Investor Takeaway Strategic Cannabis Investment in Massachusetts

With cannabis initiatives and reforms occurring throughout the states in the path of the Green Wave sweeping the Northeast, Massachusetts stands out, as described by the legal team we interviewed at Vicente Sederberg LLP, as the market with the most medical and adult-use cannabis experience. It is the market where productive regulatory steps are being taken to remove hurdles in the way of its full potential. While attention may be diverted elsewhere by developments among surrounding states, Massachusetts has generated $2.54 billion in cannabis sales and has a large number of retailers in operation that will take its neighbors a prolonged period to duplicate. What are the factors that are propelling the continued growth of this market? Actions by the Senate and House of Representatives in the Commonwealth are removing hurdles, such as problems with Host Community Agreements (HCAs) and an underperforming Social Equity program, to spur market growth to potential.

The Market Strategic Cannabis Investment in Massachusetts

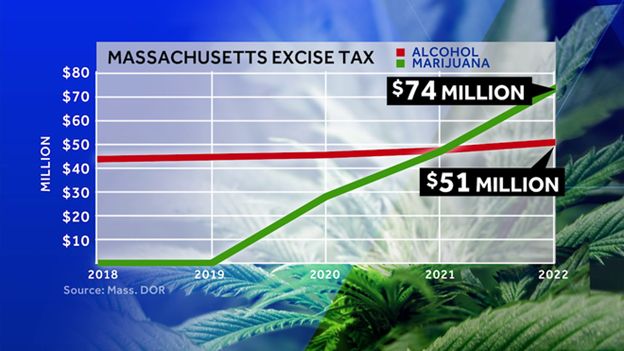

For strategic investors, Massachusetts remains the market to watch as it continues to lead the Green Wave of cannabis legalization and regulatory reform that is sweeping over the Northeast. While the news has been focused on New Jersey officially beginning adult-use cannabis sales last week with seven alternative treatment centers including 13 dispensaries statewide, Mass is now into its fourth year of adult-use sales with 387 retailers and total cannabis sales reaching $2.54 billion. And regarding resulting state revenue, WCVB took a look at excise taxes collected from alcohol sales vs. collections from cannabis. They found that halfway through the current fiscal year, Massachusetts has collected $51.3 million in alcohol excise taxes while at this same point in time marijuana excise taxes have totaled $74.2 million. Those collections are projected to continue a trajectory that far exceeds alcohol excise tax into the future.

Why Mass is a Hot Market Strategic Cannabis Investment in Massachusetts

The revenue figures reported above are derived from a 6.25% state sales tax, and an excise tax of 10.75% on adult use (in the municipalities a Host Community Agreement, HCA, local tax of up to 3% of gross revenues is also added on). While it added up to $208 million in total tax revenue for the state last fiscal year, cannabis retailers are burdened with controversial extra HCA requirements in many cities and towns. This, and the fact that the Social Equity provision of the state program is only having nominal impact, has spurred both the Mass House and Senate to draft legislation to correct those apparent hindrances to the growth potential of the state’s cannabis market.

Last month the Senate passed Bill S2801 designed to eliminate any excessive HCA obligations, beyond the legislated 3% of gross revenue requirement, to bolster the funding of SE and EE programs through the establishment of a new Cannabis Social Equity Trust Fund, and to allow on-premises consumption at community discretion. This is being pursued in an effort to reform the adult-use cannabis implementation law enacted in 2017.

Mass was, incidentally, the first state to write into law that equity and inclusion be a mandate within the legalization of cannabis. Under the proposed reforms, applicants could qualify for loans and grants from 10% of the revenue in excise taxes and applications in the Marijuana Regulation Fund each fiscal year. WBUR reports that this fund could be in the range of from $15 to $18 million in fiscal 2023.

The Boston Globe as quoted in MJBizDaily points out that the HCA provision in the Senate bill would go so far as to give the state Cannabis Control Commission (CCC) the authority to approve or reject the HCAs.

WBUR quotes Senate Ways and Means Committee Chairman Michael Rodrigues as saying:

“By clarifying the requirements of the host community agreements, making financial investments to increase social equity, and allowing for the full implementation of the cannabis industry through permitting social consumption authorization, I am confident that this legislation aids in the continued growth of a competitive and equitable commercial marijuana industry here in the Commonwealth of Massachusetts.”

The House of Representatives in the Commonwealth has similar reform legislation as part of the H4440 package which is intended for passage before the legislature session ends on July 31.

Banking reform is also making progress in the state with the recently approved acquisition of the Eastern Bank, a pioneer in marijuana banking services, by Needham Bank. In addition, cannabis banking services have recently been launched by Dedham Savings Bank.

And, regarding the presence of MSOs in the market, Mass is the home of the largest MSO, Curaleaf Holdings, which as reported in MJBizDaily generated revenue of $1.2 billion in 2021. Viridian Research reports Curaleaf having increased its cash position by $73.5 million over 2020, to $229.3 million. They also report that the MSO’s long-term debt, now a source of cash being pursued more vigorously in the industry instead of further equity dilution, increasing to $434 million last year.

What this Means to Strategic Investors

While we at Highway 33 are active in the Massachusetts market, we also sought the perspective of one of the leading legal firms that has been instrumental in guiding clients into that and other U.S. and international markets. Vicente Sederberg LLP is one of the firms with the longest tenure in cannabis practice. The firm was founded in Colorado over 10 years ago where it helped establish the first regulated medical cannabis market. It’s second office was opened in Boston in 2013 following the passage of the state’s medical cannabis law and went on to play a significant role in the push for adult-use legislation with the Marijuana Policy Project in 2016.

In discussions with Charlie Alovisetti, Partner and Chair of the Corporate Department, and Jennifer Flanagan, a former Commissioner on the Massachusetts Cannabis Control Commission and now Director of Regulatory Policy, it was pointed out that for starters, strategic investors should not consider Mass a limited-license state. Cultivation, processing, and delivery are not limited by the state. Dispensary licenses are the only “limited” licenses – limited through statute, those licenses can only be issued up to 20% of the total number of liquor licenses in each individual municipality.

The advantage of Mass relative to surrounding states, in Alovisetti’s view is the maturity of the market and the evolution of the regulatory reform. Jen Flanagan adds: “Hurdles to entering the market are becoming more balanced with the proposed statutory change instructing the CCC to review and approve HCAs. When formulated initially the HCAs were intended to establish responsibilities between the community and establishment, often times aligning in a way cities and towns otherwise operated. Because, however, the cannabis industry was not understood well by many of the municipalities at the time, it’s been a concern that conditions were imposed on operators beyond the maximum 3% on gross revenues.” This has been a heavy burden for retailers to cope with in many municipalities. With both the Senate and House bills progressing through the legislature, the state has now taken greater control to regulate and approve HCAs.

Regarding her time as an inaugural Commissioner on the Massachusetts Cannabis Control Commission, Flanagan emphasizes that: “The spirit of the adult-use cannabis law in Massachusetts was to lower the barriers of entry into the cannabis industry to allow applicants in the state to access licensing while also effectively prioritizing Social Equity.” Nevertheless, in this high cost, highly regulated industry, it has often been prohibitive for states like Mass to accomplish that objective. The establishment of the Cannabis Social Equity Trust Fund as proposed in S2801 and H4440 is designed to be an innovative approach to lower that barrier.

How We Can Help Strategic Cannabis Investment in Massachusetts

We agree with the assessment that Massachusetts is in a leadership position in the green wave sweeping the Northeast. Yet, in all cases the approach we take with our clients for risk mitigation prior to presenting them with investment opportunities, in Mass and any of the other markets across the country in which we have experience, is this:

- evaluate the prowess and the passion of the prospect’s executive team

- assess the competitive advantage of the company and how quickly it can scale for growth

- and determine just how well they are ready for the regulatory regime in their home and target growth markets

We take these steps before presenting the company to our extensive network of pre-qualified investors.

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2022 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.