Investor Takeaway Canadian Cannabis Market – Renewed Interest Up North

Recreational marijuana sales last year reached 4.8B Canadian dollars (US$3.8B), which is 19% more than 2021’s estimated figure. For every dollar in revenue or capital expenditures, the industry adds about $1.09 to Canada’s GDP from legal cannabis purchases. Yet the stock of publicly traded Canadian cannabis Licensed Producers (LPs) continues a precipitous decline. Major Canadian LPs continue to miss anticipated positive EBITDA target dates. Nevertheless, major U.S. cannabis operators are looking once again to Canada for business expansion:

- The country enjoys the advantages of a unified, centrally regulated market.

- Such policy has enabled Canada to become a major cannabis exporter.

- This gives cannabis marketers a way to prove out new products in one of the few federally-regulated recreational markets in the world.

- Trends present a compelling long-term growth opportunity for select LPs and retailers.

- Interestingly, the biggest Canadian companies’ market share is declining, while smaller companies are gaining.

- One industry consultant concludes, “For U.S. bargain hunters with cash, you could pick up a lot of quality assets from hungry sellers on the cheap.”

The Canadian Cannabis Market Canadian Cannabis Market – Renewed Interest Up North

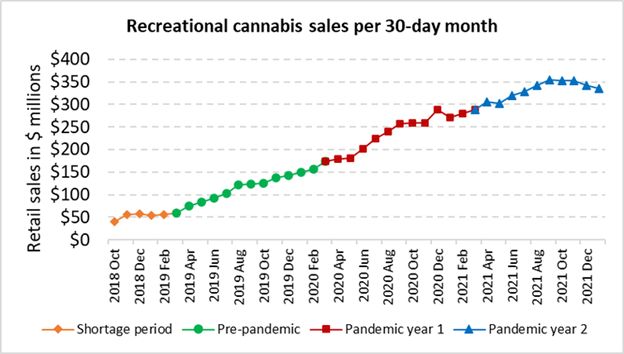

Often maligned for being a market still struggling due to fragmentation, oversupply, and price competition – being the first, but far from being the most efficient – Canada’s cannabis sales exceeded expectations in 2021. According to New Cannabis Ventures, recreational marijuana sales reached 4.8B Canadian dollars (US$3.8B), which is 19% more than 2021’s estimated figure.

MJBizDaily, citing Statistics Canada, reports that regulated adult-use cannabis sales in April were a record 372.4M Canadian dollars (US$287M), bringing total recreational sales to CA$1.4B through the first four months of the year. This according to Cantor Fitzgerald, is a 21% growth in Canada’s recreational cannabis market in the second quarter on a year-over-year basis, while estimated U.S. growth is projected to be just 1% during the same period.

In addition, Hifyre IQ, Canada’s leading real time data analytics provider for the cannabis industry, attributes this growth to: “An increase in the number of stores as well as falling flower prices that bring consumers from the illicit market have been boosting sales.” TheConversation.com finds that national sales now exceed $347M monthly, thanks partly to having at least 3,100 licensed stores.

A report recently released by Deloitte Canada finds that cannabis has contributed $43.5B to Canada’s gross domestic product since recreational cannabis was legalized in October 2018.

- For every dollar in revenue or capital expenditures, the industry adds about $1.09 to Canada’s GDP.

- The report found that the industry is responsible for 151,000 jobs. For every million dollars in revenue or capital expenditure, the cannabis sector sustains about four jobs in Canada.

- The research also estimates that the industry has generated $15.1B in Canadian tax revenues. Consumer purchases alone generated $2.9B in sales and excise taxes.

Market Performance Not Mirrored by Stock Performance

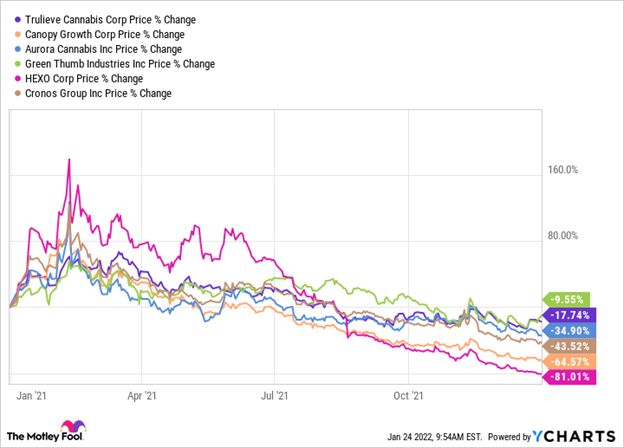

Yet the stock of publicly traded Canadian cannabis companies continues the decline that started in Q1 last year. In actuality, a major contributing factor is the delayed de-scheduling of marijuana by the U.S. government. This frustration was expressed in a recent interview with Richard Carleton, C.E.O. of the Canadian Securities Exchange (CSE). According to Mr. Carleton, “Every time we see positive movement, a setback in public expectations about the timing of U.S. federal de-scheduling is reflected in stock performance – in many cases unrelated to actual company financial performance in the marketplace.”

New Cannabis Ventures is still projecting an overall revenue growth rate in 2022 for the top 10 largest U.S. MSOs of 61%. Lately this forecast has been slipping downward for those with sluggish sales in many states and delays in the beginning of adult-use sales in newly legalized markets.

For the mega operators in Canada, however, stock prices continue their steep decline.

Market Leaders Setting a New Trend Canadian Cannabis Market – Renewed Interest Up North

MJBizDaily reports that a growing number of U.S. cannabis operators are making their way back into Canada in search of new revenue streams and relatively cheap assets. This was found to be the case for cannabis firms ranging from technology and events companies to beverage and edibles businesses. Quoting Mitchell Osak, president of Toronto-based Quanta Consulting, “For growth-focused, publicly listed U.S. companies, at a 10,000-foot level, Canada could represent an appealing market based on market size and regulatory clarity.”

And despite Canada’s overproduction of cannabis and falling prices, some U.S. executives see more opportunities north of the border versus core U.S. markets where sales are declining on a year-over-year basis.

In addition to these sales trends, Mitchell Osak pointed out in MJBizDaily that Canadian assets are relatively cheap at the moment, and the lower Canadian dollar makes M&A in Canada more appealing in some cases.“For U.S. bargain hunters with cash, you could pick up a lot of quality assets from hungry sellers on the cheap,” he said.

Get Into One of the Most Advanced Grow Facilities for Pennies on the Dollar!

Investors Sought for 1.7 Million Sq.Ft. Canadian Mega-Facility

The purchase price is pennies on the dollar – buying the company that owns the real estate, also getting $200M+ in carry forward losses to offset future tax liabilities. There’s considerable upside with this real estate investment. The investment team has de-risked the investment.

Equity investors are being invited to participate in the $10M equity investment to close on the transaction. Investors get 70% ownership of the RealCo asset and a 7% annual cap rate ($2.5M in income) after debt service starts in year 2. Closing is anticipated in 30 days after the culmination of months of negotiations with the assistance of respective law firms in the US and Canada.

This video shows the scale and magnitude of this mega-facility.

Colliers Presents Solar Fields Complex – VideoTour.mp4

This is “Colliers Presents Solar Fields Complex – VideoTour.mp4” by David Hofer on Vimeo, the home for high quality videos and the people who love them.

Trend Setting Examples

MJBizDaily found recent movement by key cannabis operators and ancillary companies Up North:

- In May, California-based cannabis technology company Blaze Solutions acquired Vancouver-based dispensary point-of-sale software company Greenline for an undisclosed sum. Chris Violas, CEO of Blaze, said the company was looking for new growth outside of its core markets. “There’s growth in the U.S., no doubt, and we’re excited about that. But, at the end of the day, there is a limited (total addressable market). So in considering Canada we asked, ‘Where could we go and be smart and win some market share?’” he told MJBizDaily.

- Also in May, California-based Kiva Confections announced a deal with Montreal-based license holder Greentone, allowing Kiva to offer its edibles at retail outlets across Canada.

- Boston Beer is one company that sees the Canadian market as a way to prove out new cannabis products in one of the few federally-regulated recreational markets in the world. The company signed on strategic partners in Canada to produce nonalcoholic THC-infused teas dubbed TeaPot. According to the company’s head of cannabis, Paul Weaver, “Flexibility in Canada allows us to test, learn and build an amazing product around TeaPot.”

What Do We See on the Horizon for Canada?

Besides the continued, albeit, slow implementation of Health Canada rule changes and updates to lift limitations from the cannabis industry, there will be the rise of up-and-commers. Among the cloudy picture painted by the recognized giants in Canada, the company High Tide (NASDAQ: HITI) (TSXV: HITI) (FSE: 2LYA), continues to accelerate sales though its 113 retail locations claiming: “revenue of $72.2 million in the first fiscal quarter of 2022, which is the second-highest quarterly revenue figure ever reported by a Canadian cannabis company that reports in Canadian dollars.” This was attributed to the innovative discount club model at its retail stores, proprietary operational efficiency software, expansion of international CBD sales, and to opening other retail locations with branding innovations.

Consolidation and the divestiture of distressed assets will highlight 2022 in Canada.

According to Forbes:

There are over 800 companies licensed to sell or process cannabis in Canada. According to some industry analysts, the surplus contributed to the oversupply of cannabis in the market. While that figure may also demonstrate a successful transition from the illegal to the legal market, some experts see the industry’s current state as unsustainable and leading to heavy consolidation.

BNN Bloomberg reports that:

The over 3,000 legal cannabis stores across the country that have helped erode the significant presence of the illicit market. Interestingly, the biggest Canadian companies’ market share is declining, while smaller companies are gaining, despite merger and acquisition (M&A) deals and record sales in 2021.

And Canadian investment dealer, ATB Capital Markets, concludes that the market still presents a compelling long-term growth opportunity for select LPs and retailers.

“While the industry continues to struggle due to fragmentation and price competition and limited marketing, just made less restraining by Canadian regulation, we believe that players with a lean cost structure, a robust capital position, and operational efficiency can successfully navigate this environment.

How We Can Help

We see the continued growth of investment prospects for strategic investors in the Canadian cannabis industry, as the listing above for the mega-cannabis facility indicates. The approach we take with our clients for risk mitigation prior to presenting them with investment opportunities: evaluating the prowess and the passion of the executive team, assessing the competitive advantage of the company and how quickly they can scale for growth, and determining how well they are ready for the regulatory regime in their home and target growth markets. We take those steps before presenting the company to our extensive network of pre-qualified investors.

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2022 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.