According to TechCrunch Cleantech is projected to be a $2.5 trillion (yes, trillion) market by as early as next year. This projection reflects the fact that more and more investment is being drawn away from fossil fuels toward the promise of low-carbon energy alternatives. Cleantech Investing Opportunities 2021

What is Cleantech

Clean technology (Cleantech), in general terms covers the development of those technologies designed to reduce the pace of climate change and the depletion of vital resources – improvement of energy efficiency and promotion of sustainability are primary areas of focus. Cleantech spans verticals ranging from renewable energy to EVs to Agtech. Within the Cleantech category, Climatetech relates to decarbonizing the economy; Cleantech refers to eco-friendly, sustainability technologies; including wind, solar, batteries, energy storage and a host of other innovations. Cleantech Investing Opportunities 2021

The Market for Cleantech Investment

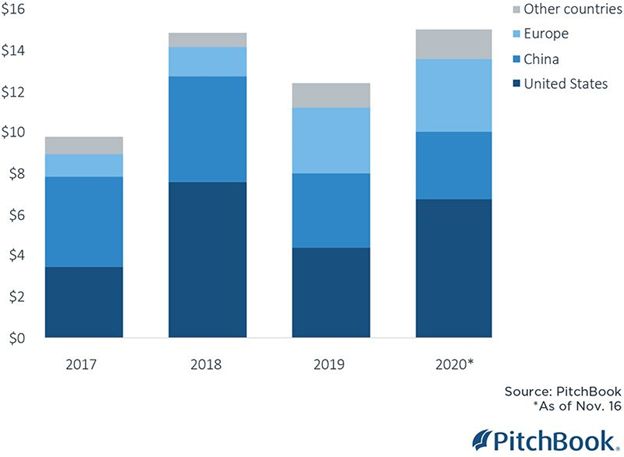

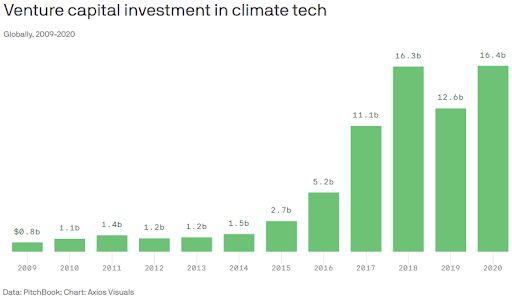

In the effort to reduce carbon emissions, electric vehicle (EV) sales now stand at well over 10 million that are on the road globally. Also, according to PwC, AI innovations in Cleantech will be a $15.7 trillion market by 2030. And, SPACInsider reports that there were 248 SPAC IPO’s in 2020 that raised over $83 billion, averaging $335 million each. Even while a balance was attempted to be struck between existing fossil fuel technology and clean energy alternatives during the President Trump Administration, VC’s have been investing an average of $6.5 billion annually in U.S. Cleantech startups over the past four years. Cleantech Investing Opportunities 2021

Already through Q1 2021, SPACInsider has accounted for over 300 SPAC IPO’s with a total raise at $100 billion. This first Quarter of the year has already exceeding the entire record year of 2020.

What Are the Hot Segments in Cleantech?

What is trending in Cleantech ranges from offshore wind and EV infrastructure to hydrogen, energy storage and Agtech (through energy-efficient indoor crop lighting and computer-generated farming).

With governments around the globe now striving to meet mid-century goals of Net-Zero carbon emissions, energy transition investment remains strong – from solar and wind to energy storage to hydrogen-powered EVs. The next-generation information and analytics firm, Markit, reports that wind installations grew again in 2020, energy storage became a $4.2 billion market, and hydrogen projects accelerated around the world. Cleantech Investing Opportunities 2021

- Green hydrogen, a zero-emissions alternative with water, not carbon dioxide, as the primary emission is projected by the University of Wisconsin’s Energy Institute to be capable of filling up to 20% of the world’s energy needs that wind, solar, and battery technology will not able to fill. Goldman Sachs forecasts green hydrogen becoming a $12 trillion industry by 2050. Breakthrough Energy Ventures, with support from Mitsubishi Heavy Industries led a $11.5 million Series A round for C-Zero, a technology originally developed by the University of California, Santa Barbara that converts natural gas to green hydrogen.

- Renewable energy sources actually provided more power than other electricity generating sources when total electric energy demand fell last year. The pace of growth for renewables is anticipated to accelerate as the Administration of President Biden has rejoined the Paris Climate Accord, dedicated to provide $2 trillion in clean energy to fully decarbonize the power generation industry by 2035, and achieve net-zero carbon emissions by 2050.

- In the $2 trillion Biden Administration infrastructure plan $174 billion would be invested to “win the EV market.” While details are still forthcoming, it is reported that $15 billion would be invested in the installation of 500,000 public EV charging stations by 2030.

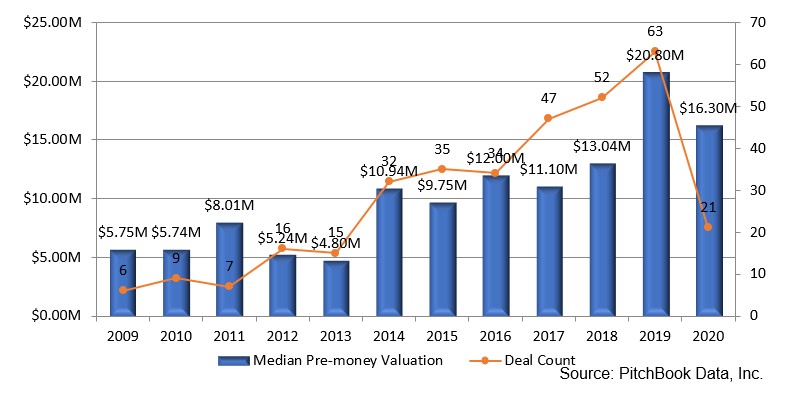

- Greening agriculture continues to be an investor priority. As discussed in a previous EDGE Briefings, ventures in Agtech attracted total capital funding reaching $2.7 billion invested across 289 venture financing rounds last year. The median pre-money valuations across all venture rounds more than doubled between 2018 and 2019, as reflected in the VC portion of the year’s investment activities depicted in the chart below. And, although innovations in production efficiencies, quality and sustainability in existing farmlands attracted the majority of funding, the fastest-growing segment in 2019 was indoor agriculture. Investment in this segment almost doubled since 2018, reaching a new high of $541 million in 2019.

This is the case because the yield from these Agtech innovations is, in fact, an emerging form of risk management uncommon to farming in the past.

Indoor Farming Surges

Indoor Farming has become the hotbed of Agtech innovation for a combination of factors – precision agriculture, architecture, and energy and resource-efficiency advancements. These innovations make growing, and consuming, food more aligned with the changing expectations of today’s consumer. Expectations for safe quality foods available from local growers; for more quality produced using less space with fewer demands on diminishing resources. In addressing these consumer demands studies by the World Wildlife Fund (WWF) found that indoor farming yields benefits in energy use, requires little or no pesticides and generates 80 percent less waste. Requiring less space than outdoor cultivation can free up land for biodiversity. And, the WWF found that precision indoor water systems use just 1 liter of water to produce a kilogram of lettuce; for field-grown lettuce, that figure is 150 liters. Cleantech Investing Opportunities 2021

Peace-of-mind about food safety, according to Food Safety News, is another important part of the puzzle when it comes to the increased demand for indoor grown produce. Safety scares originating from large-scale farms have buyers looking for lettuces and greens grown on a smaller scale and closer to home. Controlled Environment Agriculture (CEA) is the force behind the growth of the localized food market – estimated to have reached $20 billion in sales by 2019, up from $12 billion in 2014.

It is estimated that meals in the United States travel about 1,500 miles to get from farm to plate. According to Quest Sustainable Delivery, in the United States, between 30-40 per cent of the food produced is wasted. Thirty to 40 per cent! That accounts for 133 billion pounds, or $161 billion dollars. In terms of energy consumption that means that 21 to 33 per cent of U.S. agricultural water use goes to food that is ultimately wasted. A disproportionate share of that waste is due to food production sources so distant from consumers, as found by the Center for Urban Education about Sustainable Agriculture (CUESA):

- Long-distance, large-scale transportation of food consumes large quantities of fossil fuels. It is estimated that we currently put almost 10 kcal of fossil fuel energy into our food system for every 1 kcal of energy we get as food.

- Transporting food over long distances also generates great quantities of carbon dioxide emissions. Some forms of transport are more polluting than others. Air freight generates 50 times more CO2 than sea shipping. But sea shipping is slow, and in our increasing demand for fresh food, food is increasingly being shipped by faster—and more polluting—means.

- In order to transport food long distances, much of it is picked while still unripe and then gassed to “ripen” it after transport, or it is highly processed in factories using preservatives, irradiation, and other means to keep it stable for transport and sale. Scientists are experimenting with genetic modificationto produce longer-lasting, less perishable produce.

As opposed to these gross inefficiencies, locally grown is likely to be closer to the consumer than you may realize. Just how local are indoor cultivation facilities becoming? New York City-based FarmOne grows over 300 varieties of microgreens in the TriBeCa section of Manhattan. Located under the Altera Restaurant on 77 Worth Street, they claim they can reach 90 percent of their buyers within 30 minutes – by bicycle. Cleantech Investing Opportunities 2021

By 2050, the world’s population is expected to grow to 10 billion, 80 percent of whom will live in cities. With the loss of one-third of the earth’s tillable land over the last 40 years feeding the human population by indoor farming is no longer an alternative. It is a necessity. Consequently, rapid progress is being made now on the vital elements of CEA – reusable water irrigation systems, environmental controls for cooling and dehumidification, and the artificial control of light. Among those developments lighting breakthroughs are a critical component in ensuring the cost effectiveness of indoor farming. For decades indoor farming costs, particularly lighting units, were exorbitant. This limited the profit potential of growing indoors to only a handful of specialty crops, including cannabis. Between 2010 and 2014 alone, however, according to the Department of Energy, the price of LEDs dropped by 90 percent, while their efficiency (i.e. the light emitted per unit of energy) and their lifespan nearly doubled. Today, a mainstream LED bulb has about 50,000 hours of usable life, which translates to nearly six years of continuous use. And, more striking developments in lighting technology, even beyond the progress in LEDs, are now becoming available. Cleantech Investing Opportunities 2021

In search of alternatives a World Wildlife Fund study revealed that the industry could shrink its carbon footprint using fiber-optic technology that can bring sunlight into a room as an option for renewable energy. Vertical farms that use less energy will make it possible for companies in the industry to expand beyond growing leafy greens crops.

One such company in the fiber optics field, SUNPATH has developed a patented daylight delivery platform that harnesses the power of sunlight indoors claiming a higher yield per plant/per square foot at a lower running cost than traditional LED and HPS lighting while producing healthier and higher quality yielding plants. As emphasized by Joseph DiMasi, CEO of SunPath, “Both sustainable crop production and sustainable energy production are critical technologies to meet the 21st century challenges of population growth and climate change.” The company is collaborating with several groups to implement this breakthrough technology. Vertical agriculture has becoming a prominent factor in meeting that challenge and is currently attracting tens of millions of dollars in VC, private investor, and M&A support.

What does this mean in terms of where the smart money is going in light of burgeoning Agtech opportunities? VC investments in Agtech in 2019 topped $2.7 billion. According to Pitchbook, while the mainstays of digital farming in the form of crop protection and input management drew the most capital, 37% of the total, the fastest growing segment was indoor farming startups.

Following the Smart Money in Clean Tech

While Venture Capital money has been slow to flow into Cleantech in the past – since Cleantech does not fit the traditional VC model to de-risk new ideas and fund only the most promising ones, enabling exit via M&A or IPO – the advent of the SPAC has changed all that.

According to Investopedia, “special purpose acquisition companies (SPACs) are significantly improving clean tech’s venture capital construct.”

In 2020, SPACs furnished Cleantech with capital of over $4 billion. Prominent among those funded were Fisker, QuantumScape, Hyliion, XL Fleet. In 2021, even further acceleration in Cleantech funding is anticipated since around 70% of the 2019-2021 listed SPACs are still in search of a de-SPAC. SPACInsider estimates that there are 428 on the hunt with an average of $330m in cash proceeds. For SPACs, Cleantech is prime target.

What Investors Look for in a SPAC

As our investor base turns to us for guidance for SPAC investments we examine these key areas:

- Knowledgeable Shareholder Base.

Critical for a knowledgeable shareholder base to understand the business/technology being acquired.

- Management with Proven Operational Experience.

Preferably operational experience negotiating through the compliance, regulatory and financial issues specific to the healthcare industry.

- M&A Strategy Fulfilling the Vision for Future Growth.

- Since sponsoring company automatically get a 20% share in the SPAC, and IPO investors receive warrants and rights for future stock purchases, a target company my increase it’s selling price to offset this potential future liability. This may impact the value of de-SPAC company share prices. Plans for protecting the shareholder base that remain in the company after the merger closes are vital to the success of the new public entity.

- Precise financials and attainable pro formas.

This is vital valuation of assets the acquisition provides.

- Planned Integration of Company Cultures.

Maintaining employee retention when a deal occurs is always critical. And ongoing policies that promote ESG (Economic, Social and Governance) issues are becoming a standard requirement in current M&A transactions

Caution When Evaluating SPACs

On the flipside of the proven success of SPACs in Cleantech, SPAC mergers often depend on funds coming from Private Investments in Public Equity (PIPE) deals. PIPE investors often step in to replace capital from IPO investors who opt out of a SPAC merger. Some have voiced the concern that there may not be enough resources to go around for all the potential SPAC deals as funding from PIPE investors dries up. This is a situation we are monitoring closely.

Then, on April 12th the SEC announced that the agency was investigating whether or not SPAC warrants should be treated as equity investments rather than liabilities. This has slowed the SPAC process somewhat while this accounting principle is worked out and while valuations and terms are clarified for any differences between shareholders and PIPE investors. The primary concern of the SEC appears to be about over-zealous pro forma projections that lack traditional substantiation.

Investor Takeaway

With the race on by governments across the world to achieve Net-Zero, Cleantech is clearly at the forefront of investor interest – projected to be a $2.5 trillion market by as early as next year. This projection reflects the fact that more and more investment is being drawn away from fossil fuels toward the promise of low-carbon energy alternatives – from renewable energy to emissions reduction to EVs and Agtech. Agtech, in fact, exemplifies what other Cleantech sectors exhibit. This is the case because Agtech innovations are an emerging form of risk management uncommon to the nature of startups in their category in the past. Cleantech startups are now accessing alternative financing options, such as SPACs to hasten their ability to go to market and gain the vital element of scale to increase product acceptance, lower prices, and optimize investor return. Dramatic increases are predicted for the rise in M&A and reverse merger SPAC deals as startups seek an exit pathway without certain IPO hurdles. In many cases the SPAC merger process with a target company, a “de-SPAC,” can take place in a substantially shorter period of time than the traditional IPO timeline and generate higher returns for sponsors and investors alike. That said, a successful SPAC requires a strong, experienced management team to perform due diligence on targets, and help market a deal to PIPE investors. And, this must be accomplished in a relative short period of time, the two-year requirement, or all funds must be returned to investors.

How we can help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in trending segments like Cleantech, as well as our core expertise in the fields of BioPharma, Healthcare, Cannabis and CBD/Hemp companies and Agtech. We work with thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+. Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.

Join us through our Website to put the power of this expertise to work for you – www.highway33.com