilutive debt is now usurping equity raises, offering protection to investors by lending against assets as opposed to taking more risky equity positions.

- Professional financial management and institutional investors are now beginning to enter the industry ahead of federal de-scheduling.

- While the major MSOs are enjoying low borrowing rates in multimillion-dollar deals, single digit rates are still available for qualified smaller operators.

In this complicated, nuanced industry an experienced team with specific industry experience is required to provide the value added in facilitating these debt transactions.

Cannabis Industry Mid-Year ReportCannabis Industry Mid-Year Access to Capital Report

Midway into 2022 what do we know about the status of the cannabis industry in the U.S.?

- Medical-Use cannabis is legal in 37 States, Washington DC and three territories.

- Adult-use is legal in 19 of those states, DC and two territories. That is summarized by the National Congress of State Legislators (NCSL) as:

- Voters in Arizona, Montana, New Jersey and South Dakota approved measures to regulate cannabis for non-medical use.

- On Feb. 8, 2021, South Dakota Circuit Judge Christina Klinger ruled that the measure was unconstitutional. The South Dakota Supreme Court upheld this decision on November 24, 2021 by a vote of 4-1.

- New Jersey’s governor signed enacting legislation on March 1, 2021.

- New York’s legislature and governor enacted AB 1248/SB 854 on March 31, 2021.

- The Virginia General Assembly passed legislation on Feb. 27 and approved the governor’s amendments on April 7, 2021.

- The New Mexico legislature passed legislation on March 31 and the governor signed it on April 12, 2021.

- The Connecticut General Assembly passed SB 1201on June 17 and the governor signed it on June 22, 2021.

- The Rhode Island General Assembly passed the Rhode Island Cannabis Act, measures 2022-S 2430Aaaand 2022-H 7593Aaa, and the governor signed them on May 25, 2022.

- CNET.com reports on the 2021 Pew Research poll that 91% of Americans believe cannabis should be legalized to some degree – 31% for medical-use, 69% for both medical and adult-use.

- 2021 legal cannabis sales in the U.S. set another record at $27.5B, projected by MJBizDaily to grow to $33B this year.

- MJBizDaily also reports that the cannabis industry will add nearly $100B to the U.S. economy this year!

Yet because the sale, and possession of cannabis over 0.3% THC remains illegal under Controlled Substances Act of 1970 as a Schedule I – having “no accepted medical use” and a high potential for abuse and physical or psychological dependence – the industry’s #1 continuing problem is access to capital.

Tide is Turning for Industry Access to CapitalCannabis Industry Mid-Year Access to Capital Report

As more debt providers come online, recent multimillion-dollar debt financing among cannabis industry leaders shows that debt as a capital source for cannabis companies is a rational use of capital – potentially cleaning up balance sheets and enabling access to funding for expansion and/or the purchase of distressed – to use debt financing for competitive advantage in the marketplace.

While the industry has been capital-constrained, borrowing against assets has been a key source available for many cannabis companies to pursue. Vertically integrated cannabis companies often have significant real estate and other assets that can be leveraged. What has changed now, though, is that more debt providers have come online recently addressing a range of needs. Debt financing and the types most readily available to cannabis operators, including the alternative of the Medium Term Note (MTN), are described in greater detail in a recent issue of The EDGE.

The law firm, Reed Smith concludes that the rise of debt in cannabis has two primary drivers: the large asset base financed by capital raised in the public markets now used as loan collateral to fund growth, and the downside protection to investors by lending against assets as opposed to taking more risky equity positions.

Professional Investment Capital Comes to CannabisCannabis Industry Mid-Year Access to Capital Report

Toward the end of last year, the industry reached a turning point in access to capital. In 2019 a syndicate of lenders provided Curaleaf with a $300 million term loan. At the time, this was the largest and most significant debt financing an MSO was able to negotiate. Then, last year Curaleaf set another record by receiving commitments for a privately placed debt raise of $425 million, once again securing the largest debt raise to date, but also obtaining an 8% interest rate – perhaps the lowest rate in the cannabis industry at that time. At the Benzinga Capital Conference this spring Jack Mascone, the Head of Capital Markets for Seaport Global, who spearheaded these transactions provided the facts behind the headlines.

Mascone sees more significance for the future of the cannabis industry than just the milestones of these Curaleaf transactions. In the 2019 deal two-thirds of the participation in the $300M loan was from family offices and non-institutional investors. When the deal was refinanced last fall, at that the low 8% rate, more than 75% of the funding came from what Mascone considers as institutional and professional investment capital. “The migration of new participants into the cannabis market, particularly on the debt side, is prolific and it’s going to continue to lower everybody’s cost of capital,” he says.

Having said that, today not every private and public borrower in the cannabis sector has assess to those kind of investors. Better companies currently do. And the real story here from a macro perspective is that the structures you can get in this sector – notwithstanding how nuanced, how difficult it is to underwrite – are very attractive relative values for lending opportunities for institutional investors. That is going to be the case for a while and I think that as investment professionals see the inevitability of some form of SAFE, or something that permits more normalized lending activities, they are going to find a way into these deals. Not a straight line, but it is going to benefit everybody’s cost of capital, particularly on the debt side.

Thanks to their stronger market position this is substantiation of the trend away from equity to debt financing of the major MSOs that are cleaning up their balance sheets and solidified their market expansion plans.

Debt Financing Options

Panelists on the subject of debt financing at the Benzinga Capital Conference represented these options:

The approach taken by Don Brian, CEO & Chairman of Freehold Properties, is to provide long term real estate financing using mortgage-with-purchase-option in favor of the company’s REIT. “This, Brain says, “provides both dialed-in financing based on the operator’s needs, and also the opportunity for investors to benefit from the upside of the appreciation of the real estate.” Freehold is a real estate lender, but they look first at the quality of the operator, then the real estate. They are focused on the better credits in the industry, so they prefer public companies, and large privates. Their strategy, find good operators then go long and deep with them in the space of the industry they are in and where they can grow their business. Brain says though that, “It’s tough to be in the middle of the intersection of illiquidity and illegality.” To keep liquidity flowing into the industry they have a public vehicle, because raising private capital can be difficult, offering both a coupon, essentially a dividend value, for investors as well as the opportunity for appreciation of equity value by owning real estate post de-scheduling.

Steve Ham, Managing Partner Altmore Capital, is a cash flow lender. Their strategy is to look for great management team they can back. Ham says, “If they are not the kind of people you can have a beer with, they are not good prospects. Because if things go wrong there are a lot of issues to be worked out with the management team.” Altmore deals start with the relationship and then the continued communications during the process of due diligence and ongoing review of financial documents. They look into the different types of collateral of the prospect that is needed to give Altmore’s investors asset coverage for protection.

John Mazarakis, Partner & REIT Executive Chairman of Chicago Atlantic Real Estate Finance, Inc., represents the hybrid opportunity by having a REIT on the public side, with cash flow lending on the private side. Their strategy simply expressed as looking to help companies that have ability to repay. Mazarakis echo’s the common theme among the other alternatives that “relationship is over 50% of what we consider.” Chicago Atlantic focuses on states east of the Mississippi – primarily the medical states looking to go to adult-use. So, their primary criteria after establishing the relationship are:

- State

- Medical going to adult-use

- Cash flow

- Collateral

Their differentiation, providing undiluted capital while declining valuations continue to lower the value of equity. “Debt is not sexy for investors,” he says. “Not going to make 10x, but we are the unicorns, we provide a 17.5% senior secured return, unleveraged. That’s unheard of in this space – on the REIT side and on the B2C side.”

On the bright side for debt financing, Crunchbase recently reported the market could heat up as venture capital slows. Venture debt, no matter how it is defined, is giving companies cash they may need while not diluting the stakes of founders and shareholders. It can lessen the amount of more expensive venture capital needed and also lower dilution.

Crunchbase quoting David Allred, C.E.O. of Silicon Bank, “As equity capital becomes more expensive, interest in debt goes up.” “It’s always been a good tool against expensive equity,” he said. “It can prolong the life of that expensive equity.”

Steve Ham of Altmore Capital reminds us that the key to lending in the industry is the margin spread. And while that margin will tighten, the size and scope of the growing cannabis industry will continue to find more operators becoming cash flow positive. He cites this example of the relative size of the spread:

A company with $20M revenue and $4M EBITDA becomes a $60M company with $12M EBITDA. When you refi a loan from $7M in the first facility to $15M, the refinancing interest rates will go down as a result of credit quality becoming that much better. In a rising interest rate economy, you cannot tell how much that spread will compress but the good news is that the industry will continue to grow and become more cash flow positive.

In the final analysis, Don Brain concludes, “With the large states now moving from medical to adul-use begins to show the maturation of some of the operators and their ability to bring branded product to the market which I think will provide some consistent profitability in the industry.”

And, the LA Business Journal reports that Los Angeles investors are turning to the cannabis fintech industry, providing funding workarounds for companies that have historically been denied access to conventional finance.

In a phone interview with the Business Journal, Bespoke Financial founder and chief executive officer George Mancheril said the lack of access to traditional financial services such as deposit accounts and lines of credit have ranked among the cannabis industry’s most significant roadblocks. Thanks to marijuana’s Schedule 1 status, operators in the cannabis industry haven’t had access to even the most basic benefits of banking.

“Bespoke’s focus is on lending, which is something that never really existed for the cannabis industry,” said Mancheril. “These companies don’t have a ton of capital, they don’t have the finance needed to invest, and they haven’t really been able to leverage [the industry’s] growth.”

Will the Smaller Operators be Left Behind in the Search for Low Interest Debt Financing?

It is easy to see why the large MSOs qualify for the low rates in multi-million dollar transactions. However, what about the smaller and single state operators? Will they ever be able to qualify for low interest rate debt financing for their operations, growth and acquisition needs? Highway 33 Capital CEO, David Hofer, explains how sources of capital his company utilizes can make single digit (yes, single digit) loans available in the $5M to $30M range based on the following underwriting criteria:

- The borrower must own their commercial real estate property that is green zoned, has cannabis licensing, and must be generating revenue with sufficient cash flow to service the debt.

- Funds may be used for acquisition financing or to pay off construction and bridge loans and land contracts.

- Investors will take first lien position on the mortgage and these can be full recourse, limited, or no recourse in some cases.

Rates range from 7-10% with standard origination fees, with terms ranging from 2 – 5 years. Hofer says the timeframe from application to funding is approximately 90 days. He estimates that industrial warehouses they are underwriting that are “green zoned” show at least a 20 to 30% in increase value. For debt loans the company feels comfortable with LTVs of 60-65% in their green zoned properties. For investor security, and to be able to offer lower than market rates, personal guarantees and cross corporate guarantees, wherever possible, are required from their borrowers.

How We Can Help – Finding the Right Fit for Your Investment StrategyCannabis Industry Mid-Year Access to Capital Report

What we conclude from the perspectives provided by the largest of MSOs is that 2022 offers an array of opportunities in M&A transactions, of all sizes, and in non-dilutive debt financing. What we advise our investors as they assess the market in which they see as the most advantageous boils down to clarifying the investment needs and objective of all parties, determining the real value in the business by calculating a well-substantiated valuation, and matching the right investors with the right funding opportunity; the right operators whose objectives and scalability are a fit for investors’ portfolios.

At Highway 33 Capital we excel at structuring deals to meet client investment strategies in emerging 2022 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.