The Marketplace Cannabis Industry Consolidation 2021

420 Intel brands consolidation as the “Mantra for 2021.” And ever since the year kicked off with the $7.2 billion acquisition of Edipiolex, GW Pharmaceuticals byJazz Pharmaceuticals a long list of others have followed in an industry in the growth phase of its life cycle. Spuring M&A transactions has been the rise of SPACs in the industry reported in the EDGE Briefing last week. Green Wave Advisors estimates that just as of July this year SPACs have raised more than $3.6 billion through IPOs, of which $1.8 billion has already been “de-SPAC’d.” Thus, offering a shorter, less complicated way, in fact the only way, U.S. cannabis companies can access the public markets. And factors like the tide of state-by-state legalization, legalization in Mexico, potentially the world’s largest market, and the rescheduling of cannabis by the United Nations are inspiring consolidations strong enough to compete on a global scale. Cannabis Industry Consolidation 2021

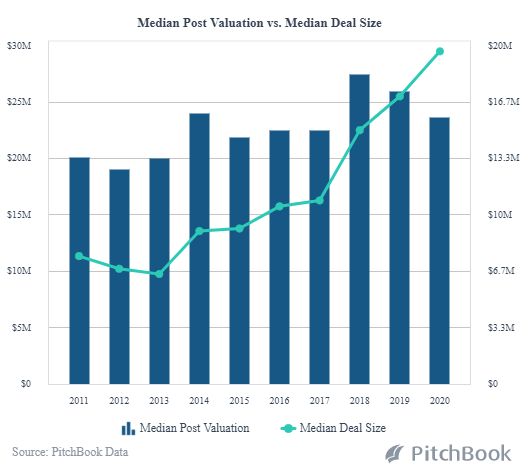

In addition to the volume of consolidations on the rise, Pitchbook also sees an escalation in deal size and post valuations.

Consolidations 2021

What are the industry examples of the most recent consolidations?

Investment source Benzinga reports the following:

Cresco Labs $90 million acquisition of Cultivate – Ayr Wellness $80 million acquisition of PA Natural Medicine – The purchase of a $55 million license owned by Harvest Health and Recreation by Planet13 Holdings – And Green Thumb Industries acquisition of Green Star Herbals for an undisclosed amount

Money and Markets tracked these consolidations that all happened just during the month of May:

- Hexo Corp. (NYSE: HEXO) just announced its $768 million acquisition of Redecan — a privately owned licensed producer in Canada.

- Curaleaf Holdings Inc. (OTC: CURLF) is acquiring one of the largest outdoor cultivation facilities in the U.S. for about $67 million — Colorado-based Los Suenos Farms.

- Trulieve Cannabis Corp. (OTC: TCNNF) announced a $2.1 billion acquisition of Harvest Health and Recreation, a Florida-based brand.

- And, the account from Cannabis Business Times that GrowGeneration Corp (Nasdaq: GRWG) has actually announced nine different acquisitions this year.

Biv.com reports that Ottawa-based Hexo Corp. (TSX:HEXO) is spending $235 million in an all-stock deal to acquire Vancouver’s Zenabis Global Inc. (TSX:ZENA). And Nanaimo-based Tilray Inc. (Nasdaq:TLRY) and Aphria Inc. closed a merger deal creating the country’s largest cannabis brand with 17% share of market. Cannabis Industry Consolidation 2021

And, among the many others of note, Marijuana Business Daily reported that just last week TerrAscend Acquired Gage Growth in $545 million all-stock deal being the first of the major multistate operators to begin consolidating the Michigan market – a market on track to become the second-largest legal cannabis state in the U.S.

Factors Driving Industry Consolidation

Well, for one, it remains the fact that capital is hard to acquire in the cannabis industry due to continuing bank restrictions. Technical 420 feels that regardless of where federal legalization stands – is the continued consolidation of the cannabis sector. They cite the finding that the most recent M&A transactions have taken a more strategic and bolt-on approach to the due-diligence process. They see these three factors as characteristic of the growing maturity of the spate of consolidations: Cannabis Industry Consolidation 2021

- Acquirers are looking for assets that are strategic and complementary in nature.

- The market is opening with a broader price range of acquisitions – from <$20 million to nearly $1 billon.

- A shift from acquisitions that leveraged market outside the U.S. to the many transactions now occurring that are leverage to the U.S. market.

Canopy Acquisition of Supreme Rationale – Characteristic of Consolidation to Come?

Marjiuana Business Daily analyzed the deal this spring of Canopy Growth (TSX: WEED) acquiring Supreme Cannabis (TSX: FIRE). After the announcement of the acquisition Canopy’s stock immediately fell by 21% on the knowledge at the time that the deal represented a huge 66% premium over the value of the stock price of Supreme. Investors were confused by the fact that giant Canopy was buying another large Canadian company while competitors with pursuing acquisition targets in the U.S. Supreme’s motive to be acquired, though, is indicative of not only the deal premium they realized, but also something more fundamental. MJBizDaily has found that the huge gap in valuation metrics between the largest market cap operators and smaller operators is what is prompting the growing volume of consolidations. They found:

Facing a significantly higher cost of capital makes growth more difficult, so companies with market caps less than $500 million increasingly will find it advantageous to combine with larger competitors to ensure ongoing development and to essentially share in the valuation arbitrage.

Sorting Through the Right Investment to Meet Your Portfolio Strategy

Leadership to market dominance typically does not happen by slow, steady organic growth. The May 10th announcement that Trulieve is acquiring Harvest in a $2.1 billion deal to form the world’s most profitable MSO is substantiation. The ever-increasing volume of consolidations began to surge in Q4 last year when over $600 million in M&A transactions were announced. Yet how should an investor assess the potential success of consolidation opportunities? The following is advice we provide our clients:

- Know what the organization is getting into– Detailed due diligence and proper integration planning are key to identifying potential issues.

- Get the right people involved– Determine essential stakeholders early and get them involved. By doing so, retention and change issues will be minimized.

- Know what the organization wants out of the deal– Determine objective business decision criteria to minimize political issues and the impact of personal preferences.

- Get it done right – Devote the necessary resources even if the company is “running lean.” Transaction execution and integration are together a full-time job.

- Know what success means– Establish a measurement process for performance milestones to track the progress toward the success of integration activities.

- Don’t underestimate the infrastructure– The IT function must be an integral part of both the due diligence and integration planning efforts. IT is a critical enabler of all integration efforts.

- Over-communicate– Personnel will be forgiving at first and will not expect all the answers. They will, however, expect strong leadership that has a vision and a plan for realizing that vision, and how to blend the cultures of the merging organizations into a compatible, inclusive growth-oriented environment.

What’s It Really Worth?

Once it is confirmed that legal/compliance requirements are met then the next major step is conducting a realistic valuation of the merged businesses. Your investment banking advisory should positively understand the idiosyncrasies of the cannabis industry in order to identify a valuation range that ensures the buyer is not overpaying and that the seller’s proformas are verifiable.

What It Takes to Make It Over the Finish Line

- The Vision of the Parties

- All stakeholders to the M&A transaction must have a clear vision as to the direction toward profitability the marriage of the parties will take. This requires good advice about the fundamental legal and business issues that will arise and the judgement calls that will have to be made during the process to keep a clear vision for the post-closing entity.

- Commitment

- Once the decision is made that a buyer’s objectives are better served by acquiring rather than taking the path of organic growth, all key management team members must fully buy into that direction regardless of hurdles that will arise along the way.

- Culture Comprehending ESG – The Critical Role it Plays in Realizing the Value in an M&A Deal

- A critical component of the very essence of the deal is the shared values and behaviors in Environmental, Social, and Governance (ESG) that shape employee experience, interaction and morale within an organization. Understanding the Culture Equation avoids differences that are likely to become too hard to manage after the transactions is completed.

Once the vetting process is completed the outreach process begins to all potential qualified acquirers. Our contact list numbers in the thousands of PE firms, MSOs, Pubcos, HNW, Family Offices and other qualified investors. They are contacted, sign our Non-disclosure agreement, are supplied with an Executive Summary about the opportunity and invited for a full presentation of an informative pitch deck and financials.

Investor Takeaway

In the four phases of an industry’s life cycle – Introduction, Growth, Maturity, Decline – the cannabis industry has quickly entered the Growth phase. Industry fundamentals are now very bullish, straight through the pandemic when cannabis was proven to be essential, almost recession-proof. Virtually every trend is pushing the industry forward. Potential pitfalls will always exist in this heavily nuanced industry – recently in the EDGE Briefing we have covered the challenges the industry will be facing with the issues of secondhand smoke/vape and Greenhouse Gas emissions – that require specialized due diligence by experienced advisors. Nevertheless, as 420 Intel puts it, the step between the growth phase and the beginning of maturity is consolidation – the mantra for 2021. The rise of SPACs and more sources of capital that become available the trend M&A activity will most likely increase – enabling multistate operators to build market share and roll out into new markets. Leading cannabis companies are bullish and eager for consolidation opportunities regardless of the pace of national legalization. So, businesses and investors are advised to begin the necessary pipeline and diligence efforts now to be ready for consolidation opportunities where the window of opportunity can close quickly.

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 M&A opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.