The Unmatched Growth of the Market

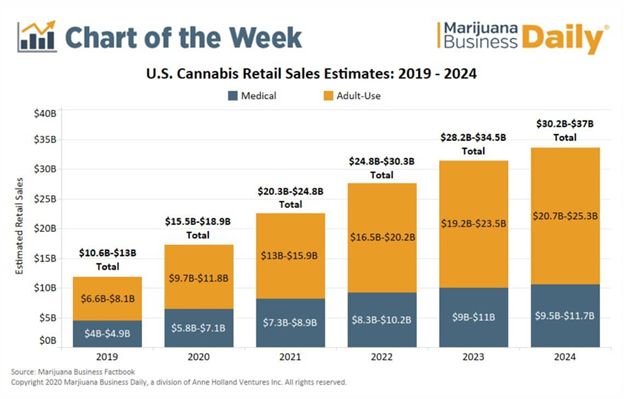

As you know from our previous EDGE Briefings, according to BDS Analytics cannabis consumption reached an all-time high of $17.5 billion in the U.S. in 2020.That is on the high side of the range that Marijuana Business Daily projected; well on pace to exceed their high-level projection for this year. Cannabis Commercial Real Estate Mid-Year Update

The Insurance Journal in their “New Dawn Risk” report on the cannabis, CBD and Hemp markets reported that U.S. legal cannabis market expanded from Zero to that $17.5 billion mark in just seven years. Their report concludes that Americans now spend almost as much on legal marijuana products as they do on Coca Cola.

Through May, capital raised in the cannabis industry totaled over $6.6 billion, compared to only a little over $2.3 billion during that same period in 2020. The industry is, in fact, transitioning – from its volatile beginnings just a few years ago to becoming more like a traditional CPG marketplace. And this is even before Big Tobacco and Big Pharma get more deeply into the industry to bring their level of professional management to cannabis operations. While many VCs and virtually all major institutional investors are still on the sidelines until federal legalization takes place, alternatives to accessing capital have arisen in the form of equity funding, debt lending and the public market through strategic acquisitions by/alliances with Canadian pubcos; and, with the growing presence of SPACs in cannabis.

Cannabis and the CRE Market

How does this rapid growth translate into opportunities in Commercial Real Estate? In last month’s posting by RISMedia they, along with several other media outlets, quote the recently released 51-page report by the National Association of REALTORS®

(NAR) entitled Marijuana and Real Estate: A Budding Issue that there is a marked increase in demand among their commercial members for warehouses, land and store fronts used for marijuana production and sales. The report states that although there are a number of reasons why commercial real estate inventory is tight in their areas, one-third of their respondents in legal marijuana states report that the marijuana industry is contributing to this condition. 29% of commercial members in legal states report that during the past four years there is a significant growth in property purchases as opposed to leasing.

General trends forecast by Forbes for Commercial Real Estate in 2021 will be accommodating for Cannabis CRE transactions:

- Forbes predicts there will be more distress asset sales from sectors slow to rebound from COVID-19.

- Work from home will put more commercial space on the market.

- To continue to aid the economic recovery the Federal Reserve is likely to keep short-term interest rates low throughout the year. This could also be a favorable development for the cannabis industry that has been plagued by being forced to pay higher interest rates on debt in the past.

Another interesting twist coming out of COVID is that real estate investors are seeing capital reallocated to businesses that were classified as “essential.” More capital is now flowing to grocery stores, dollar stores, auto parts and service centers, pharmacies, medical companies and fast food. These are considered ideal tenants. Cannabis is entering that category as well since cannabis is included as an essential service in 28 of the 36 legal states.

Regarding the rapid pace of the current growth legalization on the state-by-state basis, WealthManagement reports that it usually takes as much as two years for a cannabis market to start gaining traction in newly legalized states. Due to the enormous need for increased revenue that every state faces coming out of the Pandemic, more states are streamlining the sanctioning process, even down to the municipality level, to expedite the flow of new tax revenue. Cannabis Commercial Real Estate Mid-Year Update

Latest Developments and Transactions in the Cannabis CRE Marketplace

- Early last month AFC Gamma Inc. (NASDAQ: AFCG) of West Palm Beach authorized a $22 million credit facility for Chicago-based MSO Justice Cannabis Co. Justice, with operations in 8 states, will use the capital to purchase and build out its 72,000 sq. ft. cultivation and processing facility and a dispensary in Ewing, NJ. The transaction is a first-lien term loan on mortgages on Justice real estate properties in NJ.

- All eyes are on New York as adult use legalization takes place. MJBizDaily projects that an adult-use market in New York will generate $2.3 billion in annual sales by 2025. This is causing a land rush in the state with developers and cannabis entrepreneurs pursuing all manner of suitable grow/processing/retailing sites ranging from a former prison to cannabis campuses.

- That former prison mentioned above is in reference to Chicago-based MSO Green Thumb Industries proposing to build out a $50 million cultivation and processing facility at the former New York State prison in Warwick. The State is incentivizing the sale with the inclusion of sales and use-tax exemptions and a 15-year property tax abatement.

- New York-based MSO Columbia Care has purchased a 34-acre cultivation site in eastern Long Island from Van de Wetering Greenhouses. This was a $42.5 million cash and stock transaction for the property with 740,000 sq. ft. of operational greenhouse space and 200,000 sq.ft. of additional cultivation capacity.

- Also in New York, a developer, Zephyr Partners, has plans for a 70-acre cannabis campus with the potential of bringing 1,000 jobs to South Buffalo.

- Innovative Industrial Properties, Inc the only real estate company on the New York Stock Exchange (NYSE: IIPR) that deals in cannabis properties, acquired a 373,000 sq. ft. industrial and greenhouse space in Florida from an MSO, Parallel, with operations in Florida, Mass, Nevada and Texas. Property price was $35.3 million with which IIP will enter into a sales and leaseback arrangement with Parallel to continue operating these assets as a medical cannabis cultivation and processing facility.

- Earlier, in December, IIP also closed sale-leaseback transactions with subsidiaries of GR Companies, Inc.for two properties in Pennsylvania and North Dakota of a total of 105,000 sq. ft. of industrial space for the estimated price of $24.1 million.

- Chicago-based MSO PharmaCann is reportedly planning to expand it 180,000 sq. ft. Hamptonburgh facility to add another 705,000 sq. ft. of cultivation. The cost of the expansion is estimated to be $40 million.

- In late March, NewLake Capital Partners and GreenAcreage Real Estate Corp. announced the closing of their merger, becoming one of the largest cannabis real estate companies. NewLake Capital Partners, owns a diversified portfolio of 24 properties across 9 states with tenants that include cannabis industry giants: Curaleaf, Cresco, Columbia Care and Trulieve. The new company’s stated objective:

- …be an important long-term real estate partner to our valued tenants. Diversification is the centerpiece of our strategy, and we own some of the highest-quality cannabis properties located in limited-license jurisdictions.

- Also around that time Acreage Holdings and REIT GreenAcreage announced a total of $70 million from sale and leaseback transactions for facilities in Florida, Mass and Pennsylvania.

Smart Money Flowing into Cannabis CRE

The booming marketplace in 2021 is generating renewed interest in cannabis CRE investments. Not only are more debt funding options becoming available to cannabis operators, but also how well the cannabis industry performed during the COVID-19 crisis has shown traditional financing sources and formerly reluctant landlords that the cannabis industry exhibits recession-proof qualities. Neglected store fronts in formerly derelict areas and industrial warehouses continue to escalate in value brought on by industry expansion, particularly into areas dedicated as Green Zones within municipalities.

A Green Zone is an area designated where legal cannabis/cannabis-related businesses are allowed/encouraged to set up cultivation, manufacturing and retailing facilities. One funding resource, Canna-Hemp Debt Fund, estimates that industrial warehouses they are underwriting that are “green zoned” show at least a 20 to 30% in increase value. For debt loans the company feels comfortable with LTVs of 60-65% in their green zoned properties. For investor security, and to be able to offer lower than market rates, personal guarantees and cross corporate guarantees, wherever possible, are required from their borrowers.

Green Zones designated within Qualified Opportunity Zones (QOZs) offer investors the additional benefit of the potential of deferred and reduced taxes on capital gains while building equity in property purchased within the zone. This provides the benefits of economic improvement and job creation to the surrounding low-income, distressed neighborhood. While cannabis businesses are still subject to tax code 280E, which eliminates operational business expense deductions for income tax purposes, the current IRS ruling gives the owner of a QOZ property a hold on capital gains taxes if the property is held for a minimum of 10 years.

Because of the vagaries of the federal regulations and the laws in each municipality, and those that pertain to each individual property, the first step in any cannabis CRE investment is to always seek advice from professionals experienced in the nuances of the cannabis industry.

What to Look for in Cannabis CRE Properties?

When advising our clients who are considering cannabis CRE investments, here is the guidance we provide:

- Yes, it is about “Location, Location, Location.” In the case of cannabis CRE, though, location due diligence is crucial. Not only do the laws on the books relative to the property need scrutiny, but also a clear understanding of the support of community leaders for the cannabis enterprise is essential.

- Legal and CPA advice is vital in order to make sure risk and liability is reduced and all the potential tax savings are to be realized from the property.

- In certain cases ownership of the property as a separate entity from the cannabis business is a consideration in order to realize the greatest value from the investment.

- Local ordinances must be thoroughly comprehended in the operations plan for the property.

- Tax requirements vary from municipality to municipality and other ordinances may apply, even including those that may require a prescribed number of employees to be residents of the area in which the cannabis business is located.

- This can be a burden or an advantage for an investor. Due to limited amount of suitable properties available in many areas, investors who obtain local licensing and entitlements prior to putting a property up for sale or lease are likely to experience the greatest boost in value.

- For most states, in fact, the guideline is to have proof that a location for the cannabis operation, in the form of a lease option or sale agreement, has been secured before applying for the license.

- Rudimentary loan applicant qualifications met.

- Sellers with credit ratings below 799 should work on ways to reduce debt- to-credit ratio to qualify and improve interest rate. This is a process, though, that takes time to improve.

- Effective planning and budgeting are crucial to achieving the ROI potential of the property. Some of the main components that a business plan should include are:

- What the cannabis business will achieve.

- What are the 5-Ps of Marketing that will lead to achieving business goals – the Product, Price, Place (Distribution), Promotion, and the People that will create and effectively manage a new multi-million-dollar operation.

- Detailed financial analysis, in which cash flow will be a critical measure of expected performance by lenders. And, all anticipated business expenses should be considered, especially those unique to cannabis since many can’t be considered deductible expenses under the provisions of tax code 280E– the section of the Internal Revenue Code that denies deductions of business expenses by plant touching businesses, in some cases doubling tax rates and minimizing or eliminating cash flow. Cannabis entrepreneurs must pay more attention to this in their financial projections.

- Is risk mitigated by the loan applicant collateral?

Typically, real estate agents aren’t attuned to stringent cannabis regulations. Advice from experts who are successfully transacting in the cannabis industry is imperative.

Debt Financing Options for Cannabis CRE

The upward trend began in 2018 and advanced well into 2019 when about 30% of all capital raised in the cannabis industry was through debt financing, compared to only 19% in the boom year of 2018. We are seeing more groups already in 2021 starting both dedicated debt funds and allocating a portion of funds for cannabis debt deals. Cannabis Commercial Real Estate Mid-Year Update

While the industry has been capital-constrained, borrowing against assets has been a key source available for many cannabis companies to pursue. Vertically integrated cannabis companies often have significant real estate and other assets that can be leveraged. What has changed now, though, is that more debt providers have come online over the past couple of years addressing a range of needs. This means that cannabis companies can now refinance at more attractive rates – with these financing options available:

Sale and Leaseback Transactions

While Sale-Leaseback (SLB) transactions aren’t technically debt they do allow companies to free up liquidity from their balance sheets without dilution. An SLB is the sale of real estate assets to a buyer who then leases them back through a long-term lease.

Asset-Based Lending

Based on the valuation of real estate and equipment assets, a cannabis company can typically borrow from within the range of 40% to 75% of asset value. In the case of development projects, the loan is usually based on project costs. While less typical, there are some working capital debt options in the marketplace as well; though the availability of this option is much less than for real estate and equipment financing. Cannabis Commercial Real Estate Mid-Year Update

Convertible Options

Up to this point, most debt financing by cannabis companies was found in convertible note options with low conversion premiums – which essentially delay issuance/dilution of equity. The company creates a note that converts to equity at a future date based on a future valuation method. These notes have given investors security that they are repaid before equity holders if something goes wrong. For both the investor and the company this note structure allows the valuation question to be answered in the future while providing needed capital to the company and a more secure instrument to investors. Cannabis Commercial Real Estate Mid-Year Update

MTN – Short-Term Solution to Minimize Dilution with Funding at Single Digit Rates.

True, that the three alternatives listed above are considered the standard. Now, however, a new alternative is emerging, the Medium Term Note (MTN) for companies with relatively strong balance sheets. An MTN is an alternative to traditional long-term and expensive short-term financing – to aid a company with such objectives as accelerating a growth strategy, facilitating a roll-up M&A strategy. Cannabis Commercial Real Estate Mid-Year Update

Investor Takeaway

In just seven short years, including one full year under the curse of the pandemic, sales in the legal cannabis industry have gone from a standing start to $17.5 billion. And, with Americans now spending almost as much on legal cannabis as on Coca Cola, more capital is flowing more freely into the industry. Through May, capital raised in the cannabis industry totaled over $6.6 billion, compared to only a little over $2.3 billion during that same period in 2020. The industry is, in fact, becoming more like a traditional CPG marketplace. Due to the enormous need for increased revenue that every state faces coming out of the pandemic, more states are streamlining the sanctioning process, even down to the municipality level, to expedite the flow of new tax revenue. This booming marketplace in 2021 is generating renewed interest in cannabis commercial real estate (CRE) investments. Not only are more debt funding options becoming available to cannabis operators, but also how well the cannabis industry performed during the COVID-19 crisis has shown traditional financing sources and formerly reluctant landlords that the cannabis industry exhibits recession-proof qualities. Cannabis Commercial Real Estate Mid-Year Update

For CRE, interest is intensifying in the above-market-value, profitable cannabis CRE investments. To make those investments productive requires a resource that completely understands the national, state and municipality laws, the local ordinances, and the attitude of the community in which a property is located in order to expedite the process of a CRE investment destined to achieve a well-planned ROI. Cannabis Commercial Real Estate Mid-Year Update

How We Can Help

Next Step – Category Expertise Needed

After six long years processing millions of dollars in successful sell-side and buy-side transactions, we know the cannabis industry. We excel at structuring deals to meet client investment strategies in opportunities with our core expertise in Cannabis. And, we transact in other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell- or Buy-side client.