Industry Updated

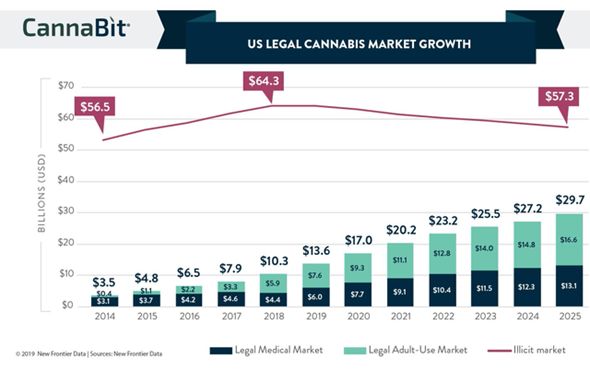

From our previous EDGE Briefings on the subject of the cannabis industry you will recall all that has been cited confirming the explosive growth to the industry, with sales volume projections changing constantly as current revenues keep accelerating beyond expectation. From literally zero sales volume in legal states just a few years ago to over $17 billion in 2020, and easily headed toward $20 billion plus this year.

Into 2021, North America has about a 50% share of the global market. This is projected to accelerate as existing legal states continue to grow in sales volume and states coming on board ramp up. The cannabis industry is rapidly growing out of the period of market euphoria and developing stronger fundamentals giving investors greater clarity to separate the winners from the losers. For sustained growth the industry will continue to need the kind of access to capital that is now materializing and the kind of management that is now being attracted to the industry. Executives with the skill set and experience to run multimillion-dollar, international corporations.

Rationale for M&A as the Next Evolutionary Step

Despite abundant money available to the large multi-state operators (MSOs), most cannabis companies still have relatively limited avenues to raise capital due to the federal illegality of the industry. How soon will it change now that the democrats control both houses of congress is still debatable. With the recent passage of the Secure and Fair Enforcement Banking Act (the “SAFE Banking Act”) in the U.S. House of Representatives there is hope that future expansions into the U.S. market may be possible for Canadian companies. The SAFE Banking Act proposes offering safe harbor from federal prosecution to financial institutions like banks and insurance companies that provide services to cannabis businesses.

Currently, American cannabis companies are working in a peculiar situation where they are fully compliant with state laws, but are at odds with federal legislation. Financial institutions require federal payment systems to operate and are under the purview of federal authority. Since cannabis is illegal at the federal level, financial institutions are unwilling to become involved with business operations that are offside federal legislation. The hope is that with the formal introduction of the SAFE Banking Act, financial institutions will be able to meet community needs, reduce cash motivated crimes, make tax collection more efficient, and allow the industry to grow and develop further. Certainly, the mood in Washington DC has a strong effect on deal decisions.

Last December the House passed the Marijuana Opportunity, Reinvestment and Expungement (MORE) Act which would remove cannabis from being a Schedule I controlled substance and enact a variety of social and criminal justice reforms. That legislation now has a better chance of advancing through the Senate to the President. A second piece of legislation critical to the future of cannabis industry in the U.S. is the SAFE Act.

While some see these developments putting legalization on the horizon, others believe that a drastic step like removal of the filibuster would be needed in order for such legislation to be brought to a vote. And, Mitch McConnel and the Republicans are not likely to go along with such action. Also, with all that President Biden has on his most pressing agenda, cannabis may not be an issue he wants to tackle immediately. Nevertheless, these developments have brought a new sense of urgency to the industry; an industry that is quickly bringing enterprise market valuations more accurately in line with the more realistic value of cannabis businesses – grounded in actual financial performance.

Earlier this Trulieve Cannabis Corp., the largest of the medical cannabis operations in Florida announced the agreement for the acquisition of Arizona-based Harvest Health and Recreation Inc. – a $2.1billion deal. That transaction shows that the industry is maturing to the point that strategic acquisitions – in this case the combined business will have operations in 11 states, comprising 22 cultivation and processing facilities with a total capacity of 3.1 million square feet, and 126 dispensaries serving both the medical and adult-use cannabis markets – are being made instead of the “Wild West” mentality that persisted throughout recent years. With stronger fundamentals now, investors can make more informed decisions when evaluating M&A opportunities.

The Pace of the M&A Activity Quickens

- Columbia Care completed the acquisition of The Green Solution (TGS) and Project Cannabis (PC) at the end of last year. Colorado-based TGS which generated $88M in revenue and $18M in EBITDA in 2020; California-based PC, revenue of $55M and $11M in EBITDA.

- In the Trulieve-Harvest Health acquisition cited earlier in this article, the all-stock $2.1 billion deal has created, according to Trulieve, the most profitable Multistate Operator in the U.S.

- In January, Ireland-based Jazz Pharmaceuticals acquired United Kingdom-based GW Pharmaceuticals in a $7.2-billion deal. GW Pharmaceuticals, as you may recall, is the manufacturer of the first cannabis-based medication approved by Food and Drug Administration – Epidiolex.

- Curaleaf Holdings Inc. entered into a definitive agreement with Los Sueños Farms to expand Curaleaf’s Colorado operations, becoming a vertically integrated company with outdoor cannabis grow facilities covering 66 acres of outdoor cultivation capacity, an 1,800-plant indoor grow, and two retail cannabis dispensary locations serving adult-use customers. The acquisition price was $49 million for operating companies, $18 million for farm property and assets.

- In a CA$50 million deal, HEXO (NYSE:HEXO,TSX:HEXO) has announced expanding its Canadian operations with the pending acquisition of 48North (TSXV: NRTH), upscale cannabis products manufacturer.

- FWB Florida, a new subsidiary of Red White & Bloom Brands Inc. announced that its own new subsidiary, RWB Florida LLC, has acquired all shares of Acreage Florida Inc. from High Street Capital Partners, a subsidiary of Acreage Holdings Inc. RWB is a vertically integrated Florida licensee. The basic deal included a cash payment of US$5 million and a cash purchase payment of approximately US$16 million.

- Australis Capital (OTCQB:AUSAF) agreed to buy cannabis company Green Therapeutics LLC in an approximate CA$10 million deal giving Australis a Las Vegas portfolio of companies including GT Flowers and the Tsunami™ and Provisions™ brands.

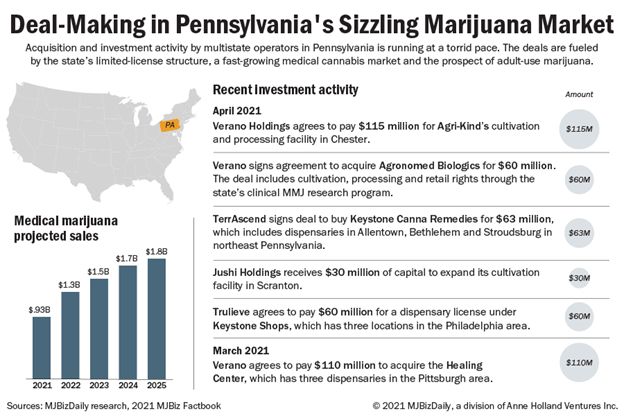

- And, just since March, some $400+ million acquisitions and investments have taken place in the hot Pennsylvania market as shown in this graphic from MJBizDaily:

Sorting Through the Right Investment to Meet Your Portfolio Strategy

For our clients, here is the advice we provide as they assess M&A opportunities in the cannabis industry:

- Know what the organization is getting into– Detailed due diligence and proper integration planning are key to identifying potential issues.

- Get the right people involved– Determine essential stakeholders early and get them involved. By doing so, retention and change issues will be minimized.

- Know what the organization wants out of the deal– Determine objective business decision criteria to minimize political issues and the impact of personal preferences.

- Get it done right – Devote the necessary resources even if the company is “running lean.” Transaction execution and integration are together a full-time job.

- Know what success means– Establish a measurement process for performance milestones to track the progress toward the success of integration activities.

- Don’t underestimate the infrastructure– The IT function must be an integral part of both the due diligence and integration planning efforts. IT is a critical enabler of all integration efforts.

- Over-communicate– Personnel will be forgiving at first and will not expect all the answers. They will, however, expect strong leadership that has a vision and a plan for realizing that vision, and how to blend the cultures of the merging organizations into a compatible, inclusive growth-oriented environment.

What’s It Really Worth?

Once it is confirmed that legal/compliance requirements are met then the next major step is conducting a realistic valuation of the merged businesses. Your investment banking advisory should positively understand the idiosyncrasies of the cannabis industry in order to identify a valuation range that ensures the buyer is not overpaying and that the seller’s proformas are verifiable.

What It Takes to Make It Over the Finish Line

- The Vision of the Parties

- All stakeholders to the M&A transaction must have a clear vision as to the direction toward profitability the marriage of the parties will take. This requires good advice about the fundamental legal and business issues that will arise and the judgement calls that will have to be made during the process to keep a clear vision for the post-closing entity.

- Commitment

- Once the decision is made that a buyer’s objectives are better served by acquiring rather than taking the path of organic growth, all key management team members must fully buy into that direction regardless of hurdles that will arise along the way.

- Culture Comprehending ESG – The Critical Role it Plays in Realizing the Value in an M&A Deal

- A critical component of the very essence of the deal is the shared values and behaviors in Environmental, Social, and Governance (ESG) that shape employee experience, interaction and morale within an organization. Understanding the Culture Equation avoids differences that are likely to become too hard to manage after the transactions is completed.

Once the vetting process is completed the outreach process begins to all potential qualified acquirers. Our contact list numbers in the thousands of PE firms, MSOs, Pubcos, HNW, Family Offices and other qualified investors. They are contacted, sign our Non-disclosure agreement, are supplied with an Executive Summary about the opportunity and invited for a full presentation of an informative pitch deck and financials.

Investor Takeaway

The cannabis industry is maturing at an accelerating pace. The initial irrational exuberance and “Wild West” of the early days of the industry are history. Industry fundamentals are very bullish, straight through the pandemic when cannabis was proven to be essential, almost recession-proof. Virtually every trend is pushing the industry forward. Potential pitfalls will always exist in this heavily nuanced industry – recently in the EDGE Briefing we have covered the challenges the industry will be facing with the issues of secondhand smoke/vape and Greenhouse Gas emissions – that require specialized due diligence by experienced advisors. Nevertheless, as more sources of capital become available the trend we are seeing in M&A activity will most likely increase. This will enable MSOs to build market share and roll out into new markets. And, company management can now be measured by the financial results, of achieving substantial EBITDA and positive cash flow. The leading cannabis companies are bullish and eager for consolidation opportunities regardless of the pace of national legalization. So, businesses are advised to begin the necessary pipeline and diligence efforts now to be ready for consolidation opportunities where the window of opportunity can close quickly.

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.