In light of the passage by the House of Representatives of the MORE Act (Marijuana Opportunity, Reinvestment and Expungement Act) last week, let’s take a look at the question: How federal legalization of cannabis will affect your strategic investment in the industry? Cannabis Federal Legalization – Implications for Strategic Investors

Under the MORE Act cannabis would be federally descheduled from being classified as a Schedule I substance by the U.S. DEA, with “no currently accepted medical use and a high potential for abuse,” and those with prior convictions would have their records expunged. While still a highly politicized issue, passage of the Act into law is highly unlikely as it now goes to the Senate for a vote at a time when the Senate is championing its own proposal for cannabis legalization.

To put these developments in context as the legalization process drags on we have previous written a three-part series on the future of the cannabis industry for strategic investors. (You can access these articles by clicking here.) As a summary, here are several pertinent points we found regarding where the future of the industry is headed:

- In Part I of the series we reviewed the undeniable growth potential of the industry in general. With states seeing legalized cannabis raking in unprecedented revenues, and with the industry promise of jobs and investment opportunities, the pace of legalization across the country continues to accelerate. A “green wave” is now sweeping over the East Coast and other formerly reluctant jurisdictions. Industry pundits and researchers are projecting the potential of the cannabis industry to reach a market size as high as $115 billion by 2030.

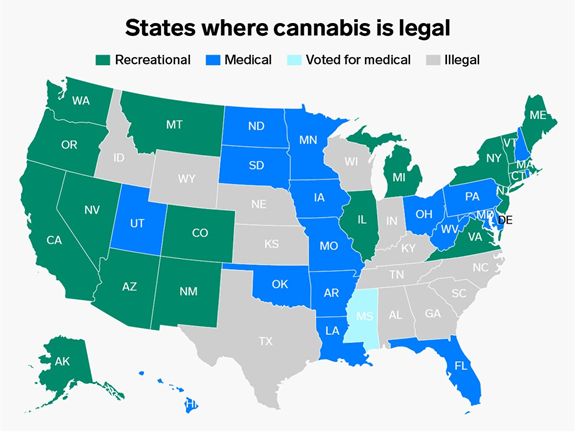

- The majority of the U.S. population now resides in states where cannabis is legalized. Currently 37 states, the District of Columbia, Guam, Puerto Rico, the Northern Mariana Islands, and the U.S. Virgin Islands have legalized medical marijuana programs. 19 of those states and DC have also approved cannabis for legal adult consumption. While Arkansas, Missouri, New Hampshire, North Carolina, and Rhode Island have taken the first steps toward putting cannabis legalization on the 2022 ballot.

-

States Where Cannabis is Legal – Business Insider, October 21, 2021

- A “green wave” is now sweeping over the East Coast and other formerly reluctant jurisdictions. Industry pundits and researchers are projecting the potential of the cannabis industry to reach a market size as high as $115 billion by 2030.

- From ResearchAndMarkets.com In 2020 , the global market for recreational marijuana was estimated to be $20.5 billion. This market is expected to grow to $90.4 billion by 2026, expanding at a CAGR of 28%.

- MJBizDaily reports that the amount of capital raised as of September 10 is already up 118% over full year 2020. This flow of capital is primarily accruing to the benefit of the large MSOs.

- In Part II we summarized the critical role these MSOs play in the future of the industry as: ”These are holding companies with separate subsidiaries in their states of operation that hold state licenses and municipality permits. They also hold the advantage over Canadian cannabis pubcos eager to engage in the compulsory strategy to grow beyond the limited bounds of their home country. They are planning the conquest of the U.S. market by making as much progress as they can before the market is opened by federal legalization. Evidence shows, though, that U.S. MSOs are a better value for the strategic investment dollar than are the Canadian pubcos.

- And in Part III we concluded that the cannabis industry is rapidly evolving into a traditional CPG model. Following the smart money into the industry leads you to the MSOs that are taking a commanding position. To separate the potential winners from the contenders: evaluate the prowess and the passion of the executive team, assess the competitive advantage of the company and how quickly they can scale for growth, and determine how well they are ready for the regulatory regimen in their home and target growth markets.

- Regarding the regulatory regimen facing the MSOs as they grow from state to state, we concluded as did a group of major MSO executives in a survey by Business Insider:

- CEOs of the largest cannabis companiesin the world said they’re not waiting for the US federal government to legalize cannabis while they focus on growing their businesses. Several said they were hopeful that Congress would pass some form of cannabis reform, but most said they were betting on a narrower banking bill ahead of full-scale legalization or decriminalization.

The Issue of Federal Legalization

While there are a number of compelling factors favoring legalization at the federal level, this is simply another case of follow-the-money – of the potential of free-flowing tax revenue, that is, as the federal government examines ways to profit from legalization. The irony is that this revenue factor, above all others, is the element that literally guarantees legalization. As is done with cigarettes and alcohol, legalized cannabis will be heavily regulated and taxed. For one example of the tax revenue bonanza is what the Colorado Sun reports about tax revenues in that state since legalization. Since legalization in the state in 2014, marijuana sales have topped $10 billion. Tax and fee revenue realized by the state have exceeded $1.63 billion to date.

On a less cynical note, however, there are gross market inefficiencies that federal legalization would cure. Federal illegality means a high cost for capital with the constraints to banking. Internal Revenue Code Section 280E, for another, has precluded cannabis businesses from realizing federal tax deductions and credits because of the Schedule I classification of cannabis. This forces cannabis businesses to pay a far greater share of net income as taxes, compared to traditional businesses. The prohibitions against banks dealing with cannabis businesses has compounded many problems the cannabis industry faces. Private investors have also been dissuaded from entering an industry where access to bankruptcy protections is completely unavailable as long as cannabis businesses operate in a Schedule I industry. Only with the advent of alternative forms of growth capital, in the form of non-dilutive debt and equity financing and subsequent M&A transactions helped to file growth for the industry.

Another disadvantage the cannabis industry is struggling through is the lack of intellectual property (IP) protection. Because the IP and trademarks of cannabis firms fall outside the protections of the Lanham Act, brands, recipes, extraction and manufacturing processes are all susceptible to infringement. Federal legalization would provide a path to resolve these issues as well.

Federal Legalization vs. the Localized Cannabis Industry

However, there are dissenters who would argue on the side of leaving the regulation of cannabis up to individual states. Those that support the States’ rights argument fear that federal lawmakers will overlook crafting legislation that protects the local small marijuana operators who pioneered the space in the first place. In the law-of-the-jungle where Big-Eats-Small, these operators who bootstrapped their way into business and struggled through the expensive and arduous process of becoming licensed would now face the inevitable treat of big businesses consuming the market. Keeping the power to regulate at the state and local levels could protect what these small businesses and what they’ve contributed to their communities. Back to a cynical tone, the argument is that the federal government has never gotten it right yet on laws regarding cannabis, why would one believe they will get national legalization right? According to a report published recently by Reuters:

If recent experience with hemp and CBD is any indication, federal regulators are likely to step in as soon as cannabis is de-scheduled to reassert their authority. Unless the groundwork for legalization is laid down in advance, legal uncertainty will simply be replaced with a regulatory one.

Regarding the rapid pace of the current growth of legalization on the state-by-state basis, WealthManagement reports that it usually takes as much as two years for a cannabis market to start gaining traction in newly legalized states. Due to the enormous need for increased revenue that every state faces coming out of the pandemic, more states are streamlining the sanctioning process, even down to the municipality level, to expedite the flow of new tax revenue.

Mitigating Risk and Maximizing Upside in this Investment Space

The evidence continues to mount that phenomenal growth is ahead for the cannabis industry with the potential of MSOs leading the way into the future, both before and after federal legalization. Investing in those operators that can scale into leadership positions is the strategy to pursue so that when full legalization does occur they will have strong exit possibilities with valuations superior to their peers. However, especially in emerging markets, due diligence is key to identify the real players from the pretenders. Here is the approach we take with our clients for risk mitigation prior to presenting strategic cannabis investment opportunities:

- First, we ascertain if the company and founders have backgrounds in cannabis science and marketing. Without this background the chances of success are greatly diminished.

- Second, we ensure that the company is familiar with and focused on meeting cGMP requirements. This is likely to become a competitive advantage, at least, and most likely a regulatory requirement in the future. If a standard like this is not in place, we typically advise moving on because the lower quality companies are a dime a dozen, and destined for commoditization.

- Third, we assess the regulatory regime in the company’s home market, and in the target markets. And we analyze the ability of the company to scale in the context of near, medium and long-term market expansion as new domestic and international markets come online. In our opinion it is critical for a properly positioned cannabis company to have the ability to scale rapidly in order to capitalize on the massive global market potential.

- Finally, once the vetting process is completed our network that includes the tens of thousands of PE firms, MSOs, Pubcos, SPACs, HNW, Family Offices and other qualified investors. Those that are most appropriate are contacted, sign our Non-disclosure agreement, are supplied with an Executive Summary about the opportunity, and invited for a full presentation with an informative pitch deck and financials followed by access to a full diligence locker.

Investor Takeaway

The evidence continues to mount that phenomenal growth is ahead for the cannabis industry with the potential of MSOs leading the way into the future, both before and after federal legalization. Investing in those operators that can scale into leadership positions is the strategy to pursue so that when full legalization does occur they will have strong exit possibilities with valuations superior to their peers. However, especially in emerging markets, due diligence is key to identify the real players from the pretenders. The approach we take with our clients for risk mitigation prior to presenting strategic cannabis investment opportunities: evaluating the prowess and the passion of the executive team, assessing the competitive advantage of the company and how quickly they can scale for growth, and how well they are ready for the regulatory regime in their home and target growth markets. We take these steps before presenting the company to our extensive network of pre-qualified investment resources.

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to provide access to capital while meeting client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in representing thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.