The quest by investors for medicines and therapies which require reduced R&D and clinical testing time/expense has accelerated the pace of M&A and consolidation transactions in pharmaceutical and biotechnology – with market value projected by Research and Markets to reach $247 billion by 2024. The driving forces behind the growing transactions and valuations are the factors of the digitization of healthcare, and the increase in human lifespan – where both ends of the spectrum, Baby Boomers on the one hand and Millennials on the other, are demanding more precise and affordable treatments. The Surge in Biotechnology M&A

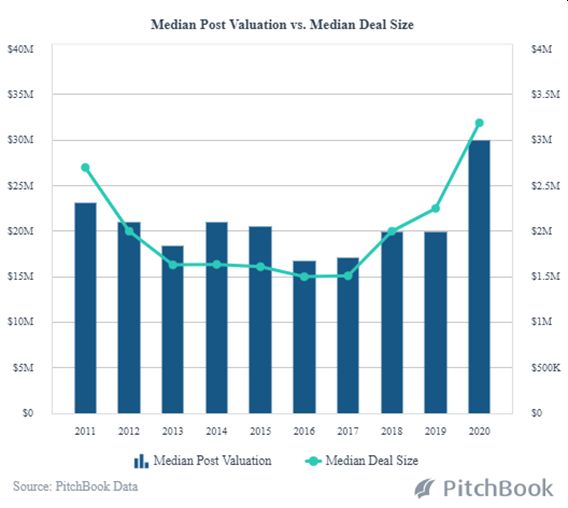

That upsurge of M&A deals was exemplified by major transactions in the later part of 2019 by Merck and Sanofi buying up promising biotech companies, Bristol-Meyers taking Celgene for $74 billion, Pfizer’s acquisition of Array BioPharma, and the AbbVie-Allergan merger. This year, while the buffeting the markets have taken has slowed the pace of M&A deals, post valuations and deal size have actually exceeded what PwC called a banner year in 2019. And, although there were only two major deals in the first quarter of 2020, Qiagen and Thermo Fisher Scientific at $11.8 billion and Forty Seven and Gilead at a $5.0 billion value, PwC notes that mid-sized biotech companies will continue to drive M&A activity as the pace in developing life-saving drugs continues to accelerate.

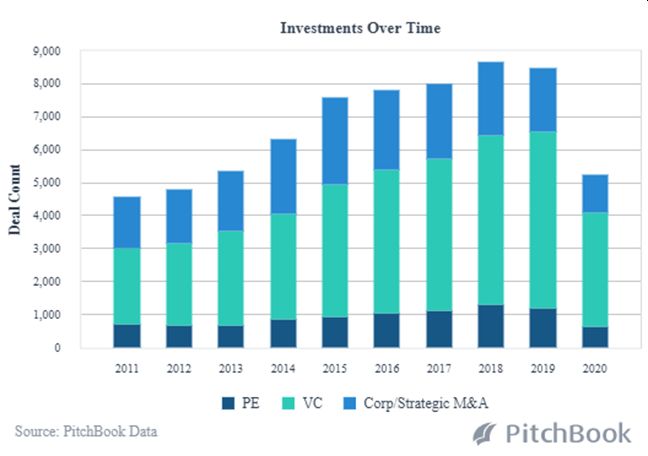

All VC and PE and Corporate Strategic M&A Transactions

Pitchbook still shows that valuations and deal size have grown significantly this year.

Risks and Rewards

The goal of a biotech company in a M&A transactions, of course, is to secure the funding for more R&D while obtaining from a merger the regulatory compliance, sales and marketing expertise for the ongoing commercialization of an expanding product line. But, mergers and acquisitions can be risky. They are not always welcomed by shareholders, and governments may initiate costly, prolonged litigation to stop them. Yet, when these deals succeed, they can deliver instant gains to stakeholders of the company being acquired. These gains that investors can realize by holding through acquisitions is compensation for the all too prevalent risk of the deal falling through. This zeal for potential profitability of successful mergers has created a highly competitive deal market as more and more biotechs are being bought and sold. The Surge in Biotechnology M&A

Sorting Through the Right Investment to Meet Your Portfolio Strategy

For our clients, here is the advice we provide as they assess M&A opportunities in the biotechnology segments:

- Know what the organization is getting into– Detailed due diligence and proper integration planning are core to identifying potential issues.

- Get the right people involved– Determine essential stakeholders early and get them involved. By doing so, retention and change issues will be minimized.

- Know what the organization wants out of the deal– Determine objective business decision criteria to minimize political issues and the impact of personal preferences.

- Get it done right – Devote the necessary resources even if the company is “running lean.” Transaction execution and integration are together a full-time job.

- Know what success means– Establish a performance measurement process to measure the success of integration activities.

- Don’t underestimate the infrastructure– The IT function must be an integral part of both the due diligence and integration planning efforts. IT is a critical enabler of other integration efforts.

- Over-communicate– Personnel will be forgiving at first and will not expect all the answers. They will, however, expect strong leadership that has a vision and a plan for how to get there, how to blend the cultures of the merging organizations into a compatible, inclusive growth-oriented environment.

What’s It Really Worth?

Once it is confirmed that legal/compliance requirements are met then the next major step is conducting a realistic valuation of the merged businesses. Your investment banking advisor should positively understand the idiosyncrasies of the biotechnology industry to identify a valuation range that ensures the buyer is not overpaying and that the seller’s proformas are verifiable. The Surge in Biotechnology M&A

What It Takes to Make It Over the Finish Line

- The Vision of the Parties

- All stakeholders to the M&A transaction must have a clear vision as to the direction toward profitability the marriage of the parties will take. This requires good advice about the fundamental legal and business issues that will arise and the judgement calls that will have to be made during the process to keep a clear vision for the post-closing entity.

- Commitment

- Once the decision is made that a Buyer’s objectives are better served by acquiring rather than taking the path of organic growth, all key management team members must fully buy into that direction regardless of hurdles that will arise along the way.

- Once the decision is made that a Buyer’s objectives are better served by acquiring rather than taking the path of organic growth, all key management team members must fully buy into that direction regardless of hurdles that will arise along the way.

How we can help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in trending segments like Biotech and Pharma, as well as our core expertise in highly regulated markets that include; Healthtech, Agtech, SaaS, CBD/Hemp, Cannabis and ancillary tech companies. We provide investors with thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise and our network to work for you.