Investor Takeaway SAFE Impact on Cannabis Industry Debt Financing

In 2021 it is estimated that capital flow into the cannabis industry topped $12.7 billion, with $3.4 billion attributed to debt financing transactions. Improving operations in the low interest environment last year saw this issuance of debt funding grow. Recent multimillion-dollar deals among cannabis industry leaders show that debt as a source of growth funds is a rational use of capital, not a sign of business distress. For cannabis operators, debt can play a vital role in the capital structure of a company in order to preserve equity and to facilitate long term growth. What does it mean that the SAFE Banking Act may actually be a detriment to the very debt financing that is propelling the growth of many large operators? We speculate that federal legalization, and likely the passage of the SAFE Banking Act, will not come as early as this year. Whatever the future of federal legalization holds, however, investment in those operators that can scale into leadership positions is the most sound investment strategy. SAFE Impact on Cannabis Industry Debt Financing

Debt in the Cannabis Industry

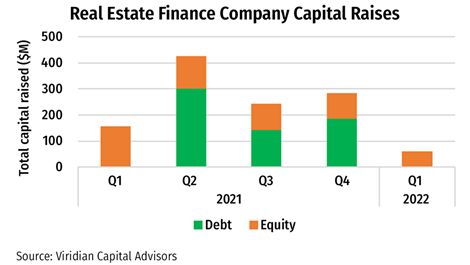

As readers of The EDGE Briefing you know we have reported about the meteoric rise of debt financing in the cannabis industry. Capital flowing into the industry is estimated to have been $12.7 billion as of December 24, according to Viridian Research (the record year was in 2018, $1.4 billion higher). U.S. equity raises climbed to $1.9 billion, but “debt was where the action was.” The amount of debt raised soared 806% over 2018, for a total of $3.4 billion. Mergers and Acquisitions remain the dominant way to accelerate growth among the bigger players in the industry. But on December 13th, with the Curaleaf announcement of receiving a privately placed debt raise of $425 million, debt financing became a significant growth strategy. The debt raise was not only the largest to date, but it also signaled the ability of large cannabis businesses that have cleaned up their balance sheets to obtain lower than industry average interest rates. In this case an 8% interest rate – the lowest rate in the cannabis industry. Thanks to their stronger market position this began the substantiation of the trend away from equity to debt financing.

Clouds on the Horizon for Cannabis Debt Financing?

Now into Q1, and even though we are continuing to close debt financing deals already into the new year, industry sources are seeing equity transactions again surfacing as outpacing debt financing.

MJBiz Finance cites a study by Viridian Research of Innovative Industrial Properties (NYSE: IIPR), the largest REIT focused on the cannabis industry. In the first week in February IIPR announced a $300 million six-year senior unsecured note offering with interest return tied to the rates of existing bonds, which varied from 3.75% to 5.5% based on maturity date. Three days later IIPR cancelled the issue citing “market conditions” as the reason. SAFE Impact on Cannabis Industry Debt Financing

So what are these “market conditions” that prompted this abrupt turnaround? Granted bond pricing is reflecting the advent of the rising inflation with higher interest rates. But, the conclusion of Viridian and others on the subject of debt financing in the industry, is that it appears that renewed optimism over the reintroduction of the SAFE Banking Act is what is primarily responsible for a cooling of big debt deals. SAFE Impact on Cannabis Industry Debt Financing

Just What is the Status of the SAFE Banking Act?

Although the U.S. Senate killed SAFE Banking as it was amended to the 2022 National Defense Authorization Act at the end of last year, the Secure and Fair Enforcement (SAFE) Banking Act came back this month as an amendment to the America COMPETES Act. SAFE, as you recall from our previous coverage on the subject, is intended to give protections to those financial institutions that provide traditional banking services to state-licensed cannabis-related businesses.

According to the National Organization for the Reform of Marijuana Laws (NORML), this is the sixth time members of the U.S. House of Representatives have sent SAFE on to the Senate as an amendment or as a stand-alone piece of legislation. And NORML found that there is significant receptivity in the industry about the passage of cannabis banking legislation:

A recent survey by Whitney Economics of 396 licensed cannabis companies reported that over 70 percent of respondents cited a “lack of access to banking or investment capital” as their top business challenge – ranking far above other challenges, such as onerous state regulations or competing with the unregulated market.

From an historical standpoint, that first of the six attempts to pass the SAFE Banking Act was in 2017, sponsored by Sen. Jeff Merkley (D-OR) and Rep. Ed Perlmutter (D-CO). As the law firm of Brennan, Manna and Diamond (BMD LLC) summarizes it: “(The legislation) would provide expanded safe harbor protections for banks working with cannabis businesses and re- or de-scheduling marijuana under federal criminal law that could eliminate uncertainties such as the cannabis industry’s issues under Section 280E of the Internal Revenue Code and the current lack of access to the U.S. Bankruptcy Courts. There is also the aspect of protecting public safety. Verbiage in the Act states that opening financial services to legitimate cannabis businesses and service providers reduces the amount of cash at such businesses.”

Financial Regulation News points out that to mitigate the risk of lack of compliance with the myriad of federal financial crimes laws, banks doing business with the cannabis industry, and their bank regulators, draw on guidance issued by FinCEN in 2014 (the “FinCEN Guidance”). The SAFE Banking Act would call for FinCEN to issue new guidance to incorporate the demand for increased bank services by traditional institutions in addition to the orientation of existing wording.

The FinCEN Guidance specifically incorporated content from a memorandum issued by the U.S. Department of Justice in 2013 by Deputy Attorney General James Cole (the “Cole Memo”), that essentially deprioritized prosecution of marijuana-related federal offenses so long as the actors were complying with state law. Among other things, the Cole Memo identified continuing priorities such as preventing distribution to minors, money flowing to criminal enterprises, and diversion of marijuana to states where it was still illegal.

Representative Perlmutter, who has championed the Act all these years announced last month that he would not seek reelection for his next term in Colorado’s 7th congressional district. He has said, though, that he still plans to continue working for SAFE Banking Act passage. His Act is now included in the America COMPETES Act as an amendment. That Act was approved by the House two weeks ago. It is focused on reinvesting in American manufacturing and research to bring back U.S. competitiveness in the global marketplace. It now advances to the Senate where action, not necessarily passage of the amendment, is expected later this year.

Legalization on the Horizon?

Adding to advocate expectations is the bilateral support for legalization, now in the form of yet another piece of legislation this time presented by Nancy Mace, GOP Representative from South Carolina. In November she introduced the first Republican-backed decriminalization bill, the States Reform Act. In essence the bill would remove cannabis from the Schedule 1 controlled substance list, while establishing a baseline of federal policies and imposing a three per cent federal excise tax on cannabis sales in each legal state.

Nevertheless, the reality as we see it is that passage of even a banking bill like SAFE is not likely this year. The industry is still trying to come to grips with the productive impact of federal legalization. From a business standpoint, existing financing sources to the industry know that legalization means more competitors bringing with it reduced lending spreads compared to loans currently out in the sector.

Even from the standpoint of traditional banking institutions, passage of the Act is not a slam dunk. BMDLLC points out that unlike private lenders, banks are subject to regulation and examination, and are held to an overarching requirement of safety and soundness.

Banks need a degree of collateral certainty by way of timely and effective control of underlying assets, so that they can protect against further dissipation in value of the underlying assets and business. This will be difficult to achieve if they must go through some process of uncertain time or success to gain asset control from the defaulting borrower.

Viridian Research, as reported by MJBiz Finance is another that feels the Act is still not likely to pass. And even if it does, as noted above, it is likely to take time to “percolate through the market.” We’ll see if in the example given at the start of this article, IIPR is simply waiting for the fervor of cannabis banking reform to fade again in order to revive their debt financing plan.

Making the Right Decision for Your Investment Portfolio

So, whatever the future of federal legalization holds, investment in those operators that can scale into leadership positions is the most sound investment strategy. Then, when full legalization does occur those companies will have strong exit possibilities with valuations superior to their peers. However, especially in emerging markets, due diligence is key to identify the real players from the pretenders.

The approach we take with our clients for risk mitigation prior to presenting strategic cannabis investment opportunities: evaluating the prowess and the passion of the executive team, assessing the competitive advantage of the company and how quickly they can scale for growth, and determining how well they are ready for the regulatory regime in their home and target growth markets. We take these steps before presenting the company to our extensive network of pre-qualified investors.

Investor Takeaway

In 2021 it is estimated that capital flow into the cannabis industry topped $12.7 billion, with $3.4 billion attributed to debt financing transactions. Improving operations in the low interest environment last year saw this issuance of debt funding grow. Recent multimillion-dollar deals among cannabis industry leaders shows that debt as a source of growth funds is a rational use of capital, not a sign of business distress. For cannabis operators, debt can play a vital role in the capital structure of a company in order to preserve equity and to facilitate long term growth. What does it mean that the SAFE Banking Act may actually be a detriment to the very debt financing that is propelling the growth of many large operators? We speculate that federal legalization, and likely the SAFE Banking Act, will not come as early as this year. Whatever the future of federal legalization holds, however, investment in those operators that can scale into leadership positions is the most sound investment strategy. SAFE Impact on Cannabis Industry Debt Financing

How We Can Help

At Highway 33, we see these challenges daily in our role as an investment banking intermediary as we arrange for the financing of growth companies in the cannabis and hemp markets via M&A, asset sale/purchase, and debt transactions. Finding the right fit for your strategic investment portfolio, or the proper way to appeal to a source for your growth funding requires transacting deals were the operators’ objectives and scalability are a strategic fit for investors’ portfolios.

We excel at structuring deals to meet client investment strategies in emerging opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.