In last week’s lead article we reviewed IPO performance in 2020, finding that PwC reported the volume of IPOs to be $150B. It was, in fact, the best year for IPOs since the dot.com era. And, within that total there were 183 traditional IPOs and a record 242 Special Purpose Acquisition Companies (SPACs) accounting for $80B of the total. The Significance of SPACs in Healthcare IPOs

The Significance of SPACs in Healthcare IPOs

SPACs are not just an alternative funding tool anymore. Prompting Market Watch to predict 2021 to be the “Year of the SPAC,” saying:

Venture-backed private companies are increasingly considering the SPAC route as an attractive path to go public. Across all sectors, SPACs used to be only a few percentage points of the IPO market, but now they are becoming a majority of IPOs, according to NASDAQ.

Examples of High-Profile SPAC M&A Transactions

Some of the transactions often cited as prime examples of the success of the SPAC acquisition process are:

- Social Capital Hedosophia Holdings purchase of a 49% stake in Richard Branson’s Virgin Galactic for $800M in 2019

- This year, DraftKings, the digital sports entertainment and gaming company, merger in April with the SPAC Diamond Eagle Acquisition Corp

- The reverse merger by Fisker with Spartan Energy Acquisition Company in October

- Electric vehicle battery developer, QuantumScape, merger with Kensington Capital Acquisition SPAC in November

- The largest SPAC raise on record, $4B by Bill Ackman’s Pershing Square Tontine Holdings in July

- And, Cancer drug maker, Immunomedics, acquisition by Gilead Sciences at $21B in September

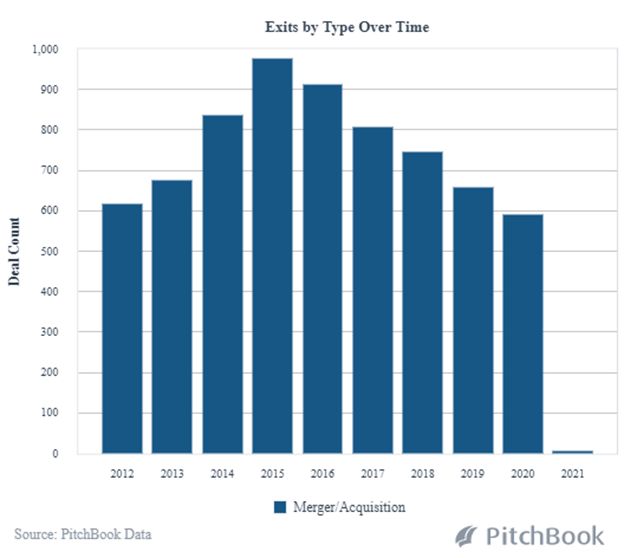

Regarding the Healthcare sector Pitchbook reports that while M&A transactions were down during the pandemic…

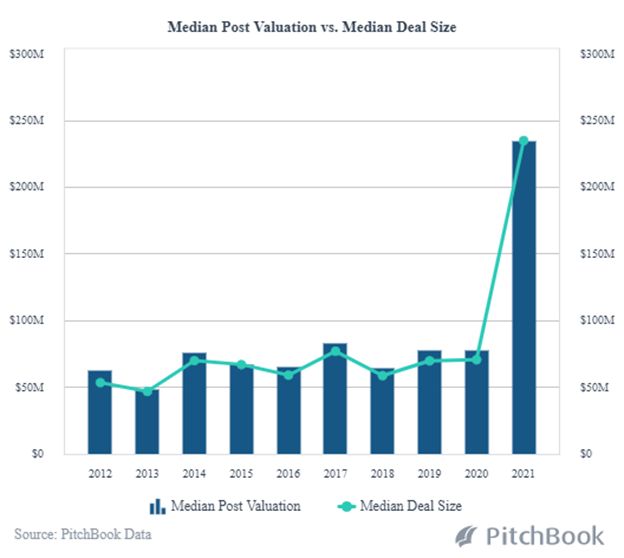

…in 2021, Healthcare M&A transactions are starting out by living up to expectations with exponentially high median post valuation and median deal size…

SPACs in Healthcare IPOs

Clarkston Consultants in their life sciences assessment for 2021 found that while 2020 was a year of collaboration, particularly in the fight against the Corona Virus, they expect a shift back to vigorous M&A activity. An example cited is the finding by SP Capital IQ that pharmaceutical companies have cash reserves equal to over 170B. This they see as indicative of the strong return to M&A in the healthcare segment in 2021. The Significance of SPACs in Healthcare IPOs

Supporting that conclusion is the fact that the large numbers of SPACs, particularly in the healthcare segment, funded in 2020 now have less than two years to find merger targets. While some see this as a potential over saturation for SPACS which could drive down expected equity returns relative to risks for sponsors, the fact is that SPACs do offer advantages over the arduous traditional IPO process of seeking public funding. Large investors including Gores Group, Apollo and Social Capital continue to raise hundreds of millions via SPAC IPOs. In healthcare/biotech some of the investors that have been most active in SPACs include: LifeSci Advisors, Casdin, RA Capital, Deerfield, Foresite, Vesper, and a long list of others.

Advantages of a SPAC, and Cautions

Why not just go public using a traditional IPO while that was a route many healthcare and biotech companies chose in 2020? In reality, SPACs do afford unmatched benefits to both sponsors and targets.

- Owners of smaller-size companies can gain greater access to funding, often enjoying a significantly higher selling price than private equity transactions and receive what amounts to an expedited IPO process by an experienced acquisition management team.

- Sponsors can not only receive a high rate of return relatively quickly, but also be guaranteed a large war chest to invest in targets, required in a short period of time.

- In addition, a study by the Warrington College of Business at the University of Florida found that it can be shown that IPOs, in general, very often underdeliver. It was found that in the last decade IPOs were underpriced by as much as 21%. From their calculations an average of $37 million went unrealized.

On the flipside, SPAC mergers often depend on funds coming from Private Investments in Public Equity (PIPE) deals. PIPE investors often step in to replace capital from IPO investors who opt out of a SPAC merger. Some have voiced the concern that there may not be enough resources to go around for all the potential SPAC deals as funding from PIPE investors dries up. The Significance of SPACs in Healthcare IPOs

Investor Take Away

2020 was a record year for SPACs; and, this year represents even greater potential as a significant liquidity option for many diverse industries, particularly in healthcare/biotech M&A transactions. In many cases the SPAC merger process with a target company can take place in a substantially shorter period of time than the traditional IPO timeline and generate higher returns for sponsors and investors alike. That said, a targeted company must be ready to accelerate to public company complex accounting, financial reporting and compliance requirements. This requires a strong, experienced management team to perform due diligence on targets, and help market a deal to PIPE investors. And, this must be accomplished in a relative short period of time, the two-year requirement, or all funds must be returned to investors.

How We Can Help

As you can see there are complexities in SPAC deals. Critical to the potential success of the deal is due diligence. Due diligence for understanding the technology in the industry/company being targeted, assessing the preemptive nature of the target’s business model, the soundness of the financial statements often yet to be audited, and the experience of the team charged with the task of growing a company into a multimillion-dollar operation.

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Healthcare, Biotech and other highly regulated markets in the fields of Pharma, Agtech, Clean/ClimateTech, Cannabis, and CBD/hemp. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.