From our previous coverage of SPACs in EDGE Briefings you know that SPACs are considered not just an alternative funding tool anymore. Market Watch, for one source, has predict 2021 to be the “Year of the SPAC,” saying: SPACs in Healthcare Update

Venture-backed private companies are increasingly considering the SPAC route as an attractive path to go public. Across all sectors, SPACs used to be only a few percentage points of the IPO market, but now they are becoming a majority of IPOs, according to NASDAQ.

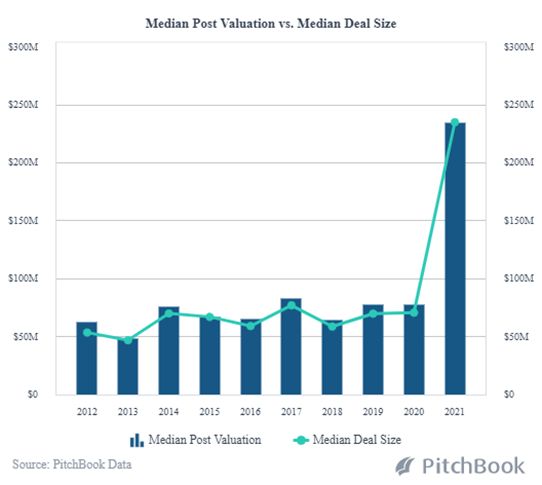

In 2021, Healthcare M&A transactions are starting out by living up to expectations with exponentially high median post valuation and median deal size…

In fact, just in the first six weeks of the year SPACs raised >$38 billion. According to CB Insights that is already nearly half the SPAC capital raised in the entire year of 2020. They predict that digital health exits will reach new heights this year. Goldman Sachs reports that SPAC deals actually outpaced traditional IPOs in 2020 – raising $73 billion versus $67 billion. And, according to SPAC Insider, to date 145 SPACs have raised >$44.5 billion compared to 55 traditional IPOs that raised $21.7 billion. With CB Insights projecting that digital health exits could rise 60% quarter-over-quarter in 2021. With the wide array of pharma innovations surrounding COVID-19, expectations are high for another big year for M&A in pharmaceutical/healthcare. Especially in the healthcare unicorn category where M&A reached record levels in 2020, another banner year is predicted for investors anticipating the potential of large ROI.

SPACs in Healthcare Deals This Year

Since our last report in the EDGE Briefing regarding SPACs in Healthcare, we have already seen major SPAC deals, including Butterfly Network, 23andMe and Hims & Hers. In the case of Hims & Hers, the company shunned the IPO route late last year and merged in January with the SPAC Oaktree Capital Management netting Him & Hers a $1.6 billion valuation and $330 million in cash.

Other major healthcare SPAC M&A developments so far this year:

- In February, digital health company Sharecare announced going public via SPAC by a merger with Falcon Capital Acquisition Corp. The anticipated valuation, $3.9M and adding approximately $400M in growth capital.

- FS Development Corp II is the second SPAC launched by Foresite Capital. Based on CEO Jim Tananbaum success with Gemini Therapeutics last fall, this new SPAC is believed to be focusing on information technology companies in the biotech space. Market cap is around $250M.

- Health Assurance Acquisition Corp (HAAC) is a SPAC intended to merge with consumer-centric, data-driven healthcare services companies. In an IPO worth $500M in November of 2020, HAAC’s market cap is now approximately $600 million.

- And the controversial Clover Health, the first VC-backed company to go public via a SPAC with Social Capital Hedosophia III, is involved in a de-SPAC transaction that a key investor has called for DOJ investigation.

What’s Driving the Trend Toward SPACs?

Why not just go public using a traditional IPO while that was a route many healthcare and biotech companies chose in 2020? In reality, SPACs do afford unmatched benefits to both sponsors and targets.

- SPACS can offer the advantage of providing more capital initially than can be raised in a later-stage round.

- Owners of smaller-size companies can gain greater access to funding, often enjoying a significantly higher selling price than private equity transactions, and receive what amounts to an expedited IPO process by an experienced acquisition management team.

- Sponsors can not only receive a high rate of return relatively quickly, but also be guaranteed a large war chest to invest in targets, required in a short period of time.

- SPACs have less strict regulatory scrutiny than traditional IPOs in some respects. A prime example is the ability to publish future earnings projections more freely, possibly making the deal more attractive in the case of pre-revenue companies. Less stringent regulatory requirements for shell companies can save as much time as 4 month in getting to market as opposed to the registration requirements for an IPO.

- In addition, a study by the Warrington College of Business at the University of Florida found that IPOs, in general, very often underdeliver. In the last decade, according to the findings, IPOs were underpriced by as much as 21%. From their calculations an average of $37M went unrealized.

What’s Ahead in 2021?

Plug and Play Tech Center cites an NYSE report that in 2020 there were 50 SPACs going public with Healthcare being their target sector. The median capital raised by these SPACs, $130M. CB Insights supports the finding that the action will be among healthcare unicorns:

Our timeline visualizes the exits of 20 healthcare companies with valuations of $1B+, from GoodRx’s $12.7B public offering to Illumina’s massive purchase of GRAIL. SPACs in Healthcare Update

They estimate that as many as 51 healthcare companies can be classified as “unicorns,” meaning private companies valued at $1B+, that like 23andMe are maturing to the point of being targets for exits. Consequently, 2021 could very likely be “the year of the healthcare SPACs”. SPAC Track estimates that with as many as 53 SPACs actively seeking healthcare and life science target companies, more startups could choose to pursue public funding to finance growth objectives over the arduous IPO process.

What Investors Look for in a SPAC

As our investor base turns to us for guidance for SPAC investments we examine these key areas:

- Knowledgeable Shareholder Base.

Critical for a knowledgeable shareholder base to understand the business/technology being acquired.

- Management with Proven Operational Experience.

Preferably operational experience negotiating through the compliance, regulatory and financial issues specific to the healthcare industry.

- M&A Strategy Fulfilling the Vision for Future Growth.

- Since sponsoring company automatically get a 20% share in the SPAC, and IPO investors receive warrants and rights for future stock purchases, a target company my increase it’s selling price to offset this potential future liability. This may impact the value of de-SPAC company share prices. Plans for protecting the shareholder base that remain in the company after the merger closes is vital to the success of the new public entity.

- Precise financials and attainable pro formas.

This is vital valuation of assets the merger provides.

- Planned Integration of Company Cultures.

Maintaining employee retention when a deal occurs is always critical. And ongoing policies that promote ESG (Economic, Social and Governance) issues are becoming a standard requirement in current M&A transactions

Caution When Evaluating SPACs

On the flipside of the proven success of SPACs in the healthcare industry, SPAC mergers often depend on funds coming from Private Investments in Public Equity (PIPE) deals. PIPE investors often step in to replace capital from IPO investors who opt out of a SPAC merger. Some have voiced the concern that there may not be enough resources to go around for all the potential SPAC deals as funding from PIPE investors dries up. This is a situation we are monitoring closely. SPACs in Healthcare Update

Investor Take Away

2020 was a record year for SPACs. This year with at least 53 SPACs looking for healthcare targets could very well fulfill the prediction by CB Insights that 2012 will be “The Year of the Healthcare SPAC.” Dramatic increases are predicted for the rise in M&A and reverse merger SPAC deals as both maturing unicorns and fresh startups seek an exit pathway without certain IPO hurdles. In many cases the SPAC merger process with a target company, a “de-SPAC,” can take place in a substantially shorter period of time than the traditional IPO timeline and generate higher returns for sponsors and investors alike. That said, a targeted company must be ready to accelerate to public company complex accounting, financial reporting and compliance requirements. This requires a strong, experienced management team to perform due diligence on targets, and help market a deal to PIPE investors. And, this must be accomplished in a relative short period of time, the two-year requirement, or all funds must be returned to investors. SPACs in Healthcare Update

How We Can Help

As you can see there are complexities in SPAC deals. Critical to the potential success of the deal is due diligence. Due diligence for understanding the technology in the industry/company being targeted, assessing the preemptive nature of the target’s business model, the soundness of the financial statements often yet to be audited, and the experience of the team charged with the task of growing a company into a multimillion dollar operation. SPACs in Healthcare Update

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Healthcare, Biotech and other highly regulated markets in the fields of Pharma, Agtech, Clean/ClimateTech, Cannabis, and CBD/hemp. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.