Investor Takeaway Cannabis Industry Turns to M&A Over Equity Raises – Part I

Worldwide, the pace of M&A transactions for industries in general is exceeding the record pace set in 2021. The same is true for global and U.S. cannabis transactions. In fact, M&A is exceeding the pace of equity financing in the cannabis industry.

- MSOs turn to debt and M&A because – according to analysts’ cash-flow estimates for 2022 and 2023 – the large MSOs are already well funded. Cash balances are high, and 2022 and 2023 expectations are for positive free cash flow.

- As a result, M&A activity will increase in 2022, as large cannabis businesses will have the means to acquire smaller competitors.

- Transformative M&A transactions to continue.

For strategic investors finding investment opportunities in the path of the MSOs’ search for M&A targets of opportunity is key.

The Torrid Pace of M&A Transactions Globally Cannabis Industry Turns to M&A Over Equity Raises – Part I

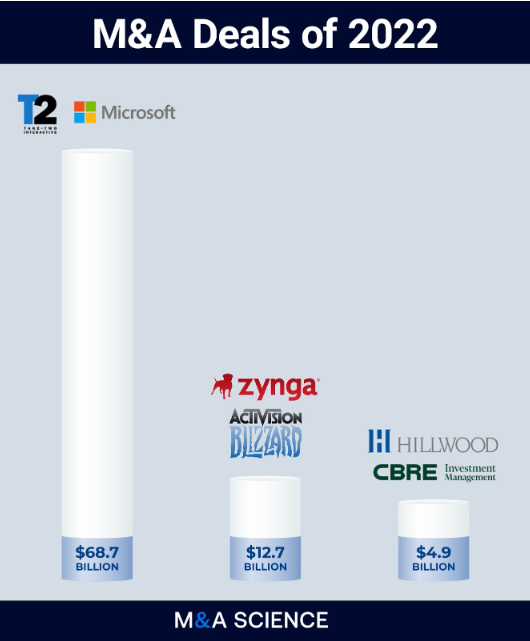

On a global basis and for industries in general M&A Science Newsletter predicts that M&A activity in 2022 will continue the torrid pace set in 2021. The Newsletter reports on the findings of a recent Deloitte survey, The Future of M&A Trends. The survey found that “… deal frequency and amounts are expected to increase even further as companies are looking for more transformational change through transactions.” It reports on these large company mergers in Q1 this year:

Characteristic of these transactions are these factors:

“Virtual Diligence” is speeding up the process of M&A. Driven by investor, consumer and employee demands, “Environmental, social, and governance (ESG) investing isn’t new, but the pandemic has throttled it into the forefront of transactions and will likely influence deal-making – improving ESG credentials through acquisitions.”

And “We,” as the survey and the M&A Science Newsletter conclude, “have no current evidence that M&A activity is slowing down. It could very well surpass the record-breaking year of 2021.”

MSOs Dominate the Equally Hot Pace of M&A in Cannabis Cannabis Industry Turns to M&A Over Equity Raises – Part I

Bloomberg cites statistics from research firm HUB International that the U.S. cannabis industry broke another sales record last year – $24 billion. Annual sales by 2028 are projected to reach $70 billion. Regarding this continued hot pace of industry growth HUB concludes:

As a result, M&A activity will increase in 2022, as large cannabis businesses will have the means to acquire smaller competitors. What’s more, expect Canadian cannabis companies — unburdened by federal restrictions — to increase their cross-border mergers and acquisitions.

An analysis by MJBizDaily found that M&A is exceeding the pace of equity financing in the cannabis industry. They attribute this to these factors:

- Usually Equity and M&A fund the industry at the same pace. Why have they disconnected?

MJBizDaliy cites reasons such as these:

The enormous gap in enterprise value/EBITDA multiples between large and small companies made it easy for acquisitions to be accretive.

Acquisition targets have been happy to accept multistate operator stocks at current discounted levels because they perceive significant upside.

Multistate operators have found it easier to enter new markets by acquisitions rather than building from scratch.

- Equity financing is down.

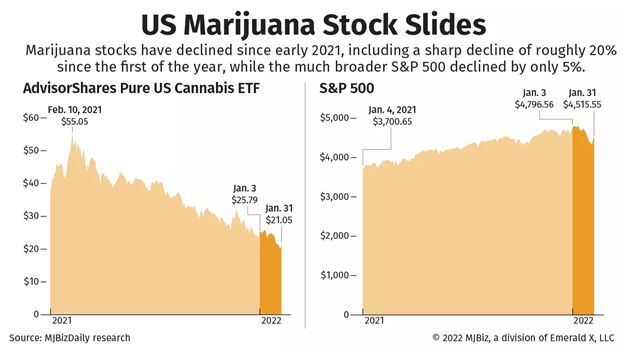

There is no question that the stock prices of the large publicly traded MSOs continue to decline…

…as MSOs turn to debt and M&A because – according to analysts’ cash-flow estimates for 2022 and 2023 – the large MSOs are already well funded. Cash balances are high, and 2022 and 2023 expectations are for positive free cash flow.

MJBIZ Daily concludes: We also expect transformative M&A transactions to continue.

Case in Point – The Turnaround of Acreage Holdings

The transformation of MSO strategy can be no better exemplified than by the evolution of Acreage Holdings. Also a speaker at the Benzinga Capital Conference in late April, Peter Caldini, CEO of Acreage, related common themes that other prominent MSO executives at the conference expressed. The Acreage turnaround has been driven by these factors:

- A new leadership team with commercial experience – experience in scaling businesses in highly regulated industries.

- Operational and financial disciplines requiring divesting underperforming assets.

- A portfolio strategy focused around core markets.

-

-

- That strategy now positions Acreage to take advantage of significant opportunities in the 8 core states of their 10-state portfolio.

- A portfolio that includes key states New York and New Jersey. Acreage is one of 10 licenses in NY, with adult use anticipated for the first half of 2023.

- Their 3rd priority state, Ohio, is medical now with an adult use initiative anticipated on the ballot in the fall.

- In Tier 2 markets, such as Massachusetts and Pennsylvania, Acreage is positioned in the premium segment of those markets.

- The reason they are not seeking to open in the Florida market is that they feel there is limited ability to scale there without eating up a disproportionate share of resources.

-

- Rightsizing by reducing as much 50% of staff has improved the overall efficiency of the organization.

The primary growth objective now is to compliment organic growth with M&A opportunities within their existing footprint.

Common Themes Among the Competitors

From the senior executives of the major MSOs represented at the Benzinga Capital Conference we found these common themes are at the root of their M&A strategies:

- The first is that all acknowledged that developing strong brands is crucial in order to lead the industry into its inevitable CPG future.

- The second is the vital support each MSO intends to provide the Social Equity programs in each of the states in which they do business, while they also pursue effective ESG policies within their own organizations.

- And the third is echoed by all the major MSOs at the conference; that restructuring their company’s finances places then in the position to take advantage of acquisitions and debt financing.

How We Can Help – Finding the Right Fit for Your Investment Strategy

What we conclude from the perspectives provided by the largest of the MSOs at the Benzinga Capital Conference is that for strategic investors finding investment opportunities in the path of the MSOs’ search for M&A targets of opportunity is key.

2022 offers an array of opportunities in M&A transactions, of all sizes, and in non-dilutive debt financing. What we advise our investors as they assess the market in which they see as the most advantageous boils down to:

- clarifying the investment needs and objective of all parties

- determining the real value in the business by calculating a well-substantiated valuation

- and, matching the right investors with the right funding opportunity; the right operators whose objectives and scalability are a fit for investors’ portfolios.

At Highway 33 Capital we excel at structuring deals to meet client investment strategies in emerging 2022 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.