Investor Takeaway Impact of Inflation on Cannabis Commercial Real Estate

In just seven short years, including years now under the curse of the disruptions caused by COVID 19 and its variants, the legal cannabis industry has gone from a standing start to over a $20 billion marketplace. Due to the enormous need for increased revenue that every state faces brought on by the pandemic, more states and municipalities are streamlining the sanctioning process to expedite the flow of new tax revenue. Expanding markets have turned cannabis commercial real estate (CRE) into a hot segment in the industry. Not only are more debt funding options available to cannabis operators, but also formerly reluctant landlords are seeing the inflation-resistant qualities the industry continues to exhibit. It is a rule-of-thumb that the value of real estate goes up during inflationary periods. CRE offers an entryway into the cannabis space with far less risk than spending the significant capital necessary to bid for a license and establish a vertically integrated operation if being awarded one. This week’s EDGE Briefing covers how the market for cannabis CRE is performing and provides help in guiding investors to expedite the process of a CRE investment destined to achieve a well-planned ROI.

State of the Cannabis Industry

The numbers keep coming in about the performance of the industry in 2021. MJBizDaily predicts the final tally to come in at $26 billion globally, up from $20 billion in 2020. They also predict that the industry will jump dramatically to $45.9 billion in 2025, surpassing the size of the craft beer industry at that point. Forbes states that the number will come in at $30 billion globally in 2021, increasing to $37 billion this year, with the potential of being a $100 billion market by 2026. And, the hottest sector in all of this projected growth is the cannabis commercial real estate (CRE) market. Impact of Inflation on Cannabis Commercial Real Estate

Cannabis CRE

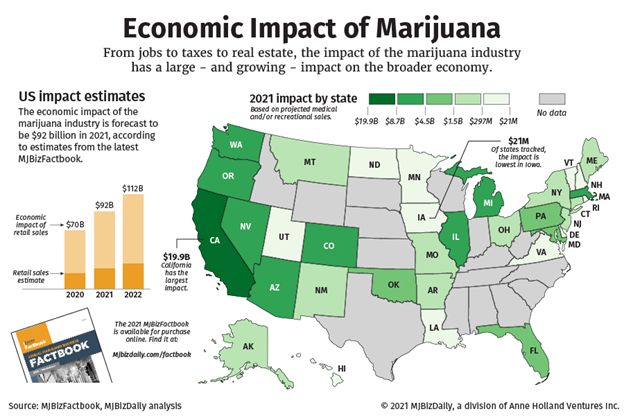

Data from the current MJBizFactbook shows that the total U.S. economic impact from marijuana sales in 2021 is expected to reach $92 billion. This is an increase of over 30% from 2020. And the total economic impact calculation rises to as much as $160 billion in 2025. Impact of Inflation on Cannabis Commercial Real Estate

In identifying the major benefactors from this economic growth potential the report calls out: “From jobs to tax revenue to commercial real estate, the marijuana industry has a large – and growing – impact on the broader economy in the United States.” Impact of Inflation on Cannabis Commercial Real Estate

In addition, real estate receives a boost from new retail, manufacturing and agricultural businesses moving into an area or established companies expanding, increasing broader demand for commercial properties.

Cultivating and manufacturing marijuana can require large investments in equipment and technology that boost not only the local economy but also areas throughout the U.S.

Using California as an example the report states that the cannabis industry will have added as much as $20 billion to state’s economy in 2021. And as reported by Globe St. in also using California as an example, the assessment by Colliers of that cannabis CRE market: “There is no stopping the influx of capital coming into this behemoth.”

Does Inflation Cloud This Rosy Picture?

Now charging onto the scene, however, comes the specter of steadily rising inflation. How will this impact cannabis CRE?

According to a recent article in Forbes, since inflation can be defined as a decline in the purchasing power of a currency, it is important to have investments well insulated from inflation. And they credit CRE being insulated from the ups and downs of the market.

In dense real estate markets and commercial centers, high demand and limited supply contribute to the appreciation of prices for real estate, which is positive for investors.

Further insulating cannabis CRE from the ravages of inflation is the fact that is it a longer term investment with an actual risk premium because of the industry’s federally illegal status. This can take the form of higher rents that can be charged and above market financing costs compared to traditional CRE. According to the real estate industry resource, EquityMuitiple: “This creates a window for regulatory arbitrage wherein investors can potentially benefit from improved returns and protections due to regulatory complexities.” They also report a growing supply and demand imbalance due to the existing legal and regulatory requirements that vary state-by-state. “This creates material barriers to entry and results in higher financing costs, creating an opportunity for investors to benefit from potentially higher income and total returns.”

And, as EquityMultiple points out, the debt component in a cannabis CRE transaction provides investors with payment priority over common and preferred equity investors in the borrowers’ properties – putting them at the top of the capital stack. The critical component in these transactions remains as with traditional CRE, choosing the right borrower.

Therefore, experienced lenders with the datasets, infrastructure, and processes to select high-quality borrowers in low-LTV properties are advantageous to such investments. Diversification, payment priority, and diligent borrower selection allow investors in debt funds to drive down risk in cannabis real estate investments while still capturing the premiums associated with these investments.

An analysis from Cushman Wakefield sees inflation staying “uncomfortably high” through much of 2022.

If inflation follows the most probable script—higher inflation for a period but not damaging to the economy—then property stands to benefit. Our analysis shows that every 1% increase in inflation is associated with a 1.1% increase in total returns. This environment also results in lower cap rates across property sectors. In other words, commercial real estate not only protects against higher inflation but provides outsize returns specifically in these environments.

It is a rule-of-thumb that the value of real estate goes up during inflationary periods. Certain properties, of course, in selected industries and locations are in a better position to benefit. Our review of the situation continues to find us bullish on the prospects for Cannabis CRE, even in the face of inflationary pressure, throughout 2022.

Case-in-Point from Arizona

Background

From Forbes we have picked up this cannabis CRE example from the State of Arizona. Thanks to the passage by voters in November 2020, the Smart and Safe Arizona Act, became what is called “the fastest adult-use rollout” – taking place in the following 100 days. By the end of January 2021, of-age consumers could purchase cannabis for recreational use at 73 dispensaries approved for dual medical marijuana and adult use sales.

The passage of the act started a land grab in this limited license state, finding Arizona now experiencing operator/license holder consolidations and more capital flowing in. There were a reported 200 cannabis CRE transactions in the state, with an estimated range of from $1 million to $2 million per project. At this pace, says Forbes, CRE investment and development could become a $1 billion market in the next five years.

Cannabis CRE Lessons Learned

Here is what Forbes found in Arizona to prepare investors for investing in cannabis CRE.

- There are a limited number of industrially zoned commercial properties in the U.S. that offer

multibillion-dollar real estate opportunity for cannabis-related businesses. The opportunities will only grow as more markets legalize.

- Relationships developed with city municipalities will matter. It is not just states that are legalizing cannabis, but also individual cities and towns.

- Commercial real estate offers an entryway into the cannabis space with less risk. Instead of spending significant capital on acquiring a license or entering a competitive license lottery, investing in real estate offers an opportunity to be involved in a variety of ways.

But, What About the Impact of Inflation on the Cannabis Industry as a Whole?

For an answer to this we turned to the latest published report from the noted cannabis industry research source, Headset. What they found is shown in the graph below. They took the monthly average price of one product – in this case Amazing Greehhouse’s Blue Dream 3.5g – at one dispensary, compared monthly price changes to all other products at all other retailers in the survey, and calculated the monthly median price by market.

Their finding, “If inflation was heavily impacting the industry we would expect that the prices of individual products would increase over time. We do not see that happening. Most of the time, in most markets, the prices of products have either held stable or decreased, as demonstrated by the large quantity of points beneath the 0% line in the above graph.”

Following the Smart Money Into Cannabis CRE

The booming marketplace this year is generating volumes of cannabis CRE investments. Not only are more debt funding options becoming available to cannabis operators, but also how well the industry performed during the height of the COVID-19 crisis and its continuing disruptions has shown a greater variety of financing sources and formerly reluctant landlords that the cannabis industry exhibits inflation-resistant qualities. Neglected storefronts in formerly derelict areas and industrial warehouses continue to escalate in value brought on by industry expansion, particularly in Green Zone dedicated areas.

The ROI on a cannabis CRE investment, as the Arizona example above shows, provides potentially greater return and far less risk to enter the industry than spending the capital to start that process of applying for a license, which you may or may not get, and then establishing a vertically integrated operation.

Investor Takeaway

In just seven short years, including years now under the curse of the disruptions caused by COVID 19 and its variants, the legal cannabis industry has gone from a standing start to over a $20 billion marketplace. Due to the enormous need for increased revenue that every state faces brought on by the pandemic, more states and municipalities are streamlining the sanctioning process to expedite the flow of new tax revenue. Expanding markets have turned cannabis CRE into a hot segment in the industry. Not only are more debt funding options available to cannabis operators, but also formerly reluctant landlords are seeing the inflation-resistant qualities the industry continues to exhibit. It is a rule-of-thumb that the value of real estate goes up during inflationary periods. And commercial real estate offers an entryway into the cannabis space with far less risk than spending the significant capital necessary to bid for a license and establish a vertically integrated operation if being awarded one. Even in the face of rising inflation, interest is intensifying in above-market-value, profitable cannabis CRE investments. To make those investments productive requires a resource that completely understands the national, state and municipality laws, the local ordinances, and the attitude of the community in which a property is located, in order to expedite the process of a CRE investment destined to achieve a well-planned ROI.

How We Can Help

After six interesting years processing millions of dollars in successful sell-side and buy-side transactions, we know the cannabis industry. We excel at structuring deals to meet client investment strategies in opportunities with our core expertise in Cannabis. And we transact in other highly regulated markets as well in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/Climate Tech, and CBD/Hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.