Regardless of what the final outcome of the Presidential and Congressional election results may be, and how the ambitious plans of an incoming administration may fare in the face of pragmatic opposition, the demands for change on environmental issues and resultant business practices will not be subside. The smart money is clearly embracing opportunities directly related to climate change. This is evinced by the S&P/TSX Renewable Energy and Clean Technology Index (INDEXTSI:TXCT) currently showing a 2019 – 2020 YTD return of over 30%. The hottest segments in the energy industry in a Biden Administration are shaping up to be… Investment Opportunities in Biden Clean Energy

The Biden Administration Green Growth Agenda

On the environment a Biden administration comes in equipped with not only the “Biden Plan for a Clean Energy Revolution and Environment Justice,” but also with the strategy of initiating policy actions well beyond the Department of Energy alone. According to the Washington Post, president-elect Biden intends to instill climate change action across the breadth of the federal government.

The White House will create a National Climate Council “co-equal” to the National Economic Council; establish a “carbon bank” under the USDA’s Commodity Credit Corporation; push to electrify cars and trucks through the Transportation Department; and develop a climate policy at the Treasury Department that promotes carbon reductions through tax, budget and regulatory policies.

At the core of the new administration’s “green growth” agenda is achieving low or zero carbon energy production. To fund this aggressive objective Biden campaigned on a proposed $2 trillion clean energy funding to decarbonize the U.S. economy. This pursuit of green energy creates the opportunity for explosive growth for renewable energy companies, from wind and solar to the possibility of renewed interest in nuclear and fusion, under more climate friendly regulations and incentives. New employment opportunities would be created, claimed to be up to 10 million jobs, and deadlines were set to eliminate power plant emissions by 2035, net-zero emissions from all sources by 2050. Investment Opportunities in Biden Clean Energy

In light of these aggressive plans for the future of energy generation, and consumption, let’s now take a look at where investor funding of clean energy technology stands at this point and where the smart money is looking for the opportunities arising out of the anticipation of new government policies.

Where Investment in the Industry Stands Now

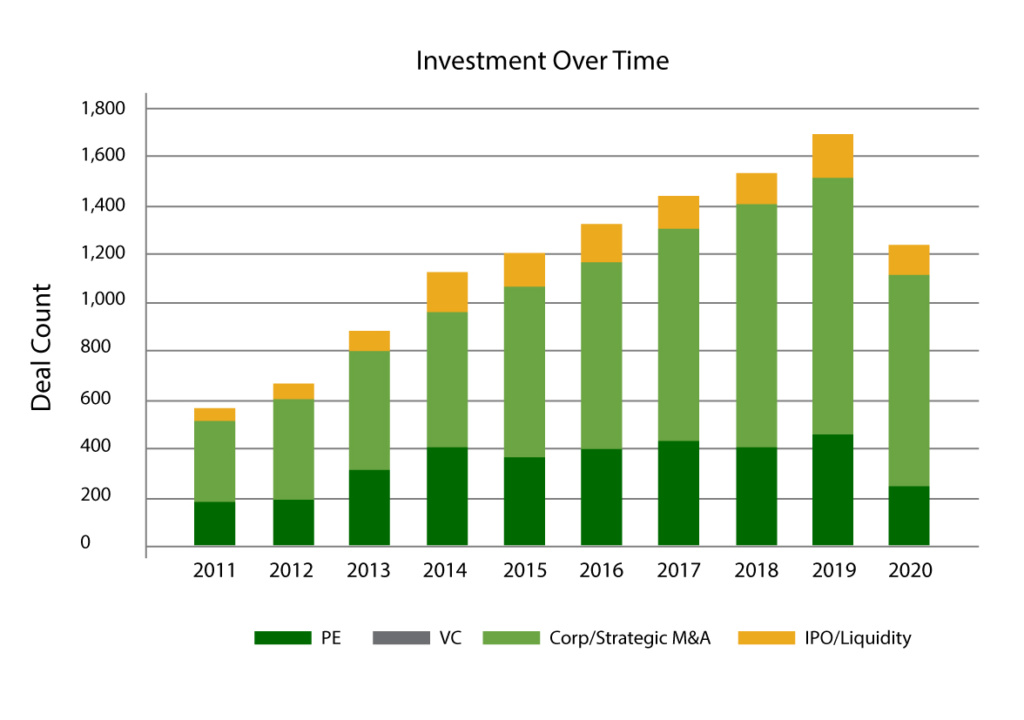

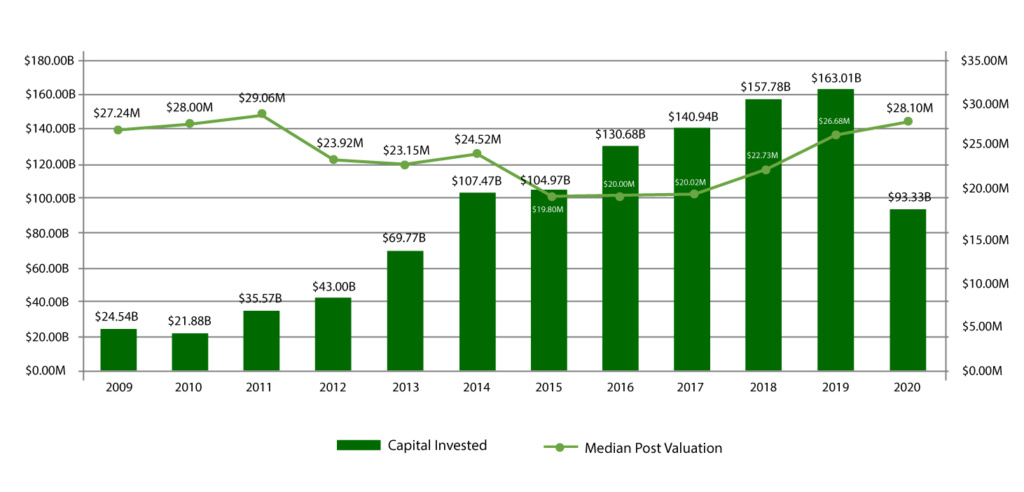

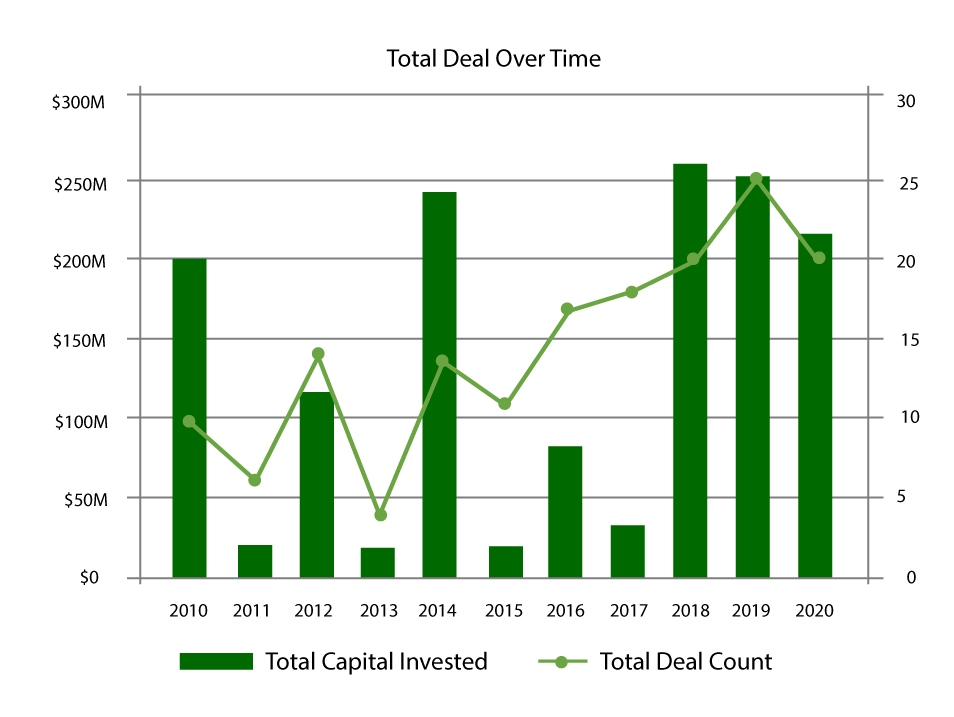

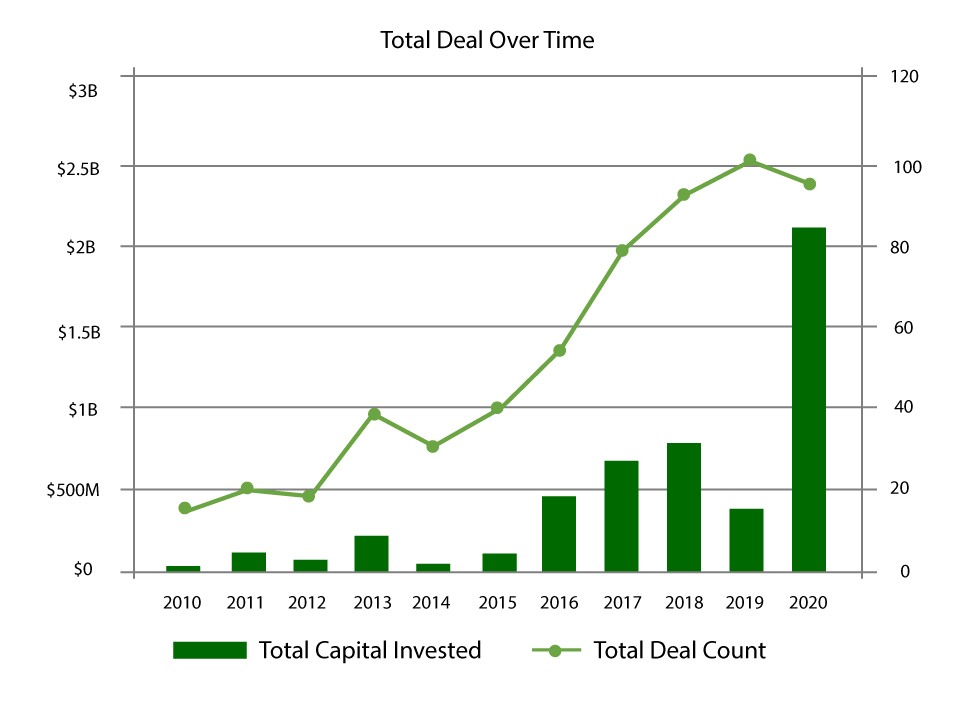

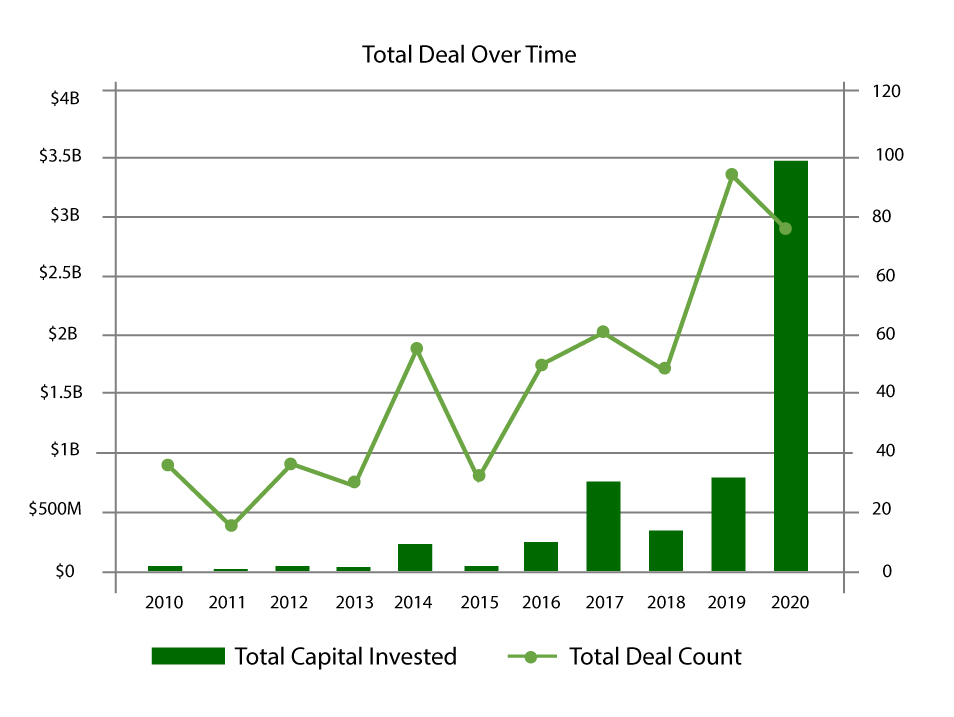

According to Pitchbook, VC and PE investment in clean energy continues at a pace that is rising substantially each year. Investment Opportunities in Biden Clean Energy

This accelerating rate of capital invested has also brought with it rising median post valuations.

Beyond this, the global investment in renewable energy is projected to ascend to new record heights in 2021, reaching as high as $16 trillion by 2030. These projections are fueled by the 2019 World Energy Outlook report from the International Energy Agency which forecast a 1 per cent per year increase in global energy demand into 2040 – a full 20% over that period of time. In an historic development in this regard, renewable energy outpaced coal for the first time ever in the U.S. in 2019, providing 23% of all US power, while the cost of renewable energy dropped significantly. For example, utility-scale solar costs sank 18%, while onshore wind costs fell 10% in the first half of 2019 alone.

Substantiation of the opportunities for clean energy is provided by the renewable energy price efficiencies being realized in wind and solar at a time when investment in environmental, social and governance (ESG) funds surged to record levels in 2019 – a 70% CAGR for these funds. Even in the absence of a national energy policy to this point in time, states and even cities are establishing aggressive decarbonization targets that present new opportunities for small to mid-size entrepreneurial firms that are creating innovative climate change solutions. Investment Opportunities in Biden Clean Energy

Clean Energy Industry Segments Most Likely to Benefit

Here is a look at some of the industry segments attracting intense investor attention.

Battery Tech

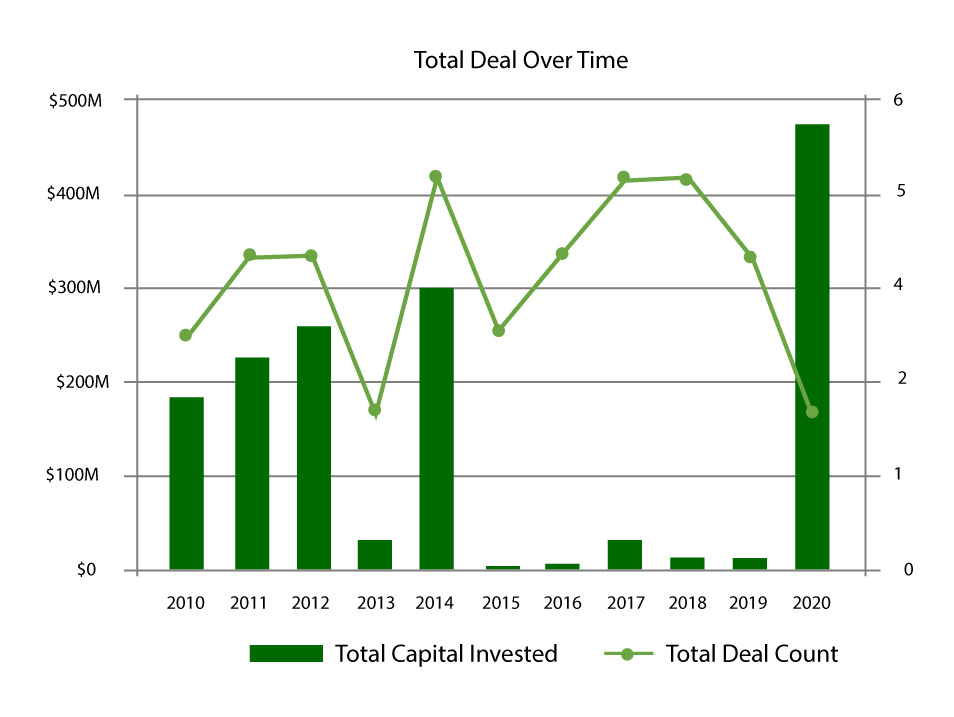

For Battery technology, Pitchbook shows deal count and capital investment rising again in 2020 over the nearly $550 million that VC’s poured into the space last year. The Biden Administration environment platform calls for federal investment of $5 billion over five years in battery and energy storage technology. This in order to accelerate R&D for a U.S. based supply chain in support of electric vehicle production.

Concentrated Solar Power (CSP)

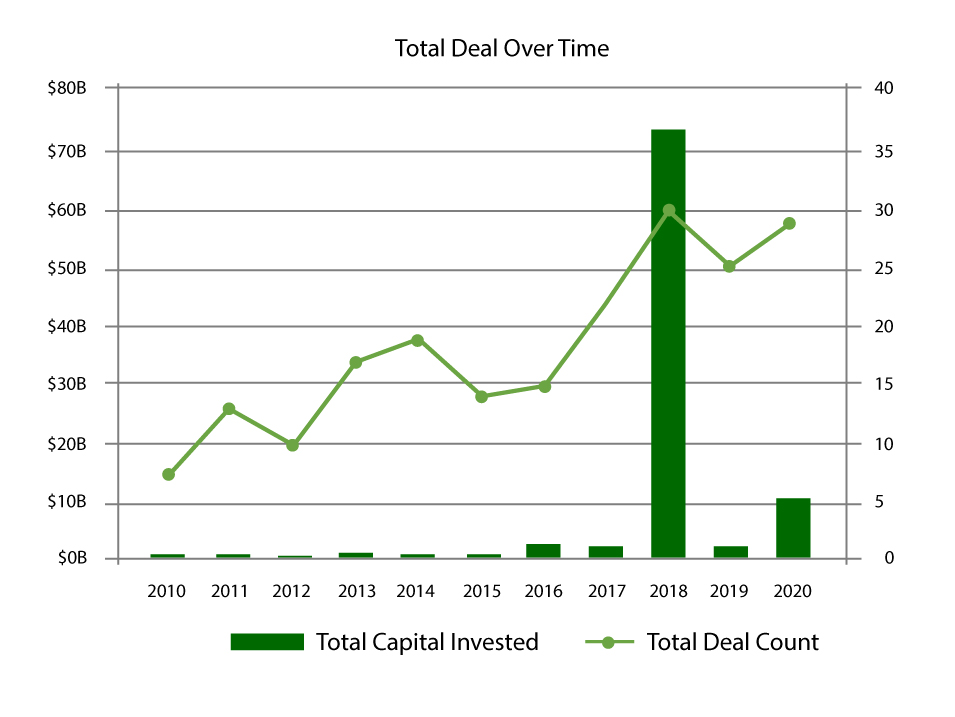

With fewer deals, but dramatically rising investments in each deal, CSP – used in utility scale operations to focus solar thermal energy to power turbines to generate electricity – represents technology advancements bringing reduced costs and increasing automation efficiency to the burgeoning solar industry. The amount of solar usage, according to the Solar Energy Industries Association, has increased by 50% annually over the past decade and is projected to keep up that pace through 2024. Investment Opportunities in Biden Clean Energy

Carbon Capture and Removal

Carbon capture and removal is also a cornerstone of Biden Administration Clean Energy plans. This process of actively capturing carbon atoms and removing them from the atmosphere includes technologies such as afforestation, biochar, and carbon sequestration. In the Biden plan a “carbon bank” would be established under the USDA’s Commodity Credit Corporation intended to pay farmers and forest owners to store carbon in their soil.

Electric Vehicle Charging Infrastructure

This segment of the electric vehicles space has seen a 20% compound annual growth in deal count from 2019 through this year according to Pitchbook. It is a vital part of the Biden plan to establish the U.S. as the global leader in the manufacture of electric vehicles and supporting infrastructure. Crunchbase has tracked big funding rounds that have been conducted by charging station manufacturers like Chargepoint. This kind of activity is only projected to increase in an administration that intends to promote a climate policy using the Treasury Department to promote electric vehicle sales through carbon reduction tax and regulatory policies.

Hydrogen

Hydrogen, used as a power source in manufacturing and studied throughout the years as an answer to automotive fuel cell development, due to its zero emissions output, has entrepreneurial companies scrambling for technology to reduce its cost of production. While, in the meantime, major oil and gas firms in the U.S. and EU are focusing on refining the costs, containment and handling safety issues of what is called “Green Hydrogen.” It turns out that there are actually many “colors” of hydrogen that vary in the amount of emissions created in their production. Of those, the most promising is “green hydrogen.” This is simply the process of manufacturing hydrogen using renewable energy – wind, solar, hydro – to power the electrolysis of water.

What’s the benefit? One major benefit is replacing industrial hydrogen made from natural gas. In the U.S. alone hydrogen made from this fossil fuel totals over 10 million metric tons per year. And, while manufacture of green hydrogen could also serve to absorb the excess energy output from high renewable energy production centers, the high costs of electrolyzers, storage and transportation are challenges that this alternative energy source must still overcome

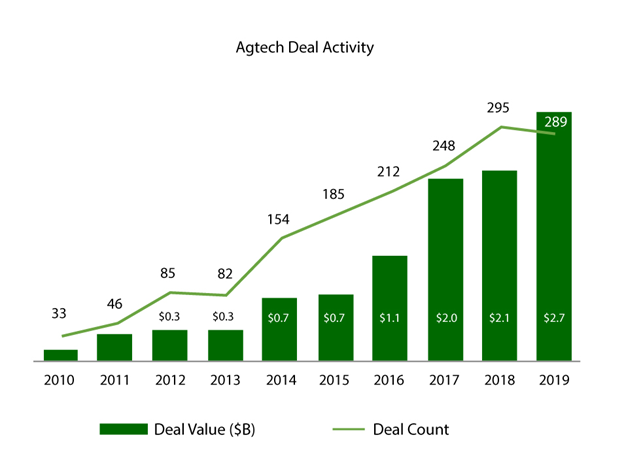

Agtech

An often overlooked industry when it comes to clean energy technology is agriculture, despite some notable trends over the last several years. According to Research and Markets, there is a US$21 billion opportunity in precision and indoor agriculture that’s going to drive ag productivity over the next several decades. This is equal to a CAGR of 12.9% between now and 2027.

To the many advantages of indoor agriculture – providing the ultimate in year-round crop production and quality while using only 1% of the water, crop acreage, and transportation energy – there is one major obstacle. All prominent systems are dependent on electric lighting. This affects the optimization of both lighting and temperature control in grow facilities. The increasing demand from indoor farming for long-lasting, energy-efficient and economical grow lights has led to government and private sector initiatives to support technological advancements in LEDs. To this point, however, even the most modern LEDs consume massive kWhs of electricity relative to crop economic value and require huge upfront CapEx investment per square foot. In search of alternatives a World Wildlife Fund study revealed that the agriculture industry could shrink its carbon footprint substantially by using fiber-optic technology that can bring sunlight indoors as a renewable energy source. Investment Opportunities in Biden Clean Energy

One such company in the fiber optics field, SunPathTech.com, has developed a patented daylight delivery platform that harnesses the power of sunlight indoors claiming a higher yield per plant/per square foot at a lower running cost than traditional LED and HPS lighting while producing healthier and higher quality yielding plants. The company is collaborating with several groups to implement this breakthrough technology.

As emphasized by Joseph DiMasi, CEO of SunPath, “Both sustainable crop production and sustainable energy production are critical technologies to meet the 21st century challenges of population growth and climate change.” Indoor agriculture has becoming a prominent factor in meeting that challenge and is currently attracting tens of millions of dollars in VC, private investor, and M&A support.

Guidance Into Fast-Paced Clean Energy Investment

High potential reward investments require an extensive vetting process. Before making recommendations to our clients about Seed or Series A, B rounds, we subject a prospect to our internal vetting regimen – in order to set investors’ expectations, ensuring they are not overpaying, and ensuring that the clean energy prospect has validated all the information in its data lockbox. Key issues examined are:

- The technology – critical, naturally, to thoroughly understand the technology and its place in the client’s investment strategy.

- The team – how comfortable is the investor with the caliber and experience of the management team and how convincing is their dedication to critical environmental issues? And, are they resilient?

- Credible funding plans – is there a clear and attainable path toward growth/toward liquidity?

- Risk Assessment – what is the type of risk the investor is willing to take?

- Timing – is investment prudent now before the onset of future risks?

- Exit – understand the company completely from their patent protection to the acumen of the management team to execute their planned exit strategy.

- Legal advice – consult with a law firm skilled in structuring legal documentation associated with the level of risk of the investment being contemplated.

- A Competent Investment Advisory – preferably an advisory experienced in clean energy that is thoroughly familiar with the industry trends that will affect the investor’s ROI.

Investor Takeaway

Regardless of what the final outcome of the Presidential and Congressional election results may be, and how the ambitious plans of an incoming administration may fare in the face of pragmatic opposition, the demands for change on environmental issues and resultant business practices will not subside. The smart money is clearly embracing opportunities directly related to climate change. This is evinced by the S&P/TSX Renewable Energy and Clean Technology Index (INDEXTSI:TXCT) currently showing a 2019 – 2020 YTD return of over 30%. Sorting out the winners in the U.S. while keeping a sharp eye on worldwide renewable energy developments, particularly in China and India, will be the challenge facing prudent investors.

How We can help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging clean energy technology as well as our core expertise with highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Cannabis and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.