Where the Smart Money is Headed in Life Sciences While the business and funding in so many segments throughout our economy has dried up during the continued detrimental impact of COVID-19, funding in Life Sciences is robust.

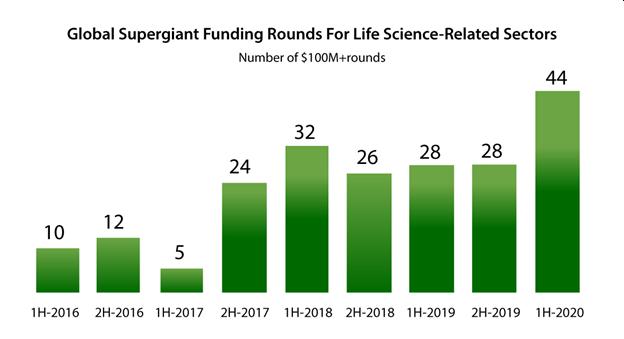

According to Crunchbase in the first half of 2020 Life Science-related companies received a record 44 “supergiant” funding rounds of $100M or more.

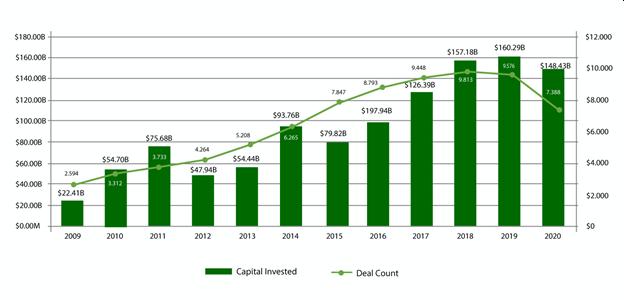

And Pitchbook shows that the amount of capital invested into the third quarter at $148.43B is nearing the record height set in 2019 of $160.29B…

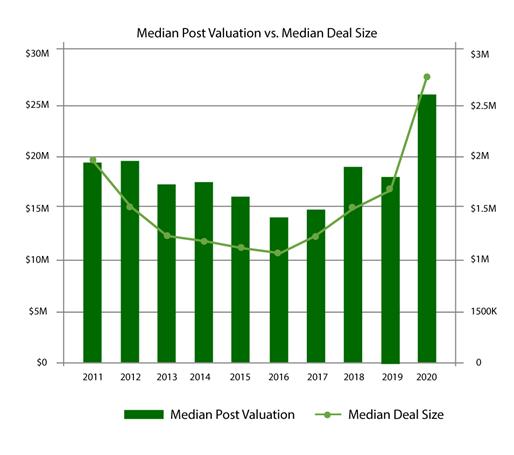

…while both deal size, on a smaller number of deals than in 2019, and media post valuation are significantly higher in 2020.

Very simply, the venture money flowing into funding rounds in the Life Sciences segments continues the accelerated pace begun in 2018 and shows no sign of diminishing during the pandemic. In fact, the search for a vaccine has put more venture and strategic funding into the category, as was the case with the $2B raised by vaccine manufacturer Moderna at the end of 2018, leading to its $30B valuation today. Where the Smart Money is Headed in Life Sciences

Major capital movement into the Life Sciences industry is not limited to the pursuit of the vaccine. This fast-paced industry encompasses a divergent array of segments that vary from pharmaceuticals and healthcare, to biotech, gene therapy and neuroscience. Here we look for the common opportunity within these segments for where smart investors are placing their bets – moving into an industry where a balance must be struck between compliance, on the one hand, and accelerating the pace of bringing product advancements to market on the other. Where the Smart Money is Headed in Life Sciences

Life Science is Becoming Digitalized

- AI and Machine Learning – While leading-edge technology has always been an integral part of Life Sciences advancements, AI and Machine Learning are now decreasing the time it takes to get a new product to market. The scope, scale and cost-efficiencies of R&D are expanding along with improvements in the manufacturing process. Data analysis from clinical trials to enable companies throughout industry segments to more rapidly predict medication effectiveness. AI brings the advantages of speed, lower cost and the ability to identify candidates. This has led to what Signify Research recently reported in BioSpace that venture investment in AI drug development and optimizing clinical trials has reached $5.2B.

- Increasing operational efficiency – The demand for precision medicines – small-volume, personalized medicines – is driving manufacturing away from large-scale bulk production to the smart factories of the future with the promise of digital automation solutions. With digitalization, according to Deloitte’s Center for Health Solutions, the number of days it takes to release a drug product could potentially be reduced from 100 days to a mere seven.

- Data-driven manufacturing – is placing renewed focus on quality and productivity. In order to better manage production costs relative to compliance standards manufacturers are using new automation technologies to track productivity in real time.

- Digitalization brings with it the promise of more accurate diagnosis – and with it, better treatment of patients, prompted by the rise of Telemedicine. Telemedicine visits doubled in the short span from 2016 through 2019, from 14% of all visits in various specialties to 28%, with COVID-19 accelerating the pace this year. And, regarding the future, according to GlobalMed, 74% of millennials prefer telemedicine visits to in-person doctor appointments.

Personalized/Precision Medicine

The dramatic and constant improvements in DNA sequencing and in genome research is propelling Life Sciences toward customized treatment therapies specific to individual patients. Genomic research is identifying the disease pathway sorting through thousands of interacting proteins to target the most effective one for a specific medicine. According to FierceBiotech, already approximately 75% of oncology treatment is based on a patient’s molecular profile, qualifying as Precision Medicine. This orientation toward patient centricity means more patient compliance with more compatible treatment and more movement from hospital care to home-based therapy.

Drug Development and Delivery

Where the Smart Money is Headed in Life Sciences

Among the myriad of change and advancements in the Life Sciences industry, the elephant-in-the-room, so to speak, the common problem all segments of the industry must resolve remains the high cost of getting new drugs and therapies to market. The Journal of Health Economics has published, in a study by authors DiMasi, Brabowski and Hansen, the estimate that the cost of R&D for a specialty drug is in the neighborhood, the premier neighborhood that is, of $2.6B per product. The same study shows that only 12 per cent of investigative medicines entering clinical trials are ultimately approved by the FDA. This is less than half of the percentage approved a decade ago.

Yet, advancements in the drug discovery and clinical trial efficiency are forcing research processes to evolve. As a result of researchers around the globe racing to find the effective vaccine for the SARS-Cov-2 virus that causes COVID-19 they are beginning to truncate the length of the drug development process. Smart technologies, such as AI/ML are leading to more effective digital modeling in order to predict therapy treatment effect on patients before beginning the lengthy, costly process of clinical trials. Hundreds of companies and institutions around the globe have downloaded software to accelerate their work on the virus genome. Many welcome new treatments that have evolved in the fields of oncology and rare genetic disorders. A drug discovery startup, Atomwise, from the NVIDIA Inception incubator program working in neural network small molecule drug discovery can screen more than 16 billion compounds within the period of two days.

Integration

Where the Smart Money is Headed in Life Sciences

It has become apparent in Life Sciences as is so many other industries that for teams to connect on crucial technology solutions they can’t operate in silos. Integration is vital to ensure compliance along with faster results and the prevention of any quality gaps along the way. Critical to Life Science companies is the integration of risk management with Corrective and Preventive Action (CAPA) to plan effectively for any high-risk event that may occur in the drug discovery/development process.

Investor Takeaway

Major capital movement into the Life Sciences industry is not limited to the pursuit of the COVID-19 vaccine. This fast-paced industry encompasses a divergent array of segments that vary from pharmaceuticals and healthcare, to biotech, gene therapy and neuroscience. The common opportunity within these segments for where smart investment money is moving is finding the opportunity that has struck that crucial balance between compliance, on the one hand, and economically accelerating the pace of bringing product advancements to market, on the other hand.

Sorting Through the Right Investment to Meet Your Portfolio Strategy

For our clients, here is the advice we provide as they assess opportunities in the Life Sciences segments:

- The technology – critical, naturally, to thoroughly understand the technology and its place in the client’s investment strategy.

- The team – how comfortable is the investor with the caliber and experience of the management team and how convincing is their dedication to change/improve people’s wellbeing? And, are they resilient?

- Is there strong IP protection?

- Are there well-functioning science-based regulatory compliance procedures?

- Credible funding plans – is there a clear and attainable path toward growth/liquidity?

- Risk assessment – what is the type of risk the investor is willing to take?

- Timing – is investment prudent now before the onset of future risks?

- Exit – understand the company completely from their patent protection to the acumen of the management team to execute their exit strategy.

- Legal advice – consult with a law firm skilled in structuring legal documentation associated with the level of risk of the investment being contemplated.

- A competent investment advisory – preferably an advisory experienced in Life Sciences that is thoroughly familiar with the industry trends that will affect the investor’s ROI.

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in trending industries like Life Sciences as well as our core expertise in highly regulated markets that include; Biotech, Healthtech, SaaS, CBD/Hemp, Cannabis and ancillary tech companies. We provide investors with thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise and our network to work for you.