Investor Takeaway The Impact of Climbing Interest Rates on Cannabis Debt Financing

In 2021 it is estimated that capital flow into the cannabis industry topped $12.7 billion, with $3.4 billion attributed to debt financing transactions. Improving operations in the low interest environment last year saw debt funding grow. Continuing multimillion-dollar debt funding among cannabis industry leaders shows that debt as a source of growth funds is a rational use of capital, not a sign of business distress. For cannabis operators debt can play a vital role in the capital structure of a company in order to preserve equity and to facilitate long term growth. In 2022 will the driving forces behind this rise of debt financing in the cannabis industry prevail in the face of the Federal Reserve raising interest rates, in as many as three increments this year? The continued lack of federal de-scheduling complicates the traditional lending model because bankruptcy is not an option and there is no consistency in state-by-state licensing and ownership standards. In this complicated, nuanced industry an experienced team with specific industry experience is required to provide value added in facilitating a debt transaction.

The Cannabis Financial Marketplace The Impact of Climbing Interest Rates on Cannabis Debt Financing

Going into 2022 capital flowing into the cannabis industry, estimated to be $12.7 billion as of end of last year, is just $1.4 billion short of the record year 2018, according Viridian Research. They found that U.S. equity raises climbed to $1.9 billion, but “debt was where the action was.” Debt raised soared 806% over the 2018, for a total of $3.4 billion. Mergers and Acquisitions remain the dominant way to accelerate growth among the bigger players in the industry. Toward the end of last year, however, the industry reached a turning point in access to capital when a syndicate of lenders provided Curaleaf with a $300 million term loan. At the time, this was the largest and most significant debt financing an MSO was able to negotiate. Then, a couple of weeks later Curaleaf set another record by receiving commitments for a privately placed debt raise of $425 million. Once again securing the largest debt raise to date, but also obtaining an 8% interest rate – perhaps the lowest rate in the cannabis industry at that time. Thanks to their stronger market position this is substantiation of the trend away from equity to debt financing of the major MSOs that are cleaning up their balance sheets and solidified their market expansion plans.

Nevertheless, the primary underlying reason for the rise of debt was that the low interest-rate environment in the U.S. economy attracted more debt providers to come online. And continuing multimillion-dollar debt funding among cannabis industry leaders shows that debt as a capital source for cannabis companies is a rational use of capital – potentially cleaning up balance sheets and enabling access to funding for expansion and/or the purchase of distressed assets coming out of the pandemic – to use debt financing for competitive advantage in the marketplace.

On the bright side for debt financing, Crunchbase recently reported the market could heat up as venture capital slows. Venture debt, no mater how it is defined, is giving companies cash they may need while not diluting the stakes of founders and shareholders. It can lessen the amount of more expensive venture capital needed and also lower dilution.

Crunchbase quoting David Allred, C.E.O. of Silicon Bank, “As equity capital becomes more expensive, interest in debt goes up.” “It’s always been a good tool against expensive equity,” he said. “It can prolong the life of that expensive equity.”

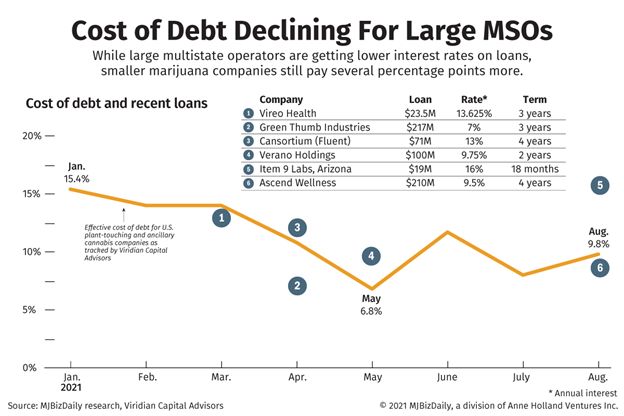

Prior to rising inflation and recent action by the fed on interest rates, particularly for major MSOs, interest rates had been declining:The Impact of Climbing Interest Rates on Cannabis Debt Financing

Bespoke Financial calls debt financing “the lynchpin enabling cannabis companies to outpace the competition, manage long term expenses.” While the industry has been capital-constrained, borrowing against assets has been a key source available for many cannabis companies to pursue. Vertically integrated cannabis companies often have significant real estate and other assets that can be leveraged. What has changed now, though, is that more debt providers have come online over the past couple of years addressing a range of needs. This means that cannabis companies can now refinance at more attractive rates.

As an example, Bespoke, that claims to be the first cannabis-focused fintech lender, secured a $5 million inventory line of credit for California-based cannabis company Claybourne, Co. The line will enable Calybourne to expand cultivation capacity supporting their popular flower and pre-roll products without limiting the company’s ability to launch new products.

Action in the Current Cannabis Marketplace The Impact of Climbing Interest Rates on Cannabis Debt Financing

Law360.com reports that in mid-March Cannabis Tech Co. Agrify obtained $135M In Debt Financing. Agrify provides cultivation and extraction solutions to the cannabis industry. An unidentified institutional lender will provide up to $135 million in a senior secured note facility. The note will mature on March 1, 2026 with a 6.75% annualized coupon to be paid quarterly, in cash, beginning Feb. 1, 2023. By paying interest in kind instead of cash the effective rate of 8.75% will be added to the principal.

MJBizDaily reports the Veridian Research finding that in February Oakland, California-based Harborside (CSE: HBOR; OTCQX: HBORF) closed the first $45.35 million tranche of its $77.3 million financing with Pelorus Equity Group. The interesting facet of this transaction is that part of this financing will be used to replace a low-interest loan the cannabis company acquired a year ago. That bank line of credit, as you may recall from previous issues of the EDGE, was hailed a year ago because of being thought to be one of the first cannabis loans from an unnamed federally insured bank at the rock bottom 5.75% interest rate. The reason for the low rate was over-collateralization of the deal. So, why did Harborside retire this extremely low debt? It was for the sake of flexibility.

(Flexibility being the watchword for debt funding that you will see reappear in regard to other reported debt transactions.)

The Pelorus loan is secured by “certain real estate assets and cannabis licenses of (Harborside), Urbn Leaf and Loudpack,” making the combined entity a heavy-hitter among vertically integrated operators in California.

Also in February PYMNTS.com reported that Delta 9 Cannabis Inc. entered into a $32 million debt-financing partnership with connectFirst Credit Union Ltd., with the funds coming through First Calgary Financial. According John Arbuthnot, CEO of Delta 9, “To our knowledge, this interest rate is among the most competitive rates established by any public cannabis company to date.” The agreement includes a $23 million commercial mortgage facility, a $5 million acquisition facility and a $4 million authorized overdraft. The commercial mortgage portion matures after five years and amortizes over a 12-year term. It includes $11.2 million for the repayment of existing long-term debt and $11.8 million for the repayment of the Delta 9’s 8.5% unsecured convertible debentures due July 17.

Cautions in Debt Transactions The Impact of Climbing Interest Rates on Cannabis Debt Financing

Business insider reported, as you know, that two weeks ago the Federal Open Market Committee raised its benchmark interest rate by 0.25 percentage points, ending the near-zero rates of the pandemic era and starting a hiking cycle set to last well into 2023. The benchmark rate, of course, influences borrowing rates throughout the economy. As with other sectors, the impact on the cannabis marketplace and the pace of debt financing remains up for speculation. But, this and the federal de-scheduling of cannabis, the lack of clarity on the future of taxation and regulation, and previous under-performance by major Canadian pubcos continue to trouble investors about how much capital to deploy into the industry.

In addition, the rates heralded in the headlines are in reality not the actual cost the be incurred by the borrower. The reason is that most debt investment in cannabis contain warrants and convertible notes that add to the true cost of a loan. In some cases this adds a 25% to 35% premium to the effective interest rate. And the major rating agencies appear to be waiting for legalization to issue credit ratings, and even secondary raters like Egan-Jones have confined their ratings to non-plant-touching companies.

What Can Strategic Investors Use as a Guide Through Debt Deals for the Right Investment to Meet A Portfolio Strategy?

In general, debt plays a vital role in the capital structure of a company in order to preserve equity and to facilitate long term growth. So, it is crucial to understand the options available that best support a long-term strategy:

Sale and Leaseback Transactions

While Sale-Leaseback (SLB) transactions aren’t technically debt they do allow companies to free up liquidity from their balance sheets without dilution. The upside of this alternative is that cannabis companies increasingly have been selling their cultivation, processing and storage facilities and immediately leasing them back as a way to instantly raise tens of millions of dollars. The potential downside is that an SLB locks the asset seller into a longer commitment than other straight debt alternatives that now are likely to be able to be secured for rates similar to the SLB. It should be noted, however, that in common debt transactions lenders will be looking for more than a mere promise to repay. A security interest and/or corporate or personal guarantee (PG) will most likely be required. An SLB is a great option in obtaining capital for cannabis operators, and one that has been used by many of the largest companies in the space.

Asset-Based Lending

Based on the valuation of real estate and equipment assets, a cannabis company can typically borrow from within the range of 40% to 75% of asset value. In the case of development projects, the loan is usually based on project costs. While less typical, there are some working capital debt options in the market as well, though the availability of this option is much less than for real estate and equipment financing.

Convertible Options

- Up to this point, most debt financing by cannabis companies was found in convertible note options with low conversion premiums – which essentially delay dilution of equity. The company creates a note that converts to equity, often preferred stock, at a future date based on a future valuation method. These notes, similar to promissory notes with interest payable on or before a maturity date, have given investors security that they are repaid before equity holders if something goes wrong. For both the investor and the company this note structure allows the valuation question to be answered in the future while providing needed capital to the company and a more secure instrument to investors.

MTN – Short-Term Solution to Minimize Dilution with Funding at Single Digit Rates

- True, that the three alternatives listed above are considered the standard. Now, however, a new alternative is emerging, the Medium Term Note (MTN) for companies with relatively strong balance sheets. An MTN is an alternative to traditional long-term and expensive short-term financing – to aid a company with such objectives as accelerating a growth strategy, facilitating a roll-up M&A strategy.

- An MTN is essentially a bond issuance through investment bankers and funded by private institutional sources, in the range from $20M to $100M+, with specific characteristics to facilitate being issued quickly in order to take advantage of temporary market opportunities.

- The key is to effectively customize the MTN with characteristics most advantageous to the issuer that appeal to the strategy of an investor. This results in rates typically lower than other forms of debt financing. With our network of institutional funding sources for MTNs we provide an overview of the funding need and the upside for investors. Then, we assist the issuer with legal, accounting, underwriting, and rating services in order to begin the preparation of the offering.

For companies seeking debt, the following are key considerations:

- Most cannabis debt providers will require PGs from principals. This is always a tough decision for founders and one that carries real risk. Are you willing to PG the debt?

- What assets does the company have? Or is purchasing? Real estate, equipment, accounts receivable, other assets?

- Does the company have existing debt? And how much debt can the company take on while not taking undue risk with cash flow?

For investors who are considering lending to cannabis companies the following are key considerations:

- What are the credit scores of the principals? Is there any credit data on the company? How timely do they pay their payables, for example?

- What is the company’s existing cash flow? How realistic is the projection for future cash flow?

- How will the company use the funds? Is the use of funds realistic?

- What security will the investor have that they can recover funds if the loan isn’t repaid: PG? Cross-corporate guarantee? First lien on assets?

- Does the management team have the right experience for the type of project/company that they want to be?

- Does the company have its state and local cannabis licenses? If real estate is involved, what is the status of current local permits?

- Due diligence by experienced industry advisors is crucial since the lack of bankruptcy protection and restrictions on cannabis license ownership can complicate the debt financing transaction.

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to provide access to capital while meeting client investment strategies in emerging 2022 opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.