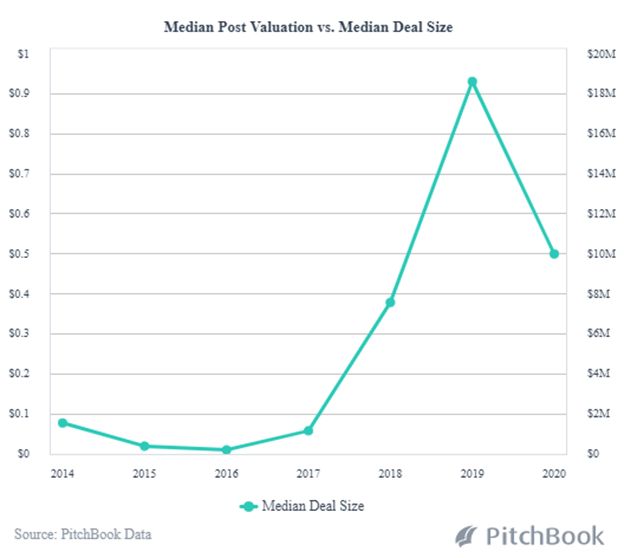

Overall in 2020, capital flowing into the cannabis industry dropped to $4.2M from $11.6B in 2019, and the even higher level of $14.2B in 2018, as reported by Viridian Research. Yet, just in the first two weeks of January cannabis companies in North America raised over $619M. All indicators point toward a record year in capital flowing into the industry. Debt Financing in the Cannabis Capital Bonanza

The upward trend began in 2018 and advanced well into 2019 when about 30% of all capital raised in the cannabis industry was through debt financing, compared to only 19% in the boom year of 2018. We are seeing more groups already in 2021 starting both dedicated debt funds and allocating a portion of funds for cannabis debt deals. Debt Financing in the Cannabis Capital Bonanza

Why Cannabis Turns to Debt Financing

While the industry has been capital-constrained, borrowing against assets has been a key source available for many cannabis companies to pursue. Vertically integrated cannabis companies often have significant real estate and other assets that can be leveraged. What has changed now, though, is that more debt providers have come online over the past couple of years addressing a range of needs. This means that cannabis companies now can refinance at more attractive rates. Debt Financing in the Cannabis Capital Bonanza

- In 2020, large multistate operators (MSOs) Curaleaf and Cresco announcing their debt raises of approximately $300M and $200M, respectively, illustrating the capital available at the high-end of the market at that time. Then, on January 11 this year, Curaleaf has again secured a new round of financing – a $50 million secured revolving credit facility with a three-year term. Curaleaf will be paying a 10.25% interest rate for funds when needed. This is significantly lower than the interest rates cannabis companies paid for loans in previous years when the likelihood of progress on easing Federal regulations did not look as promising.

- Likewise, one of the largest MSOs, Green Thumb Industries, is reportedly seeking refinancing of its current $100M debt, currently carrying a 12% interest rate. Because of the capital markets now opening up, they feel they can obtain as significantly lower rate.

- When its stock was floundering in 2020, Acreage Holdings was able to raise debt with the credit arm of an unidentified institutional investor, for up to $100M; as opposed to further diluting equity at their weak stock prices at the time.

- Toward the end of 2020, Holistic Industries, a U.S. privately held, vertically-integrated cannabis company, closed an oversubscribed round of $35M in debt for expansion and the potential of acquiring distressed assets.

Debt Financing in Cannabis, What are the Options?

Sale and Leaseback Transactions

- While Sale-Leaseback (SLB) transactions aren’t technically debt they do allow companies to free up liquidity from their balance sheets without dilution. An SLB is the sale of real-estate assets to a buyer who then leases them back through a long-term lease.

Asset-Based Lending

- Based on the valuation of real estate and equipment assets, a cannabis company can typically borrow from within the range of 40% to 75% of asset value. In the case of development projects, the loan is usually based on project costs. While less typical, there are some working capital debt options in the market as well; though the availability of this option is much less than for real estate and equipment financing.

Convertible Options

- Up to this point, most debt financing by cannabis companies was found in convertible note options with low conversion premiums – which essentially delay issuance/dilution of equity. The company creates a note that converts to equity at a future date based on a future valuation method. These notes have given investors security that they are repaid before equity holders if something goes wrong. For both the investor and the company this note structure allows the valuation question to be answered in the future while providing needed capital to the company and a more secure instrument to investors.

MTN – Short-Term Solution to Minimize Dilution with Funding at Single Digit Rates

- True, that the three alternatives listed above are considered the standard. Now, however, a new alternative is emerging, the Medium Term Note (MTN) for companies with relatively strong balance sheets. An MTN is an alternative to traditional long-term and expensive short-term financing – to aid a company with such objectives as accelerating a growth strategy, facilitating a roll-up M&A strategy.

- An MTN is essentially a bond issuance through investment bankers and funded by private institutional sources, in the range from $20M to $100M+, with specific characteristics to facilitate being issued quickly in order to take advantage of temporary market opportunities.

- The key is to effectively customize the MTN with characteristics most advantageous to the issuer that appeal to the strategy of an investor. This results in rates typically lower than other forms of debt financing. With our network of institutional funding sources for the MTNs we provide an overview of the funding need and the upside for investors. Then, we assist the issuer with legal, accounting, underwriting, and rating services in order to begin the preparation of the offering.

For companies seeking debt, the following are key considerations:

- Most cannabis debt providers will require personal guarantees (PG) from principals. This is always a tough decision for founders and one that carries real risk. Are you willing to PG the debt?

- What assets does the company have? Or is purchasing? Real estate, equipment, accounts receivable, other assets?

- Does the company have existing debt? And how much debt can the company take on while not taking undue risk with cash flow?

For investors who are considering lending to cannabis companies the following are key considerations:

- What are the credit scores of the principals? Is there any data on the company? How timely do they pay their payables, for example?

- What is the company’s existing cash flow? How realistic is the projection for future cash flow?

- How will the company use the funds? Is the use of funds realistic?

- What security will the investor have that they can recover funds if the loan isn’t repaid? PG? Cross-corporate guarantee? First lien on assets?

- Does the management team have the right experience for the type of project/company that they want to be?

- Does the company have its state and local cannabis licenses? If real estate is involved what is the status of current local permits?

Finding The Right Fit for Your Investment Strategy

Given these considerations, here is what we take into consideration to guide the investors from our network as they examine debt financing opportunities:

Getting Down to Business Goals

The goal is always to thoroughly understand the investment needs and objectives of both buyer and seller to develop productive relationships that lead to successful transaction outcomes.

Real Value in the Marketplace

We determine ROI potential with well-substantiated valuations. We guide operators through the vetting process our investors expect for the best opportunities from potentially high rates of return while saving time and creating valuable investor-operator relationships. Debt Financing in the Cannabis Capital Bonanza

“Choke Point” Advantage

Does the company offer a relevant differentiating benefit that chokes off immediate competition? As legalization at the federal level becomes more likely, strong brands with protected IP and a scalable leadership position in the market will win. These “winners” will be differentiated from a growing list of cannabis companies licensed under the current patchwork of state-by-state regulations who will be forced to compete as a commodity and ultimately be marginalized and pushed out of the market.

Expert Management Team

The nascent legal cannabis industry is moving at high speed toward professional management with the expertise to build unique IP and brands that dominate the market. Survival tactics employed by managers who have operated in the gray market often do not translate well in the openly competitive legal marketplace.

The Right Time / Most Advantageous Cash-Infusion Partner

The trend of increasing legalization will continue to attract more sophisticated competition and investors. Our systematic process is designed to match the right investors and M&A partners with the right operators whose objectives and scalability are a fit for their portfolios.

Investor takeaway

Just in the first two weeks of January cannabis companies in North America raised over $619M. All indicators point toward a record year in capital flowing into the industry. While vertically integrated cannabis companies have always had significant assets to collateralize, what has changed is that more debt providers have come online over the past couple of years addressing a range of needs. This means that because of the capital markets now opening up, cannabis companies can obtain debt financing at significantly lower rates. The debt funding among cannabis industry leaders shows that debt as a capital source for cannabis companies is a rational use of capital – potentially cleaning up balance sheets and enabling access to funding for expansion and/or the purchase of distressed assets coming out of the pandemic. And, new debt alternatives, like the Medium Term Note (MTN) are emerging as alternatives to traditional long-term and expensive short-term financing – to aid a company with such objectives as accelerating a growth strategy, facilitating a roll-up M&A strategy.

Next Step – Category Expertise Needed

With capital finally flowing more freely into the cannabis industry there is no better time to establish your position and get your targeted business to come out a winner among those destined to struggle for survival. A talented deal team with not only debt financing experience, but also direct experience in cannabis is essential. Expectations for performance are important to clarify at the beginning of the process along with a clear understanding of the compensation the advisors will receive for the extensive services rendered. At Highway33 Capital Advisors we stand ready 24/7 to provide the guidance our clients seek.

How We Can Help – CR Debt at Below Market Rates

At Highway 33 Capital Advisory we excel at facilitating for CR debt lending at below market rates for operators that are cash flowing/generating revenue, have significant equity into the business and are looking for CR debt to accelerate build-outs and acquisitions.

This is in addition to our expertise at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.