As the third and last part of our three-part series on the future of strategic investing in cannabis we narrow the focus to the factors for where/how to look for success in potential investments in such a burgeoning industry. In Part I of the series we reviewed the undeniable growth potential of the industry in general. With states seeing legalized cannabis raking in unprecedented revenues, and with the industry promise of jobs and investment opportunities, the pace of legalization across the country continues to accelerate. A “green wave” is now sweeping over the East Coast and other formerly reluctant jurisdictions. Industry pundits and researchers are projecting the potential of the cannabis industry to reach as high as a market size of $115 billion by 2030. The Future of Cannabis Industry Strategic Investing – Part III

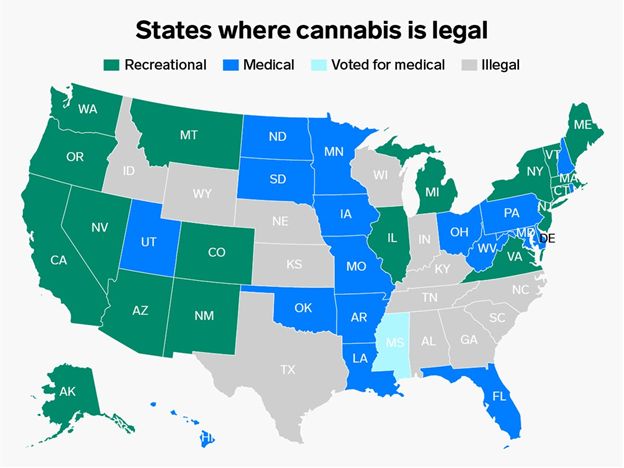

The majority of the U.S. population now resides in states where cannabis is legalized. Currently 37 states, the District of Columbia, Guam, Puerto Rico, the Northern Mariana Islands, and the U.S. Virgin Islands have legalized medical marijuana programs. 19 of those states and DC have also approved cannabis for legal adult consumption. While Arkansas, Missouri, New Hampshire, North Carolina, and Rhode Island have taken the first steps toward putting cannabis legalization on the 2022 ballot.

In Part II of the series we detailed the role MSOs play in the future of cannabis, named the major players and provided our evaluation critieia.

Substantiating Market Potential

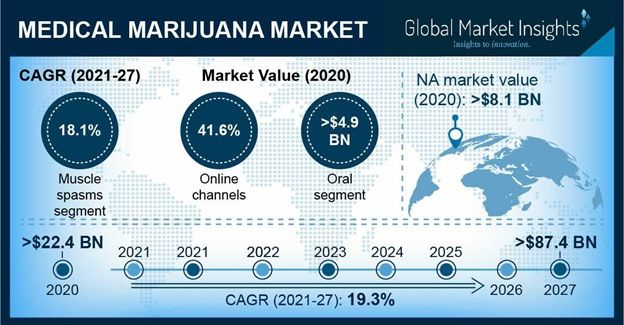

For another look to substantiate market potential, Global Market Insights projects, the medical marijuana market is estimated to be $22.4 billion globally and is expected to have a compounded annual growth rate (CAGR) of 19.3% from 2021 – 2027.

The increasing awareness among patients as well as healthcare professionals regarding the benefits of medical marijuana has compelled the regulatory authorities in over 30 countries to have legalized its medical use through various national programs.

From ResearchAndMarkets.com In 2020 , the global market for recreational marijuana was estimated to be $20.5 billion. This market is expected to grow to $90.4 billion by 2026, expanding at a CAGR of 28%. This is attributed to continued legalization on the one hand; on the other hand, the use of cannabis is growing more popular while alcohol and tobacco continue to become less popular.

Meanwhile the Brightfield Group predicts a $22 billion market for CBD by 2022. They say that “There are sure to be some problematic regulations and bumps along the way. But there is too much momentum, too much demand, and too much potential for this industry not to explode.”

Perspective from MJBizCon

As many of you know, we at Highway 33 Capital Advisory sponsored the FinanceForum at MJBizCon last month. From this, the largest gathering of cannabis industry operators, and investors, we came away with these insights from the CEO/President of MJBizDaily, Chris Walsh, as reported in his recap of the conference on CNN:

- Despite a global pandemic, discombobulated supply chains, ballooning inflationand an ongoing fight to legalize marijuana on a federal level, the cannabis industry in America is flourishing.

- Sales hit $20 billion in 2020, are on pace to top $26 billion this year, and are projected to leapfrog to $45.9 billion in 2025.

- That nearly $46 billion in sales would make the cannabis industry larger than the craft beer industry.

- Not long ago, quarter of a billion dollar deals were few and far betweenin this business. Now they’re happening in quick succession: The latest being e-commerce and tech firm Dutchie, which this month raised $350 million in its latest investor round.

- “You’re seeing the next phase of a maturing industry take hold here.”

These dynamic growth factors continue to be the case even through Walsh sees no significant federal reform next year, even including banking reform.

Tracking Who’s Buying

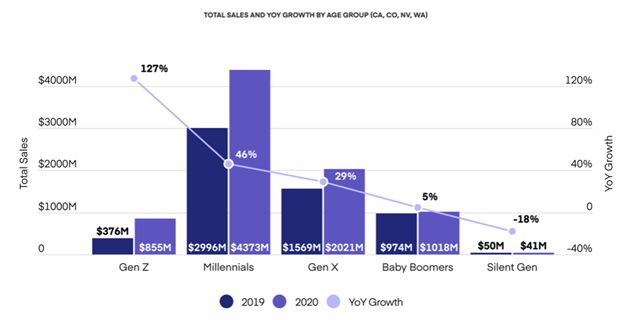

Industry research firm Headset reporting on the percentage increases in consumption by generations found a 127% increase in coming-of-age GenZ, born 1997 to 2012, while Millennials, 1981-1996, continue to account for the largest share of total sales, ahead of GenX, 1965-1980, next in the accounting of total sales. These younger generations feel far less of the stigma of the use of cannabis products than older generations. Generations that faced severe legal penalties prior to the spread of legalization across the country. Cannabis product manufacturers will certainly be catering to/following the trends set by these more youthful cohorts.

What Products are Hot

Product trends that will appeal to the tastes of the younger generations, particularly the patients and users new to cannabis, will be closely watched by Big Pharma, Big Tobacco, and Big Alcohol as they begin their tentative moves into cannabis.

Although a niche product now, accounting for only around 2% of cannabis sales, infused beverages have already attracted players from the world’s largest companies. As reported by MJBizDaily:

- Molson Coors Beverage Co. and Canopy Growth Corp. expanding multistate distribution and predicting big gains across all levels of the THC spectrum, from nonintoxicating CBD sports drinks to THC-infused alcohol alternatives.

- Molson Coors this fall expanded distribution of its Truss line of CBD drinks, a joint venture with Canadian cannabis grower Hexo Corp., from only Colorado to 17 states.

- Karma Water, a functional-beverage company based in New York, partnered with Canopy Growth to launch a CBD water in roughly 25,000 retailers across the U.S.

- Canopy launched its own line of flavored CBD beverages in the U.S., called Quatreau.

- And, Ayr recently acquired Levia, a Massachusetts-based infused seltzer company. Levia sales have surged in Massachusetts, and Ayr is betting it can also happen in other states.

But, we said that the infused beverage category only accounts for a small fraction of total industry sales. Why all this movement by major brands? Well, mainly because alcohol consumption has fallen off so dramatically in recent years. Without major inroads with the younger generations MJBizDaily says their business is basically “drying up.” This comes at a time when advances in emulsion processes have succeeded in making the “skunk water” description of early cannabis-infused beverages much better tasting and flavorful.

Cannabis the Disruptor

What the entrance of the beverage giants into cannabis tells us is that this is just one example of the broad scope of the disrupting impact cannabis can have. According to a quote from Avis Bulbulyan, CEO and founder of Siva Enterprises:

When you look at just manufacturing, for example, practically anything that you can consume, you can infuse, now go figure out what your customer wants. When you think about a sector like that, the possibilities become endless and that’s just one sector — imagine breaking down the entire supply chain.

One very poignant conclusion we draw from this is that investors should not count out cultivation. No matter what the product innovation. And no matter what consumable product will be disrupted by the infusion of cannabis, the raw material has to come from somewhere. And, the more efficient with quality crops that low-cost cultivators can become the more doors, unanticipated now, will be opening for them in the future. For cultivators now, recreational use will likely be dominated by large operators, but there will always be opportunities for smaller growers who capitalize on local climate and consumer preferences to carve out niche positions. In the end, quality control, consistency at low cost, even the development of IP for specialized strains, will separate winners from losers in the agribusiness side of the industry.

Is This the Most Lucrative Direction for Cannabis in Your Portfolio?

In terms of uses for the whole plant and the cannabinoid structure it contains, it just may be that pharmaceutical cannabis is the future of the modern cannabis industry – and in our view it is a key option to consider in order to make smart investments in the category. Cannabis contains active ingredients called cannabinoids. The first and second most abundant of these are tetrahydrocannabinol (THC) and the popular cannabidiol (CBD). These are just two, however, of the approximate 144+ cannabinoids that can appear in trace amounts in a marijuana plant. Many of these cannabinoids are soon to be making their way as Active Pharmaceutical Ingredients (APIs) in pharmaceutical medications for the treatment of chronic pain, glaucoma, epilepsy, and the growing body of research in the treatment of HIV/AIDS, Lupus, and MS. This along with promising developments as an anti-proliferative effect on different types of cancer cells. And, cannabinoids as APIs are also being introduced into medications that hold the promise of reducing the dosages of opioids and prompting the discovery of treatments for Alzheimer’s Disease.

According to the GMP compliance consultancy PharmOut in their Industry Growth Predictions for 2020- 2025 the global demand for cannabis, medical and recreational, is increasing consistently at a growth rate of 17% to 23% per annum. And, while true medical-grade cannabis will be influenced by supply/demand and cost pressures as well as by stringent cultivation, processing and export regulations, it is not unreasonable as some analysts predict for the global medicinal cannabis market to eventually reach $650 billion – making it the third largest worldwide market after oil and arms.

Following the Smart Money into the Industry

MJBizDaily reports that the amount of capital raised in the cannabis industry as of September 10 is already up 118% over full year 2020. This flow of capital is primarily accruing to the benefit of the large Multi-state Operators (MSOs). These are holding companies with separate subsidiaries in their states of operation that hold state licenses and municipality permits. They also hold the advantage over Canadian cannabis pubcos eager to engage in the compulsory strategy to grow beyond the limited bounds of their home country. They are planning the conquest of the U.S. market by making as much progress as they can before the market is opened by federal legalization. Evidence shows, though, that U.S. MSOs are a better value for the strategic investment dollar than are their Canadian counterparts.

An analysis by Benzinger recommends looking to MSO’s for future growth, stating that by the end of Q2 this year consolidation in the cannabis industry reached an all-time high with little signs of slowing down, “as more states come online and companies look for ways to enter new markets and build larger sources of revenue.” Benzinger found that while smaller operators have limited access to capital, credit markets are opening up to MSOs. Institutional investors are taking equity stakes in MSOs. For these reasons, their analysis concludes, it is no surprise that MSOs are outgrowing the industry in both organic terms and via M&A. The Future of Cannabis Industry Strategic Investing – Part III

An Industry Still Buffeted by Controversy

Beginning in the ‘70’s, Big Tobacco ignored warning signs that a crisis of far-reaching proportions would shake their industry to its foundation. That crisis, the specter of secondhand smoke. The tobacco industry has paid a high price for not addressing the issue effectively. Now, consumer advocates are beginning to put vapes under the same microscope – to determine any potentially harmful effects of secondhand smoke from the use of vaporizer devices.

And on March 8th a Colorado State University study, was published in Nature Sustainability. The study found that indoor cannabis cultivation is a major generator of Green House Gas (GHG) emissions. In just the state of Colorado alone the researchers at the university estimated that indoor cannabis grows emitted 2.6 million tons of GHG emissions annually. This accounts for 1.3% of the state’s total GHG emissions. For context, coal mining in the state accounts for only 1.8%. These are issues that require addressing before the full potential of the bold predictions for the industry’s future will be realized. The Future of Cannabis Industry Strategic Investing – Part III

Mitigating Risk and Maximizing Upside in this Investment Space

The evidence continues to mount that phenomenal growth is ahead for the cannabis industry with MSOs leading the way into the future, both before and after federal legalization. However, especially in emerging markets, due diligence is key to identify the real players from the pretenders. Here is the approach we take with our clients for risk mitigation prior to presenting strategic cannabis investment opportunities:

- First, we ascertain if the company and founders have backgrounds in cannabis science, marketing their competitive advantage, and are passionate about the business. Without this background the chances of success are greatly diminished. As MJBizCon keynote speaker, entrepreneur and Shark Tank celebrity, Daymond John, who focuses first on the entrepreneur instead of the company, says, “I look for people who are creative, scrappy and honest.”

- Second, we ensure that the company is familiar with and focused on meeting EU cGMP requirements. This is likely to become a competitive advantage, at least, and most likely a regulatory requirement in the future. If a standard like this is not in place, we typically advise moving on because the lower quality companies are a dime-a-dozen, and destined for commoditization.

- Third, we assess the regulatory regimen in the company’s home market, and in the target markets. And we analyze the ability of the company to scale in the context of near, medium and long-term market expansion as new major domestic and international markets come online. In our opinion it is critical for a properly positioned cannabis company to have the ability to scale rapidly in order to capitalize on the massive global market potential.

- Finally, once the vetting process is completed our contact list numbers in the tens of thousands of PE firms, MSOs, Pubcos, HNW, Family Offices and other qualified investors. Those that are most appropriate are contacted, sign our Non-disclosure agreement, are supplied with an Executive Summary about the opportunity, and invited for a full presentation of an informative pitch deck and financials.

Investor takeaway

As the third and last part of our three-part series on the future of strategic investing in cannabis, we narrow the focus to where/how to look for success in potential investments in such a burgeoning and highly disruptive industry – disruption that could shut down an entire supply chain. An industry rapidly evolving into a traditional CPG model. Following the smart money into the industry leads you to the MSOs that are taking a commanding position, already to the extent of being a better value for the investment dollar than their Canadian counterparts. And we have outlined the formula we apply to separate the potential winners from the contenders – by evaluating the prowess and the passion of the executive team. By assessing the competitive advantage of the company and how quickly they can scale for growth. And how well they are ready for the regulatory regimen in their home and target growth markets. These steps we take before presenting the company to our extensive list of investment resources. The Future of Cannabis Industry Strategic Investing – Part III

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to provide access to capital while meeting client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.