Of keen interest to investors is the extensive clean energy support to be found in the recently approved Congressional legislation for $900B COVID-19 relief and $1.4T in federal spending and tax credit extensions. The Income Tax Credit (ITC) for solar energy projects which was scheduled to drop from 26% to 22% in 2021, will stay at 26% through 2023. The wind industry also received a limited extension of its production tax credit, and $35B was approved for energy technology research and development on public lands. Before the passage of this legislation the solar ITC was mandated to decline at the end of 2020 to 22% and fall to 10% at the end of this year. The tax extension will now remain at the 26% level for projects that begin construction all the way to the end of 2022. The credit will then fall to 22% for projects that begin construction by the end of 2023, and then permanently fall to 10% for large scale solar projects, and zero percent for small scale solar projects, that begin construction in 2024. Investment Tax Credit Extension Boost to Renewables

Clean Energy Investment Escalation

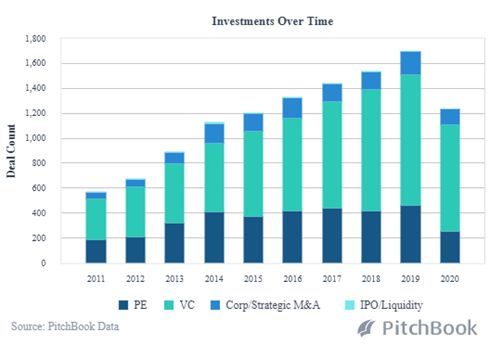

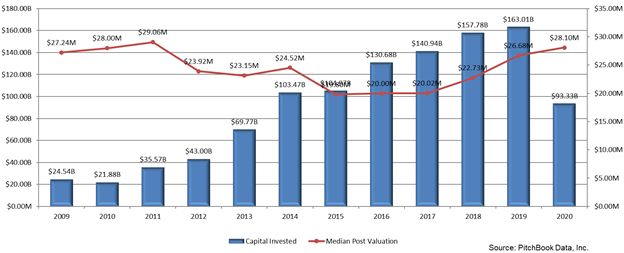

According to Pitchbook, VC and PE investment in clean energy continues at a pace that has been rising substantially each year, before the lull during the pandemic.

This accelerating rate of capital invested has also brought with it rising median post valuations.

With the passage of the new legislation, the tax extensions add substance to the forecast that global investment in renewable energy will reach new record heights in 2021, climbing as high as $16T by 2030. These projections are fueled by the 2019 World Energy Outlook report from the International Energy Agency which forecast a 1 per cent per year increase in global energy demand into 2040 – a full 20% over the course of that period of time. In an historic development, renewable energy actually outpaced coal for the first time ever in the U.S. in 2019, providing 23% of all US power, while the cost of renewable energy dropped significantly. For example, utility-scale solar costs sank 18%, while onshore wind costs fell 10% in the first half of 2019 alone.

Clean Energy Segments to Benefit from R&D Funding

Beneficiaries of the $35B in Department of Energy R&D programs over the next five years will range from wind, geothermal, and hydro to help for hard-to-decarbonize industries like steel and cement, as well as to the modernization of reactors to finally begin to fulfill the promise nuclear energy.

Battery Tech

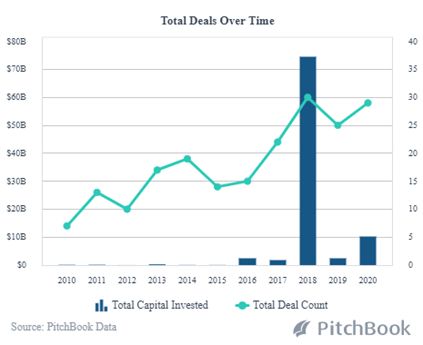

Mentioned prominently in the ITC legislation is the importance of battery/energy storage technology. Pitchbook shows that deal count and capital investment rose again in 2020 over the nearly $550 million that VC’s poured into the space last year. The new legislation calls for federal investment of $1 billion over five years in battery and energy storage technology, augmented by a competitive grant program for states, utilities and private industry that is designed to protect electric infrastructure against disruption as it facilitates a future of a zero-carbon energy supply.

Carbon Capture and Removal

This process of actively capturing carbon atoms and removing them from the atmosphere includes technologies such as afforestation, biochar, and carbon sequestration. The Biden administration has been promoting a plan for a “carbon bank” that would be established under the USDA’s Commodity Credit Corporation intended to pay farmers and forest owners to store carbon in their soil.

Solar’s Big Win

The tax credit extension will provide additional solar growth in 2022 through 2025, as more projects can secure the 26 percent and 22 percent tax credits. According to the Solar Energy Industry Association (SEIA), the ITC is essential to the transition of a fossil fuel economy to clean energy and estimates that the average annual solar growth rate in the US since the enactment of the ITC in 2006 is 52%. SEIA believes that the ITC program has enabled businesses to drive down costs and has spurred major funding by tax equity investors who can efficiently realize the tax benefits of the ITC and accelerated depreciation. According to the consultants at Wood MacKenzie, tax equity investors are vital to this sector and they expect to see solid growth in investment in solar and wind projects throughout the foreseeable future. Investment Tax Credit Extension Boost to Renewables

The Rise of Fiber Optics Solar

Section 48 of the new ITC legislation further extends the credit and phase-out for property with which construction has begun before Jan. 1, 2024 in such cases as property which uses solar energy to generate electricity, to heat or cool, or to provide solar process heat, to illuminate the inside of a structure using fiber-optic distributed sunlight, and/or equipment which uses the ground or ground water as a thermal energy source to heat a structure. Examples of phase-out extensions are those that exist for fiber-optic solar, qualified fuel cell and qualified small wind energy property. The phase-out in these categories is extended for property whose construction began before Jan. 1, 2024 to 26% for property which began construction before Jan. 1, 2023 and 22% for property which began construction after Dec. 31, 2022 and before Jan. 1, 2024 and 0% for any property not placed in service by Jan. 1, 2026.

Fiber Optic Solar Advantage in Agtech

Agtech

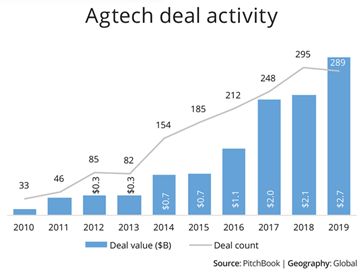

An example of the solar advantage in the tax extension legislation can be found in the often overlooked industry when it comes to clean energy technology in agriculture. According to Research and Markets, there is a US$21 billion opportunity in precision and indoor agriculture that’s going to drive ag productivity over the next several decades. This is equal to a CAGR of 12.9% between now and 2027.

To the many advantages of indoor agriculture – providing the ultimate year-round crop production and quality while using only 1% of the water, crop acreage, and transportation energy – there is one major obstacle. All prominent systems are dependent on electric lighting. This affects the optimization of both lighting and temperature control in grow facilities. The increasing demand from indoor farming for long-lasting, energy-efficient and economical grow lights has led to government and private sector initiatives to support technological advancements in LEDs. To this point, however, even the most modern LEDs consume massive kWhs of electricity relative to crop economic value and require huge upfront CapEx investment per square foot. In search of alternatives a World Wildlife Fund study revealed that the agriculture industry could shrink its carbon footprint substantially by using fiber-optic technology that can bring sunlight indoors as a renewable energy source.

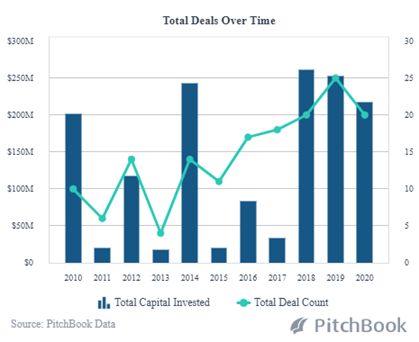

One such company in the fiber optics field, SunPathTech.com , has developed a patented daylight delivery platform that harnesses the power of pure spectrum sunlight indoors claiming a higher yield per plant/per square foot at a lower running cost than traditional LED and HPS lighting while producing healthier and higher quality yielding plants. The company is collaborating with several groups to implement this breakthrough technology. As emphasized by Joseph DiMasi, CEO of SunPath, “Both sustainable crop production and sustainable energy production are critical technologies to meet the 21st century challenges of population growth and climate change.” Indoor agriculture has become a prominent factor in meeting that challenge and is currently attracting tens of millions of dollars in VC, private investor, and M&A support.

Guidance Into Fast-Paced, Clean Energy Investment

High potential reward investments require an extensive vetting process. Before making recommendations to our clients about Seed or Series A, B rounds, we subject a prospect to our internal vetting regimen – in order to set investors’ expectations, ensuring they are not overpaying; and, ensuring that the clean energy prospect has validated all the information in its data lockbox. Key issues examined are:

- The technology – critical, naturally, to thoroughly understand the technology and its place in the client’s investment strategy.

- The team – how comfortable is the investor with the caliber and experience of the management team and how convincing is their dedication to critical environmental issues? And, are they resilient?

- Credible funding plans – is there a clear and attainable path toward growth/toward liquidity?

- Risk Assessment – what is the type of risk the investor is willing to take?

- Timing – is investment prudent now before the onset of future risks?

- Exit – understand the company completely from their patent protection to the acumen of the management team to execute their planned exit strategy.

- Legal advice – consult with a law firm skilled in structuring legal documentation associated with the level of risk of the investment being contemplated.

- A Competent Investment Advisory – preferably an advisory experienced in clean energy that is thoroughly familiar with the industry trends that will affect the investor’s ROI.

Investor Takeaway

Among the benefits of the new legislation to the future of clean energy is the extension of the federal solar ITC tax credit to remain at 26% until January 1, 2023. This will assist the solar industry to recover from losses experienced last year due to the COVID-19 pandemic. This extension of the solar tax credit has tremendous potential to boost local economies through job creation as well as bringing new cost-efficiencies to commercial and industrial indoor lighting. Investment Tax Credit Extension Boost to Renewables

The smart money is clearly embracing opportunities like this that are directly related to climate change. This is evinced by the S&P/TSX Renewable Energy and Clean Technology Index (INDEXTSI:TXCT) currently showing a 2019 – 2020 return of over 30%. Sorting out the winners in the U.S. while keeping a sharp eye on worldwide renewable energy developments, particularly in China and India, will be the challenge facing prudent investors.

How We can help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging clean energy technology as well as our core expertise with highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Cannabis and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments. Investment Tax Credit Extension Boost to Renewables

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.