Investor Takeaway Will Inflation Derail Cannabis Debt Financing

In 2021 it is estimated that capital flow into the cannabis industry topped $12.7 billion, with $3.4 billion attributed to debt financing transactions. Improving operations in the low interest environment last year saw this issuance of debt funding grow. Recent multimillion-dollar debt funding among cannabis industry leaders shows that debt as a source of growth funds is a rational use of capital, not a sign of business distress. For cannabis operators debt can play a vital role in the capital structure of a company in order to preserve equity and to facilitate long term growth. In 2022 will the driving forces behind this rise of debt financing in the cannabis industry prevail in the face of the signals from the Federal Reserve that interest rates will climb in as many as three increments this year? This week’s issue of the EDGE Briefing examines the strength of debt financing in the current inflationary environment as a guide for strategic investment decision-makers.

State of the Industry Will Inflation Derail Cannabis Debt Financing

The flourishing cannabis industry got a bit of a wake up call last year. Sales came down off the vigorous pace set YOY 2020, publicly traded Multistate Operators (MSOs) experienced continued decreasing stock value, and the expected accelerated pace of federal legalization did not materialize. YOY sales growth for many key states is off significantly from the torrid pace set in 2020. California, Colorado, Nevada, Oregon and Washington that were reported to have had a YOY growth in 2020 near 40%, as reported by MJBizDaily, are seeing their YOY sales growth dropping to around 16% in 2021 according to industry research firm Headset.

This malaise is not expected to detour the U.S. cannabis industry from reaching the predicted $30 billion sales level in 2025. More states are coming onboard. States new to expanded legalization such as Alabama, Connecticut, New Mexico, New York, and Virginia are predicted by MJBizDaily to add as much as $5.9 billion through 2025. And, according to New Frontier Data, as impressive as the industry sales growth has been so far, this has come from the approximately 45 million U.S. consumers in legal markets. There are some 160 million U.S. buyers who could still join the market.

Trending Debt Financing Will Inflation Derail Cannabis Debt Financing

This is the backdrop for the industry going into 2022, while, capital flowing in, estimated to be $12.7 billion as of December 24, is just $1.4 billion short of the record year 2018, according Viridian Research. They found that U.S. equity raises climbed to $1.9 billion, but “debt was where the action was.” Debt raised soared 806% over the 2018, for a total of $3.4 billion. Mergers and Acquisitions remain the dominant way to accelerate growth among the bigger players in the industry. Toward the end of last year, however, the industry reached a turning point in access to capital when a syndicate of lenders provided Curaleaf with a $300 million term loan. At the time, this was the largest and most significant debt financing an MSO was able to negotiate. Then, a couple of weeks ago Curaleaf set another record by receiving commitments for a privately placed debt raise of $425 million. Once again securing the largest debt raise to date, but also obtaining an 8% interest rate – perhaps the lowest rate in the cannabis industry. Thanks to their stronger market position this is substantiation of the trend away from equity to debt financing of the major MSOs that have cleaned up their balance sheets and solidified their market expansion plans.

Driving Forces

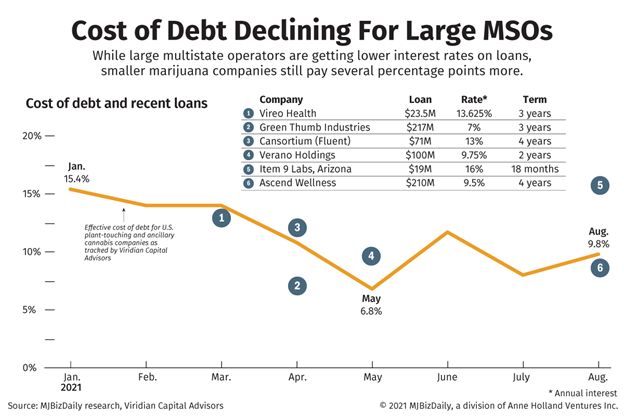

The Curaleaf Debt financing transaction demonstrates how debt is becoming cheaper. According to Viridian Research, the cost of debt has fallen at least 300 bps for $100 million+ debt issuance over 2020. Curaleaf (CURLF) borrowing at that record level of $425 million for five years at an 8.0% is down from 13.0% for a $300 million four-year loan facility secured by CURLF in 2020. Other examples cited in The Weekly Stash:

- Green Thumb Industries (GTBIF) raised $217 million at a 9.1% effective rate in 2021 compared to the $105 million it borrowed at 12.86% in 2019.

- Cresco Labs (CRLBF) secured a $200 million loan at 9.5% in 2021 compared to its $100 million debt issuance at 12.7% in February 2020 and another $100 million debt issuance at approximately 12% in December 2020.

Also reported in The Weekly Stash, this decline in the debt financing cost – especially for large caps – is being driven by cannabis operators’ strong fundamentals, falling stock prices, and the emergence of cannabis institutional lenders. They see this benefiting small cap companies as fundamentals strengthen, sources of funding expand, and federal legalization inches closer to reality. They predict that:

Debt issuance to grow further in 2022 and believe this will support large caps’ growth plans (organic and inorganic) and fuel M&A activity in the industry.

Marc Hauser of Reed Smith LLP sees the rise of debt in the cannabis industry being primarily driven by two main factors.

From the borrower’s perspective, cannabis businesses built a large asset base financed by capital raised through public issuances during 2017-early 2019 that could be used as loan collateral. Companies could now finance growth without having to further dilute.

From the investor’s perspective, lending against assets (real estate, equipment, and even inventory and licenses) provide a measure of downside protection (particularly given that a cannabis borrower can’t file for bankruptcy) that investment equities don’t offer, particularly in the wake of continuing cannabis stock price volatility.

Nevertheless, the primary underlying reason for the rise of debt is that the low interest-rate environment the U.S. economy has been experiencing has attracted more debt providers to come online, and recent multimillion-dollar debt funding among cannabis industry leaders shows that debt as a capital source for cannabis companies is a rational use of capital – potentially cleaning up balance sheets and enabling access to funding for expansion and/or the purchase of distressed assets coming out of the pandemic – to use debt financing for competitive advantage in the marketplace.

Inflation and the Fed Will Inflation Derail Cannabis Debt Financing

The potential of higher interest rates, in general, makes raising capital harder and increases its cost. Low interest rates, however, have made those costs relatively cheaper in recent years. That’s about to change. The industry may face increasing challenges in 2022 after the Federal Reserve signaled this month that it plans to raise interest rates three times by the end of next year.

Bankrate.com reports that inflation has skyrocketed in 2021, with consumer prices in November climbing 6.9 percent from a year ago, the fastest pace since 1982. Fed Chairman Jerome Powell said at a December post-meeting press conference that:

The Fed’s hawkish pivot is meant to put U.S. central bankers in a defensive position. Officials see elevated inflation persisting through at least 2024, with the Personal Consumption Expenditures price index ending 2021 at 5.3 percent, though moderating down to 2.6 percent at the end of 2022.

Our assessment of this situation at this point is to rely on the almost inflation-proof qualities that the cannabis industry has displayed and to support the finding by sources quoted in this article that improved fundamentals by leading cannabis industry MSOs will continue to support debt funding alternatives.

MTN – Short-Term Solution to Minimize Dilution with Funding at Single Digit Rates

Here, for example, is a new alternative is emerging, the Medium Term Note (MTN) for companies with relatively strong balance sheets. An MTN is an alternative to traditional long-term and expensive short-term financing – to aid a company with such objectives as accelerating a growth strategy, facilitating a roll-up M&A strategy.

- An MTN is essentially a bond issuance through investment bankers and funded by private institutional sources, in the range from $20M to $100M+, with specific characteristics to facilitate being issued quickly in order to take advantage of temporary market opportunities.

- The key is to effectively customize the MTN with characteristics most advantageous to the issuer that appeal to the strategy of an investor. This results in rates typically lower than other forms of debt financing. With our network of institutional funding sources for MTNs we provide an overview of the funding need and the upside for investors. Then, we assist the issuer with legal, accounting, underwriting, and rating services in order to begin the preparation of the offering. .

Investor Takeaway

In 2021 it is estimated that capital flow into the cannabis industry topped $12.7 billion, with $3.4 billion attributed to debt financing transactions. Improving operations in the low interest environment last year saw this issuance of debt funding grow. Recent multimillion-dollar debt funding among cannabis industry leaders shows that debt as a source of growth funds is a rational use of capital, not a sign of business distress. For cannabis operators debt can play a vital role in the capital structure of a company in order to preserve equity and to facilitate long term growth. In 2022 will the driving forces behind this rise of debt financing in the cannabis industry prevail in the face of the signals from the Federal Reserve that interest rates will climb in as many as three increments this year? Signs point toward continued debt issuance in support the growth of large caps as valuations below the potential of many small cap MSOs make them attractive targets.

How We Can Help

At Highway 33, we see these challenges daily in our role as an investment banking intermediary as we arrange for the funding of growth companies in the cannabis and hemp markets via M&A, asset sale/purchase, and debt transactions. It is still the case that very few institutional sources of capital are active in the cannabis space. Finding the right fit for your strategic investment portfolio, or the proper way to appeal to a source for your growth funding, comes down to clarifying the investment needs and objective of all parties, determining the real value in the business by calculating a well-substantiated valuation, and matching the right investors with the right funding opportunity – the right operators whose objectives and scalability are a fit for investors’ portfolios.

We excel at structuring deals to meet client investment strategies in emerging opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.