Expectation for 2021 Cannabis Industry M&A Update

Coming into 2021 the stage was set for a banner year for strategic investments in the cannabis industry. 36 states, and the District of Columbia, now have comprehensive medical marijuana programs and 15 of those state, plus Washington DC, having legalized adult recreational marijuana use. The pandemic has put revenue strains on other major states that will also likely take the route of legalizing adult use. A banner year was projected for 2021 when an influx of liquidity would boost this formerly cash-restrained industry toward its $35B potential as early as 2025.

The watchword for 2021 was consolidation; since more than $600 million in M&A transactions were announced in Q4 2020, on the heels of the mid-year lull. The pace of this growth in 2021 was expected to be led by those multi-state operators (MSOs) who are now acting more like CPG companies in the maturing cannabis market. This was the expectation since the major MSO’s have been cleaning up their finances as well as their operating procedures, trimming underperforming entities, and accumulating dry powder for roll-up acquisitions. Cannabis companies raised nearly $134 million in the two weeks before Election Day, a 185% increase over the same period last year. Most of the money flowed to MSOs. In addition, the biggest stocks by market capitalization saw a roughly 20% bump ahead of the election and now are trading at record volumes, providing plenty of stock currency for further acquisitions.

Where Are We One Year into the Pandemic?

While COVID-19 shuttered many traditional businesses, more cannabis than ever before was consumed in the U.S. in 2020 – a record $17.5B in legal sales – a 46% increase from 2019, according to a recent report cited in Forbes published by BDSA, a cannabis sales data platform. This was aided by the unprecedented step taken by 28 of the legal cannabis states where dispensary operations were classified as essential businesses. Cannabis Industry M&A Update

Those predictions for an avalanche of consolidation in the cannabis industry in 2021 are, indeed, being realized. It comes with the realization that after the go-go, land-grab early years of legalization M&A will now focus on synergistic acquisitions more strategically designed to increase sales and market share in expanded marketplaces. Cannabis Industry M&A Update

Strategic M&A

An Accenture analysis of Capital Q data 2020, found that firms making acquisitions in a downturn are likely to yield a higher TSR over a three-year span than the S&P average for the sector in which they compete. That is, a 22% increase from M&A during economic downturns. But, even more pertinent to current circumstances, a 30% increase from M&A during epidemics. Any way it is calculated, M&A in down periods in the economic cycle is vitally important for recovery and growth. Cannabis Industry M&A Update

And, Consolidation in the cannabis industry has already begun:

- Two leading Canadian cannabis companies, Aphria and Tilray, announced plans in mid-December for a $4 billion “reverse acquisition.” Once completed this year the merger will create the largest company by revenue in the cannabis industry. As predicted, this merger accelerated the pace of other acquisitions in the industry as other large operators are seeking deals to remain competitive.

- Also included at the end of 2020 were acquisitions by Jushi Holdings, Trulieve and Ayr Strategies in Pennsylvania, Ayr also making acquisitions in Ohio and Arizona, TerrAscend with a Maryland acquisition.

- Then, on January 14, Canopy growth announced its filing of an early warning report regarding maintaining an option for a 20% pro rata ownership interest in TerrAscend. This is contingent on amendments to or changes in the Federal regulations on cannabis in the U.S.

- On the same date, Cresco Labs, the large MSO, announced its expansion into Florida by the acquisition of Bluma Wellness, Inc. Cresco will now have operations in 7 of the 10 most populated states.

- GrowGeneration acquired Washington-based Indoor Garden and Lighting for expansion in the Pacific Northwest, and acquired Main-based Grow Depot, bringing the total number of GrowGen locations across the U.S. to 42.

- Verano, a Chicago-based MSO covering 2 states bought Alternative Medical Enterprises (AltMed) of Florida.

- In California, due to close this month is the merger between Caliva and Left Coast Ventures into the Subversive Capital Acquisition SPAC.

- In one of the larger, most recent transactions Ayr Strategies (AYRWF) acquired Florida-based Liberty Health Sciences (LHSIF) for $290 million.

- And, to launch its “Green Wave of Acceptance” strategy, on the heels of several acquisitions last year, Curaleaf tendered an offering on the CSE for US $200M. That offering quickly became oversubscribed, grossing Curaleaf US $251M.

Canadian firms are cautiously entering the U.S. market with investments in CBD derivatives under hemp-derived CBD permissions. Yet, as investors in Canadian enterprises continue to seek ways to gain greater access to the U.S. cannabis market, M&A transactions are expected to play greater role – a process that has already started among Canadian companies. The large Aphria-Tilray reverse acquisition, referred to above, was followed in late January when Heritage Cannabis (CSE:CANN) (OTCQX: HERTF), a development stage vertically integrated medical cannabis company, closed the US$35.25M acquisition of Premium 5 Ltd, a Canadian based producer of high quality concentrates. With a large number of public operators in a limited market size, more M&A activity is anticipated among the major players in Canada.

What’s Driving this M&A Action

Certainly, the final election results are having a strong affect on deal decisions. There is, of course, a flurry of Executive Orders coming out of the Oval Office and new laws and regulations promised on taxes, trade, healthcare and the environment are being pursued. This extends to cannabis legislation where more progress is anticipated within the next two years – prior to mid-term elections, November, 2022.

Last December the house passed the Marijuana Opportunity, Reinvestment and Expungement (MORE) Act which would remove cannabis from being a Schedule 1 controlled substance and enact a variety of social and criminal justice reforms. That legislation now has a better chance of advancing through the Senate to the President. A second piece of legislation critical to the future of cannabis industry in the U.S. is the Secure and Fair Enforcement (SAFE) Act. This Act also passed by the House last year would enable Federally Insured banks to accept deposits from legitimate cannabis and hemp-related businesses.

While some see these developments putting legalization on the horizon, others believe that a drastic step like removal of the filibuster would be needed in order for such legislation to be brought to a vote. And, Mitch McConnel and the Republicans are not likely to go along with such action. Also, with all that President Biden has on his most pressing agenda, cannabis may not be an issue he wants to tackle immediately. Nevertheless, these developments have brought a new sense of urgency to the industry; an industry that is quickly bringing enterprise market valuations more accurately in line with the more realistic value of cannabis businesses – grounded in actual financial performance. Cannabis Industry M&A Update

Sorting Through the Right Investment to Meet Your Portfolio Strategy

For our clients, here is the advice we provide as they assess M&A opportunities in the cannabis industry:

- Know what the organization is getting into– Detailed due diligence and proper integration planning are core to identifying potential issues.

- Get the right people involved– Determine essential stakeholders early and get them involved. By doing so, retention and change issues will be minimized.

- Know what the organization wants out of the deal– Determine objective business decision criteria to minimize political issues and the impact of personal preferences.

- Get it done right – Devote the necessary resources even if the company is “running lean.” Transaction execution and integration are together a full-time job.

- Know what success means– Establish a performance milestones measurement process to measure the success of integration activities.

- Don’t underestimate the infrastructure– The IT function must be an integral part of both the due diligence and integration planning efforts. IT is a critical enabler of all integration efforts.

- Over-communicate– Personnel will be forgiving at first and will not expect all the answers. They will, however, expect strong leadership that has a vision and a plan for how to get there, how to blend the cultures of the merging organizations into a compatible, inclusive growth-oriented environment.

What’s It Really Worth?

Once it is confirmed that legal/compliance requirements are met then the next major step is conducting a realistic valuation of the merged businesses. Your investment banking advisory should positively understand the idiosyncrasies of the cannabis industry to identify a valuation range that ensures the buyer is not overpaying and that the seller’s proformas are verifiable.

What It Takes to Make It Over the Finish Line

- The Vision of the Parties

- All stakeholders to the M&A transaction must have a clear vision as to the direction toward profitability the marriage of the parties will take. This requires good advice about the fundamental legal and business issues that will arise and the judgement calls that will have to be made during the process to keep a clear vision for the post-closing entity.

- Commitment

- Once the decision is made that a Buyer’s objectives are better served by acquiring rather than taking the path of organic growth, all key management team members must fully buy into that direction regardless of hurdles that will arise along the way.

Investor Takeaway

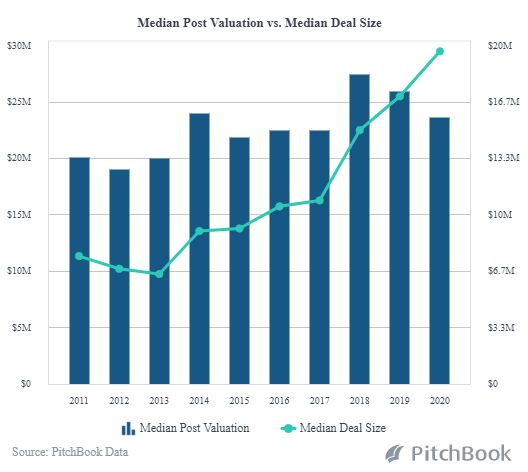

M&A is already living up to the expectations for 2021 set in motion by large transactions consummated late in 2020 and those already taking place at the beginning of this year. Growth is expected to be led by MSOs who have achieved scale, cleaned up their balance sheets and stockpiled dry powder for roll-up acquisitions. The cannabis M&A market is moving into a more mature phase. The valuation model for acquisitions in the cannabis space is evolving from one based on sales, typically associated with emerging growth industries, to a more mature industry model based on profits or Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). Many cannabis MSOs have stabilized and generate positive EBITDA, which justifies the evolution away from a sales-driven model. So, businesses are advised to begin the necessary pipeline and diligence efforts now to be ready for consolidation opportunities where the window of opportunity can close quickly; when the highest returns have been shown to occur when M&A transactions happen as a result of economic downturns.

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.