In the emerging tech space venture debt has become a $6 to 8 billion marketplace being particularly attractive to investors in emerging tech companies that are at or near profitable EBITDA. A primary motivating factor is that venture debt is a cheaper form of non-dilutive capital enabling early investors to retain ownership share over a longer duration of a company’s lifespan without further dilution prior to an attractive exit opportunity. In this article we take a look at investor considerations for this potentially lucrative alternative. Emerging Tech Turning to Debt Financing

Venture Debt is a fast growing form of financing for technology companies. Spinta Capital estimates it amounts to $6 to 8 billion per year. These loans are usually made to pre-profit startups with intellectual property or first-mover technology advantages. The loans are typically structured as some form of term loan with warrants for conversion to company stock.

Recent examples cited by Crunchbase include:

- Udacity, in Edtech, raised $75M in debt from Hercules Capital

- Envoy, on-demand electric vehicles, $70M debt from Macquarie Group

- And, of course, the additional $1 billion in debt, at an estimated 9% interest rate, raised by Airbnb in April from sources including Fidelity, T. Rowe Price, and others.

A primary motivating factor in these and other well-publicized cases is that debt financing reduces dilution and is playing an important role in funding promising pre-revenue companies. It preserves capital to bolster company value in later funding rounds. And, it is a cheaper form of non-dilutive capital enabling early investors to retain ownership share over a longer duration of a company’s lifespan with the accompanying attractive exit opportunity.

Biotech – The Shift from Traditional Equity Financing

As an example, take Biotech. Companies are racing to get their COVID-19 vaccine to market. Bioscience breakthroughs are advancing at a pace unmatched in scientific history in the U.S. and they need capital up and down the balance sheet.

Traditionally, biotech startups have turned to a limited number of sources to begin the search for significant R&D capital needed to commercialize their innovation. Those sources are;

- Grants and public funding from government, corporate and research organizations. While this is a highly prestigious avenue it is also the most competitive arena in which the search for initial funding is conducted.

- University funds – getting research started within universities has provided a degree of financial backing as well as access to valuable university resources, an arduous process.

- VCs – these sources carefully analyze and determine which startups provide the strongest potential for the highest return; while they also take a big enough share of the startup to make it worth their effort. They are typically more effective in later stage financing rounds as startups develop hard financial performance data.

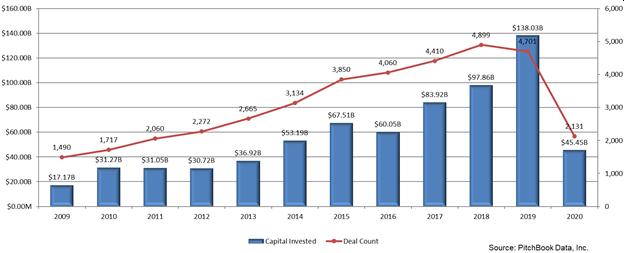

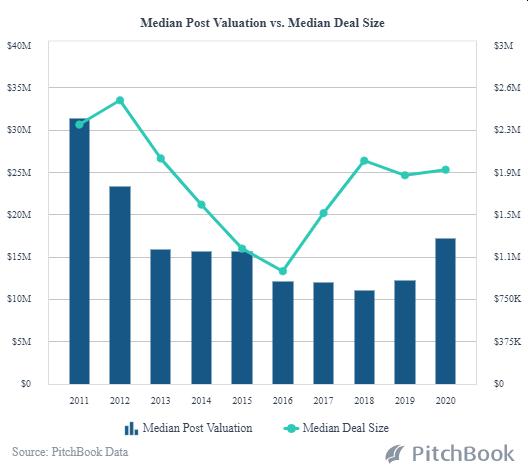

Tracking Total VC Activity in the Biotech Space

According to Pitchbook, VC funding in biotech and pharma startups more than tripled in the past decade – from $5 billion in 2009 to over $17 billion in 2019, with the median exit size of these biotech and pharma companies reaching an all-time high of $270.2 million that year. The VC deal value for startups in the Healthtech segment jumped during that time from $9 billion to $30 billion in some 2,544 deals in the industry in 2019.

VC funding isn’t the only solution for biotech companies though as with other new forms of financing venture debt has evolved. Funding a biotech in a highly regulated industry is a complex challenge. Experienced advice is required on the costs associated with drug development, pre-clinical valuation and clinical trial testing. This makes private funding debt and M&A deals for biotech and pharma companies ideal alternatives for investors who are well-aware of the amount of capital required to meet development and testing milestones. Then, once sufficient pre-clinical data is shown using debt funding, founders are more likely to proceed along the fundraising timeline and raise early-stage VC rounds.

Funding Growth with Venture Debt

Venture debt is well-suited for accelerating the growth timeline for an emerging tech company that has a clear path toward profitability and doesn’t want to participate in a time consuming, dilutive equity round.

- Venture debt does not require a pre-money valuation.

- By using debt funding to improve company performance we can put the company in a better position for a higher valuation when the company is ready to turn to the equity markets.

- The company can avoid the need for bridge round financing. A bridge often calls into question how well management has handled funds previously raised. Questions about this can increase the level of risk associated with the bridge loan and raising the interest rate charged; thereby, jeopardizing the potential of positive cash flow that a loan at a lower rate would not impede.

- This gives the C-suite the advantage of maintaining control over dilution and the requisite extension of decision-making power to investors who may be opposed to management’s growth strategy. This is especially the situation when an equity investor is interested in a specific use-case only.

- More flexible loan options can help a company achieve profitability goals at a faster pace with reduced interest payment burdens.

Venture Debt Funding Options

Line of Credit – this formula-based alternative for revenue generating companies is usually tied to a percentage of the value of accounts receivable, or, particularly in the case of SaaS, monthly recurring revenue (MMR). It is typically a low-cost loan without fees other than interest.

Growth Capital Term Loan – these loans can be obtained for large capital expenditures or general operating purposes, in many cases collateralized by a blanket lien on company tangible and/or intellectual property assets.

Medium-Term Note (MTN) – an MTN is a new alternative that is emerging for companies with relatively strong balance sheets. It is an option to traditional long-term and expensive short-term financing – that is designed to aid a company with such objectives as accelerating a growth strategy or facilitating an M&A strategy. Emerging Tech Turning to Debt Financing

An MTN is essentially a bond issuance through investment bankers and funded by private institutional sources, in the range from $20M to $100M+, with specific characteristics to facilitate being issued quickly in order to take advantage of temporary market opportunities.

We have developed access to a network of institutional funding sources for the MTNs.

Finding the Right Fit for Your Venture Debt Lending Strategy

Potentially high reward investments require an extensive vetting process. Before making recommendations to our clients about Seed or Series A, B rounds, we subject a prospect to our internal vetting regimen – in order to set investors’ expectations, ensuring they are not overpaying, and ensuring that the emerging tech prospect has validated all the information in its data lockbox.

Investor Takeaway

In a $6 to 8 billion marketplace venture debt is particularly attractive for investors is emerging tech companies that are at or nearing profitable EBITDA. Venture debt is minimally dilutive and can completely eliminate the need for later rounds of equity financing. Repayment options may also lessen the burden on cash flow as the company prepares for more substantial growth funding rounds. It is not without risk, of course, since leveraging a company with a limited track record requires careful evaluation. Emerging Tech Turning to Debt Financing

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging tech segments like Biotech and Healthtech, as well as our core expertise in highly regulated markets that include; Pharma, SaaS, CBD/Hemp, Cannabis and ancillary tech companies. We provide investors with thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise and our network to work for you.