Mention cannabis just a few short years ago and the images that came to mind would certainly not foretell that this substance – still listed in Schedule I, the most dangerous and addictive classification, of the Federal Controlled Substances Act – would become one of the fastest growing industries. For investors what, in fact, are the trends now unveiling as we progress into the second half of 2021? Cannabis Investment Trends 2021

Explosive Growth. Accelerated Legalization.

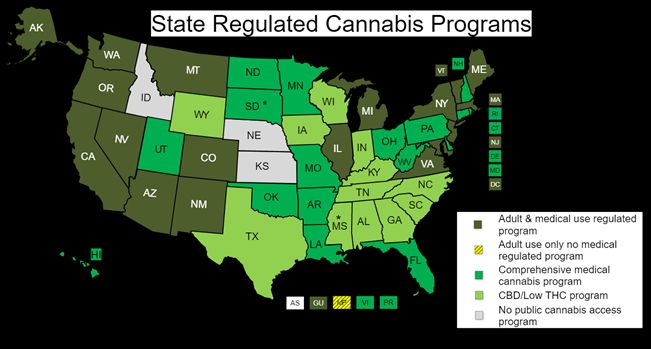

As you know from previous reports in EDGE Briefings, citing a report in Forbes by BDS Analytics, more cannabis than ever before was consumed in the U.S. in 2020 – a record $17.5 billion in legal sales. Legal changes have spawned a burgeoning industry where 36 states, District of Columbia, Guam, Puerto Rico and U.S. Virgin Islands have approved comprehensive, publicly available medical marijuana/cannabis programs. And, as of April 14 as reported by the National Conference of State legislatures (NCSL) 18 of those states (now actually 19, with the recent inclusion of Connecticut), two territories and the District of Columbia have enacted legislation for adult use as well:

- Voters in Arizona, Montana, New Jersey, and South Dakota approved measures to regulate cannabis for adult use.

- On February 8, 2021, South Dakota Circuit Judge Christina Klinger ruled that the measure was unconstitutional. The decision is being appealed as of March 31, 2021.

- New Jersey’s governor signed enacting legislation on March 1, 2021.

- New York’s legislature and governor enacted AB 1248/SB 854 on March 31, 2021.

- The Virginia legislature passed legislation on February 27 and approved the governor’s amendments on April 7, 2021.

- New Mexico legislature passed legislation on March 31 and the governor signed legislation on April 12, 2021.

Currently, American cannabis companies are working in a peculiar situation where they are fully compliant with state laws, but are at odds with federal regulations. Financial institutions require federal payment systems to operate and are under the purview of federal authority. Since cannabis is illegal at the federal level, financial institutions are unwilling to become involved with business operations that are offside federal legislation. Yet, according to Gallup Research, 68% of the U.S. population supports the full legalization of cannabis. As a result of mounting pressure from the public and the vocal support of the current administration, the potential of federal legalization seems to be just a matter of when, not if.

This month Senators Schumer, Booker, and Finance Committee Chairman Wyden introduced the first draft of the Cannabis Administration and Opportunity Act . The key elements of the bill:

- Remove marijuana as a Schedule I substance.

- Levy national taxes on the sale of marijuana

- Wipe clean the criminal records of those convicted of minor marijuana-related offenses

This combined with the progress of the SAFE Banking Act through Congress and the House passage of the MORE Act cast legalization in a whole new light. This progress is already a long way from the ‘90’s when the first medical marijuana was legalized in California, and 2012 when Colorado and the State of Washington first approved recreational use.

CBD sales, products that face far less legal strictures than those containing THC, have also experienced explosive growth since the passage of the 2018 Farm Bill. According to the Brightfield Group, a leading research firm for emerging product categories, CBD sales are projected to reach $12.4 billion by as early as 2023. Cannabis Investment Trends 2021

Proven Economic Impact

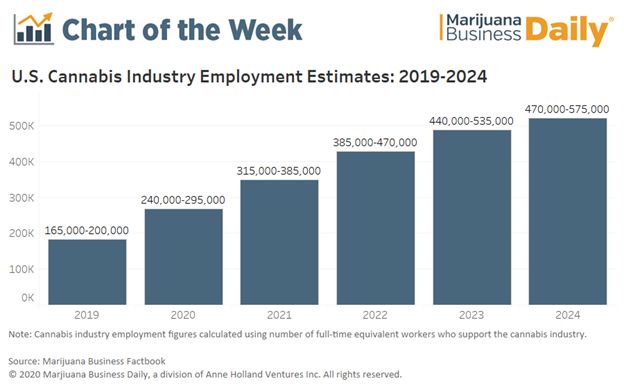

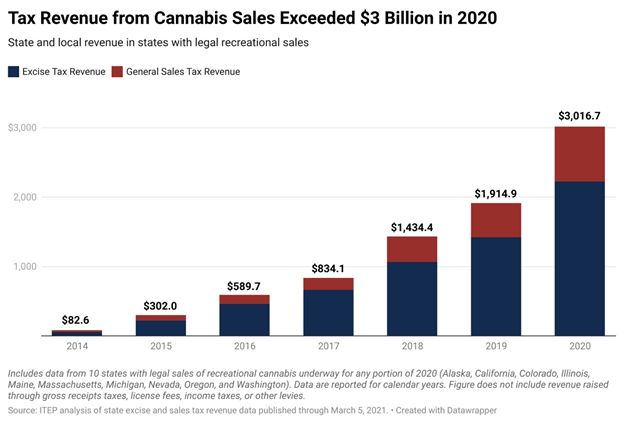

The impact from legal cannabis sales on the economy is projected to reach $92 billion this year. This projection from data compiled by MJBizDaily shows that for every $1 spent by consumers and patients in the recreational and medical markets, an additional $2.50 flows into the economy. Jobs created within/related to the industry could reach as high as 385,000 this year. This has already had a far-reaching effect on key measures of the economy. Taxes collected are estimated to be as high as $3 billion in 2020, reduce law enforcement costs are being realized, and evidence is growing that cannabis can be instrumental in cutting down the rate of opioid addiction. Cannabis Investment Trends 2021

Regarding employment, the MJBizDaily analysis goes on to project that the number of workers in the U.S. cannabis industry will jump to as high as 385,000 by the end of the year. For perspective, this is actually slightly higher than the number of computer programmers employed in the U.S. Cannabis Investment Trends 2021

From tax data analyzed by the Institute on Taxation and Economic Planning (ITEP) from the 10 states in 2020 where adult use as well as medical marijuana was legal, excise and sales taxes exceeded, as mentioned above, $3 billion in 2020 – over a $1billion increase over 2019. And, that $3 billion total included $1 billion in California alone.

With the growth in cannabis usage in legal states and the new markets opening in states now making cannabis legally available these tax revenues are only bound to increase in the short-term. And from a long-term perspective, along with their employment forecast New Frontier also projects that federal legalization of cannabis could generate an additional $105.6 billion in federal tax revenue by 2025.

Industry Consolidation

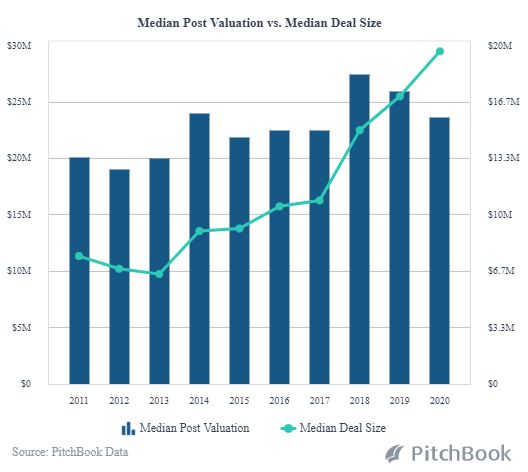

Leadership to market dominance typically does not happen by slow, steady organic growth. The May 10th announcement that Trulieve is acquiring Harvest in a $2.1 billion deal to form the world’s most profitable MSO is substantiation. The ever-increasing volume of Mergers & Acquisitions began to surge in Q4 last year when over $600 million in M&A transactions were announced. Consolidation and mega-deals have already set the tone for 2021. Multi-state operators (MSOs), such as the Trulieve/Harvest example, are leading the charge in the U.S. by having achieved scale, cleaned up their balance sheets and stockpiling dry powder for roll-up acquisitions. These MSOs are now acting more like CPG companies in the maturing cannabis market. In Canada, investors want strategic ways to gain greater access to the U.S. cannabis market. M&A transactions, as exemplified by the pending Aphria-Tilray reverse acquisition, are expected to play greater role. The valuation model for acquisitions in the cannabis space is evolving from one based on sales, typically associated with emerging growth industries, to a more mature industry model based on profits or Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) which justifies the evolution away from a sales-driven model. Cannabis Investment Trends 2021

Sources like Pitchbook, for one, project deal size and post valuations will be on the rise.

Capital Flowing into the Cannabis Industry

As we reported in a recent EDGE Briefing, 2021 is becoming the most lucrative year in the history of legal cannabis in the U.S. With public support for legalization and states coming out of the pandemic in their own panic for increased tax revenues, funding is flowing into this capital-constrained industry. The majority of states now have medical and, in many cases, adult use legalization in place and sources like Grand View Research project a US industry size of $33 billion this year, $84 billion by 2028. Through May, capital raised in the cannabis industry totaled over $6.6 billion, compared to only a little over $2.3 billion in 2020. As more debt providers come online, recent multimillion-dollar debt funding among cannabis industry leaders shows that debt as a capital source for cannabis companies is a rational use of capital – potentially cleaning up balance sheets and enabling access to funding for expansion and/or the purchase of distressed assets coming out of the pandemic – to use debt financing for competitive advantage in the marketplace.

And all this is even before Big Tobacco and Big Pharma get more deeply into the industry to bring their level of professional management to cannabis operations.

Cannabis Industry Maturing to the Point of Turning to Debt

While the industry has been capital-constrained, borrowing against assets has been a key source available for many cannabis companies to pursue. Vertically integrated cannabis companies often have significant real estate and other assets that can be leveraged. What has changed now, though, is that more debt providers have come online over the past couple of years addressing a range of needs. This means that cannabis companies can now refinance at more attractive rates. Significant developments: Cannabis Investment Trends 2021

- In 2020, large MSOs Curaleaf and Cresco Labs announced their debt raises of approximately $300M and $200M, respectively, illustrating the capital available at the high-end of the market at that time. Then, on January 11 this year, Curaleaf has again secured a new round of financing – a $50 million secured revolving credit facility with a three-year term. Curaleaf will be paying a 10.25% interest rate for funds when needed. This is significantly lower than the interest rates cannabis companies paid for loans in previous years when the likelihood of progress on easing federal regulations did not look as promising.

- When its stock was floundering in 2020, Acreage Holdings was able to raise debt with the credit arm of an unidentified institutional investor, for up to $100M; as opposed to further diluting equity at their weak stock prices at the time.

- Chicago-based MSO Green Thumb Industries raised $217 million through the issuance of senior secured debt to retire existing senior secured debt and for “growth initiatives.” With an interest rate of 7% per year for the maturity date of April, 2024, Green Thumb describes this transaction as industry leading.

- Another Chicago-based MSO, Justice Cannabis, raised $22 million through a credit facility from Palm Beach-based AFC Gamma to build out a 72,000 sq. ft. cultivation/processing facility and acquire a dispensary in Ewing, New Jersey.

- Toward the end of 2020, Holistic Industries, a U.S. privately held, vertically-integrated cannabis company, closed an oversubscribed round of $35M in debt for expansion and the potential of acquiring distressed assets.

- In March 4Front of Phoenix raised $6.5 million in sale-leaseback deal with Innovative Industrial Properties for a property in Illinois, with an additional $45 million to build out 558,000 sq. ft. of cultivation.

- HEXO Corp. (TSX: HEXO)(NYSE: HEXO) closed a public offering of $360 million principal amount of senior secured convertible notes maturing May 1, 2023. Proceeds will fund the $331 million cash payment in HEXO’s $766 million acquisition of Redecan in Ontario, the largest private Canadian LP.

Debt Financing in Cannabis, What are the Options?

Sale and Leaseback Transactions

- While Sale-Leaseback (SLB) transactions aren’t technically debt they do allow companies to free up liquidity from their balance sheets without dilution. An SLB is the sale of real-estate assets to a buyer who then leases them back through a long-term lease. The upside of this alternative is that large cannabis companies increasingly have been selling their cultivation, processing and storage facilities and immediately leasing them back as a way to instantly raise tens of millions of dollars. The potential downside is that an SLB locks the asset seller into a long commitment than other straight debt alternatives that now are likely to be able to be secured for rates similar to the SLB. It should be noted, however, that in common debt transactions lenders will be looking for more than a mere promise to repay. A security interest and/or corporate or personal guarantee will most likely be required.

Asset-Based Lending

- Based on the valuation of real estate and equipment assets, a cannabis company can typically borrow from within the range of 40% to 75% of asset value. In the case of development projects, the loan is usually based on project costs. While less typical, there are some working capital debt options in the market as well; though the availability of this option is much less than for real estate and equipment financing.

Convertible Options

- Up to this point, most debt financing by cannabis companies was found in convertible note options with low conversion premiums – which essentially delay dilution of equity. The company creates a note that converts to equity, often preferred stock, at a future date based on a future valuation method. These notes, similar to promissory notes with interest payable on or before a maturity date, have given investors security that they are repaid before equity holders if something goes wrong. For both the investor and the company this note structure allows the valuation question to be answered in the future while providing needed capital to the company and a more secure instrument to investors.

- Events triggering “conversion” include:

-

- loan outstanding beyond its maturity date;

- company raising defined capital amount in priced equity round;

- sale of company; or

- change in “control” (ex, change in entity’s effective control or ownership; sale of a large portion of company’s assets).

MTN – Short-Term Solution to Minimize Dilution with Funding at Single Digit Rates

- True, that the three alternatives listed above are considered the standard. Now, however, a new alternative is emerging, the Medium Term Note (MTN) for companies with relatively strong balance sheets. An MTN is an alternative to traditional long-term and expensive short-term financing – to aid a company with such objectives as accelerating a growth strategy, facilitating a roll-up M&A strategy.

- An MTN is essentially a bond issuance through investment bankers and funded by private institutional sources, in the range from $20M to $100M+, with specific characteristics to facilitate being issued quickly in order to take advantage of temporary market opportunities.

- The key is to effectively customize the MTN with characteristics most advantageous to the issuer that appeal to the strategy of an investor. This results in rates typically lower than other forms of debt financing. With our network of institutional funding sources for MTNs we provide an overview of the funding need and the upside for investors. Then, we assist the issuer with legal, accounting, underwriting, and rating services in order to begin the preparation of the offering.

For companies seeking debt, the following are key considerations:

- Most cannabis debt providers will require personal guarantees (PG) from principals. This is always a tough decision for founders and one that carries real risk. Are you willing to PG the debt?

- What assets does the company have? Or is purchasing? Real estate, equipment, accounts receivable, other assets?

- Does the company have existing debt? And how much debt can the company take on while not taking undue risk with cash flow?

For investors who are considering lending to cannabis companies the following are key considerations:

- What are the credit scores of the principals? Is there any credit data on the company? How timely do they pay their payables, for example?

- What is the company’s existing cash flow? How realistic is the projection for future cash flow?

- How will the company use the funds? Is the use of funds realistic?

- What security will the investor have that they can recover funds if the loan isn’t repaid? PG? Cross-corporate guarantee? First lien on assets?

- Does the management team have the right experience for the type of project/company that they want to be?

- Does the company have its state and local cannabis licenses? If real estate is involved, what is the status of current local permits?

Investor takeaway

What are the investment trends guiding the cannabis industry to another explosive year in 2021? Primary among them is the flow of capital the industry is now experiencing as investors become more confident in the results of state-by-state legalization and the positive signs for federal legalization progress now coming out of Washington. While many VCs and virtually all major institutional investors are still on the sidelines until federal legalization does take place, alternatives to accessing capital have arisen in the form of equity funding, debt lending and the public market through strategic acquisitions by/alliances with Canadian pubcos; Through May, capital raised in the cannabis industry totaled over $6.6 billion, compared to only a little over $2.3 billion in 2020. With growing consolidation in the industry Mergers & Acquisitions, which recorded over $600 million in transactions in Q4 2020, are already exceeding that last year’s record. And as more debt providers come online, recent multimillion-dollar debt funding among cannabis industry leaders shows that debt as a capital source for cannabis companies is a rational use of capital.

How We Can Help

The critical factors in assessing the potential of the array of funding opportunities in the industry still rely on careful execution of the basics of investment analysis:

- Due diligence for understanding the full scope of the business in the industry segment being targeted.

- Analyzing the preemptive nature of the target’s business model.

- Determining the soundness of the financial statements, particularly in cases where they are yet to be audited.

- And assessing the zeal of the team charged with the task of growing a company into a multimillion-dollar operation.

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+. Cannabis Investment Trends 2021

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.