Investor Takeaway Cannabis Legalization – Lessons Learned from CBD/Hemp

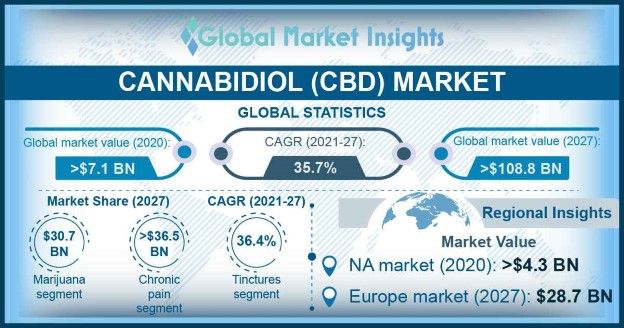

The value of the hemp market reached $824 million in 2021. The global CAGR of the CBD industry is projected to grow at a massive 35.7% from 2021 to 2027, yielding a $108.8 billion market value by 2027. The major breakthrough that spawned this growth, the 2018 Farm Bill. According to it, the cultivation, manufacture, distribution, and dispensing hemp was now allowed and CBD production was made legal under restrictions stated in the legislation. Thus, the supercharged CBD market began in earnest. Yet several revisions of the Farm Bill and conflicting messages, even silence, from the U.S. Food and Drug Administration on critical issues continues to raise questions about the legality of hemp-related products. What is legal and what is not; what are the problems and loopholes in the current hemp/CBD federal legislation; and what are the lessons to be learned for effective federal cannabis legalization? Answers to these questions require national standards that resolve the vagaries of the laws in state jurisdictions. Yet, predictions are still strong that these hurdles will be overcome and consumer demand will pull the cannabis industry to its full potential. In all cases, due diligence with experienced guidance in the nuanced cannabis industry is the first step in approaching this marketplace.

State of the CBD/Hemp Market Cannabis Legalization – Lessons Learned from CBD/Hemp

A study by the U.S. Department of Agriculture (USDA) as reported in Jdsupra.com as the first-ever federal survey on the hemp industry, found that the value of the hemp market reached $824 million in 2021. Cannabis industry research source the Brightfield Group has calculated the global CAGR of the CBD industry to grow at a massive 35.7% from 2021 to 2027, yielding a $108.8 billion market value by 2027.

This surging growth followed the de-scheduling of hemp in the 2018 Farm Bill. This legislation opened financing resources for the hemp cultivation industry and prompted the adoption of CBD by major CPG manufacturers, mass retailers and the healthcare industry. According to Brightfield Group:

There is too much momentum, too much demand, and too much potential for this industry not to continue expanding toward the forecasted $20 billion (U.S market) by 2025.

This they forecast despite what they aptly identify as “the bizarre and challenging regulatory framework that surrounds this industry.” Just as is the objective of the entire cannabis industry, marijuana included, the CBD and Hemp industries just want to be normalized and operate under the same set of rules and regulations as any other consumer products industry. Yet, a patchwork of state regulations and deafening silence by the FDA on the issues of CBD as an ingredient in foods and cosmetics still provides no national regulatory standard for the legality of hemp and CBD products.

What Exactly are CBD and Hemp?

CFAH.org, a straight-talking medication information resource, summarizes CBD, short for “cannabidiol,” as just one of over 400 cannabinoid and other chemical compounds found in the lowly 7-point leaf cannabis plant. Of those compounds, CBD had been found, at least to date, to be the most relevant for medical use. CBD has proven effective in working with the receptors and hormones of the endocannabinoid system in the human body potentially providing a long list of benefits and uses. CFAH found that:

Even the World Health Organization recently stated that “In humans, CBD exhibits no effects indicative of any abuse or dependence potential. To date, there is no evidence of public health-related problems associated with the use of pure CBD.”

Regarding Hemp, Prima Magazine points out the difference between marijuana and hemp being that hemp, while in the same cannabis family, comes from Cannabis sativa L. plants (distinguished from marijuana by their 5-point leaf) which contain 0.3% THC or less. Over that THC limit and the plant is considered federally illegal marijuana. With the passage of the 2018 Farm Bill, hemp is now legally grown nationally. Of its many uses, as a source of nutritional supplements it is now under the jurisdiction of the Food and Drug Administration (FDA). Like CBD, however, the FDA has not issued standard guidelines for the sale of hemp-derived products. Even though legal, the process for clarification always seems to be, as Brightfield Group summarizes it, two steps forward, one step back – likely to come across yet more problematic regulations and bumps along the way.

And regarding the difference between cannabis CBD and hemp CBD, both hemp and marijuana plants contain CBD. This component is more abundant in the hemp plant, making processing CBD from that source more economical. The other significant difference is a legal distinction. CBD coming from the hemp plant is within the FDA guidelines and is legal in all states. CBD from the marijuana must prove that it contains only .03% or less THC, which often becomes a contentious issue.

So, What’s Legal and What’s Not?

CFAH. org reminds us that standards are still up to each state to work out in response to federal legalization. And “while the laws on CBD’s legalities are loosening federally, in a select few states you can still be arrested and thrown in jail for having a bottle of CBD oil on you.” Basically, the latest changes in the Farm Bill have divided the country into two basic categories:

- Legal States

There are currently 9 states in this category – including states Washington Colorado, Oregon, and California that adapted their laws in advance of Farm Bill changes – where CBD products are readily available at retail and online.

- Conditionally Legal States

The rest of the states allow citizens to buy CBD/hemp-derived products with an array of restrictions. Examples range from needing a doctor’s approval in North Dakota and Minnesota to where online sales are prohibited in Michigan and Nebraska.

In some states, such as North Dakota or Minnesota you’ll need a doctor’s approval and licensed medical card in order to buy cannabis products including CBD.

Farm Bill Refinements and an Unintended Consequence

Following previous adjustments to the regulation first approved in the 2018 Farm Bill a new congressional bill submitted early last month seeks to provide hemp businesses with the greater flexibility they have been seeking. Provisions will expand lab testing options beyond only those authorized by the DEA, allow people with prior minor drug offenses to rejoin the industry, and seeks to increase the legal THC threshold for hemp products from the current 0.3 percent to 1 percent on a dry weight basis. A major provision in the proposed legislation will be to clarify the status of the Delta-8 THC variant.

It turns out that an unintended consequence of the 2018 Farm Bill is that while it clearly specified that only a hemp plant with less than 0.3 percent of Delta-9 THC is legal, it left the door open for other intoxicating isomers like Delta-8-THC which has the same chemical formula, but with the molecules slightly rearranged. The new Farm Bill fix proposes to close the Delta-8 v. Delta-9 loophole.

The California Example

Natural Products Insider has been tracking approved California legislation from late last year designed to clarify a controversy in the federalization of the use of CBD in dietary supplements, foods, beverages and cosmetics, with AB45, a bill to legalize it in the state. In the Insider, Jody McGuinness, executive director of the Hemp Industries Association, is quoted as saying, though, that: “There is no doubt that legalizing CBD in the world’s fifth-largest economy is a major win for hemp. But some of the onerous and impractical restrictions in this bill are going to create significant problems for manufacturers and farmers alike.” This third attempt to get a CBD bill passed in California is still fraught with problems related to overbearing state government restrictions and oversight leading the Insider to conclude that “the California law brings into sharper relief the fact that there is no real federal regulation around CBD.” It simply perpetuates the patchwork of 50-state solutions being attempted in the lack of conclusive direction from the FDA.

Lessons for Cannabis Legalization

What are the Implications then of all the fits and starts in CBD/Hemp legalization for the cannabis industry? In a dissertation by Julie Andersen Hill carried in the Boston Law Review she points out factors including the following:

- Federal legalization of marijuana is also unlikely to immediately solve the marijuana industry’s banking problems. Hemp legalization did not throw open the doors of all banks. Instead, most banks waited on the sidelines as federal, state, and tribal officials worked to develop a regulatory framework to oversee the industry.

- Even states that have already legalized marijuana would have to adjust their regulation to conform to a new federal structure.

- The hemp experience shows that the content of the federal regulatory structure matters for banking.

- As policy makers consider cannabis regulatory schemes, they should avoid creating situations where it is difficult for the industry and banks to confirm compliance with the law, as the consequences of non-compliance are financially significant.

As we can see from this CBD/hemp experience, federal legalization alone is not enough. The industry needs regulatory structure that establishes a baseline. One that provides a platform for robust state-initiated legislation to support federal efforts to begin to mitigate the risks inherent in an investment in this emerging industry.

Making the Right Decision for Your Investment Portfolio

So, whatever the future of federal legalization holds, investment in those operators that can scale into leadership positions is the soundest investment strategy. Then, when full legalization does occur those companies will have strong exit possibilities with valuations superior to their peers. However, especially in emerging markets, due diligence is key to identify the real players from the pretenders.

The approach we take with our clients for risk mitigation prior to presenting strategic cannabis investment opportunities: evaluating the prowess and the passion of the executive team, assessing the competitive advantage of the company and how quickly they can scale for growth, and determining how well they are ready for the regulatory regimen in their home and target growth markets. We take these steps before presenting the company to our extensive network of pre-qualified investors.

Investor Takeaway

The value of the hemp market reached $824 million in 2021. The global CAGR of the CBD industry is projected to grow at a massive 35.7% from 2021 to 2027, yielding a $108.8 billion market value by 2027. The major breakthrough that spawned this growth, the 2018 Farm Bill. According to it, the cultivation, manufacture, distribution, and dispensing hemp was now allowed, and CBD production was made legal under restrictions stated in the legislation. Thus, the supercharged CBD market began in earnest. Yet several revisions of the Farm Bill and conflicting messages, even silence, from the U.S. Food and Drug Administration on critical issues continues to raise questions about the legality of hemp-related products. What is legal and what is not; what are the problems and loopholes in the current hemp/CBD federal legislation: and what are the lessons to be learned for effective federal cannabis legalization? Answers to these questions require national standards that resolve the vagaries of the laws in state jurisdictions. Yet, predictions are still strong that these hurdles will be overcome and consumer demand will pull the cannabis industry to its full potential. In all cases, due diligence with experienced guidance in the nuanced cannabis industry is the first step in approaching this marketplace.

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2022 opportunities with our core expertise in CBD/Hemp and Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and SaaS. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.