For industry revenue and growth potential you can just about pick your number. Grand View Research predicts a U.S. market size of some $33 billion this year, reaching as high as $84 billion by 2028. The Motley Fool reports the prediction by cannabis industry research source BDSA that the U.S. market will reach $34.5 billion in 2025 achieving a CAGR of 18% yearly from now until then. 420 Intel projects an even higher CAGR growth rate for the U.S. industry of 26.7% from now through 2028. And New Frontier Data projects a $31.1 billion U.S. market by the end of 2024. Any way you cut it, the U.S. cannabis market is leading in the race to make the cannabis industry the largest consumer products industry … in the world. The Pace of Cannabis Industry Consolidations

Consolidations – The Mantra for Industry Growth in 2021

Leadership to market dominance typically does not happen by slow, steady organic growth. Trulieve just recently acquiring Harvest in a $2.1 billion deal to form the world’s most profitable MSO substantiates that premise. YTD 2021, over 144 transactions have been announced or closed, compared to 32 in the same period last year. The ever-increasing volume of Mergers & Acquisitions began to surge in Q4 last year when over $600 million in M&A transactions were announced. Consolidation and mega-deals, as predicted, set the tone for 2021. MSOs are leading the charge in the U.S. by having achieved scale, cleaned up their balance sheets, and stockpiling dry powder for roll-up acquisitions. These MSOs are now acting more like CPG companies in the maturing cannabis market. The Pace of Cannabis Industry Consolidations

In Canada, investors want strategic ways to gain greater access to the U.S. cannabis market. M&A transactions, as exemplified by the pending Aphria-Tilray reverse acquisition, are expected to play greater role. The Pace of Cannabis Industry Consolidations

Why this matters is well expressed by Regrow.io :

As these mergers and acquisitions in the cannabis industry continue to find their way into mainstream business conversations, the closer we come to public acceptance. This acceptance represents countless jobs and validation for those who have believed in this industry’s potential from day one. While cannabis remains illegal on the federal level, companies are forced to find new avenues for growth due to legal limitations, such as the inability for cannabis to cross state lines. This is why the industry is seeing multi-state operators joining forces to expand operations more efficiently.

Action in the Current Marketplace

In March, U.S. News reported that the U.S. cannabis industry had already raised $2 billion in equity capital in 2021. That total was dwarfed on May 10 when in one M&A transaction alone Trulieve acquired Harvest for over $2 billion. Recent major transactions activity:

In that transaction Trulieve (CSE:TRUL ) (OTC: TCNNF) acquired Harvest Health and Recreation (CSE:HARV , OTCQX: HRVSF) in a $2.1 billion deal that forms in the U.S. what is reported to be the “world’s most profitable multi-state operator.” This is based on the combined adjusted EBITDA of $461 million that Trulieve projects for 2021. Trulieve will now have a retail network of 126 dispensaries across 11 states which they state gives them “an unparalleled platform for continued growth.” Trulieve’s acquisition of all of the issued and outstanding Harvest shares will be filed on SEDAR and made available under Harvest’s issuer profile at www.sedar.com.

Some of the other recent transactions of note:

- Marijuana Business Daily reported that in October TerrAscend acquired Gage Growth in $545 million all-stock deal being the first of the MSOs to begin consolidating the Michigan market – a market on track to become the second-largest legal cannabis state in the U.S.

- Another recent large-scale consolidation was Hydrofarm Holdings Group Inc. (NASDAQ: HYFM) acquired House & Garden Inc., Humboldt Wholesale, Allied Imports & Logistics, and South Coast Horticultural Supply Inc. (collectively to become “House & Garden”).

Ganjapreneur reports on Ayr Wellness Inc., Curaleaf Holdings Inc., and The Parent Company each announced acquisition deals last month for $80 million, $67 million, and $65.2 million, respectively.

- Miami-based MSO, Ayr Wellness, announced the close of its purchase of PA Natural Medicine, LLC, which operates three dispensaries in Bloomsburg, State College, and Selinsgrove, Pennsylvania. The terms of the deal include upfront consideration of $80 million, including $35 million in cash $25 million in seller notes, and $20 million in stock. An earn-out based on 2021 Adjusted EBITDA, is payable in the first quarter of next year.

- Massachusetts’ Curaleaflast month said it had completed its acquisition of Los Sueños Farms, which at 66 acres is the largest outdoor grow in Colorado. Boris Jordan, executive chairman of Curaleaf, said the “deal provides Curaleaf with a high-quality, efficient, and low-cost supply of biomass to support our wholesale and retail customers in Colorado.” The $67 million deal includes land, equipment, a 1,800 plant indoor grow, and two retail cannabis dispensaries.

- The $62.5 million deal announced also last month by California-based The Parent Company (TPCO Holding Corp) is for 100% equity of the retail dispensary and delivery operator Coastal Holding Company, LLC, for $16.2 million in cash with considerations of up to $40 million in equity of The Parent Company upon the completion of milestone events.

- Motley Fool, though, thinks there is an M&A that has a greater potential for return on investment than even the Trulieve/Harvest merger. That is, the Greenlane (NASDAQ:GNLN) and KushCo (OTC:KSHB) merger. For one thing they are not strictly marijuana producers, but market non-plant touching products as well. The main reason, though, is that based on the smaller market cap of the merger, there is more potential upside from the deal.

Privately-held PharmaCann, an MSO operating in Illinois, Maryland, Massachusetts, New York, Ohio, and Pennsylvania announced on October 12 finalizing a deal to acquire LivWell. And on November 1, Columbia Care (CSE: CCHW; OTCQX: CCHWF) completed its acquisition of Denver-based Medicine Man. The $42 million deal includes $8.4 million in cash and $33.6 million in stock. The acquisition was based on a valuation of 4.5X 2021 EBITDA. The Pace of Cannabis Industry Consolidations

That Trulieve/Harvest Health acquisition mentioned above is seen by the industry as having more far-reaching affect than merely the size of the deal. This M&A between two of the largest cannabis MSO’s that are publicly-owned puts literally all cannabis companies in play for an M&A transaction. Green Growth CPAs sees the dramatic impact this transaction has on the industry as follows: The Pace of Cannabis Industry Consolidations

Ultimately, what does this mean? It means that suddenly, all cannabis companies are potentially in play for M&A deals. While the number of public and well-capitalized cannabis MSOs is growing, there is a clear leading class with: Trulieve, Curaleaf, Verano, Cresco Labs, and Green Thumb Industries. In the wake of the Trulieve/Harvest deal, anyone not in the aforementioned top of the class becomes a potential target for those on top.

Why Consolidation is the Future of the Cannabis Industry

Well, for one, it remains the fact that capital is hard to acquire in the cannabis industry due to continuing bank restrictions. Technical 420 feels that regardless of were federal legalization stands – continued consolidation will be the norm in the cannabis industry. They cite the finding that the most recent M&A transactions have taken a more strategic and bolt-on approach to the due-diligence process. They see these three factors as characteristic of the growing maturity of the cannabis industry that these recent consolidations exemplifies:

- Acquirers are looking for assets that are strategic and complementary in nature.

- The markets opening with a broader price range of acquisitions – from <$20 million to nearly $1 billion.

- A shift from acquisitions that leveraged market outside the U.S. to the many transactions now occurring that are leverage to the U.S. market.

Forbes sums up the key drivers propelling industry growth as regulations, marketing and scale. Inconsistent laws state-by-state and restrictive tax regulations limit the ability of an individual operator to scale. This choking effect on margins provides further impetus for consolidation in the industry.

Emergence of the Cannabis SPACs

Another contributory factor to the boom is the emergence of the cannabis Special Purpose Acquisition Company (SPAC). Over the last 18 months, the industry has had about 20 cannabis SPACs go public in the U.S. and Canada. With many VC and PE investors, as well as virtually all institutional investors, staying away from the industry, this puts the use of SPACs in the limelight – for cannabis companies in the U.S. and in Canada to access capital over traditional sources and in order to pursue the path of going public. In fact, SPACs are bringing substantial liquidity to maintain sales growth and provide cannabis companies with the competitive advantage of more quickly getting to market. In many cases the SPAC merger process with a target company, termed to “de-SPAC,” can take place in a substantially shorter period of time than the traditional IPO timeline. This, though, must be accomplished in a relative short period of time – the two-year requirement for all funds to be invested or, if not, returned to investors.

The capital and legal restraints the cannabis industry has experienced have shown the flaws in traditional approaches for a new industry to raise funds, Particularly in the case of the banker-centric IPO process. SPACs appear to be the answer for a better route for cannabis companies to follow to access public markets. SPACs are thriving in the hot marketplace cannabis has become. Yet, IPOs have experienced hot and cold market swings. Is it inevitable as some predict that SPACs/Cannabis SPACs will experience the same cycles. SPAC mergers often depend on funds coming from Private Investments in Public Equity (PIPE) deals. PIPE investors often step in to replace capital from IPO investors who opt ou of a SPAC merger. The Pace of Cannabis Industry Consolidations

Some have voiced the concern that there may not be enough resources to go around all the potential SPAC deals as funding from PIPE investors dries up. As the SEC is requesting, likely improvements will be forthcoming in the SPAC process in order to more tightly follow the IPO disclosure process, and reduce the deal underwriting costs, which often run as high as 5 to 6%. SPACs allow companies to gain quicker access to liquidity. An IPO, the traditional approach to go public, can take up to a year to fully execute. A SPAC, however, can shorten that process, negotiating and closing included, to just a few months. So, in reality, SPACs do afford unmatched benefits over IPOs to both sponsors and targets.

Avoiding the Potential Pitfalls in M&A Transactions

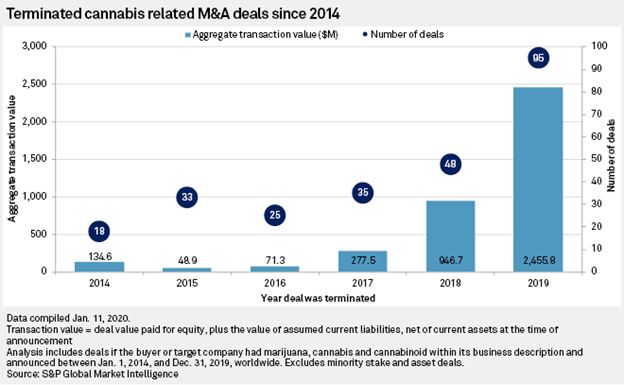

With this fiercely rapid pace of M&A deals comes the danger of pitfalls in a successful deal in such a complicated industry; an industry subjected to state-by-state regulations while still being illegal federally. The latest figures we can find on the impact of M&A miscues in the cannabis industry come from SP Global Market Intelligence from research done by cannabis research firm New Frontier Data. Two years ago it was found that companies/investors backed out of 95 M&A deals valued at $2.46 billion.

The basic aspects of M&A transactions that need scrutiny to avoid these reported business losses, according to Marijuana Business Daily, are:

- The Purchase Price – With deals being primarily cash and stock, sellers need to perform due diligence on the stock they are getting.

If the buyer is public, the sellers should know when (under securities laws) and how the stock may be sold (will the broker execute a trade in a cannabis stock?).

If the buyer is private, the sellers should consider doing due diligence on the buyer.

- Change of Control – In cannabis this means that most state and municipal regulatory agencies will require some sort of vetting and approval for the change in control.

- Legacy Liabilities – In an M&A transaction, unlike in a simple asset acquisition, a buyer does not have the luxury of picking and choosing assets. In cannabis the acquirer needs to conduct due diligence into the true nature of the seller’s finances, which can often be unaudited.

- Handling Debt – In the case of the cannabis industry a distressed company cannot file for bankruptcy protection in order to restructure its debts to become an acquisition target. This puts additional pressure on the buyer to avoid creditor lawsuit entanglements

What’s It Really Worth?

Once it is confirmed that legal/compliance requirements are met, then the next major step is conducting a realistic valuation of the business. Your investment banking intermediary will develop financial models to include the most important fixed and variable financial factors that will be the most important components in determining the value of a company. There are, of course, significantly different financial factors to consider for different companies, particularly complex in highly regulated industries such as cannabis. In the cannabis industry your advisors must positively understand the idiosyncrasies in this marketplace in order to identify a valuation range that ensures the buyer is not overpaying and that the seller’s proformas are verifiable.

What It Takes to Make It Over the Finish Line

- The Vision of the Parties

- All stakeholders to the M&A transaction must have a clear vision as to the direction toward profitability the marriage of the parties will take. This requires good advice about the fundamental legal and business issues that will arise and the judgement calls that will have to be made during the process to keep a clear vision for the post-closing entity.

- Commitment

- Once the decision is made that a buyer’s objectives are better served by acquiring rather than taking the path of organic growth, all key management team members must fully buy into that direction regardless of hurdles that will arise along the way.

- Culture Comprehending ESG – The Critical Role it Plays in Realizing the Value in an M&A Deal

- A critical component of the very essence of the deal is the shared values and behaviors in Environmental, Social, and Governance (ESG) that shape employee experience, interaction, and morale within an organization. Understanding the Culture Equation avoids differences that are likely to become too hard to manage after the transactions is completed.

Investor Takeaway

Simply put, cannabis is on a fast pace to become the leading consumer products industry … in the world. With 2021 becoming the most lucrative year in the history of legal cannabis, industry projections of the U.S. market reaching $33 billion, reaching $84 billion by 2028 may be an understatement. Along with this market growth is the ever-increasing volume of M&A transactions in the industry. YTD 2021, over 144 transactions have been announced or closed, compared to 32 in the same period last year. 420 Intel points out that the step between the “growth” phase and the beginning of “maturity” is consolidation – the mantra for 2021. The rise of SPACs and more sources of capital that become available the trend M&A activity will most likely increase – enabling MSOs to build market share and roll out into new markets. Leading cannabis companies are bullish and eager for consolidation opportunities regardless of the pace of national legalization. In addressing the question of the role consolidation will play in the future of the cannabis industry for our clients the finding is that M&A will continue to intensify and that careful due diligence, following our multistep process, is necessary to select the right opportunity for their investment portfolio strategy. The Pace of Cannabis Industry Consolidations

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to provide access to capital while meeting client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.