Major Change Coming to Cannabis Strategic Investments Impact of Liquidity on Cannabis Strategic Investments in 2022

Highway 33 Capital analysts predict that what has been lacking in the capital-constrained cannabis industry will undergo substantial change in 2022. That is, increased liquidity will lead to increased M&A activity.

In basic supply and demand more liquidity may not always increase prices – for example if many more companies went on sale the greater liquidity would make more transactions possible but may not increase the price of each deal. Cannabis right now is a market that is starved for liquidity because of government regulations (or, you could say, because of lack of federal legality/regulations). That makes it different than an “average” market. All economic pricing is on the margin. Therefore, the infusion of additional liquidity will likely have an outsized or larger impact on pricing.

Why is Market Liquidity so Important?

A liquid market is generally associated with less risk. In a liquid market, a seller will quickly find a buyer without having to cut the price of the asset to make it attractive. And conversely a buyer won’t have to pay an increased amount to secure the asset they want. Impact of Liquidity on Cannabis Strategic Investments in 2022

Investopedia says that higher liquidity means that there are a large number of orders to buy and sell in the underlying market. This increases the probability that the highest price any buyer is prepared to pay and the lowest price any seller is happy to accept will move closer together – the bid-offer spread will tighten. Impact of Liquidity on Cannabis Strategic Investments in 2022

Regarding the cannabis investment marketplace, Highway 33 Capital Managing Partner, Cam Horan, expresses the situation this way:

The impact of greater liquidity on a capital starved industry will be increasing the money larger MSO’s and Pubcos have to spend on expansion including M&A. This will drive prices higher for assets in attractive limited license states and for targets that have significant revenue and profits in those markets.

Cannabis Market Liquidity Increase in 2022 – Rationale

- Building blocks are in place for an increase in liquidity:

- More institutional debt came into the market in 2021 and fund sizes for credit funds and raises of credit funds are increasing as institutional debt providers are getting more comfortable that asset backed debt is a manageable risk to fund real estate and equipment – hard assets.

- The Canadian Stock Exchange (CSE), which focuses on working with entrepreneurs to access the public capital markets in Canada and internationally, is making changes that will allow 60-80 companies on that exchange to “uplist” within the exchange. The “uplisting” will mean more stringent reporting requirements that institutional investors require. This means as companies get this designation they will receive more investment from institutional investors – i.e., increased liquidity through larger market caps. That will make it easier to raise private capital for those companies, both debt and equity, and their stock as currency for deals will be worth more. Pretty much all U.S. based plant touching companies trade on the CSE as the primary exchange. Actually, only the OTC in the U.S. is the other place U.S. cannabis stocks that touch the plant trade and OTC has very little institutional money.

- We have heard it’s possible that the Toronto Stock Exchange (TSX) may allow plant touching U.S. companies to list – this would also draw significant institutional investment.

- If any form of banking reform happens in the U.S. that will allow U.S. cannabis companies on traditional U.S .exchanges potentially and would be an explosion of capital.

- Even if just (a) and (b) happened and continued in 2022 that alone would provide leading U.S. Pubcos and larger multistate operators (MSOs) to access much more capital.

- If (c) and (d) happened the change will be much larger. The increase in liquidity will range from significant to industry changing in the next 12-24 months.

These conclusions were supported by research done by MJBizDaily in June. In assessing why liquidity remains low for the U.S. plant-touching operators in comparison to the Canadian licensed producers (LPs), it was found simply that U.S. operators have access only to lower-volume exchanges, such as the CSE and the OTC market. The larger exchanges, Nasdaq and Toronto Stock Exchange (TSX), don’t allow this type of operator because it breaks U.S. federal laws. So, the MJResearchCo arm of MJBizDaily undertook a study to determine how much could liquidity increase for U.S. cannabis companies if they could “uplist” to higher-volume stock exchanges?

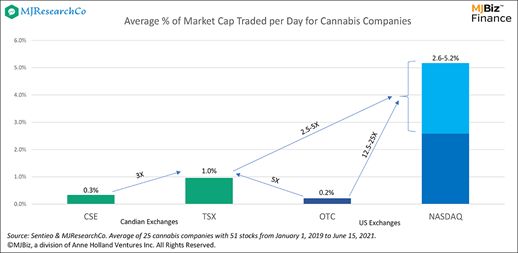

From this analysis, it was found that the liquidity as a percent of valuation would increase about 3X for stocks that move to the TSX from the CSE.

Moving to the higher-volume Nasdaq offers a 2.5X-5X improvement in liquidity from the TSX and a 12.5X-25X improvement from the OTC markets, as seen in the chart above. Higher liquidity results in greater access to capital at a lower cost (which, in turn, means higher valuation).

The research concluded that the ability of U.S. based plant touching operators to uplist to the higher-volume exchanges would happen either if federal laws change or if exchanges themselves change polices.

Movement By the CSE

The CSE is taking action to facilitate an uplifting process within the exchange. The CSE is evaluating a new “Senior Tier” proposal. This would remove the “venture issuer” category by creating a “senior issuer” tier. The “venture issuer” designation was primarily the reason why CSE-listed shares were prohibited from certain institutional investment accounts and stock indices, which limited their liquidity and access to capital.

Senior Issuer parameters – the firm must have a minimum 300 shareholders, and at least two of the four following standards must be met:

- Equity standard: S/H Equity of $5mm and Public Float value of $10mm

- Net Income standard: $400,000 + S/H equity of $2.5mm

- Market Value Standard:$50mm market value of all securities (Market Cap)

- Revenue + Asset Standard: $50mm revenue & 50mm Assets

There is also a special provision for SPACs in requiring light initial costs, and low ongoing CAD fees, which the CSE feels will make a CSE-listed SPAC more appealing to U.S. cannabis businesses looking for both capital and liquidity.

What Would the Liquidity Numbers Generated by the Uplift Look Like?

In analyzing this potential Bloomberg finds that the “senior tier” would have the – biggest impact on U.S. MSOs. CSE Chief Executive Officer, Richard Carleton is quoted as saying that the U.S. cannabis companies make up around 80% of the C$40 billion ($31.6 billion) in market value hosted by the exchange. Large MSOs listed on the CSE include Curaleaf Holdings Inc., Green Thumb Industries Inc. and Trulieve Cannabis Corp. From those numbers we have calculated the following:

- 80% of the CSE market cap is cannabis companies most all of which are US based.

- Total CSE market cap is $31.6 B USD so 80% being cannabis means $25.28B is the CSE cannabis market cap.

- Let’s say 80% of the market cap will qualify to “uplist” to the “senior tier.”

- If that uplisting doubled those companies market caps that would be an additional $20B in liquidity.

Bloomberg concludes:

More favorable conditions for such companies would also make the CSE more competitive with the TSX — and eventually the Nasdaq and NYSE, should rules change — as a venue for cannabis companies to list.

CSE Action Underway

Early last month the CSE made it official that the Ontario Securities Commission (OSC) and British Columbia Securities Commission (BCSC) have initiated a 60-day comment period on the CSE’s key proposal to materially revise its listing policies. That is, to create the senior issuers tier for the CSE’s larger and more advanced issuers, and to update listing requirements for earlier stage companies. It is anticipated that senior tier issuers would then receive benefits available to comparable issuers on other Canadian stock exchanges.

Investor Takeaway

The lack of federal legalization has shackled the industry performance due to the inability of U.S. cannabis operators to attract capital from institutional investors. The major change coming to cannabis strategic investing this year that we see is the increase in liquidity coming to this capital-constrained industry. Institutional debt providers are getting more comfortable that asset backed debt is a manageable risk to fund real estate and equipment. The Canadian Stock Exchange (CSE), is making changes that will allow “venture issuers” on that exchange to “uplist” within the exchange to a “senior issuers” tier. Establishing more stringent reporting requirements that institutional investors require will lead to the potential of more investment from institutional investors – i.e. increased liquidity through larger market caps. Greater liquidity will lead to increased M&A activity with increased prices for assets leading to higher transactional prices as deal competition also increases.

How We Can Help

With these exciting prospects for strategic investors in the cannabis industry on the horizon, the approach we take with our clients for risk mitigation prior to presenting them with investment opportunities: evaluating the prowess and the passion of the executive team, assessing the competitive advantage of the company and how quickly they can scale for growth, and how well they are ready for the regulatory regime in their home and target growth markets. We take these steps before presenting the company to our extensive network of pre-qualified investors.

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.