DISCLAIMER – As readers of The EDGE Briefing you know that we provide a digest of the most current investment information we have researched and analyzed from the highly regulated industries, particularly cannabis, which are our focus. In these articles we attempt to be as objective as possible. Nevertheless, we continue to respond to questions about the value an investment banking intermediary brings to financial transactions between buyers and sellers, between investors and operators. Value of Investment Banking Intermediary in Cannabis Investments

So, we are taking a slight diversion in this issue to clarify the role that a boutique investment banking advisory plays in connecting investors and operators to the highly vetted opportunities that are the right fit for their mutual growth or exit strategies; so that the buyer is not overpaying and the seller is gaining a return aligned with a realistic valuation of the business.

What is an Investment Banking Intermediary?

Based on extensive industry connections in middle market transactions, an investment banking intermediary facilitates M&A transactions, debt financing and equity raises. An investment banking intermediary like ours typically conducts buy-side and sell-side transactions among midsize to large companies and high Net Worth Individuals (HNWs), Multi-state Operators (MSOs), family offices and other private investment sources. In the case of cannabis, the major institutional financial resources remain on the sidelines, an investment banking intermediary plays the vital role of bringing funding to this capital-constrained industry. In biotech, an investment banking intermediary fills the void by facilitating M&A transactions and other alternative financing for the lengthy, rigorous process of underwriting and research that it takes to get medicines and therapies to market. An investment banking intermediary thrives on participating in the potential of rapidly growing industries that do not fit the funding model of traditional institutional sources of capital. Value of Investment Banking Intermediary in Cannabis Investments

What the Investment Banking Intermediary Does?

Investment banking transactions in the middle market generally consist of four phases: preparation and due diligence, marketing, negotiations, and closing the deal. The due diligence phase includes working with sellers to generate detailed materials, develop market positioning, compile data room materials, write offering materials, and identify prospective purchasers. Prospective buyers/sellers are sought in the marketing phase. Letters of intent (LOI) from prospective buyers and final due diligence comprise the negotiations phase. Deal closing activities can involve a number of steps including obtaining regulatory and stakeholder approval, confirm due diligence, drafting and reviewing final sale documents.

Some of the latest data we have on the contribution that an investment banking intermediary makes comes from a 2016 research survey by Professor Michael McDonald, of Fairfield University. The survey, “The Value of Middle Market Investment Bankers,” questioned 85 business owners who used an investment banker to sell their businesses for between $10 million and $250 million during the period from 2011 to 2016. The survey found that the list of specific services to the business owners provided by investment bankers included:

- Conduct preliminary due diligence

- Assist the Company in preparing marketing materials that describe the Company’s business, its products and services, customer relationships, sales and marketing strategy, operations, financials, outlook, opportunities and acquisition rationale

- Assist the Company in preparing a financial model to be included in the Memorandum

- Assist the Company in setting up a data room that would be available to prospective buyers

- Assist the Company in identifying and contacting potential acquirers to determine their level of interest

- Arrange for meetings and other communications between the Company and prospective acquirers

- Assist the Company in responding to due diligence requests from prospective acquirers

- Provide advice and assistance in negotiating the terms, conditions and pricing of any transaction with an acquirer

- Review, analyze and negotiate the documents related to a Transaction with an acquirer.

Value Added

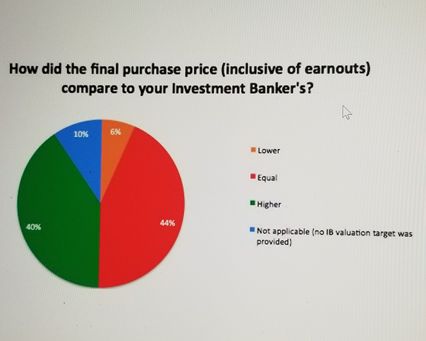

The Fairfield University survey cited above concluded that 84% of the respondents definitely felt that investment bankers added value to the sales transaction. Meaning that the final sales price was equal to or higher than their initial sale price expectation.

The survey examined eight areas where business owners could find value in the services of investment bankers:

- Preparing the company for sale – implementing changes if other elements in the business that would enhance its value.

- Managing the M&A process and strategy – from creating teasers about the opportunity to their investor base to managing the data room and negotiating key terms leading to a final agreement.

- Identifying and finding the buyer – from researching their network/database for the qualified buyers whose investment strategy best fits seller’s objectives.

- Adding credibility to the seller – ensuring buyers that they are entering into a reputable process.

- Coaching the owners – guidance through the often arduous process, avoiding pitfalls common to inexperienced sellers.

- Enabling management to focus on running the company during the sale process.

- Negotiating the transaction – negotiating LOI terms for the benefit of both parties to the transaction.

- And, structuring the transaction – a structure that maximized buyer’s profits and minimizes seller’s risk.

From the examination of these 8 factors it was concluded that “managing the sale process” is the most valuable service provided by investment bankers. In fact, the top three among these factors were: “managing the M&A process & strategy”, “structuring the transaction”, and “educating and coaching the owner.”

This survey was conducted, of course, before the flurry of transactions we now find are taking place in the cannabis industry. However, the findings are completely compatible with the current state of M&A transactions in that industry because of the fact that, then as now, the M&A middle market is grossly inefficient. The parallels between the inefficiencies of the middle market, in general, and the cannabis industry in particular are:

- There is most often scant public information about middle market.

- There is no version of a stock market for middle market companies, as was the case in the cannabis industry prior to Canadian pubco’s entering the public markets.

- Information validation sources for the middle market have been sparce.

- And, these factors make the sales process in the middle market particularly difficult and time consuming.

All of which, again, points to the significance of engaging an investment banking intermediary to conduct these transactions as efficiently as possible. Just imagine yourself as a business owner confronted with all this unfamiliar territory to navigate through to a sale without the help of experienced professionals.

In addition, compounding the problem for buyers and seller in the cannabis industry are these factors:

- Unlike all other major industries, cannabis capital markets are constrained in a way that does not reflect industry potential.

- Even with federal legalization of Hemp, there is still uncertainty and hesitation by large capital sources to provide both debt and equity.

- At Highway 33, we see these challenges daily in our role as an investment banking intermediary as we arrange for the funding of growth companies in the cannabis and hemp markets via debt, M&A, and equity transactions.

- There are limited sources for these transactions unless you have taken the years it has taken us to build up a network of experienced cannabis/hemp investment resources. It is still the case that very few institutional sources of capital are active in the cannabis space.

What’s It Really Worth?

Once it is confirmed that legal/compliance requirements are met then the next major step is conducting a realistic valuation of the business. The investment banking intermediary will develop financial models to include the most important fixed and variable financial factors that will be the most important components in determining the value of a company. There are, of course, significantly different financial factors to consider for different companies, particularly complex in highly regulated industries. In the cannabis industry an investment banking intermediary must positively understand the idiosyncrasies in this marketplace in order to identify a valuation range that ensures the buyer is not overpaying and that the seller’s proformas are verifiable.

For example, MSOs in the cannabis industry are now acting more like CPG companies as the market matures. So, the valuation model for acquisitions in the cannabis space is evolving from one based on sales, typically associated with emerging growth industries, to a more mature industry model based on profits or Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). Many large cannabis MSOs have stabilized and generate positive EBITDA, which justifies the evolution away from a sales-driven model. The larger MSOs have raised money and realize that solidifying operations is essential before the sector opens up to larger traditional business competitors and institutional capital entering the market. Value of Investment Banking Intermediary in Cannabis Investments

Fees

What you can anticipate is typically a monthly retainer for a prescribed period or until the business is sold, plus a commission success fee structure. The survey cited above found that retainers and fees vary widely, the basis still being the size of the transaction.

Like other investment bankers, we do not publish our fees online. Not only do we consider that such disclosure would violate our fiduciary responsibility to our clients, but also the fee structure varies greatly by the size and complexity of each transaction. The logic behind such fees goes beyond just covering the fixed costs investment bankers incur. It extends to the heart of the effectiveness of the process in accomplishing the goals of buyers and sellers. On the buy-side or the sell-side, our fees are structured so that our clients are committed to a course of action that will benefit them in the most efficient manner. And, importantly, the fee structure incentivizes the investment banker’s team to stay on track to enable the client to realize a successful closing.

Sorting Through the Right Investment to Meet Your Portfolio Strategy

For our clients, here is the advice we provide as they assess M&A opportunities in the cannabis industry:

- Know what the organization is getting into– Detailed due diligence and proper integration planning are core to identifying potential issues.

- Get the right people involved– Determine essential stakeholders early and get them involved. An experienced team with investment bankers, legal counsel, accounting and tax professionals will ensure that the process is well managed and that buyers and sellers have the expertise to ensure a successful transaction.

- Know what the organization wants out of the deal– Determine objective business decision criteria to minimize political issues and the impact of personal preferences.

- Get it done right – Devote the necessary resources even if the company is “running lean.” Transaction execution and integration are together a full-time job.

- Know what success means– Establish a performance milestones measurement process to measure the success of integration activities.

- Over-communicate– Personnel will be forgiving at first and will not expect all the answers. They will, however, expect strong leadership that has a vision and a plan for how to get there, how to blend the cultures of the merging organizations into a compatible, inclusive growth-oriented environment.

What It Takes to Make It Over the Finish Line

- The Vision of the Parties

- All stakeholders to the M&A transaction must have a clear vision as to the direction toward profitability the marriage of the parties will take. This requires good advice about the fundamental legal and business issues that will arise and the judgement calls that will have to be made during the process to keep a clear vision for the post-closing entity.

- Commitment

- Once the decision is made that a buyer’s objectives are better served by acquiring rather than taking the path of organic growth, all key management team members must fully buy into that direction regardless of hurdles that will arise along the way.

For our clients, once the vetting process is completed the outreach process begins to all potential qualified acquirers. Our contact list numbers in the thousands of PE firms, MSOs, Pubcos, HNW, Family Offices and other qualified investors. They are contacted, sign our Non-disclosure agreement, are supplied with an Executive Summary about the opportunity and invited for a full presentation of an informative pitch deck and financials. Value of Investment Banking Intermediary in Cannabis Investments

Investor Takeaway

What is the value of an investment banking intermediary in helping clients realize the most value in buy-side or sell-side transactions? One thorough survey conducted by Fairfield University sought to go beyond empirical evidence to survey executives involved in actual middle market M&A transactions conducted by their investment banker. The finding of the research was that the vast majority of these executives, 84%, felt they realized added value in their sales transaction. The survey found that there were eight primary services which add value in buy-side and sell-side transactions of which the most valuable service is “managing the M&A process and strategy.” Key among the steps in the process along with having access to a network of qualified prospects is helping a business determine a substantiated market value, and keeping all parties to the transaction on track to a successful closing. The investment banking intermediary plays a key role in creating the best offering on behalf of a potential seller. Without their involvement, this task is likely to be an overwhelming and distracting process. The ability to provide guidance to get a transaction across-the-finish-line is the value added a client should expect. Value of Investment Banking Intermediary in Cannabis Investments

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.