Investor Takeaway Will Cannabis Debt Financing Survive Rate Hikes by The Fed?

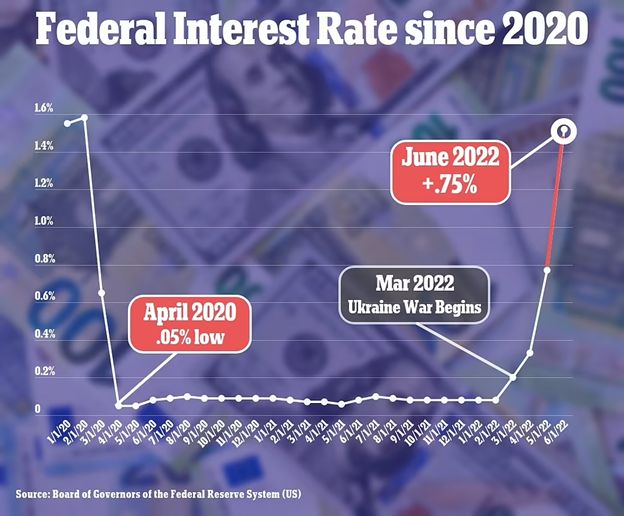

Improving operations in the low interest environment last year spurred unprecedented debt financing growth in the cannabis industry. Last week, however, the Federal Reserve raised the federal funds rate by three quarters of a per cent. A move that was the biggest rate hike since 1994.

- Yet multimillion-dollar debt transactions among cannabis industry leaders continue.

- For cannabis operators debt can play a vital role in the capital structure of a company in order to preserve equity and to facilitate long term growth.

- A quirk of the U.S. tax code favors companies with capital structures that lean toward debt rather than equity.

- The migration of new participants into the cannabis market, particularly on the debt side, is prolific and it’s going to continue to lower everybody’s cost of capital.

- Smaller operators with licenses in property they own in green zones who have revenue and cash flow to sustain the loan can still qualify for single digit interest rates.

Non-dilutive Debt and the Action by the Fed Will Cannabis Debt Financing Survive Rate Hikes by The Fed?

Last week, as you are all painfully aware, the Federal Reserve increased federal funds rate by 0.75% in biggest hike since 1994.

The outlook from that point on about rate increases is cloudy. With the hint of more big moves to come – forecasting that the federal funds rate will end 2022 at a range of 3.25% to 3.5% and next year at close to 4%, the stock market plunged. When Fed Chairman Jerome Powell then stated, as reported in USA Today, “I do not expect moves of this size to be common,” stocks rebounded somewhat, closing up 54 points.

Regardless of this damper on the inflationary economy overall, we can speculate that this action will continue to be a blow to share prices of the major cannabis MSOs. As equity value began to decline for these pubcos, non-dilutive debt financing has clearly become the option of choice. Now with rising interest rates how will this form of growth financing be affected in the cannabis industry?

At this point the pace of debt financing continues unabated. Major recent transactions include: Will Cannabis Debt Financing Survive Rate Hikes by The Fed?

- At the end of 2021, Fluresh, one of the largest vertically integrated operators in Michigan, announced what it described as an historic transaction for the cannabis industry – closing $48M in “engagements from a Federally Chartered Bank.” The secured bank note is for aggregate gross proceeds of $25 million with a variable interest rate at the time of closing of 5.75% per annum with 50% of the aggregate proceeds capped at 7.0%.

- MarketWatch reported that on January 28 Trulieve Cannabis closed a $75 million private placement of 8% senior secured notes due 2026. This was its second tranche of senior notes following a massive $350M debt offering that closed on Oct. 6.

- In late February Columbia Care Inc. closed a $185M debt offering priced at 9.5% in senior secured first lien notes from an unnamed source due 2026.

- Canaccord Genuity Corp. led these debt deals for both Trulieve and Columbia Care.

- Both of these transactions followed the trend continuing into 2022 where cannabis companies are raising capital with non-dilutive debt as opposed to turning to the public markets as share prices decline.

- The goal according to a news release statement by Columbia Care CEO Nicholas Vita, “This non-dilutive financing provides Columbia Care with additional flexibility to continue executing on our strategic growth initiatives,”

- Also, in February Harborside Inc., a California focused vertically integrated operator, announced closing of the first tranche of $45.4Mof Pelorus roll up financing out of the total expected of $77.3M funded through three separate loans to Harborside, received approximately $15.5M, Loudpack, received approximately $16.4M, and Urbn Leaf, received approximately $13.5M. From its share of the proceeds of the Roll Up Financing, Harborside repaid $12M outstanding under its senior secured revolving credit facility.

- On May 18, MSO AscendWellness Holdings, Inc. announced closing $36.5M of additional funding under the increase option of its existing term loan credit facility – from an August 2021 transaction of a $210M senior secured term loan credit facility with Seaport Global Securities LLC as lead manager.

Will the Pace of Debt Financing Continue? Will Cannabis Debt Financing Survive Rate Hikes by The Fed?

As we have been reporting, the pace of capital creation in the cannabis industry through M&A transactions has already exceeded equity raises. Now William Freedman in Cannabis Business Times provides this analysis of a key reason debt financing has become so much more attractive to issuers than equity. While some drivers are internal, others are external—both regulatory and economic.

“[A] quirk of the U.S. tax code favors companies with capital structures that lean toward debt rather than equity,” according to American Estate & Trust. “Interest payments are tax-deductible; dividend payments are not.”

While Internal Revenue Code Section 280E, as applied today, prohibits cannabis businesses from deducting that interest along with many other standard expenses, it all hinges on cannabis’s classification as a Schedule-I drug and the murky legal definition of “trafficking,” according to the Congressional Research Service. So it was just a matter of time before the cannabis industry switched from equity to debt as an emergent funding source.

Perspective from Curaleaf

As you may recall from our reporting on the Benzinga Capital Conference this spring, the growth strategies for 2022 of many of the major MSO were presented. Here is what we learned from Jack Mascone, the Head of Capital Markets for Seaport Global, who spearheaded the huge Curaleaf debt transactions – the facts behind the headlines.

Toward the end of last year the industry reached a turning point in access to capital. In 2019 a syndicate of lenders provided Curaleaf with a $300 million term loan. At the time, this was the largest and most significant debt financing an MSO was able to negotiate.

Then, last year Curaleaf set another record by receiving commitments for a privately placed debt raise of $425 million, once again securing the largest debt raise to date, but also obtaining an 8% interest rate – perhaps the lowest rate in the cannabis industry at that time.

Mascone sees more significance for the future of the cannabis industry than just the milestones of these Curaleaf transactions. In the 2019 deal two-thirds of the participation in the $300M loan was from family offices and non-institutional investors. When the deal was refinanced last fall, at that low 8% rate, more than 75% of the funding came from what Mascone considers as institutional and professional investment capital. “The migration of new participants into the cannabis market, particularly on the debt side, is prolific and it’s going to continue to lower everybody’s cost of capital,” he says.

Will the Smaller Operators be left Behind in the Search for Low Interest Debt Financing?

Of course, it is easy to see why the large MSOs qualify for the low rates in these multi-million dollar transactions. However, what about the smaller and single state operators? Will they ever be able to qualify for low interest rate debt financing for their operations, growth and acquisition needs? Highway 33 Capital CEO, David Hofer, explains how sources of capital his company utilizes can make single digit (yes, single digit) loans available in the $5M to $30M range based on the following underwriting criteria:

- The borrower must own their commercial real estate property that is green zoned, has cannabis licensing, and must be generating revenue with sufficient cash flow to service the debt.

- Funds may be used for acquisition financing or to pay off construction and bridge loans and land contracts.

- Investors will take first lien position on the mortgage and these can be full recourse, limited, or no recourse in some cases.

Rates range from 7-10% with standard origination fees, with terms ranging from 2 – 5 years. Hofer says the timeframe from application to funding is approximately 90 days. All applications are handled by senior members of the firm’s management team.

What Can Strategic Investors Use as a Guide Through Debt Deals for the Right Investment to Meet A Portfolio Strategy?

Debt plays a more vital role than ever for maturing cannabis companies because debt financing interest rates, as we see it, are at the lowest point now than they will be over the next 5 to 10 years! In the capital structure of a company debt preserves equity and facilitates long term growth. The primary options available to cannabis operators are these.

Sale and Leaseback Transactions

While Sale-Leaseback (SLB) transactions aren’t technically debt they do allow companies to free up liquidity from their balance sheets without dilution. The upside of this alternative is that cannabis companies increasingly have been selling their cultivation, processing and storage facilities and immediately leasing them back as a way to instantly raise tens of millions of dollars. The potential downside is that an SLB locks the asset seller into a longer commitment than other straight debt alternatives that now are likely to be able to be secured for rates similar to the SLB. It should be noted, however, that in common debt transactions lenders will be looking for more than a mere promise to repay. A security interest and/or corporate or personal guarantee (PG) will most likely be required. An SLB is a great option in obtaining capital for cannabis operators, and one that has been used by many of the largest companies in the space.

Asset-Based Lending

Based on the valuation of real estate and equipment assets, a cannabis company can typically borrow from within the range of 40% to 75% of asset value. In the case of development projects, the loan is usually based on project costs. While less typical, there are some working capital debt options in the market as well, though the availability of this option is much less than for real estate and equipment financing.

Convertible Options

- Up to this point, most debt financing by cannabis companies was found in convertible note options with low conversion premiums – which essentially delay dilution of equity. The company creates a note that converts to equity, often preferred stock, at a future date based on a future valuation method. These notes, similar to promissory notes with interest payable on or before a maturity date, have given investors security that they are repaid before equity holders if something goes wrong. For both the investor and the company this note structure allows the valuation question to be answered in the future while providing needed capital to the company and a more secure instrument to investors.

MTN – Short-Term Solution to Minimize Dilution with Funding at Single Digit Rates

- True, that the three alternatives listed above are considered the standard. Now, however, a new alternative is emerging, the Medium Term Note (MTN) for companies with relatively strong balance sheets. An MTN is an alternative to traditional long-term and expensive short-term financing – to aid a company with such objectives as accelerating a growth strategy, facilitating a roll-up M&A strategy.

- An MTN is essentially a bond issuance through investment bankers and funded by private institutional sources, in the range from $20M to $100M+, with specific characteristics to facilitate being issued quickly in order to take advantage of temporary market opportunities.

- The key is to effectively customize the MTN with characteristics most advantageous to the issuer that appeal to the strategy of an investor. This results in rates typically lower than other forms of debt financing. With our network of institutional funding sources for MTNs we provide an overview of the funding need and the upside for investors. Then, we assist the issuer with legal, accounting, underwriting, and rating services in order to begin the preparation of the offering.

How We Can Help – Finding the Right Fit for Your Investment Strategy

At Highway 33 Capital, we see decision-making challenges daily in our role as an investment banking intermediary as we arrange for the funding of growth companies in the cannabis and hemp markets via M&A, asset sale/purchase, and debt transactions. Finding the right fit for your strategic investment portfolio, or the proper way to appeal to a source for your growth funding, comes down to:

- clarifying the investment needs and objective of all parties

- determining the real value in the business by calculating a well-substantiated valuation

- and matching the right investors with the right funding opportunity – the right operators whose objectives and scalability are a fit for investors’ portfolios

We excel at structuring deals to meet client investment strategies in emerging opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.