NOTE: This Week the Partners of Highway 33 Capital Advisory will be at the Salon Suite at the Wynn in Las Vegas during the MJBizCon, October 20 – 22. Please let us know if we can talk about your strategic investment strategy one-on-one. Click here and we’ll set up a time to meet. Click Here>>>

State of the Cannabis industry Cannabis Debt Financing 2021

In the EDGE Briefing last week we reviewed how any way you cut it, even in a faltering economy with a rising rate of inflation, the U.S. cannabis industry continues on a path of explosive growth. Predictions of industry revenue range as high as those from Grand View Research – a U.S. market size of some $33 billion this year, reaching as high as $84 billion by 2028. Through the first half of the year capital raised in the cannabis industry totaled over $6.6 billion, compared to only a little over $2.3 billion in 2020. Marijuana Business Daily report on Viridian Research findings that the amount of capital raised as of September 10 is already up 118% over full year 2020. And as more debt providers come online, recent multimillion-dollar debt funding among cannabis industry leaders shows that debt as a funding source for cannabis companies is a rational use of capital. Cannabis Debt Financing 2021

As Bloomberg stated, cannabis companies have faced very high interest rate, high prices when seeking debt financing:

…but a pair of recent bond offerings show that terms are improving even as banks largely shun the industry. Trulieve Cannabis recently raised $350 million by issuing a five-year secured bond callable after two years with an 8% coupon. While that’s still costly compared to terms for companies in other industries, it’s better than a 9.75% coupon security of similar duration issued by the company in 2019, according to Bloomberg data. Cannabis Debt Financing 2021

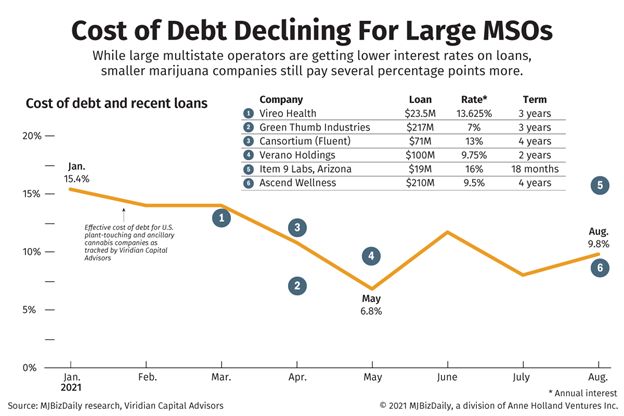

Marijuana Business Daily reports that large cannabis MSOs that have strengthened their balance sheets now qualify for lower loan interest rates these days.

The law firm of Brennan, Manna & Diamond expressed the growing trend of debt financing in the industry in Mondag,com by saying:

Loan numbers are difficult to come by, but knowledgeable sources estimate that borrowing for “plant touching” cannabis, businesses (e.g., growers, processors, retailers, testing labs and delivery services) was at least in the low to mid-hundreds of millions last year, numbers that appear certain to increase dramatically.

Regulatory Hurdles Being Cleared

Cannabis Business Executive reports that last November the SEC extended rules for raising capital that have strong ramifications for the cannabis industry in a final ruling entitled “Facilitating Capital Formation and Expanding Investment Opportunities by Improving Access to Capital in Private Markets.” With the intent of improving access to capital in general, these are some of the most important ruling changes pertinent to the cannabis industry: Cannabis Debt Financing 2021

- When no money or other consideration is being solicited companies can communicate with potential investors to see how much interest there is and what types of investors are interested without worrying about violating the SEC’s requirements.

- Reg A Tier 2 limit was increased from capping offerings at $50 million to $75 million. This has the potential of accelerating the process for companies now at the upper limit of raising money under this rule.

- The upper limit of unaccredited investors under rule 504 had been increased to $10 million. In the past this restriction in Reg D limited the investment of unaccredited investors to $1 million.

And the Secure and Fair Enforcement Banking Act for 2021 (SAFE) that has recently been approved by the U.S. House of Representatives now lifts a burden that weighed heavily on the industry – that federally insured banks could not deal with cannabis companies. This could cause the traditional banking institutions to rush into the industry, instead of the entire industry just being served by state charted banks and credit unions. The bill now goes on to the Senate where two uncertainties exist. One is the question of how Republican Senators will vote on the bill. And the second is, ironically, whether or not the Democrats under Majority Leader Schumer will instead push the more all- encompassing legislation, the Cannabis Administration and Opportunity Act. That could delay the passage of the separate SAFE Act. Cannabis Debt Financing 2021

According to Brennan Manna & Diamond:

For Banks, this will open an entirely new lending market. A market that is already large and rapidly growing, and increasingly populated by strong, stable and profitable businesses – in other words, highly desirable customers; and, at least for some period of time, lending to this market will offer the Banks pricing at the premium end of their conventional commercial lending rates while still saving borrowers between 3% or 4% at the low end, and significantly more at the high end.

Cannabis Industry Maturing to the Point of Turning to Debt

Bespoke Financial calls Debt Financing “the lynchpin enabling cannabis companies to outpace the competition, manage long term expenses.” Cannabis Debt Financing 2021

While the industry has been capital-constrained, borrowing against assets has been a key source available for many cannabis companies to pursue. Vertically integrated cannabis companies often have significant real estate and other assets that can be leveraged. What has changed now, though, is that more debt providers have come online over the past couple of years addressing a range of needs. This means that cannabis companies can now refinance at more attractive rates.

As an example, Bespoke, that claims to be the first cannabis-focused fintech lender, secured a $5 million inventory line of credit for California-based cannabis company Claybourne, Co. The line will enable Calybourne to expand cultivation capacity supporting their popular flower and pre-roll products without limiting the company’s ability to launch new products.

Action in the Current Marketplace

According to Judson Hill of Bespoke Financial reporting in Benzinga: Cannabis Debt Financing 2021

What is most exciting as a lender in the cannabis industry is to see the transformation over the past three years from debt being seen as something for distressed businesses to new credit facilities being hailed in the headlines as a major mark of success. As the country moves toward federal legalization, I only see more and more capital coming into the cannabis space, but this time around it will be much more prudently placed than it was in 2018.

Here are significant, current debt transactions:

- Large vertically integrated MSO Ascend Wellness Holdings, Inc. (CSE: AAWH.U, OTCQX: AAWH), negotiated a US$210 millionSenior Secured Term Loan with Seaport Global Securities LLC for the proceeds to repay substantially all of the Company’s previous debt and finance the Company’s pending investment in MedMen NY, Inc

- Investing News Network reports that Avicanna Inc. closed on the previously announced secured term loan financing of $2,118,000. The Term Loan is due October 19, 2022.

- Body and Mind Inc. (CSE: BAMM) (OTCQB: BMMJ) closed a US$11.1 million debt financing to be able to draw the initial term loan of US$6.67 million, US$6 million in funds is advanced to the Company and delayed draw term loan of US$4.44 million prior to December 31, 2021.

- Altmore Capital, a leading senior debt lender, closed its first cannabis debt fund exceeding its goal by over 200 percent. The new fund is available to plant-touching businesses with more than $10 millionin revenue. To date, Altmore has invested in and led over $130 million in financing in the cannabis industry and expects to complete an additional $200 million to $300 million in the next year.

- FARMACEUTICALRX, the leading natural and organic multistate vertically integrated medical marijuana operator in the U. S. closed an up to $21 million senior secured term with AFC Gamma, Inc. (NASDAQ: AFCG) (“AFC”). The Senior Term Loan proceeds will be used to fund construction of the company’s processing and Level 1 cultivation facility in Ohio and obtain certification to focus on bringing research and development-based innovation to the medical marijuana sector.

- SKYMINT, Michigan’s leading vertically integrated cannabis company, announced the acquisition of 3Fifteen Cannabis and the closing of its concurrent $70 million Senior Secured Term Loan from Tropics LP, an affiliate of SunStream Bancorp Inc. The objective is to strengthen SKYMINT’s dominant position within the nation’s third largest cannabis market. A market reported in an article in this week’s EDGE, below, growing toward becoming second only to California.

- And, while Trulieve’s (CSE: TRUL; OTCQX: TCNNF) acquisition of Harvest Health & Recreation (CSE: HARV; OTCQX: HRVSF) created shockwaves throughout the industry – by two of the largest publicly traded Canadian cannabis giants merging in an all-stock deal worth over $1.4 billion, Trulieve had also raised $350 million by issuing a five-year secured bond callable after two years with an 8% coupon. According to Bloomberg, the debt transactions involves:

- Senior secured notes that mature Oct. 6, 2026.

- The 8% coupon with no equity kickers and no original issue discount.

- Notes that are noncallable for two years. After that, they are callable at scheduled premiums.

- Approximately $240 million of the proceeds will retire existing Harvest debt, with the rest available for capex and general corporate purposes.

What Can Strategic Investors Use as a Guide Through Debt Deals for the Right Investment to Meet A Portfolio Strategy?

In general, debt plays a vital role in the capital structure of a company in order to preserve equity and to facilitate long term growth. So, it is crucial to understand the options available that best support a long-term strategy:

Sale and Leaseback Transactions

While Sale-Leaseback (SLB) transactions aren’t technically debt they do allow companies to free up liquidity from their balance sheets without dilution. The upside of this alternative is that cannabis companies increasingly have been selling their cultivation, processing and storage facilities and immediately leasing them back as a way to instantly raise tens of millions of dollars. The potential downside is that an SLB locks the asset seller into a longer commitment than other straight debt alternatives that now are likely to be able to be secured for rates similar to the SLB. It should be noted, however, that in common debt transactions lenders will be looking for more than a mere promise to repay. A security interest and/or corporate or personal guarantee will most likely be required. An SLB is a great option in obtaining capital for cannabis operators, and one that has been used by many of the largest companies in the space.

Asset-Based Lending

Based on the valuation of real estate and equipment assets, a cannabis company can typically borrow from within the range of 40% to 75% of asset value. In the case of development projects, the loan is usually based on project costs. While less typical, there are some working capital debt options in the market as well; though the availability of this option is much less than for real estate and equipment financing.

Convertible Options

- Up to this point, most debt financing by cannabis companies was found in convertible note options with low conversion premiums – which essentially delay dilution of equity. The company creates a note that converts to equity, often preferred stock, at a future date based on a future valuation method. These notes, similar to promissory notes with interest payable on or before a maturity date, have given investors security that they are repaid before equity holders if something goes wrong. For both the investor and the company this note structure allows the valuation question to be answered in the future while providing needed capital to the company and a more secure instrument to investors.

MTN – Short-Term Solution to Minimize Dilution with Funding at Single Digit Rates

- True, that the three alternatives listed above are considered the standard. Now, however, a new alternative is emerging, the Medium Term Note (MTN) for companies with relatively strong balance sheets. An MTN is an alternative to traditional long-term and expensive short-term financing – to aid a company with such objectives as accelerating a growth strategy, facilitating a roll-up M&A strategy.

- An MTN is essentially a bond issuance through investment bankers and funded by private institutional sources, in the range from $20M to $100M+, with specific characteristics to facilitate being issued quickly in order to take advantage of temporary market opportunities.

- The key is to effectively customize the MTN with characteristics most advantageous to the issuer that appeal to the strategy of an investor. This results in rates typically lower than other forms of debt financing. With our network of institutional funding sources for MTNs we provide an overview of the funding need and the upside for investors. Then, we assist the issuer with legal, accounting, underwriting, and rating services in order to begin the preparation of the offering.

For companies seeking debt, the following are key considerations:

- Most cannabis debt providers will require personal guarantees (PGs) from principals. This is always a tough decision for founders and one that carries real risk. Are you willing to PG the debt?

- What assets does the company have? Or is purchasing? Real estate, equipment, accounts receivable, other assets?

- Does the company have existing debt? And how much debt can the company take on while not taking undue risk with cash flow?

For investors who are considering lending to cannabis companies the following are key considerations:

- What are the credit scores of the principals? Is there any credit data on the company? How timely do they pay their payables, for example?

- What is the company’s existing cash flow? How realistic is the projection for future cash flow?

- How will the company use the funds? Is the use of funds realistic?

- What security will the investor have that they can recover funds if the loan isn’t repaid? PG? Cross-corporate guarantee? First lien on assets?

- Does the management team have the right experience for the type of project/company that they want to be?

- Does the company have its state and local cannabis licenses? If real estate is involved, what is the status of current local permits?

- Due diligence by experienced industry advisors is crucial since the lack of bankruptcy protection and restrictions on cannabis license ownership can complicate the debt financing transaction.

The Growth of Funds Dedicated to Cannabis Financing

The booming marketplace in 2021 is generating renewed interest in cannabis commercial (CRE) investments. Not only are more debt funding options becoming available to cannabis operators, but also how well the cannabis industry performed during the COVID-19 crisis has shown traditional financing sources and formerly reluctant landlords that the cannabis industry exhibits recession-proof qualities. Neglected store fronts in formerly derelict areas and industrial warehouses continue to escalate in value brought on by industry expansion, particularly into areas dedicated as Green Zones within municipalities.

A Green Zone is an area designated where legal cannabis/cannabis-related businesses are allowed/encouraged to set up cultivation, manufacturing and retailing facilities. One funding resource, Canna-Hemp Debt Fund , estimates that industrial warehouses they are underwriting that are “green zoned” show at least a 20 to 30% in increase value. For debt loans the company feels comfortable with LTVs of 60-65% in their green zoned properties. For investor security, and to be able to offer lower than market rates, personal guarantees and cross corporate guarantees, wherever possible, are required from their borrowers.

Investor takeaway

The tide of capital flowing into the industry has risen substantially as investors become more confident in the results of state-by-state legalization and the positive signs for federal legalization progress. A U.S. market size of some $33 billion this year, reaching as high as $84 billion by 2028 is being forecast; and Marijuana Business Daily reports that the amount of capital raised as of September 10 is already up 118% over full year 2020. Recent multimillion-dollar debt funding among cannabis industry leaders shows that debt as a capital source is a rational use of capital, not a sign of business distress. So, this rapid pace of legalization across the has opened up an entirely new lending market. For cannabis operators debt can play vital role in the capital structure of a company in order to preserve equity and to facilitate long term growth. Still the lack of federal legalization complicates the traditional lending model because bankruptcy is not an option and there is no consistency in state-by-state licensing and ownership standards. In this complicated, nuanced industry an experienced team with specific industry experience is required to provide the value added in facilitating a debt transaction. Cannabis Debt Financing 2021

How We Can Help

Let’s Talk

We will be at the Salon Suite this week at the Wynn in Las Vegas during the MJBizCon, October 20 – 22. Please let us know if we can discuss your cannabis investment strategy one-on-one. Click here and we’ll set up a time to meet. Click Here>>>

At Highway 33 Capital Advisory we excel at structuring deals to provide access to capital while meeting client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.