With cannabis market size predictions growing larger each time we look it should be full steam ahead for U.S. and Canadian cannabis companies. After all, statistics from StockDetect.com tell us that U.S. cannabis sales this year will likely reach $24 billion, Canada $4 billion. Crunchbase reports on the continued flow of capital into the industry finding that in the first five months of the year 132 funding events raised an average of $15 million. That is up 165% over the average investment size in 2020. With cannabis business being declared “essential businesses” by most legal states during the height of the pandemic the future looks rosy indeed. Yet, this year legal states began reporting sales volume decreases compared to last year and the continued clouded federal legalization picture has taken a toll on cannabis publicly traded stocks. Undercapitalized cannabis businesses are feeling the strain. Purchasing Cannabis Distressed Assets

Take California as an example. Cannabis businesses are failing in the state that has a far greater sales potential than the entire country of Canada. As in several other of them most promising states, local authorization must precede state licensing. The state’s 482 cities and 58 counties all have different licensing and permit requirements. How about the expense of needing a deed or lease in place before an applicant can even begin the expensive and slow state licensing process? And then, there is the reality of the thriving illegal market flying in the face of the heavy burden of compliance and taxation on licensed operators. Combine this with the underlying volatility of huge marketplace and the inability of operators in trouble to turn to the bankruptcy courts and you have all the ingredients for business failures. An operator’s options then are limited to seeking palpable debt funding, selling assets, or completely liquidating. Purchasing Cannabis Distressed Assets

What A Buyer Interested in Distressed Assets Needs to Know

From the Lexology.com library the international law firm of Gowling WLG lists these important considerations for potential buyers of distressed M&A in Canada to consider:

- The differences between distressed deals and traditional M&A boil down to these three:

-

- Timetable – As opposed to the lengthy traditional M&A process, a distressed deal can transpire rapidly, some in a matter of days.

- Risk Profile – The risks associated with distressed deals are by their nature much greater than traditional M&A since limited due diligence and limited or no representations and warranties are usually the case.

- Court Involvement – Many distressed M&A transactions must be processed through a formal insolvency proceeding overseen by a court. (Consensual workouts can be conducted outside the court process.)

- Composition of a typical distressed transaction. Each case is different, of course. While some may simply involve the purchase of assets, often times a more creative approach is required such as acquiring debt, acquisition through formal insolvency proceeding, or specially structured merger.

- Insolvency proceedings in Canada. Being federally legalized in that country, insolvency proceedings in Canada are conducted under the Companies’ Creditors Arrangement Act (the “CCAA”) and certain related provincial legislation.

- Completing a transaction inside vs. outside formal insolvency proceeding.

- On the one hand, court oversight assures that a buyer is purchasing all assets free and clear; irrespective of whether or not the proceeds from the transaction are sufficient to pay out the seller’s existing’s creditors. On the other hand, the buyer inevitably takes on a greater degree of risk in spite of the court scrutiny. In an insolvency proceeding the buyer will typically be unable to conduct comprehensive due diligence. Instead, due diligence is limited to key aspects of the transaction.

- Gowling stresses these financial and legal due diligence steps:

-

- Identify, as fully as possible, the assets that come with the purchase

- Review key contracts and licenses

- Meet the management team (provided a trustee or receiver has not been appointed)

- Consider third party consents

- And, examine other areas of risk exposure including environmental, employee and other common liabilities

- A Sales and Investor Solicitation Process may be part of the seller’s restructuring process. In an “SISP” a seller may solicit offers from potential investors for all or part of the firm’s assets. In formal insolvencies this is often by court order and is a potential red flag for the buyer when a Stalking Horse Agreement may be employed to set a minimum bid threshold that may or may not reflect market conditions.

While these are the potentially complicated steps in the process of acquiring a distressed company in Canada, most states in the U.S. have such burdensome disclosure requirements on owners of financial interests in a distressed M&A transaction as to add their own level of complication to the process. Purchasing Cannabis Distressed Assets

A Way Out of Distress Through Debt

For the factors listed above many cannabis operators in the U.S. are finding themselves with cashflow problems. Being able to attract investors with the security of assets in the company, rather than with the potential of a high return/higher risk through an offering of equity, is often a desired option. According to cannalogblog of harrisbricken.com:

Most distressed asset investors are looking to buy the debt of the failing cannabis company or to extend it credit in return for a large chunk of profits when the once failing cannabis company rights itself. Most of these distressed cannabis asset investors are prioritizing debt over equity because of the priority on pay outs in the event of a dissolution.

It is important, then, to understand the options available that best support a long-term survival strategy: Purchasing Cannabis Distressed Assets

Sale and Leaseback Transactions

While Sale-Leaseback (SLB) transactions aren’t technically debt they do allow companies to free up liquidity from their balance sheets without dilution. The upside of this alternative is that cannabis companies increasingly have been selling their cultivation, processing and storage facilities and immediately leasing them back as a way to instantly raise tens huge sums. The potential downside is that an SLB locks the asset seller into a longer commitment than other straight debt alternatives that now are likely to be able to be secured for rates similar to the SLB. It should be noted, however, that in common debt transactions lenders will be looking for more than a mere promise to repay. A security interest and/or corporate or personal guarantee will most likely be required. An SLB is a great option in obtaining capital for cannabis operators, and one that has been used by many of the largest companies in the space.

Asset-Based Lending

Based on the valuation of real estate and equipment assets, a cannabis company can typically borrow from within the range of 40% to 75% of asset value. In the case of development projects, the loan is usually based on project costs. While less typical, there are some working capital debt options in the market as well; though the availability of this option is much less than for real estate and equipment financing

Convertible Options

- Up to this point, most debt financing by cannabis companies has been found in convertible note options with low conversion premiums – which essentially delay dilution of equity. The company creates a note that converts to equity, often preferred stock, at a future date based on a future valuation method. These notes, similar to promissory notes with interest payable on or before a maturity date, have given investors security that they are repaid before equity holders if something goes wrong. For both the investor and the company this note structure allows the valuation question to be answered in the future while providing needed capital to the company and a more secure instrument to investors.

For companies seeking debt, the following are key considerations:

- Most cannabis debt providers will require personal guarantees (PGs) from principals. This is always a tough decision for founders and one that carries real risk. Are you willing to PG the debt?

- What assets does the company have? Or is purchasing? Real estate, equipment, accounts receivable, other assets?

- Does the company have existing debt? And how much debt can the company take on while not taking further undue risk with cash flow?

For investors who are considering lending to cannabis companies the following are key considerations:

- What are the credit scores of the principals? Is there any credit data on the company? How timely do they pay their payables, for example?

- What is the company’s existing cash flow? How realistic is the projection for future cash flow?

- How will the company use the funds? Is the use of funds realistic?

- What security will the investor have that they can recover funds if the loan isn’t repaid? PG? Cross-corporate guarantee? First lien on assets?

- Does the management team have the right experience for the type of company that they want to be?

- Does the company have its state and local cannabis licenses? If real estate is involved, what is the status of current local permits?

- Due diligence by experienced industry advisors is crucial since the lack of bankruptcy protection and restrictions on cannabis license ownership can complicate the debt financing transaction.

Alternative to Buying Distressed Assets/Operators – Look for Write-downs Instead

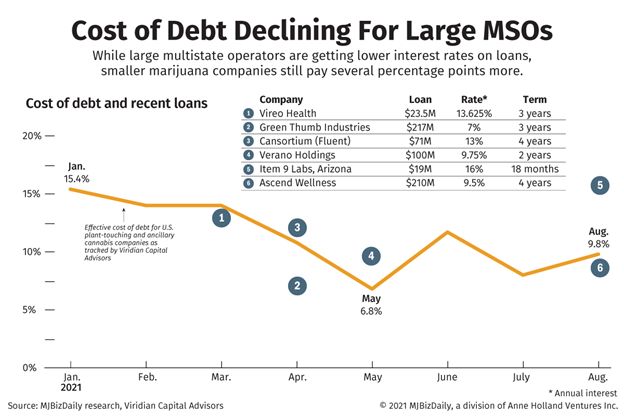

In discussing debt, the reality in the marketplace is that tier 1 MSO’s have the clout to secure debt in large amounts at declining rates… Purchasing Cannabis Distressed Assets

…while less liquid operators are more likely to be forced to take the path of selling off assets. Yet, we are even finding that the large Canadian pubcos, still looking for profitability after 3 years on the public markets, and in an effort to clean up their balance sheets, are following the path of selling off underperforming assets. According to our Managing Partner, David Hofer, “We are seeing write-down assets being sold for as little as $.10-$.20 on the original dollar investment.”

We at Highway 33, along with most other cannabis industry sources, see a bright long-term future for the industry, certainly on a path to approach $50 billion by 2025. However, as the performance of Canadian pubcos’ stock continues to be flat, as opposed to their U. S. counterparts, more action in the area of write-downs and divestitures will likely be the short-term strategy to watch.

Investor Takeaway

For an industry with such explosive growth being forecast, many obstacles are in the path of consistent positive cashflow for operators. When in trouble in the federally legal country of Canadian, cannabis companies have a court supervised bankruptcy process for distressed or insolvent operators. While there are complex steps in this process, the U.S. has no bankruptcy protection for an industry dealing in a federally illegal substance. And most states have such burdensome disclosure requirements on owners of financial interests in a distressed transactions as to add their own level of complication to the relief being sought by distressed operators. More often debt can play a vital role in the capital restructuring of a struggling company in order to preserve equity and to facilitate long term growth. Caution through extensive due diligence is required in distressed buyout opportunities. And often seeking divestitures is a less risky path for investors to follow. In this complicated, nuanced industry an experienced team with specific industry experience is required to provide the value added in facilitating successful distressed asset transactions.

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to provide access to capital while meeting client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.