With legalization spreading across the country, industry pundits and researchers are projecting the potential of the industry to reach as high as a market size of $115 billion by 2030. And Marijuana Business Daily reports that the amount of capital raised as of September 10 is already up 118% over full year 2020. This flow of capital is primarily accruing to the benefit of the large Multi-state Operators (MSOs). Last year the SEC created a new ruling lifting methods of access to capital that have been hurdles to industries such as cannabis in the past. In this dynamic, nuanced and skyrocketing industry we are presenting in this three-part series the factors to be aware of when making strategic investment portfolio decisions in the cannabis industry. The Future of Cannabis Industry Strategic Investing – Part II, The MOSs

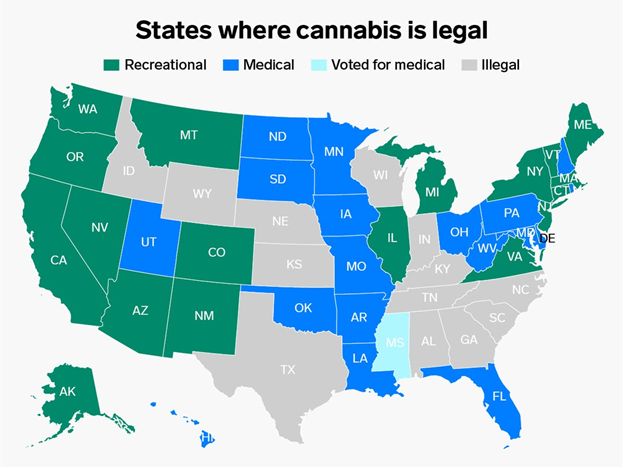

Currently 37 states, the District of Columbia, Guam, Puerto Rico, the Northern Mariana Islands, and the U.S. Virgin Islands have legalized medical marijuana programs. 19 of those states and DC have also approved cannabis for legal adult consumption.

The Multi-state Operators

In terms of where the industry in the U.S. is headed in the future, MSOs play the lead role. MOSs are cannabis companies that have established/bought into operations in various states. They are vertically integrated companies with multiple retail venues in many of the most affluent markets that have legalized medical or medical-recreational use. These are holding companies with separate subsidiaries in their states of operation that hold state and municipality licenses and permits. While cannabis/cannabis products cannot be transported across state lines, processes, IP, branding, etc. can be. (Actually, because of the lack of ability to perform their basic business across state lines, MoneyworksMagazine.com states that the correct terminology should be Multiple State Operators.)

As compiled by Green Market Reports, here are the largest of the MSO’s in the U.S. markets – listed by valuation:

- Curaleaf(CURA.CN)(CURLF) $4 billion valuation

- Operates in 13 states, having just acquired assets in Oregon and Illinois, has 12 cultivation and 11 processing sites, along with over 70 retail locations.

- The stated strategy of Curaleaf is: “be in every large market that we can be in the United States, with the highest-quality products and service for every kind of cannabis consumer.”

- Trulieve (TRUL.CN)(TCNNF) approximate valuation $2.9 billion after the recent acquisition of Harvest Health and Recreation.

- This acquisition last month now gives Trulieve operations in 18 states and is claiming to now be the largest cannabis company in the world by revenue.

- The acquisition moves Trulieve beyond its strong presence in Florida to have multiple assets that include: 107 dispensaries, 15 cultivation facilities, and 13 manufacturing facilities with licenses for cultivation, processing, and retailing. This includes Harvest Health’s subsequent acquisition of Verano in an $850 million all-stock deal.

- Green Thumb Industries (GTII.CN)(GTBIF) $2.8 billion valuation

- Operates in 10 states with licenses for 71 retail locations, 11 manufacturing facilities. Acquired Beboe Brands recently.

- Acreage Holdings(ACRG.U)(ACRGF) $1.9 billion valuation

- 12 states operational, licenses in 19 states.

- 68 retail operational dispensaries, 21 cultivation licenses.

- In 2019 Canopy Growth entered into a purchase agreement with Acreage with the deal pending U.S. federal legalization.

- MedMen (MMEN.CN)(MMNFF) $1.8 billion valuation

- 12 states with 78 licenses for retail locations, 30 operational stores, and 11 cultivation/manufacturing licenses.

- Tilray, with its merger with Aphria earlier this year making the company the top player in Canada in terms of revenue, recently announced that it was acquiring the convertible notes of MSO MedMen, giving it a 21% stake in the business and allowing it to enter multiple states, including Florida and California. Execution of this “placeholder” deal cannot occur, however, until federal legalization is passed in the U.S.

- And, the Columbia Care purchase of MedMen Denver for $42.0 million, $8.4 million in cash and $33.6 million in stock, represents a multiple of approximately 4.5x projected 2021 EBITDA. This now positions Columbia Care as the largest operator in Colorado, the second largest cannabis market in the U.S., that MedMen first opened in 2009.

- 4Front Ventures, approx. $300 million valuation

- 5 states, 5 dispensaries with plans to expand to 7. Merging with Cannex Capital (CNNX).

- Cresco Labs (CL.CN)(CRLBF) $200 million valuation

- 7 states, 16 retail locations and 10 production facilities.

Impact of MSOs on the Market

The MSO model has the advantages of leading the way to recognition of branded cannabis products on a national basis as an MSO grows from state to state. MSOs have been acquiring existing vertically integrated licenses without going through the lengthy, arduous, and costly process to which the companies they are acquiring were subjected. Then, when it comes to states issuing new licenses, the MSOs are in an advantageous position, being a big established business, to qualify before other contenders. Some, however, take the opposite view. Back to MoneyWorks Magazine, reporters there feel that legalization will bring more advantages for single state operators (SSOs). The argument is that SSOs are more likely to:

… be doing the necessary operational development and preparation for a broader cannabis future, without overextending themselves into multiple markets, taking on multiple burdens. They will be well placed to expand when the market becomes a national one having accrued knowledge, experience, and revenue, rather than just finance and facilities.

Where Do Canadian Pubcos Stand?

The major Canadian publicly traded companies enjoy a nationally legal market with less securities regulation constraints than in the U.S. This, of course, has given them greater access to capital to begin buying their way into the U.S. market through M&A transactions. The recent acquisition by Canopy Growth of Wana Brands, the best-selling edibles brand for $297.5 million, and the merger earlier this year of Aphria by Tilray, are prime examples. This trend will continue to increase the capital flow into the U.S. cannabis industry to continue to fuel the explosive growth pundits are projecting. In terms of inserting themselves into the U.S. market, announced megadeals must still await implementation until federal legalization occurs. Major players waiting in the wings as reported by Investopedia are:

- Revenue (TTM): CA$283.1 million

- Net Income (TTM): -CA$2.4 billion

- Market Cap: CA$2.3 billion

- 1-Year Trailing Total Return: -17.5%

- Exchange: Toronto Stock Exchange

Ayr Wellness Inc. (AYR.A.CX)

- Revenue (TTM): CA$207.0 million

- Net Income (TTM): -CA$231.0 million

- Market Cap: CA$1.5 billion

- 1-Year Trailing Total Return: 317.8%

- Exchange: Canadian Securities Exchange

TerrAscend Corp. (TER.CX)

- Revenue (TTM): CA$198.3 million

- Net Income (TTM): -CA$155.1 million

- Market Cap: CA$2.2 billion

- 1-Year Trailing Total Return: 403.3%

- Exchange: Canadian Securities Exchange

- Revenue (TTM): CA$111.6 million

- Net Income (TTM): -CA$213.1 million

- Market Cap: CA$993.8 million

- 1-Year Trailing Total Return: 105.1%

- Exchange: Toronto Stock Exchange

Village Farms International Inc. (VFF.TO)

- Revenue (TTM): CA$228.0 million

- Net Income (TTM): CA$15.3 million

- Market Cap: CA$1.4 billion

- 1-Year Trailing Total Return: 377.4%

- Exchange: Toronto Stock Exchange

Fire & Flower Holdings Corp. (FAF.TO)

- Revenue (TTM): CA$101.6 million

- Net Income (TTM): -CA$89.8 million

- Market Cap: CA$272.3 million

- 1-Year Trailing Total Return: 185.0%

- Exchange: Toronto Stock Exchange

Strategies for Entering the U.S. Market

As noted above, many of these Canadian cannabis pubcos are making deals to gain superior competitive positioning when U.S. federal legalization occurs. Canopy Growth in addition to their acquisition agreement with Acreage has also entered into a partnership agreement with Constellation Brands. The agreement would give Canopy the substantial advantage of Constellation’s vast national distribution network when legalization would allow cannabis/cannabis products to be transported across state lines. The Canadian cultivator Cronos that is already active in the U.S. CBD market (branded product line Happy Dance will be carried by the over 500 locations of Ulta Beauty) has obtained a partnership with the Altria Group. This provides Cronos with the benefit of the resources and distribution network of the tobacco giant. The Future of Cannabis Industry Strategic Investing – Part II, The MOSs

U.S. cannabis companies, however, dismiss potential inroads by Canadian competitors as a major threat. Their rationale is that while the Canadian cannabis pubcos have to await for federal legalization, U.S. companies have not only been acquiring many of the best assets, but have also been more profitable than their Canadian counterparts. And, by the time the U.S. market does open to them the Canadian companies will have to pay much higher prices for the assets they seek, while also finding themselves in competition with the likes of Big Tobacco, Big Pharma, and Big Alcohol muscling their way into market. The Future of Cannabis Industry Strategic Investing – Part II, The MOSs

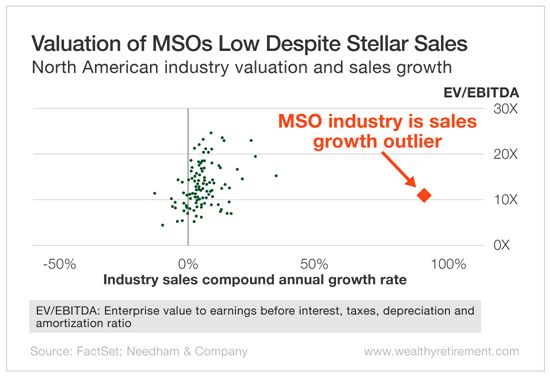

And in the chart below WealthyRetirement.com shows why U.S. MOSs are a greater value today than the Canadian cannabis operators.

-

- This is because these MSOs are the only cannabis companies that can currently access capital at a reasonable price.

- As long as cannabis is illegal at the federal level, these companies can grow and gain market share against little competition, establish brand strength, buy out smaller competitors and gain the advantage of scale.

- At 31.3 times EV/EBITDA (enterprise value to earnings before interest, taxes, depreciation and amortization), Canadian companies are valued four times higher than American MSOs.

- The mistake here isn’t that Canadian companies are valued too high… It’s that American MSOs are valued too low.

Mitigating Risk and Maximizing Upside in this Investment Space

The evidence continues to mount that phenomenal growth is ahead for the cannabis industry with the potential of MOSs leading the way into the future, both before and after federal legalization. However, especially in emerging markets, due diligence is key to identify the real players from the pretenders. Here is the approach we take with our clients for risk mitigation prior to presenting strategic cannabis investment opportunities: The Future of Cannabis Industry Strategic Investing – Part II, The MOSs

- First, we ascertain if the company and founders have backgrounds in cannabis science and marketing. Without this background the chances of success are greatly diminished.

- Second, we ensure that the company is familiar with and focused on meeting EU cGMP requirements. This is likely to become a competitive advantage, at least, and most likely a regulatory requirement in the future. If a standard like this is not in place, we typically advise moving on because the lower quality companies are a dime a dozen, and destined for commoditization.

- Third, we assess the regulatory regimen in the company’s home market, and in the target markets. And we analyze the ability of the company to scale in the context of near, medium and long-term market expansion as new major domestic and international markets come online. In our opinion it is critical for a properly positioned cannabis company to have the ability to scale rapidly in order to capitalize on the massive global market potential.

- Finally, once the vetting process is completed our contact list numbers in the tens of thousands of PE firms, MSOs, Pubcos, HNW, Family Offices and other qualified investors. Those that are most appropriate are contacted, sign our Non-disclosure agreement, are supplied with an Executive Summary about the opportunity, and invited for a full presentation of an informative pitch deck and financials.

Investor takeaway

With legalization spreading across the country, industry pundits and researchers are projecting the potential of the cannabis industry to reach as high as a market size of $115 billion by 2030. And Marijuana Business Daily reports that the amount of capital raised as of September 10 is already up 118% over full year 2020. This flow of capital is primarily accruing to the benefit of the large Multi-state Operators (MSOs). These are holding companies with separate subsidiaries in their states of operation that hold state licenses and municipality permits. They also hold the advantage over Canadian cannabis pubcos eager to engage in the compulsory strategy to grow beyond the limited bounds of their home country. They are planning the conquest of the U.S. market by making as much progress as they can before the market is opened by federal legalization. Evidence shows, though, that U.S. MSOs are a better value for the strategic investment dollar than are the Canadian pubcos. In the final analysis after all the nuances in the cannabis industry, processing a successful cannabis investment transaction requires: evaluating the strength of the target’s management team, ensuring the company meets cGMP standards, determining how the company meets the regulatory regimen in their market, and how attainable is their exit strategy. The smart money will always turn to advisory sources with extensive industry experience before making strategic investment portfolio decisions.

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to provide access to capital while meeting client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.