Explosive Growth of the Cannabis Industry

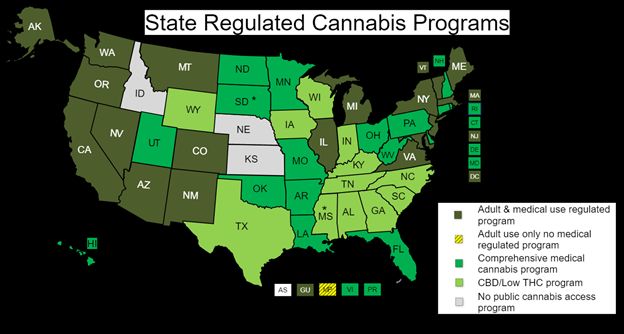

As you know from previous reports is EDGE Briefing, citing a report in Forbes by BDS Analytics, more cannabis than ever before was consumed in the U.S. in 2020 – a record $17.5 billion in legal sales. The legal changes have spawned a burgeoning industry where 35 states, District of Columbia, Guam, Puerto Rico and U.S. Virgin Islands have approved comprehensive, publicly available medical marijuana/cannabis programs. And, as of April 14 as reported by the National Conference of State legislatures (NCSL) 17 of those states, two territories and the District of Columbia have enacted legislation to regulate cannabis for adult use as well:

- Voters in Arizona, Montana, New Jersey, and South Dakota approved measures to regulate cannabis for adult use.

- On February 8, 2021, South Dakota Circuit Judge Christina Klinger ruled that the measure was unconstitutional. The decision is being appealed as of March 31, 2021.

- New Jersey’s governor signed enacting legislation on March 1, 2021.

- New York’s legislature and governor enacted AB 1248/SB 854 on March 31, 2021.

- The Virginia legislature passed legislation on February 27 and approved the governor’s amendments on April 7, 2021.

- New Mexico legislature passed legislation on March 31 and the governor signed legislation on April 12, 2021.

- These actions bring the number of states with adult-use regulated cannabis to 17, plus two territories and the District of Columbia.

- This total does NOT include South Dakota’s court-over-turned measure, which is pending appeal.

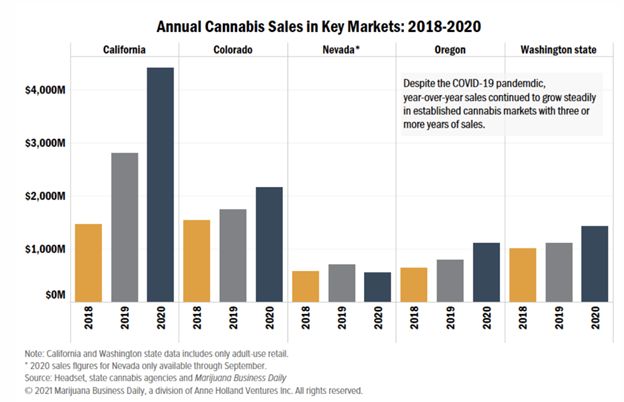

In key cannabis sales markets Marijuana Business Daily reports these sales trends.

While those are dramatic results within the cannabis industry, what can be said about the impact those revenue results have on the U.S. economy?

Key Measurements of the Economic Impact of Cannabis in the U.S.

In an analysis provided by MJBizDaily in their annual Marijuana Business FactBook the economic impact from legal cannabis sales on the economy is projected to reach $92 billion this year. This projection is up 30% from 2020 and growing toward $169 billion in 2025. Their methodology for the projections was to take the standard practice of using a multiple of 3.5 on the projected of cannabis sales from agriculture to manufacturing to retail. It was calculated that for every $1 spent by consumers and patients in the recreational and medical markets, an additional $2.50 flows into the economy. This has already had a far-reaching effect on key measures of the economy.

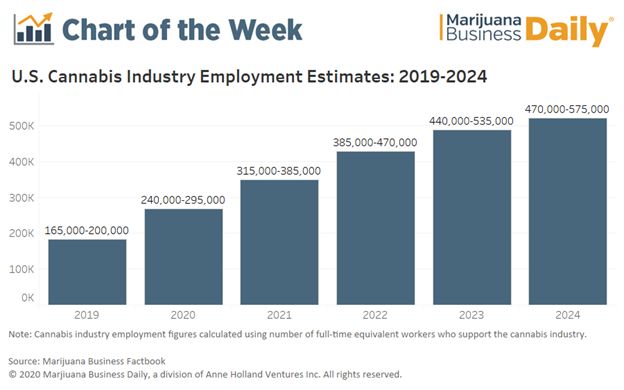

Employment

The MJBizDaily analysis goes on to project that the number of workers in the U.S. cannabis industry will jump to as high as 385,000 by the end of the year. For perspective, this is actually slightly higher than the number of computer programmers employed in the U.S.

That increase in employment also means an increase in worker spending on housing, transportation, daily needs and growing options for entertainment. The New York Times states that one medical marijuana dispensary in Oakland, CA, Harborside, employs 120 people. AZBusiness Magazine reports that weGrow, with stores in California, Arizona and Washington D.C. creates 75 indirect jobs per store. Investopedia cites an RCG Economics and Marijuana Policy Group study on Nevada that legal sales of recreational cannabis will create up to 41,000 jobs in 2024 and generate over $1.7 billion in labor income.

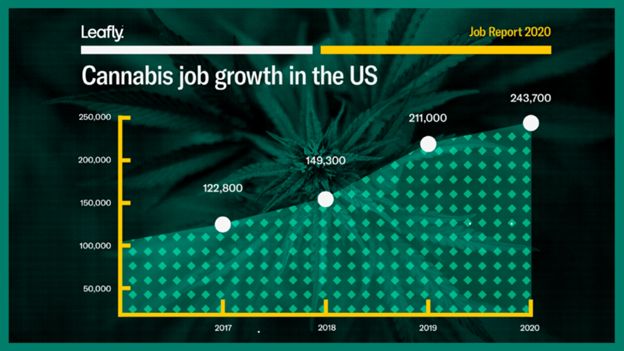

The industry resource Leafly found a similar number in their cannabis jobs report for 2020 that was within the range MJBIZDaily derived:

And from the perspective of the impact federal legalization of marijuana would make on the economy, New Frontier Data reports that nationwide 1,000,000 jobs could be created by 2025.

Taxes

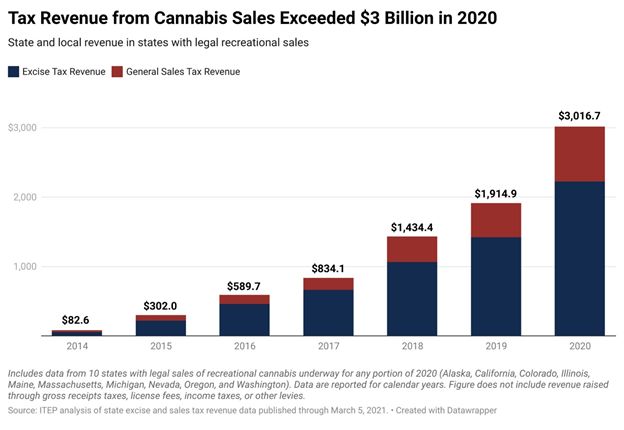

From tax data analyzed by the Institute on Taxation and Economic Planning (ITEP) from the 10 states in 2020 where adult use as well as medical marijuana was legal, excise and sales taxes exceeded $3 billion in 2020 – over a $1billion increase over 2019. And, that $3 billion total included $1 billion in California alone.

With the growth in cannabis usage in legal states and the new markets opening in states now making cannabis legally available these tax revenues are only bound to increase in the short-term.

- Investopedia found that medical and recreational marijuana dispensary sales in Oakland, CA added $1.4 million, 3% of the city’s total business tax revenue, last year.

- The State of Colorado realized $302 million in taxes and fees on medial and recreational cannabis on statewide sales of over $1.7 billion in 2020.

- December 2019 figures from the State of California show that since January 2018, California’s cannabis sales had generated $411.3 million in excise tax, $98.9 million in cultivation tax, and $335.1 million in sales tax.

- Connecticut projecting how cannabis sales could help cut future budget deficits calculated that with anticipated legal cannabis sales over the a five-year period ranging from $784 million to $952 million, tax revenues of between $188 and $223 million would be generated, in addition to $21 million in taxes generated at the local level.

Along with their employment forecast New Frontier also projects that federal legalization of cannabis could generate an additional $105.6 billion in federal tax revenue by 2025.

Law Enforcement

Last month the Huff Post reported on a study from the Shadow Conventions by Harvard economist Jeffrey Miron and endorsed by over 300 economists that federal government legalization of marijuana would save $7.7 billion annually by no longer enforcing current prohibitions. (This the study found that the federal government could also bring in tax revenues of over $6 billion if marijuana was taxed at rates similar to alcohol and tobacco.) From a 2007 study by AlterNet, inmates incarcerated on marijuana-related charges cost U.S. prisons $1 billion annually. And, Norml, the marijuana law reform organization, reports on a Journal of Adolescent Health study published in April, 2020, that found that:

The enactment of adult use cannabis regulation is not associated with significant upticks in marijuana use by adolescents.

Use of Other Drugs

In a study published last week in Scientific American by JAMA International Medicine after analyzing over 5 years of Medicare Part D and Medicaid prescription data found that in legal cannabis states the number of opioids and the daily doses of opioids went down significantly.

One of the two new studies found that people on Medicare filled 14 percent fewer prescriptions for opioids after medical marijuana laws were passed in their states. The second study found that Medicaid enrollees filled nearly 40 fewer opioid prescriptions per 1,000 people each year after their state passed any law making cannabis accessible—with greater drops seen in states that legalized both medical and recreational marijuana.

The Hill reported last year that numerous studies do indicate that cannabis access not only reduces use of prescription opioids, but also reduces prescription drug consumption of for drugs, such as sleep aids, anti-depressants and anti-anxiety medications.

How does marijuana legalization affect alcohol sales? According to the Centers for Disease Control (CDC) Excessive alcohol use is responsible for more than 95,000 deaths in the United States each year, It is a leading cause of preventable death in the United States, and cost the nation $249 billion in 2010. Although study results in general are still preliminary, teams of researchers from the University of Connecticut and Georgia State University compiled alcohol sales data from Nielsen’s Retail Scanner database which tracks product sales in 90 popular retail chains in the U.S. The researchers found alcohol sales went down by about 15% after a state created a medical marijuana program.

Property Values

The booming marketplace in 2021 is generating renewed interest in cannabis commercial (CRE) investments. Not only are more debt funding options becoming available to cannabis operators, but also how well the cannabis industry performed during the COVID-19 crisis has shown traditional financing sources and formerly reluctant landlords that the cannabis industry exhibits recession-proof qualities. Neglected store fronts in formerly derelict areas and industrial warehouses continue to escalate in value brought on by industry expansion, particularly into areas dedicated as Green Zones within municipalities.

A Green Zone is an area designated where legal cannabis/cannabis-related businesses are allowed/encouraged to set up cultivation, manufacturing and retailing facilities. One funding resource, Canna-Hemp Debt Fund, estimates that industrial warehouses they are underwriting that are “green zoned” show at least a 20 to 30% in increased value. For debt loans the company feels comfortable with LTVs of 60-65% in their green zoned properties. For investor security, and to be able to offer lower than market rates, personal guarantees and cross corporate guarantees, wherever possible, are required from their borrowers.

Economic Benefit Conundrum

Another major way the cannabis industry can provide major economic benefit is resolving the problem described in a recent article in the EDGE Briefing when we reported on the challenging and complicated issue of Greenhouse Gas (GHG) emissions.

States and Cities all across the county are counting on being revived by the taxes on the billions of dollars that are generated by cannabis legalization. What they have not been willing to face, however, is that cannabis production generates a size extra-large carbon footprint. These state and cities are sacrificing their goals of drastically reducing their GHG emissions. Big Think harshly sums up the conundrum with the quip: “Hippies finally got their legal weed at a high cost to the environment. How Faustian!”

The challenge facing the cannabis industry was brought out in a detailed research report issued by Colorado State University (CSU). The study, first published in Nature Sustainability on March 8th of this year, states that indoor cannabis cultivation is a major generator of GHG emissions. In just the state of Colorado alone the researchers at the university estimated that indoor cannabis grows emitted 2.6 million tons of GHG emissions annually. That is the equivalent of the annual tailpipe emissions of 520,000 motor vehicles. Another way to look at it is that cannabis indoor cultivation accounts for 1.3% of the state’s total GHG emissions. For context coal mining in the state accounts for only 1.8%.

Energy Saving Alternatives

In looking for answers for the ways indoor cultivation can mimicking the outdoors one promising development stands out among energy saving alternatives to the heavy burden of HVAC systems put on power consumption/GHG emissions. That technological development is harnessing the power of the sun.

How Cannabis Benefits the Economy 2021A company in the fiber optics field, SunPathTech.com, has developed a patented daylight delivery platform that harnesses the power of pure spectrum sunlight indoors. The technology startup claims a higher yield per plant/per square foot at a lower running cost than traditional LED and HPS lighting while producing healthier and higher quality yielding plants. The company is collaborating with several groups to implement this breakthrough technology. As emphasized by Joseph DiMasi, CEO of SunPath, “Both sustainable crop production and sustainable energy production are critical technologies to meet the 21st century challenges of population growth and climate change.” Indoor agriculture has becoming a prominent factor in meeting that challenge and is currently attracting tens of millions of dollars in VC, private investor, and M&A support.

Finding The Right Fit for Your Investment Strategy

How Cannabis Benefits the Economy 2021Making smart moves into this high demand industry is becoming less risky as the industry rapidly matures. For our clients considering debt or equity investments in the industry here are the steps we take in formulating our recommendations.

Getting Down to Business Goals

How Cannabis Benefits the Economy 2021The goal is always to thoroughly understand the investment needs and objectives of both buyer and seller to develop productive relationships that lead to successful transaction outcomes. Making sure the cannabis company you are investing in has an active plan to reduce GHG emissions, for example, is vital to prepare as the debate over the carbon footprint of the cannabis industry intensifies.

Real Value in the Marketplace

How Cannabis Benefits the Economy 2021We determine ROI potential with well-substantiated valuations. We guide operators through the vetting process our investors expect for the best opportunities from potentially high rates of return while saving time and creating valuable investor-operator relationships.

“Choke Point” Advantage

As legalization at the federal level becomes more likely, strong brands with protected IP and a scalable leadership position in the market will win. These “winners” will be differentiated from a growing list of cannabis companies licensed under the current patchwork of state-by-state regulations that will be forced to compete as a commodity and ultimately be marginalized and pushed out of the market.

Expert Management Team

How Cannabis Benefits the Economy 2021

The nascent legal cannabis industry is moving at high speed toward professional management with the expertise to build unique IP and brands that dominate the market. Survival tactics employed by managers who have operated in the gray market often do not translate well in the openly competitive legal marketplace. How well management is preparing for the future challenges facing the industry, such as the pressing GHG emissions issue is a key consideration.

ESG

How Cannabis Benefits the Economy 2021Today workers are scrutinizing/prioritizing company standards and objectives as never before. During COVID-19 prioritizing safety, security and a healthy working environment were key concerns in evaluating employers. Even stronger scrutiny is placed on an employer’s policies that promote Economic, Social and Governance (ESG) attuned to the progress of society. Just as employees expect companies to keep clean facilities, they expect that environmental standards and personal dignity will be indigenous to their workplace.

The Right Time / Most Advantageous Cash-Infusion Partner

The trend of increasing legalization will continue to attract more sophisticated competition and investors. Our systematic process is designed to match the right investors and M&A partners with the right operators whose objectives and scalability are a fit for their portfolios.

Investor Takeaway

The economic impact from legal cannabis sales on the economy is projected to reach $92 billion this year. This projection from data compiled by MJBizDaily shows that for every $1 spent by consumers and patients in the recreational and medical markets, an additional $2.50 flows into the economy. Jobs created within/related to the industry could reach as high as 385,000 this year. This has already had a far-reaching effect on key measures of the economy. Taxes collected are estimated to be as high as $3 billion in 2020. And the positive effect on reducing law enforcement costs, cutting down the rate of opioid addiction and the rise in value of cannabis CRE properties cannot be denied. While there are still hurdles for the industry to overcome in terms of issues regarding legalization, carbon footprint, and secondhand smoke, the industry remains attractive to investors with both debt and equity strategies. With capital finally flowing more freely into the cannabis industry there is no better time to establish your position and get your targeted business to come out a winner among those destined to struggle for survival.

How We Can Help

How Cannabis Benefits the Economy 2021We excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments. Expectations for performance are important to clarify at the beginning of the process along with a clear understanding of the compensation the advisors will receive for the extensive services rendered. At Highway 33 Capital Advisors we stand ready 24/7 to provide the guidance our clients seek.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.