Here is How the Smart Money is Preparing NOW!

Managing Partner

A Look At the Cannabis Investment Landscape in 2023

- The cannabis markets have been in the doldrums since early 2021 when there was excitement over possible legalization with a new presidential administration. While publicly traded stocks can move quickly the wheels of government turn slowly.

- Since early 2021 publicly traded MSO’s have declined over 90% from their highs.

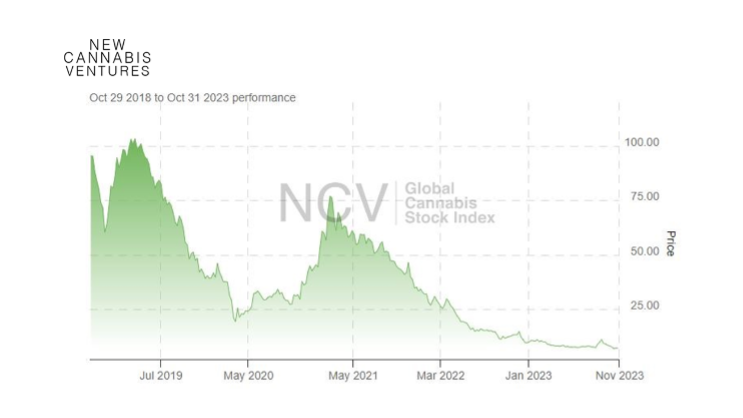

Here is how New Cannabis Ventures tracked the precipitous fall:

- State cannabis markets have matured in Michigan and Massachusetts while legacy states like California, Colorado, Oregon, Washington have had fierce price competition.

- While the debt lending sector remained a bright spot for getting liquidity into the market the banking failures in the Spring of 2023 along with rising interest rates have cooled the debt markets for cannabis companies this year.

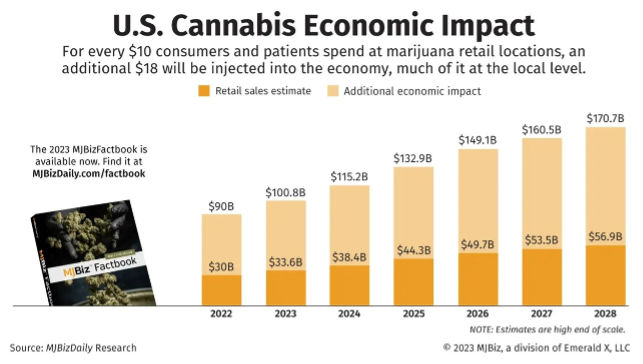

- Still the cannabis market as a whole in the US is projected to grow at a 10% + CAGR and top $40 billion is sales by 2027 according the BDS Analytics.

And, MJBiz with an even more aggressive $53.5 billion shows the total impact cannabis has on the economy this way:

From Several Years of Disappointment Why Are We So Optimistic about 2024?

With all the headwinds the industry is still facing, will the cannabis markets get the growth capital needed? What event are we confident will spur the cannabis market in the next year?

There are two possibilities. One is passage of the Secure and Fair Enforcement Act (known as the SAFE Banking Act) and the other is Rescheduling cannabis by the DEA.

SAFE Banking Act

- The industry has long tracked the SAFE Banking Act as a way to both improve cannabis companies access to banking and capital and to help pave the way for further reform.

- SAFE has been passed out of committee in the Senate and seems likely to be passed by the full Senate. The Senate in the past has been viewed as the blockage for passage so there has been heightened expectations given the Senate’s progress.

- Without belaboring the analysis, our view is that the House has not be able to get anything done this year to pass SAFE, and passage next year remains dubious.

It’s going to take a first step, however, in order to pave the way for the SAFE’s passage in future congressional sessions. That step is rescheduling in 2024.

Rescheduling

- In what has been called one of the most comprehensive investigations ever conducted by the Federal Department of Health & Human Services (HHS), on August 29th HHS recommended to the DEA that cannabis be rescheduled from Schedule 1 to Schedule 3 as a controlled substance.

- The implication of the HHS recommendation is that cannabis has medicinal value.

- It is statutory that the DEA can’t dispute HHS’s finding, which makes rescheduling to Schedule 3 very likely to happen – and happen in 2024.

- Reclassification to Schedule 3 would remove a major obstacle to the growth of the cannabis industry, Section 280E of the IRS Tax Code.

- Since 280E brands cannabis companies as trafficking a Schedule 1 substance, they are taxed on gross profits instead of net profits as all other business are taxed.

- There are two primary implications of 280E taxes now on cannabis companies. First, they have been starving for free cash flow despite positive EBITDA. The second implication has been that cannabis companies have been valued far less than other companies would be for M&A purposes.

- While rescheduling will have other longer-term implications for cannabis the near-term benefit of 280E removal is the impact hitting headline.

- We believe that the DEA will reschedule to 3 in the next 6-12 months after a preliminary ruling is put out for notice and comment. Then a final rule will be promulgated. It’s clear the Administration wants this change and while the bureaucracy is large in DC this is clearly within the purview of the Administrative Procedures Act and doesn’t require legislative approval.

- It is also very likely there will be legal challenges to the rule which could slow down implementation.

- Even with the almost inevitable legal challenges the future expectations of investors, lenders, and companies as they project their cash flow will be that rescheduling will be implemented.

Implications for Valuations & Markets

- With rescheduling, additional free cash flow will allow cannabis companies to reinvest in growth in ways they can’t today.

- We estimate most cannabis companies will increase free cash flow 2x or more

- This will keep some companies in business that are on the edge and will allow stronger companies to reinvest in growth. Those reinvestments may include investing in organic growth, product development, marketing, and M&A.

- Many cannabis companies will be worth more post rescheduling – though not all. Smaller companies in highly competitive states where the state market has stopped growing or is declining will not see increased buyer interest. Thus, multiple expansion is unlikely in those markets for smaller companies.

- Larger companies, MSO’s and certainly publicly traded MSO’s, will see increases in valuations. Publicly traded companies will see the largest bump as institutional investors look to take positions. Private companies will benefit as well that are located in growth states with good profits and solid assets.

- The influx of institutional money, the increase in valuation for many cannabis companies, and the increase in cash to invest in growth will continue to accelerate consolidation in many State markets and between MSOs.

Conclusions

- We see rescheduling as the catalytic event that lifts the cannabis markets out the doldrums they have been in over the past few years.

- Aside from the publicly traded companies that see an immediate lift the other implications will take time to play out over 2024 and 2025. This will not be an overnight turnaround.

- The rising tide won’t lift all boats but companies that are well positioned will benefit over time from this change in multiple ways.

- Rescheduling will pave the way for additional momentum building changes including SAFE, more states approving adult use, and eventually full legalization.

So Where is the Smart Money Going Right Now To Prepare for Unprecedented Future Market Growth?

- Strategic Investors are playing a game of monopoly and we’re investment banking intermediaries that are helping to strengthen their portfolios.

- Buyers are looking to us to provide “pocket listings” of assets (cultivation, processing and retailing) that are in highly desirable markets from Sellers who will agree to reasonable prices and terms.

- This enables buyers to build the right portfolio prior to rescheduling and the elimination of 280E. The immediate boost of EBITDA and Free Cash Flow makes them far more attractive to larger acquirers.

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.