The Pace of SPACs SPACs in Highly Regulated Industries

In 2020, Sophia Kunthara of Crunchbase branded 2020 as the “Year of the SPAC.” She like many others does not see the pace of SPAC transactions slackening in 2021. She found that to this early point in the year 145 SPAC IPO have raised $44.5B, average deal size $307M. This compares with the full year 2020 where 248 SPAC IPOs were reported to have raised $83B. By contrast, 2021 has seen 55 traditional IPO raise $21.7B thus far. SPACs in Highly Regulated Industries

As tracked by Crunchbase, here are some of those taking the IPO route, vs. SPAC, thus far into 2021:

1/13 – Affirm, which competes with After Pay and Klarma in the “buy now, pay later” space, entered the public market with an $11.9B IPO valuation.

1/14 – Much heralded Poshmark, the new and second-hand clothing/accessories sensation. A $3B IPO valuation.

1/28 – Qualtrics, the Utah-based SAP spin out. A $15B IPO Valuation! SPACs in Highly Regulated Industries

Prominent SPAC transactions:

1/8 – Clover Health went public after an acquisition by Social Capital Hedosophia with a SPAC valuation of $7B.

1/13 – Billtrust, went public after a merger with South Mountain Merger Corp with a $1.3B SPAC valuation.

1/21 – Hims and Hers Health went public after a merger with SOAC Oaktree Acquisitions, with a 1.6B SPAC valuation.

The Importance of SPACs in Highly Regulated Industries

As you recall from our previous articles on this subject, although being around for decades as an alternative finance tool, SPACs, also called “blank check companies,” are formed to raise money through an IPO specifically to buy another company. At the time of an IPO filing a SPAC needs neither existing business operations, nor even a stated target for acquisition. By the end of two years the SPAC must complete an acquisition or return all funds to all investors. SPAC investors, therefore, have no idea into which company their money will be invested, requiring confidence in an experienced management team or sponsor.

SPACs engage underwriters and institutional investors before offering shares to the public. Funds cannot be disbursed except to complete a specific acquisition. And, after the acquisition the SPAC is commonly listed on a major stock exchange. Founding management team and sponsors typically invest in a 20% interest in the SPAC with the remaining 80% interest held by public shareholders of “units” of the IPO – a common share of stock along with a fraction of a warrant. All shares have similar voting rights. SPACs in Highly Regulated Industries

Advantages of a SPAC, and Cautions

Why not just go public using a traditional IPO since that was a route many healthcare and tech companies chose in 2020? In reality, SPACs do afford unmatched benefits to both sponsors and targets.

- Owners of smaller-size companies can gain greater access to funding, often enjoying a significantly higher selling price than private equity transactions and receive what amounts to an expedited IPO process by an experienced acquisition management team.

- Sponsors can not only receive a high rate of return relatively quickly, but also be guaranteed a large war chest to invest in targets, required in a short period of time.

- In addition, a study by the Warrington College of Business at the University of Florida found that it can be shown that IPOs, in general, very often underdeliver. It was found that in the last decade IPOs were underpriced by as much as 21%. From their calculations an average of $37M went unrealized.

On the flipside, SPAC mergers often depend on funds coming from Private Investments in Public Equity (PIPE) deals. PIPE investors often step in to replace capital from IPO investors who opt out of a SPAC merger. Some have voiced the concern that there may not be enough resources to go around for all the potential SPAC deals as funding from PIPE investors dries up.

SPACs in Healthcare IPOs

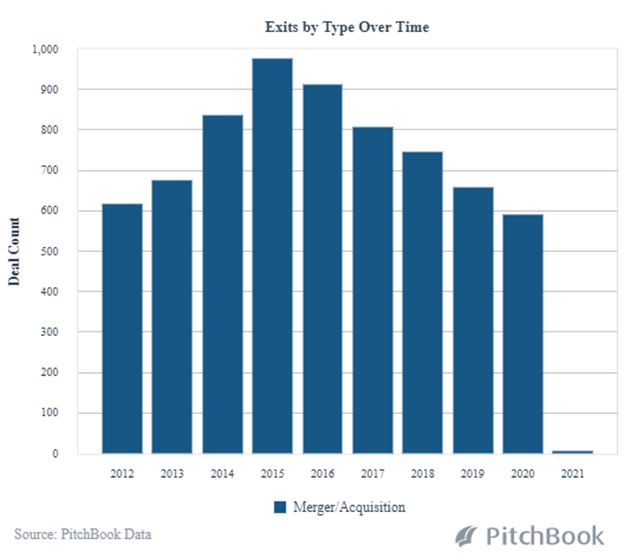

Regarding the potential for the wave of SPAC descending on the Healthcare industry, the indicator of Mergers and Acquisitions transactions is helpful. Pitchbook reports that while M&A transactions were down during the pandemic…

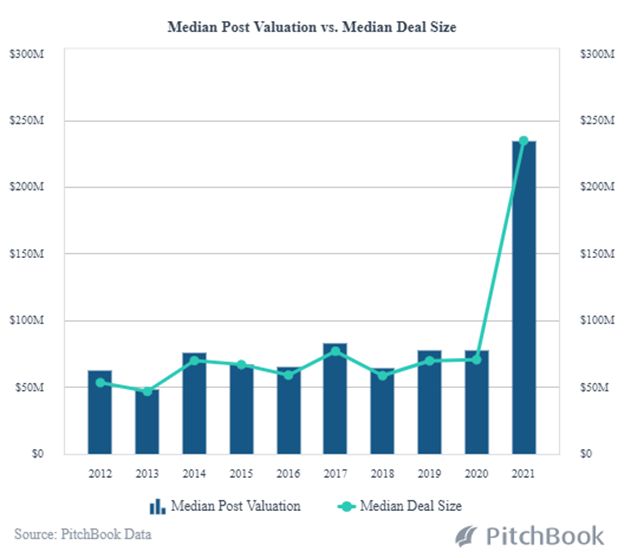

…in 2021, Healthcare M&A transactions are starting out by living up to expectations with exponentially high median post valuation and median deal size…

Clarkston Consultants in their life sciences assessment for 2021 found that while 2020 was a year of collaboration, particularly in the fight against the Corona Virus, they expect a shift back to vigorous M&A activity. An example cited is the finding by SP Capital IQ that pharmaceutical companies have cash reserves equal to over 170B. This they see as indicative of the strong return to M&A in the healthcare industry in 2021.

Supporting that conclusion is the fact that the large numbers of SPACs, particularly in healthcare, funded in 2020 now have less than two years to find merger targets. While some see this as a potential over saturation for SPACS which could drive down expected equity returns relative to risks for sponsors, the fact is that SPACs do offer advantages over the arduous traditional IPO process of seeking public funding. Large investors including Gores Group, Apollo and Social Capital continue to raise hundreds of millions via SPAC IPOs. In healthcare/biotech some of the investors that have been most active in SPACs include: LifeSci Advisors, Casdin, RA Capital, Deerfield, Foresite, Vesper, and a long list of others, including:

- SPAC VG Acquisition Corp(NYSE: VGAC.U) will acquire 23andMe for $509 million in cash and $250 million in private investment in public equity (PIPE) financing. The deal values the DNA analytics firm at $4.4B.

GigCapital2 (NYSE: GIX) is a SPAC that is on schedule to merge with two telemedicine firms, UpHealth and Cloudbreak, during the first half of the year. The merger of UpHealth, virtual health consultations globally and with a digital pharmacy that can ship prescriptions to all 50 states, and Cloudbreak with their specialty in providing medical interpreters during online doctor visits in over 250 languages, is expected to raise $600M.

- Dragoneer Growth Opportunities SPAC is sponsored by the Dragoneer Investment Group, began in 2012, and manages more than $10 billion in assets. Having backed Spotify (SPOT) and Uber technologies in the past, the SPAC will now focus on software, Internet and healthcare IT segments.

SPACs in Cannabis

Statistics prepared by the leading cannabis industry research firm, BDA Analytics, show U.S. cannabis sales to have reached $15B in 2019, and are still on a pace to double in size to $30B as soon as 2024. 2021 is predicted to be a banner year as legalization nationally draws closer. If not the election of a presidential administration that campaigned on cannabis law reform, it is likely that passage of the SAFE Banking Act will be an aggressive step forward on a national basis. Coming out of COVID-19 all states are facing unfathomable revenue shortfalls and will be scrambling for more sources of tax revenue. This places renewed pressure on local jurisdictions to look to the revenue-generation/employment-creation potential of cannabis cultivation/ production/sales. New York, Connecticut, and Virginia are major medical marijuana markets that are most likely to move toward passage of adult use this year. SPACs in Highly Regulated Industries

While this is the setting for the potential of cannabis in 2021, its national legal status continues to keep VC, institutional investors and private equity money away from the industry. This puts the use of SPACs in the limelight for cannabis companies in the U.S. to access capital over traditional sources and in order to pursue the path of going public.

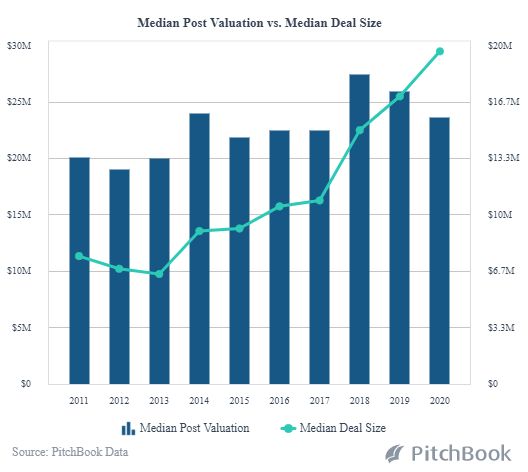

While M&A in the cannabis industry has not quite lived up to pre-COVID expectations, 2021 is projected to be a banner year as more operators turn to SPAC sponsors for raising capital.

Among the major SPACs focusing on the cannabis space:

- Schultze Special Purpose Acquisition

Now listed on Nasdaq (NASDAQ: SAMA) joined the growing list of cannabis SPACs, The SPAC has over $130M cash on the balance sheet, making it well positioned for potential M&A opportunities. The fund has an LOI in place with Clever leaves International for a combined publicly-traded entity. Clever Leaves is an international operator out of Colombia of pharmaceutical-grade cannabis cultivation and extraction.

- Akerna

In 2019, Akerna Corp. (KERN) acquired the cannabis software operations and compliance company MJ Freeway, making it the first cannabis-focused SPAC. Later that year Akerna acquired Ample Organics, the leading seed-to-sale company in Canada.

- Merida Merger

In late 2019, Merida Merger Corp. (Nasdaq: MCMJ) joined Nasdaq with a successful track record in cannabis by its parent Merida Capital Partners, an IB involved with the industry since 2009. Its first investment in cannabis-related companies began in 2013. Its IPO launched last year was targeted to raise $120M.

- Ayr Strategies

Ayr Strategies Inc. (CSE: AYR.A, OTCQX: AYRSF) is a multi-state operator (MSO) with five operating companies in Massachusetts and Nevada. Through its vertical integration the company is a leading cultivator, manufacturer and retailer of cannabis products. The acquisition agenda for Ayr Strategies includes: Washoe Wellness, The Canopy NV, Sira Naturals, LivFree Wellness, and CannaPunch of Nevada

Investor Take Away

In 2021, SPACs will represent a significant liquidity option particularly for Healthcare and Cannabis companies to provide them with the competitive advantage of more quickly getting to market. In many cases the SPAC merger process with a target company can take place in a substantially shorter period of time than the traditional IPO timeline. That said, a targeted company must be ready to accelerate to public company complex accounting, financial reporting and compliance requirements. This requires a strong, experienced management team to perform due diligence on targets, and help market a deal to PIPE investors. And, this must be accomplished in a relative short period of time, the two-year requirement, or all funds must be returned to investors.

How We Can Help

The critical factors in assessing the potential of a SPAC:

- Due diligence for understanding the technology in the industry being targeted

- Analyzing the preemptive nature of the target’s business model

- Determining the soundness of the financial statements yet to be audited

- And assessing the zeal of the team charged with the task of growing a company into a multimillion-dollar operation.

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Healthcare and Cannabis along with highly regulated markets in the fields of Pharma, Bitech, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.