The Cannabis Insider

April 27, 2022

If you follow Cannabis.net you are aware of the ongoing battle we have with branding experts over whether cannabis is a commodity and will be treated as such in the future, or if you can brand cannabis based on “my stuff is the best, my stuff is ultra-good, my cannabis genetics are so much better than everyone else.” While state-by-state legalization has left “moats” around cannabis markets in each state, some brands have prospered and commanded higher price points by sending the marketing message that “this strain or bud is way better than the one next to it on the shelf”. But what happens when interstate commerce begins and there is an efficient national cannabis market? Margins will compress, consumers will shop on price, effects, and how far they had to go to get said product, which is what every consumer survey has shown us down so far in the legal marijuana industry. Cannabis Pricing Analysis Shows Commoditization in Fully Legalized States

Is cannabis just a plant like tomatoes, lettuce, and kale, and in the end, it will be traded on the CBOT with future contracts that mimic corn, soybeans, and wheat? While branding experts who depend on clients believing they can differentiate their product on dispensary shelves will tell you otherwise, it appears the rest of the world that is not relying on branding revenue seems to disagree. Cannabis Pricing Analysis Shows Commoditization in Fully Legalized States

The first example in a legal case going in Germany that aims to make “all cannabis flower labelled as generic”. Is all cannabis flower generic? The growers and brands commanding higher per pound prices will tell you know, but the Supreme Court in Germany may decide for Europe if cannabis strains are really all that different or if they are all really the same.

Now comes a great piece by Intro-Act entitled, “Cannabis Pricing Analysis Shows Commoditization In Fully Legalized States”. With graphs and in-depth analysis check out the full article in the link above, but here are the summary point with my comments after each one.

CANNABIS PRICING ANALYSIS SHOWS COMMODITIZATION IN FULLY LEGALIZED STATES

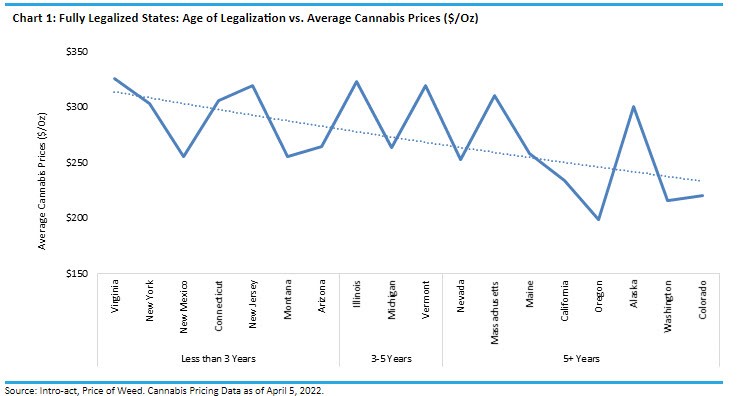

We analyze cannabis prices in 35 legal state markets in the U.S. to understand how age of legalization affects prices, the difference between fully legalized and medical only states, and the impact on pricing of prevalence rate, dispensary density, and market size. We also present a ranking of states to identify pricing leaders and laggards.

– Takeaway #1: Cannabis prices tend to fall as fully legalized states mature, reflecting commoditization of marijuana; medical only states are relatively unaffected. Our analysis shows that the average cannabis price in older recreational markets like NV, MA, MI, CA, OR, AK, WA, and CO, with a legalization age of five+ years, stood at $249/oz on April 5. This is ~15% lower than the $290/oz average for newly legalized recreational states such as VA, NY, NM, CT, NJ, MT, and AZ, which have a legalization age of less than three years. On the other hand, states that have legalized only medical marijuana have seen average cannabis prices remain stable around the $300/oz mark. The average cannabis price in older medical states (AR, FL, ND, OH, PA, LA, MD, MN, NH, DE, RI, and HI) is almost ~$50/oz higher than the average price in the older recreational markets listed above, suggesting that medical cannabis does not lend itself to commoditization the same way as adult-use cannabis does.

Cannabis.net point – This trend will be emphasized with full federal legalization and oversupplied markets with preserved high-quality cannabis like California will be shipping to undersupplied markets like Florida and Massachusetts.

– Takeaway #2: Commoditization is also visible at a regional level, with early adopter states in the West having lower prices vs. relatively late entrants from the Northeast and Midwest. Western states (WA, CO, CA, and NV) took the lead in legalizing recreational marijuana (starting 2012) and are now on the lower end of the cannabis pricing spectrum, with an average price of ~$250/oz. On the other hand, states in the Midwest (IA, MN, MO, ND, OH) and Northeast (NH, RI, PA) – which are either medical only, in the process of legalizing recreational cannabis, or have recently embraced full legalization – boast average prices of ~$311/oz and ~$303/oz, respectively.

Cannabis.net point – Regional prices will show this due to the fact people can drive large amounts of cannabis across state lines into non-legal states. See Oklahoma who has an uncapped cannabis license market and is now growing 10x the amount the residents of the state could possible consumer. Where is it going? Texas.

– Takeaway #3: Prevalence rate and dispensary density are the other key factors that impact pricing. Our analysis shows that states with high marijuana prevalence rates have lower cannabis pricing vs. those with lower prevalence rates. For instance, OR, which has the highest marijuana prevalence rate across all states at 26%, has an average price of $198.5/oz vs. UT, which has the lowest prevalence rate at 8% but enjoys an average price of $262/oz. We also see that pricing is inversely proportional to dispensary density. States with 120+ dispensaries per million people – like OR, AL, PA, NV, and CO – have an average cannabis price of ~$259/oz. On the other hand, states that have <120 dispensaries per million people – such as NY, CA, IL, OK, NM, LA, WA, etc. – have an average price of ~$292/oz. Overall, we find that as prevalence rate and dispensary density increase, cannabis prices tend to fall, driven by a surge in retail stores and higher cannabis supply.

Cannabis.net point – This is the exact point that Federal legalization and interstate commerce will eliminate, the need for cannabis to be grown near you, or for you to be near a dispensary. Fed Ex, UPS, and dare say Amazon, all shipping cannabis to your door.

– Takeaway #4: Bigger cannabis markets exhibit lower marijuana prices compared to their smaller peers. The average price in large markets with over $1 billion in annual legal cannabis sales, such as CA, CO, FL, etc. is $265/oz. This is much lower than the ~$309/oz average price in smaller markets such as UT, NH, VA, etc. that had less than $100 million in legal sales in 2021. We believe this difference is primarily due to a combination of three factors – age of legalization, prevalence rate, and dispensary density – and reinforces our views above.

Cannabis.net point – Cannabis is a plant that can grow indoors or outdoors in 12 to 16 weeks, it is not a difficult process once you have done a few group cycles. If you want to expand from 10 to 100 and even 1000 plants, THAT is a difficult thing, but the actual growing of the plant is not super complex. Hence, larger markets have the ability to grow way more weed than can be consumed by people in that state-restricted area.

– Takeaway #5: Consumers in VA, IL, NJ, ND, IA, and MD are paying more for their stash of cannabis, while those in OR, WA, CO, UT, FL, and RI are enjoying lower prices. Fully legalized states where marijuana is sold at higher prices include VA, IL, and NJ – these are the three pricing leaders with average prices of $542/oz, $326/oz, and $323/oz, respectively. Among medical only states, the three leading markets are ND, IA, and MD where consumers are paying $354/oz, $334/oz, and $321/oz, respectively. OR, WA, and CO are the fully legalized markets on the lower end of the pricing spectrum, with average prices of $198.5/oz, ~$216/oz, and ~$221/oz, respectively. UT, FL, and RI are the states where medical cannabis users are paying less compared to consumers in other states. The average price in these three states stands at $262/oz, $264/oz, and $281/oz, respectively.

Cannabis.net point – Newer markets have higher costs as they ramp up growing facilities but as history has shown, getting to equilibrium for that state will happen and excess will also be part of the inventory as more and more cannabis starts getting grown on the legal and illegal markets.