The Exploding Consumer Market SPACs in Cannabis Update

As we reported in a recent issue of the EDGE Briefing, while COVID-19 shuttered many traditional businesses, more cannabis than ever before was consumed in the U.S. in 2020 – a record $17.5B in legal sales – a 46% increase from 2019, according to a recent report cited in Forbes published by BDSA, a cannabis sales data platform. This was aided by the unprecedented step taken by 28 of the legal cannabis states where dispensary operations were classified as “essential businesses.”

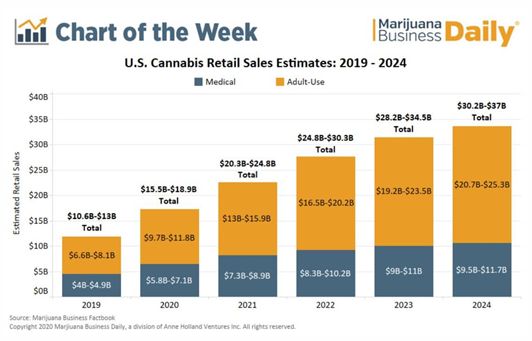

Marijuana Business Daily tracks/projects the growth of the industry in this manner…

Capital Flowing into the Industry

Overall in 2020, capital flowing into the cannabis industry dropped to $4.2 billion from $11.6 billion in 2019, and the even higher level of $14.2 billon in 2018, as reported by Viridian Research. Total assets held by cannabis related SPACs in 2020, were worth more than $2 billion in assets. While just in the first two weeks of January cannabis companies in North America raised over $619 million. This fresh capital targets high-value investments that have a healthy future as a publicly traded firm.

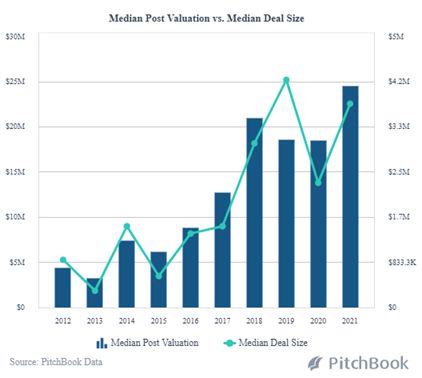

Pitchbook is seeing dramatically rising median post valuations and deal sizes in privately owned cannabis companies backed by VC or PE investment as we progress into this very active year…

SPACs – A Major Force in the Future of the Industry

As you recall from our previous articles on this subject, although being around for decades as an alternative finance tool, SPACs, also called “blank check companies,” are formed to raise money through an IPO specifically to buy another company. At the time of an IPO filing a SPAC needs neither existing business operations, nor even a stated target for acquisition. By the end of two years the SPAC must complete an acquisition (a “de-SPAC’) or return all funds to all investors. SPAC investors, therefore, have no idea into which company their money will be invested, requiring confidence in an experienced management team or sponsor.

SPACs engage underwriters and institutional investors before offering shares to the public. Funds cannot be disbursed except to complete a specific acquisition. And, after the acquisition the SPAC is commonly listed on a major stock exchange. Founding management team and sponsors typically invest in a 20% interest in the SPAC with the remaining 80% interest held by public shareholders of “units” of the IPO – a common share of stock along with a fraction of a warrant. All shares have similar voting rights.

Advantages of a SPAC, and Cautions

Put simply, SPACs allow companies to gain quicker access to liquidity. An IPO, the traditional approach to go public, can take up to a year to fully execute. Taking the route of a SPAC, however, can shorten that process, negotiating and closing included, to just a few months. So, in reality, SPACs do afford unmatched benefits to both sponsors and targets.

- Owners of smaller-size companies can gain greater access to funding, often enjoying a significantly higher selling price than private equity transactions, and receive what amounts to an expedited IPO process by an experienced acquisition management team.

- Sponsors can not only receive a high rate of return relatively quickly from a de-SPAC, but can also be guaranteed a large war chest to invest in targets, required in a short period of time.

- In addition, a study by the Warrington College of Business at the University of Florida found that it can be shown that IPOs, in general, very often underdeliver. It was found that in the last decade IPOs were underpriced by as much as 21%. From their calculations an average of $37M went unrealized.

On the flipside, SPAC mergers often depend on funds coming from Private Investments in Public Equity (PIPE) deals. PIPE investors often step in to replace capital from IPO investors who opt out of a SPAC merger. Some have voiced the concern that there may not be enough resources to go around for all the potential SPAC deals as funding from PIPE investors dries up.

SPACs in the Cash Constrained Cannabis Industry

2021 is predicted to be a banner year for the cannabis industry as the pace of the baby-steps toward legalization start gaining stride. While national legalization is still on the more distant horizon, it is likely that passage of the SAFE Banking Act will be an aggressive step forward on a national basis. Coming out of COVID-19 all states are facing unfathomable revenue shortfalls and will be scrambling for more sources of tax revenue. This places renewed pressure on local jurisdictions to look to the revenue-generation/employment-creation potential of cannabis cultivation/ production/sales. SPACs in Cannabis Update

The industry has matured to the point where major players are now focused on strategic acquisitions, efficient operations and EBITDA. And, MSOs are estimated to have $1B in dry powder, along with an estimated $2B worth of M&A deals in the works as this formerly cash-restrained industry advances toward its $35B potential as early as 2025.

While this is the setting for the potential of cannabis in 2021, its national legal status continues to keep VC, institutional investors and private equity money away from the industry. This puts the use of SPACs in the limelight for cannabis companies in the U.S. to access capital over traditional sources and in order to pursue the path of going public. SPACs in the cash constrained cannabis industry is a perfect match. SPACs in Cannabis Update

Interestingly, SPACs are expected to play a major role in Canada as well as the U.S. where a shake out is forecast among public companies that will be forced to either merge for survival or face the prospect of bankruptcy.

Major SPACS Focusing on the Cannabis Space

- Subversive Capital Acquisitions Corp, recently renamed The Parent Company (TPC)

Completed its acquisition last week of California’s Caliva and Left Coast Ventures and began trading on the Neo Exchange. Market Cap >$1 billion.

The two acquisitions: Caliva, a vertically integrated CA operator associated with Jay-Z, and Left Coast Ventures, another large vertically integrated operator.

- Sliver Spike Acquisition Corp

Acquired Weedmaps’ parent company, WH Holding Company, and flipped it into a public enterprise through a reverse merger. The resulting business was given a $1.5-billion valuation.

These two SPACs will give the cannabis industry a huge liquidity infusion, a combined $660+ million of cash and public traded currencies, to consolidate smaller operators in California and promote more rapid inorganic growth.

- Greenrose Acquisition Corp

In March this New York-based SPAC entered into agreements to acquire four marijuana businesses – Futureworks (doing business as The Health Center), Shango Holdings, Theraplant and True Harvest – in a deal initially valued at $210.

- Choice Consolidation Corp

In February the SPAC announced that it had raised $150 million in an initial offering, becoming the 10th SPAC to trade on the NEO exchange.

- Schultze Special Purpose Acquisition

Now listed on Nasdaq (NASDAQ: SAMA) joined the growing list of cannabis SPACs, The SPAC has over $130M cash on the balance sheet, making it well positioned for potential M&A opportunities. The fund has an LOI in place with Clever Leaves International for a combined publicly-traded entity. Clever Leaves is an international operator out of Colombia of pharmaceutical-grade cannabis cultivation and extraction.

- Akerna

In 2019, Akerna Corp. (KERN) acquired the cannabis software operations and compliance company MJ Freeway, making it the first cannabis-focused SPAC. Later that year Akerna acquired Ample Organics, the leading seed-to-sale company in Canada.

- Merida Merger

In late 2019, Merida Merger Corp. (Nasdaq: MCMJ) joined Nasdaq with a successful track record in cannabis by its parent Merida Capital Partners, an IB involved with the industry since 2009. Its first investment in cannabis-related companies began in 2013. Its IPO launched last year was targeted to raise $120M.

- Ayr Strategies

Ayr Strategies Inc. (CSE: AYR.A, OTCQX: AYRSF) is a multi-state operator (MSO) with five operating companies in Massachusetts and Nevada. Through its vertical integration the company is a leading cultivator, manufacturer and retailer of cannabis products. The acquisition agenda for Ayr Strategies includes: Washoe Wellness, The Canopy NV, Sira Naturals, LivFree Wellness, and CannaPunch of Nevada SPACs in Cannabis Update

What Investors Look for in a SPAC

- Knowledgeable Shareholder Base.

Critical for a knowledgeable shareholder base to understand the business/technology being acquired.

- Management with Proven Operational Experience.

Preferably operational experience negotiating through the compliance, regulatory and financial issues specific to the cannabis industry.

-

- M&A Strategy Fulfilling the Vision for Future Growth.

- Precise financials and attainable pro formas.

This is vital valuation of assets the merger provides.

- Planned Integration of Company Cultures.

Maintaining employee retention when a deal occurs is always critical. And ongoing policies that promote ESG (Economic, Social and Governance) issue are becoming a standard requirement in current M&A transactions. SPACs in Cannabis Update

Investor Take Away

In 2021, coming off a year where more cannabis was consumed than ever before – a record $17.5B in legal sales – a 46% increase from 2019, SPACs are bringing substantial liquidity to maintain sales growth and provide cannabis companies with the competitive advantage of more quickly getting to market. In many cases the SPAC merger process with a target company, termed to “de-SPAC,” can take place in a substantially shorter period of time than the traditional IPO timeline. That said, a targeted company must be ready to accelerate to public company complex accounting, financial reporting and compliance requirements. And, this must be accomplished in a relative short period of time, the two-year requirement, or all funds must be returned to investors. This requires a strong, experienced management team to perform due diligence on targets, and help market a deal to PIPE investors. Often it is the case that the acquisition target does not have financial records that measure up to investor scrutiny. In the final analysis, the most important factor in decisions about a SPAC investment, therefore, is the caliber and trust embodied in the senior management of the SPAC. SPACs in Cannabis Update

How We Can Help

At Highway 33 Capital Advisory we excel at mitigating investor risk through extensive due diligence and structuring SPAC transactions to meet client investment strategies in emerging 2021 opportunities – with our core expertise in Cannabis along with highly regulated markets in the fields of Pharma, Biotech, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.