Investor takeaway

With public support for legalization and states that are coping with the continuing COVID crisis in their own panic for increased tax revenues, growth is on the horizon for the industry in 2022. The majority of states now have medical and, in many cases, adult use legalization in place leading to projections of a US industry size of $33 billion in 2021, $84 billion by 2028. Funding is flowing into this capital-constrained industry through M&A transactions primarily among MSOs of all sizes By mid-December there were 306 M&A transactions compared to 86 in 2020. Yet the stock market performance of public MSOs dropped so dramatically that one source calls it the “Pot Bubble Burst.” While MSOs do need to accomplish much more in EBITDA beyond their increasing revenue figures, MSOs will lead the continuing wave of consolidation throughout 2022. This week’s EDGE Briefing looks at the strengths and weaknesses of MSOs carrying that potential into 2022. The Future of Cannabis MSOs 2022

Industry Growth through M&A

While we are awaiting the final sales figures for the cannabis industry in 2021, it is clear that sustained growth is on the horizon for 2022. With public support for legalization and states coping with the pandemic in their own panic for increased tax revenues, funding is flowing into this capital-constrained industry. The majority of states now have medical and, in many cases, adult use legalization in place and sources like Grand View Research project a US industry size of $33 billion in 2021, $84 billion by 2028. And industry research source Viridian reports that through mid-December there were 306 M&A transactions compared to 86 in 2020. The Future of Cannabis MSOs 2022

These M&A deals are propelled by three major factors according to MJBizDaily:

- Lower cost of capital in the form of continuing low interest rates

- Valuation disparity between acquiring companies and targeted companies.

- And the shareholder pressure on the major pubcos to increase revenue through market expansion.

Technical 420 sees it this way: Acquirers are looking for assets that are strategic and complementary in nature. The markets are opening with a broader price range of acquisitions – from <$20 million to nearly $1 billion. And there is a shift from acquisitions that leveraged market outside the U.S. to the many transactions now occurring that are leverage to the U.S. market.

Forbes sums up the key drivers propelling industry growth as regulations, marketing and scale. Inconsistent laws state-by-state and restrictive tax regulations limit the ability of an individual operator to scale. This choking effect on margins provides further impetus for consolidation in the industry.

Market Growth and The MSOs

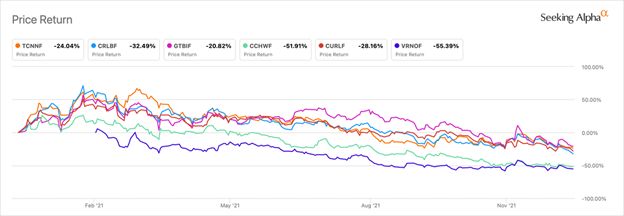

The majority of these M&A deals, of course, are being conducted by the large and medium-sized Multi-State Operators (MSOs). A year ago the major publicly traded MSOs started Q1 with very promising performance. But then, as Seeking Alpha reports in the chart below, results went off the rails from that point on throughout the rest of the year. The Future of Cannabis MSOs 2022

With Canopy Growth Corporation down over 80% from its 2021 peak, Seeking Alpha goes so far as to call this the “Pot Bubble Burst.”

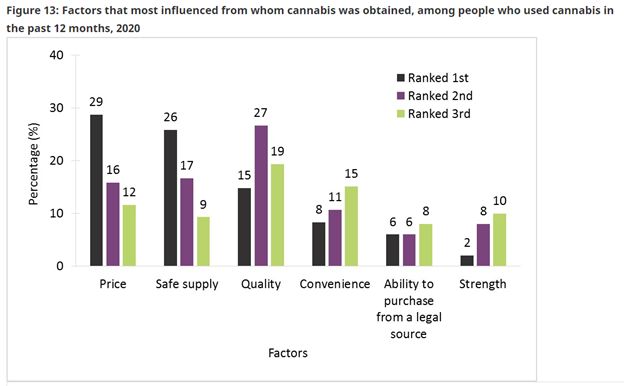

So, what is going on? What is the real role MSO’s will play in the future of the cannabis industry in 2022? One of the key factors listed by Seeking Alpha is the legal, and primarily illegal, competition on price in local markets that MSO’s have not yet mastered. Because, they say, that when it comes right down to it, price is the biggest driver in a commoditized product; and they consider cannabis to rank highly as a commoditized product. The Future of Cannabis MSOs 2022

This problem is amplified by Technical 420 in their findings that :

First, complying with varying and inconsistent state regulations means that economies of scale are tough to achieve; there is no single, optimized end-to-end manufacturing process for all products.

Second, due to the geographical and environmental limitations, product consistency is hard to maintain because of variations in the raw materials. Part of the power of any brand is its consistency, but you can’t achieve that when flowers grown in Southern California differ from those grown in, say, Pennsylvania.

The Future of MSO’s in the Cannabis Industry

There is an addition factor that can’t be discounted as affecting the stock market performance of publicly traded MSOs. That is the fits and starts of federal cannabis legislation. Most in the industry were pinning their hopes on the passage of the SAFE Act, at least, in 2021. Oddly though, House Majority Leader, Chuck Shumer championed his own version of a more encompassing legislation, the Cannabis Administration and Opportunity Act (CAOA) intended to end the War on Drugs. This development came late in the negotiations to add the SAFE Act amendment into the National Defense Authorization Act (NDAA). That was probably done because support for the SAFE Act was fading among Senate Democrats, confounded the situation. SAFE did not make it into the NDAA. Nevertheless, positive movement on both sides of the isle see newly proposed legislature that many believe will lead to some form of federal action in 2022. In advising their stock market audience, sources such as TheDalesReport (TDR) are assessing the situation as follows:

Given that new legislative hope will again churn over the next couple of quarters, we believe U.S. cannabis has a strong chance of producing outsized returns in 2022. Even without, Tier-1 MSOS will continue growing steadily as new recreational markets come online (New Jersey, Vermont, perhaps New York [late year]). And cannabis MSO companies remain deeply discounted to retail discretionary stocks in general.

The role of MSO’s as consolidation continues to be the survival route for many undervalued operators was addressed by what MJBiz CEO Chris Walsh predicted at the general session at MJBizCon in Las Vegas in October; saying that there’s no indication the consolidation activity is going to abate anytime soon. That acquisitions will noticeably accelerate. “You’re going to see some of the biggest companies coming together.”

And when discussing the issue of the significance of MSOs in the future of the industry, our Managing Partner, Cam Horan, expressed it this way:

“Leadership to market dominance typically does not happen by slow, steady organic growth. Trulieve just recently acquiring Harvest in a $2.1 billion deal to form the world’s most profitable MSO substantiates that premise. The cannabis market is maturing rapidly regardless of the slow pace of federalization. MSOs are leading the charge in the U.S. by having achieved scale, cleaned up their balance sheets, and stockpiling dry powder for roll-up acquisitions. These MSOs are now acting more like CPG companies in the maturing cannabis market.”

An additional major factor in favor of the potential of MSOs is the unintended consequence of the cannabis legalization in most states limiting the number of licenses being issued. The hot markets of interest to our investors in 2022 – Illinois, Florida, New York, Ohio, New Jersey, Connecticut and Nevada all have taken the path of restricting the number of licenses available in their state. By doing this large MSOs have been able to expand their size and market coverage by being big enough to employ the strategy of buying up many of these licenses. This is exemplified by Massachusetts-based MSO Curaleaf Holdings entering into a definitive agreement to acquire an Arizona retailer for $13 million. This is the 10th license acquisition it has made in this booming adult-use market. The deal, according to MJBizDaily is $12 million in cash and $1 million in stock. In addition, Curaleaf has also stated they would acquire Tryke Cos., which will bring two additional retail licenses to Curaleaf’s growing footprint in Arizona.

Finding The Right Fit for Your Investment Strategy

What we have concluded is that 2022 offers an array of opportunities in existing and emerging cannabis states across the country, of which M&A deals among MSOs of all sizes, stand out. What we advise our investors as they assess the market in which they see as the most advantageous boils down to this:

Finding the right fit for your strategic investment portfolio, or the correct way to appeal to a source for your growth funding comes down to clarifying the investment needs and objectives of all parties, determining the real value in the business by calculating a well-substantiated valuation, and matching the right investors with the right funding opportunity – the right operators whose objectives and scalability are a fit for investors’ portfolios.

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.