Deal Volume on the Rise

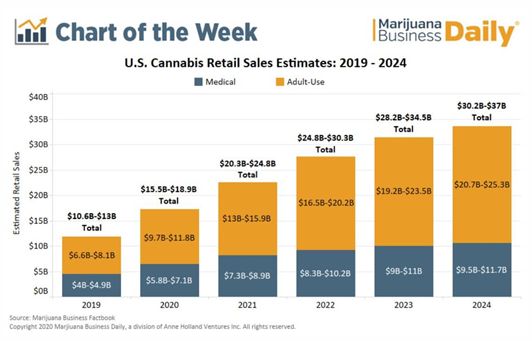

Cannabis M&A Action into 2021 Already valued at about $50 billion, the cannabis industry continues to expand globally at a record pace, expected to surge over the next decade. As we reported in a recent issue of the EDGE Briefing, while COVID-19 shuttered many traditional businesses, more cannabis than ever before was consumed in the U.S. in 2020 – a record $17.5B in legal sales – a 46% increase from 2019, according to a recent report cited in Forbes published by BDSA, a cannabis sales data platform. This was aided by the unprecedented step taken by 28 of the legal cannabis states during the height of the pandemic where dispensary operations were classified as “essential businesses.”

Marijuana Business Daily tracks/projects the growth of the industry in this manner…

Bringing much needed capital to this industry that major financial institutions still are legally bound to avoid is the ever-increasing volume of Mergers & Acquisitions that began to surge in Q4 last year when over $600 million in M&A transactions were announced. Expectations for 2021, where the watchword is “consolidation,” are already being exceeded. M&A is being led by multi-state operators (MSOs) who have achieved scale, cleaned up their balance sheets and stockpiled dry powder for roll-up acquisitions. These MSOs are now acting more like CPG companies in the maturing cannabis market. The valuation model for acquisitions in the cannabis space is evolving from one based on sales, typically associated with emerging growth industries, to a more mature industry model based on profits or Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). Many large cannabis MSOs have stabilized and generate positive EBITDA, which justifies the evolution away from a sales-driven model. The larger MSOs have raised money and realize that solidifying operations is essential before the sector opens up to larger traditional business competitors and institutional capital entering the market.

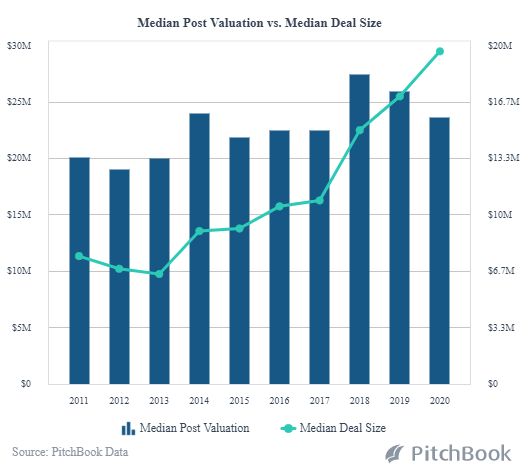

Sources like Pitchbook, for one, project deal size and post valuations will be on the rise.

2021 M&A Transactions

In March, U.S. News reported that the U.S. cannabis industry had already raised $2 billion in equity capital in 2021. That total was dwarfed on May 10 when in one transaction alone Trulieve acquired Harvest for over $2 billion. Here is a look at the major transaction activity to date:

- Just last week Trulieve (CSE: TRUL) (OTC: TCNNF) acquired Harvest Health and Recreation (CSE: HARV, OTCQX: HRVSF) in a $2.1 billion deal that forms in the U.S. what is reported to be the “world’s most profitable multi-state operator.” This is based on the combined adjusted EBITDA of $461 million that Trulieve projects for 2021. Trulieve will now have a retail network of 126 dispensaries across 11 states which they state gives them “an unparalleled platform for continued growth.”

- Following this development TerrAscend closed the acquisition of U.S. companies GuadCo, LLC and KCR Holdings LLC for roughly US$70 million which will expand dispensary operations in Southeastern Pennsylvania.

- Then in February, one of the most significant mega-deals in the cannabis industry closed when Ireland-based Jazz Pharmaceuticals laid down $7.2-billion for United Kingdom-based GW Pharmaceuticals. GW Pharmaceuticals is the pioneering pharma manufacturer that was successful in obtaining U.S. FDA approval of the cannabis-based epilepsy drug Epidiolex.

- Cresco Labs (CRLBF), a Chicago-based MSO which now operates in 9 states acquired Bluma Wellness for $213 million.

- Among the numerous deals Verano – the Chicago-based MSO that has been on an acquisition roll of dispensaries in Arizona, Pennsylvania and Ohio – closed its acquisition of Florida-based Alternative Medical Enterprises (AltMed) in February for an undisclosed amount.

- The acquisition of the CBD distributor, Green Roads, by Canada’s Valens Company(TSX: VLNS) (OTCQX: VLNCF) is expected to close in June.

- New York-based Ayr Strategies (AYRWF) acquired Florida-based Liberty Health Sciences (LHSIF) for $290 million.

- For a 31.5% position in Curaleaf International, Curaleaf Holdings (CSE:CURA,OTCQX:CURLF)secured a US$130 million investment from a source described as a “strategic institutional investor.” This is an extension of the company’s Green Wave of Acceptance strategy that began last year with the US$200 million offering made on the CSE that turned out to be over-subscribed to the tune of US$251 million.

- Turning Point Brands, Inc.(NYSE: TPB), Louisville, KY, invested $8.7 million in Docklight Brands Inc., owner of the popular Bob Marley brand of cannabis and CBD products.

- Green Thumb Industries Inc. (CSE: GTII) (OTCQX: GTBIF), recently announced the inking of an agreement to acquire 100% of Dharma Pharmaceuticals, the medical cannabis distributor in Virginia.

- And, in early April came the long-anticipated announcement that Canopy Growth Corp finalized the agreement to acquire Supreme Cannabis Company in a mega-deal valued at US$346 million. Closing is expected in June. Canopy, as you may recall, currently has the largest market cap of all the Canadian cannabis pubcos on the strength of a US$4 billion investment by Constellation Brands.

More Deals to Come

The aggressive appetite for acquisitions continues with more activity on the books:

- With more interest in cannabis being evinced by Big Tobacco, British American Tobacco provided a cash infusion that enabled Organigram Holdings (NASDAQ:OGI,TSX:OGI) to announce the coming acquisition of The Edibles & Infusions Corp. with cash and shares transaction.

- Trulieve Cannabis (CSE:TRUL,OTCQX:TCNNF) announced a pending $60 million cash and shares deal with Keystone Shops, giving Trulieve 83 dispensaries in Pennsylvania.

- Jushi Holdings Inc. (CSE: JUSH) (OTC: JUSHF) is in the process of acquiring Nature’s Remedy for $110 million, giving Jushi 2 dispensaries and a cultivation/production facility.

- Colorado-based General Cannabis Corp (OTCQB: CANN) is set to acquire cannabis retailer Trees for a reported $40 million cash deal.

- In California, due to close this month is the merger between Caliva and Left Coast Ventures into the Subversive Capital Acquisition SPAC.

- Last month MSO Cresco Labs (CSE:CL) (OTCQX:CRLBF) is awaiting final clearance from the U.S. DOJ Antitrust Division under the Hart-Scott-Rodino Antitrust Improvements Act to initiate the acquisition of Cultivate Licensing LLC and BL Real Estate. The acquisition that requires a waiting period and additional approval in Massachusetts is expected Q4.

- And, just a little over a week ago the final process was set in motion for Canadian cannabis giants the Aphria -Tilray reverse acquisition. According to the companies, this merger will create the world’s largest cannabis company based on revenue. That is based on the estimated 2020 revenue of the combined Tilray-Aphria of $874 million, putting it ahead of U.S. MSO Curaleaf Holdings at $842 million and Canada’s Trulieve at $602 million.

Driving Factors

Despite abundant money available to the large multi-state operators (MSOs), most cannabis companies still have relatively limited avenues to raise capital due to the federal illegality of the industry. How soon will it change now that the democrats control both houses of congress is still debatable. With the recent passage of the Secure and Fair Enforcement Banking Act (the “SAFE Banking Act”) in the U.S. House of Representatives there is hope that future expansions into the U.S. market may be possible for Canadian companies. The SAFE Banking Act proposes offering safe harbor from federal prosecution to financial institutions like banks and insurance companies that provide services to cannabis businesses. Cannabis M&A Action into 2021

Currently, American cannabis companies are working in a peculiar situation where they are fully compliant with state laws, but are at odds with federal legislation. Financial institutions require federal payment systems to operate and are under the purview of federal authority. Since cannabis is illegal at the federal level, financial institutions are unwilling to become involved with business operations that are offside federal legislation. The hope is that with the formal introduction of the SAFE Banking Act, financial institutions will be able to meet community needs, reduce cash motivated crimes, make tax collection more efficient, and allow the industry to grow and develop further. Certainly, the mood in Washington DC has a strong effect on deal decisions. There is, of course, a flurry of Executive Orders coming out of the Oval Office and new laws and regulations promised on taxes, trade, healthcare and the environment being pursued. This extends to cannabis legislation where more progress is anticipated within the next two years – prior to mid-term elections, November, 2022. Cannabis M&A Action into 2021

Last December the house passed the Marijuana Opportunity, Reinvestment and Expungement (MORE) Act which would remove cannabis from being a Schedule I controlled substance and enact a variety of social and criminal justice reforms. That legislation now has a better chance of advancing through the Senate to the President. A second piece of legislation critical to the future of cannabis industry in the U.S. is the SAFE Act.

While some see these developments putting legalization on the horizon, others believe that a drastic step like removal of the filibuster would be needed in order for such legislation to be brought to a vote. And, Mitch McConnel and the Republicans are not likely to go along with such action. Also, with all that President Biden has on his most pressing agenda, cannabis may not be an issue he wants to tackle immediately. Nevertheless, these developments have brought a new sense of urgency to the industry; an industry that is quickly bringing enterprise market valuations more accurately in line with the more realistic value of cannabis businesses – grounded in actual financial performance. Cannabis M&A Action into 2021

Sorting Through the Right Investment to Meet Your Portfolio Strategy

For our clients, here is the advice we provide as they assess M&A opportunities in the cannabis industry:

- Know what the organization is getting into– Detailed due diligence and proper integration planning are core to identifying potential issues.

- Get the right people involved– Determine essential stakeholders early and get them involved. By doing so, retention and change issues will be minimized.

- Know what the organization wants out of the deal– Determine objective business decision criteria to minimize political issues and the impact of personal preferences.

- Get it done right – Devote the necessary resources even if the company is “running lean.” Transaction execution and integration are together a full-time job.

- Know what success means– Establish a performance milestones measurement process to measure the success of integration activities.

- Don’t underestimate the infrastructure– The IT function must be an integral part of both the due diligence and integration planning efforts. IT is a critical enabler of all integration efforts.

- Over-communicate– Personnel will be forgiving at first and will not expect all the answers. They will, however, expect strong leadership that has a vision and a plan for how to get there, how to blend the cultures of the merging organizations into a compatible, inclusive growth-oriented environment.

What’s It Really Worth?

Once it is confirmed that legal/compliance requirements are met then the next major step is conducting a realistic valuation of the merged businesses. Your investment banking advisory should positively understand the idiosyncrasies of the cannabis industry in order to identify a valuation range that ensures the buyer is not overpaying and that the seller’s proformas are verifiable.

What It Takes to Make It Over the Finish Line

- The Vision of the Parties

- All stakeholders to the M&A transaction must have a clear vision as to the direction toward profitability the marriage of the parties will take. This requires good advice about the fundamental legal and business issues that will arise and the judgement calls that will have to be made during the process to keep a clear vision for the post-closing entity.

- Commitment

- Once the decision is made that a buyer’s objectives are better served by acquiring rather than taking the path of organic growth, all key management team members must fully buy into that direction regardless of hurdles that will arise along the way.

- Culture Comprehending ESG – The Critical Role it Plays in Realizing the Value in an M&A Deal

- A critical component of the very essence of the deal is the shared values and behaviors in Environmental, Social, and Governance (ESG) that shape employee experience, interaction and morale within an organization. Understanding the Culture Equation avoids differences that are likely to become too hard to manage after the transactions is completed.

For our clients, once the vetting process is completed the outreach process begins to all potential qualified acquirers. Our contact list numbers in the thousands of PE firms, MSOs, Pubcos, HNW, Family Offices and other qualified investors. They are contacted, sign our Non-disclosure agreement, are supplied with an Executive Summary about the opportunity and invited for a full presentation of an informative pitch deck and financials. Cannabis M&A Action into 2021

Investor Takeaway

Leadership to market dominance typically does not happen by slow, steady organic growth. The May 10th announcement that Trulieve is acquiring Harvest in a $2.1 billion deal to form the world’s most profitable MSO is substantiation. The ever-increasing volume of Mergers & Acquisitions began to surge in Q4 last year when over $600 million in M&A transactions were announced. Consolidation and mega-deals have already set the tone for 2021. Multi-state operators (MSOs), such as the Trulieve/Harvest example, are leading the charge in the U.S. by having achieved scale, cleaned up their balance sheets and stockpiling dry powder for roll-up acquisitions. These MSOs are now acting more like CPG companies in the maturing cannabis market. In Canada, investors want strategic ways to gain greater access to the U.S. cannabis market. M&A transactions, as exemplified by the pending Aphria-Tilray reverse acquisition, are expected to play greater role. The valuation model for acquisitions in the cannabis space is evolving from one based on sales, typically associated with emerging growth industries, to a more mature industry model based on profits or Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) which justifies the evolution away from a sales-driven model. So, businesses are advised to begin the necessary pipeline and diligence efforts now to be ready for consolidation opportunities where the window of opportunity can close quickly. Like all investments, though, following a thoughtful due diligence process aided by experienced advisers is recommended for the rapidly evolving cannabis industry. Cannabis M&A Action into 2021

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.