Investor Takeaway Hottest Cannabis Market for Strategic Investors 2022

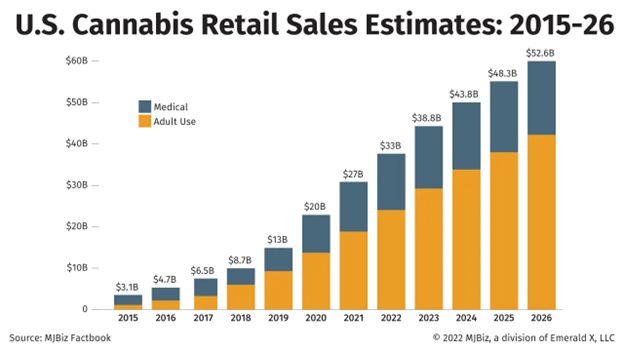

Cannabis sales across the U.S. are projected to reach over $33B this year, growing, according to the MJBizFactbook, to upwards of $52.6B in 2026. While this may substantiate to recession-resistance of this marketplace, one market, the State of New York, is posed to begin the climb to become the top cannabis sales market – in the world.

- Grand View Research predicts sales in the State as high as $7B by 2025.

- The State is fulfilling its promise to make the launch of cannabis the most equitable of all the programs launched throughout the country.

- 52 Conditional Adult-use Cultivation Licenses have been issued to hemp cultivators in order to meet expected demand. The marijuana flower from these grows will be processed by only 13 hemp cultivation/ product production facilities converted for the purpose along cGMP guidelines.

- The obvious, a majority of cannabis is being traded now through illicit channels. The action, State Legislature is expected to cut down product prices and improve monitoring of the supply chain, and crackdown, as in NYC, on illicit operators in advance of the opening of Adult-use sales.

- Sales by Conditional Adult-Use Retail Dispensaries are expected to begin by the end of the year.

The Industry In 2022 Hottest Cannabis Market for Strategic Investors 2022

We all know that it has not been a pretty picture for investors in cannabis publicly traded companies for several quarters. Since Q1 2021 cannabis stock prices have continued their slide, ahead of the current decline of the public markets. Most analysts point out the substantial difference between the current market and the significant market pull back from cannabis stocks in 2019. That is, that now these companies have restructured their balance sheets emphasizing EBITDA over often irrational market share growth. And the addition of new Adult-use markets coming online keeps the general level of U.S. cannabis sales, reaching new heights with $33B predicted this year, $53B in 2026.

Updated June 2022

According to the MJBiz Factbook, total U.S. medical and Adult-use cannabis sales are on track to reach >$33B by the end of 2022, largely driven by the opening of new Adult-use markets. This forecast is then projected to be approximately $52.6B by 2026. This continues to raise the question of whether or not cannabis sales will defy a recessionary economy?

In this supercharged environment here is a summary of the market generating the most interest among our network of investors.

Awakening of the Hottest Market for Strategic Cannabis Investment in 2022

NEW YORK – The Market: Hottest Cannabis Market for Strategic Investors 2022

The size of the New York cannabis market is projected to reach $7.B by 2025, according to Grand View Research. This will rival California in becoming the largest cannabis market – in the world. This projection is based on the strength of the recreational cannabis use in the State which is planned to begin as early as yearend. While the market size projection from Reuters’ sources is much lower – for the NY regulated cannabis market to reach $4.2 billion by 2027 – that total, led by the 100 to 200 conditional licensed adult use retailers under review now, still supports over $10 billion in total economic impact and 76,000 jobs.

NewCannabisVentures sums up the State’s potential as: Hottest Cannabis Market for Strategic Investors 2022

According to FY 2023 Executive Budget, the New York State projects to generate $1.25 billion in cannabis tax revenue over the next 6 years: $56 million (includes $40 million in license fees) in FY 2023, $95 million in FY 2024, $158 million in FY 2025, $245 million in FY 2026, $339 million for FY 2027 and $363 in FY 2028. All State cannabis revenue will be deposited in the Cannabis Revenue Fund in which 40% would be directed to education, 40% to the Community Grants Reinvestment Fund and 20% to the Drug Treatment and Public Education Fund. For the local tax, 25% is directed to the county and 75% is directed to the city, town or village within the county.

The Government of the State of New York prides itself on the innovative approach being taken to protect small community businesses to enable them to compete with the giant MSOs that have already arrived in the medical cannabis sales throughout the state. The regulated cannabis program in New York calls for half of all licenses going to those marginalized communities most damaged by the War on Drugs, and other innovations designed to remove the stigma of the use of cannabis. New York has structured its inclusive legislation to provide what is describe as creating the healthiest cannabis markets in the U.S. Yet, as publications such as The City quip, even while NYC has opted-in, adult users will still be “waiting a while to inhale,” substantial progress has been made of late in the State legislature and with official actions of the new Governor.

Neighboring State, New Jersey, has chosen to jumpstart their Adult-use sales by recently opening the market with 23 dispensaries in operation throughout the state – from 11 operators – to service the 117,000 registered medical marijuana patients. It will likely take at least until the fall before newly approved applicants are able to be open for business.

NEW JERSEY

Retail license with a site plan approval for new 3K s.f. freestanding retail building in Monmouth County. Construction permits being pulled. Buildout is expected to be 4 1/2 months per the contract. 30-year lease and local application for Adult-use sales that is expected to be approved in November. All adjacent municipalities have opted OUT of cannabis.

Ask, joint-venture deal structure that leads to outright ownership for the buyer over time.

Details available CLICK HERE.

Reuters reports, on the other hand, that New York has taken a decidedly different approach to jump-starting its market, “choosing instead to prioritize social equity applicants impacted by the war on drugs through its ‘Seeding Opportunity Initiative,’ while its regulator, the Office of Cannabis Management (OCM), keeps working on proposed rules for the wider market.”

At the center of this initiative is the “Conditional Adult-Use Retail Dispensary” license. This license is directed to social equity entrepreneurs who have been convicted (or had a close family member convicted) of marijuana-related offenses and who have a background in owning and operating a small business.

The Rockefeller Institute Marijuana Opt-Out Tracker has found that Dispensary Opt Outs total 764/1520 Municipalities; Consumption Site Opt Outs, 883/1520 municipalities. RockInstitute.org reports that municipalities that opted out before the end of 2021 can change their mind at any time and rejoin the cannabis retail market program, but, “any town, city, or village that initially permits dispensaries and/or consumption lounges cannot change their mind after that 2021 deadline. Under current law, once a municipality is in, they are in permanently. Those municipalities that choose to not opt out can still use zoning and other reasonable time, place, and manner restrictions to regulate where dispensaries and/or consumption lounges are located.”

Governor Kathy Hochul recently signed Senate Bill S8084A into law, which permits certain hemp cultivators and processors to apply for “Conditional Adult-Use Cultivator” and “Conditional Adult-Use Processor” licenses this year. These cultivators and processors will be the source of cannabis for the Conditional Adult-Use Retail Dispensaries.

52 conditional adult-use cultivation license have been issued to hemp cultivators in order to meet expected demand. Conditional Licenses had until the end of June to convert to full licensing. The marijuana flower from these grows will be processed by only 13 hemp Cultivation/Product Production Facilities converted for the purpose along cGMP guidelines. Retail sales from general licensed businesses, however, are not likely to commence until the end of 2022, or early 2023.

Unmatched New York Opportunity

Hemp grower,1 of the only 13 cGMP compliant processors that received their Conditional Adult-use Cannabis Cultivator/Processor License.

Minimal buildout required for 50K s.f. (Hybrid license allows for 30K s.f. indoor grow, 20K s.f. processing and storage) facility for lease. Existing 11,500 s.f. facility (14 ft. tall overhead doors, loading dock with 10 ft. tall door and 18 ft. ceiling height in approximately 70% of the building, 9 ft. height in 30% of the building with 18 parking spots) meets all NY State requirements for cGMP compliant facilities. Conditional certificate has converted to full THC cultivation in June and the processing license is forthcoming. An estimated $1.5M has been invested into the CO2 and integrated ethanol extraction systems and related processing equipment that comes with the license. License owned by equity investor, not operators.

Ask, $21M for 100% of the equity over time. This DEAL can be flexible on compliant terms and structures.

Details available CLICK HERE.

Significance of the State of New York Market to Strategic Cannabis Investors

Besides the massive sales potential in the State, and the fact that it is, in essence, a limited-license-state at this time, NewCanabisVentures points out these developments in the progress being made for the regulated cannabis industry to go-to-market in a timely manner – as early as this fall:

- State officials have diligently studied what works and what doesn’t work in the other 18 states that allow Adult-use cannabis.

- The state is fulfilling its promise to make the launch of the cannabis program the most equitable of all the programs launched throughout the country; getting the New York MRTA Adult-use program started focusing on small businesses, small cultivators/processors and industries that are growing hemp within the State.

- Conditional Adult-Use Retail Dispensaries – a subset of dispensaries must be owned by equity-entrepreneurs with a prior cannabis-related criminal offense and have a background owning and operating a small business – will be the first to open and make sales in New York State, establishing equity-owned businesses at the front-end of New York’s Adult-use market.

- Spectrum Local News reports that the Conditional Adult-Use Retail Dispensary applications could open later this summer.

- The state’s emerging cannabis industry is on track to license up to 150 dispensaries through early 2023.

- Cultivators are going to start harvesting their crops sometime in September.

- In their findings in studying the market, Grandview Research points out the obvious, that a majority of cannabis is being traded now through illicit channels. Nevertheless, in order to curb ongoing illegal trafficking, the State Legislature is expected to cut down product prices and improve monitoring of the supply chain. Recently announced actions in New York City are indicative of crackdowns coming on illicit operators throughout the state in advance of the opening of Adult-use sales.

The Biggest Potential for “Limited License State”

In essence, New York at this point in time is, indeed, a limited license sate. Rules for retailers have been finalized and applications are for being taken now Industry consultant Jay Czarkowski explained it in an interview in FLX420:

In New York right now we don’t have all the answers, but all indications are that there are going to be a limited number of licenses,” he explained recently from the Colorado headquarters of the firm he founded, Canna Advisors. “Any time there’s a limit on licenses, there’s going to be great demand. Let’s say the limit is “X” – well there’s going to be 5X, 8X amount of people trying to get one.”

How We Can Help

Not only do we have one-of-a-kind opportunities available for strategic investors in New York and all along the Eastern Seaboard, Highway 33 Capital also has strict risk mitigation procedures in place for our clients. The approach we take prior to presenting them with investment opportunities is this:

- Evaluate the prowess and the passion of the prospect’s executive team

- Assess the competitive advantage of the company and how quickly that team can scale for growth

- Determine just how well they are ready for the regulatory regime in their home and target growth markets.

We take those steps before presenting the company to our extensive network of pre-qualified investors.

At Highway 33 Capital we excel at structuring deals to meet client investment strategies in emerging 2022 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-Side or Buy-Side client.