For Cannabis Consumers Inflation is No ObstacleJuly 12, 2022

Posted by New Frontier Data

For Cannabis Consumers Inflation is No ObstacleAs the summer is heating up, so have been public fears and political rhetoric about inflation and rising costs for gasoline, food, and the consumer price index (CPI) overall. Yet while the CPI in May saw its highest year-over-year spike since 1981, the outlook remains calm enough for the legal cannabis industry.

For Cannabis Consumers Inflation is No ObstacleWith three-quarters of U.S. states now having adopted legal reforms (38 of them and Washington, D.C., allow it for medical use, and 19 have approved it for adult-use sales and consumption), it is unsurprising that the plant’s broader availability is being met with greater social acceptance, and more adaptive applications in people’s lifestyles. Throughout the COVID-19 pandemic, cannabis proved itself among those products which consumers will last cut out when trying to save money; the broadening availability of value-added products only offers more options for incorporating them into Americans’ lifestyles.

Last week’s discussion of flower’s dominance examined one important trend for marketers to note: Understanding purchasing behavior is imperative when trying to leverage an effective marketing strategy.

Stores, State Laws, and Sticking Around

A state’s cannabis laws greatly determine the sources available to consumers. Brick-and-mortar stores and delivery services — the primary forms of regulated cannabis outlets — are utilized considerably more by consumers who reside in adult-use markets than those using other state markets. Informal sources like friends, family, or dealers are leading sources in illicit markets (where high-THC cannabis products are prohibited).

In medical-only markets, illicit dealers are significantly less utilized than in completely illicit states. This is likely because in medical-only markets, registered patients act as intermediaries between legal dispensaries and unregistered friends and family who consume. Four in ten (43%) of current consumers say that they supply friends or family with cannabis; 12% of current consumers report doing so regularly.

As legal access expands and new markets come online, businesses who can reach these consumers that have primarily utilized informal sources and facilitate a positive first experience will be well positioned to retain that business. Nearly 9 in 10 (89%) of consumers who source from businesses report either always or usually purchasing from those same businesses. Familiarity is the leading reason why consumers with high business loyalty report sticking with their same sources.

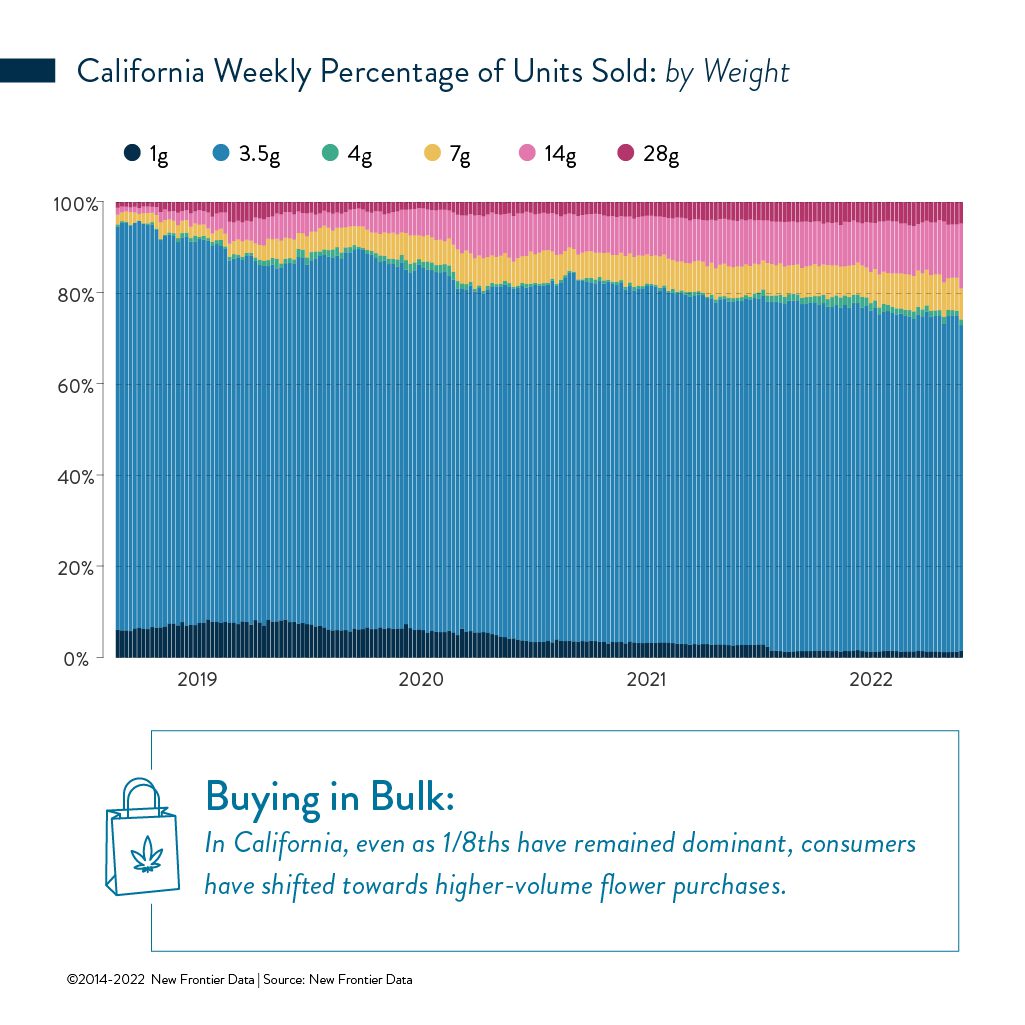

As with product preferences, purchasing behaviors are malleable, and evolve over time. Again, close examination of California’s legal market, sized at $5.9B in 2021 according to the Market Data dashboard in Equio, New Frontier Data’s cannabis business intelligence platform, offers some compelling insights to how consumers choose to purchase flower.

California Comparisons

As noted in New Frontier Data’s recent report, The Power of Flower, consumers in California overwhelmingly purchase their flower in measures of 1/8th of an ounce. Regardless of a consumer’s age or gender, nearly 4 in 5 (79%) of all 2021 flower sales involved eighth-ounce units. An additional 1% of sales was attributed to a “farmer’s eighth” (i.e., an extra 0.5 gram). Just 10% of transactions involved larger-volume purchases

Beyond broad availability, another explanation for the dominance of eighths is price elasticity: More 61% of consumers cited price as either a very or extremely important factor in making a purchasing decision.

Looking specifically at April 2021, the median gross sale for an eighth in the lowest price quartile was $20, with $60 being the highest. That range provides a great deal of flexibility for consumers throughout a variety of socioeconomic circumstances.

Price variance is especially important when we consider that the most common reason cited by consumers considering switching their choice of businesses is to take advantage of a sale at a different store (57%).

Straining the Definition

The second-most common reason to switch businesses is to find specific products not available elsewhere (45%). It is important to note that more than half (51%) of consumers claim that the effect which the product will provide is the most useful information about their cannabis product, while less than 1 in 5 (17%) cite the strain’s name as being the most useful information.

Brands which can effectively communicate the effects which their product can provide may find greater success attracting new consumers than those simply advertising an uncommon or specific strain.

Strain can be a powerful tool for brands and producers alike. Consumers may demonstrate strong desire for specific strains which they actively seek. However, reasons for use are highly diverse, personalized, and intentional. As the industry grows, brands must identify their ideal consumers, and engage them with an understanding of why, how, and when they use cannabis.

In this endeavor, consumer education is imperative. Generations of hybridization have likely eroded whatever perceived characteristics that strain types might have had. The general mantras that indica is associated with a relaxing body high, sativa with a more energized or head high, and hybrids somewhere in the middle of both, are potentially misleading.

The various terpenes found in a plant can drastically affect a user’s experience. Even subsequent crops from the same genetic stock can produce a fundamentally different product, depending on grow conditions and time of harvest. Brands should leverage consumer testing and feedback to understand what effects are more commonly experienced with their products, and reference those to their customers.

The Power of Flower

Over time, even as eighths have remained dominant, consumers have shifted toward higher-volume flower purchases. This may indicate a maturing consumer base grown more confident of enjoying the flower purchased, and therefore more willing to buy products in bulk.

Alternatively, the introduction of more cost-competitive, higher-volume products selling smaller buds or pre-ground shake could be attractive to either cost-conscious or more frequent consumers.

Regardless, the broadening availability of value-added products is offering consumers more ways in which to integrate cannabis into their lives. The range of product types used is fragmenting as consumers become more intentional with their use. It is especially important for flower brands to understand how this hastening fragmentation of use will impact demand for their products.