Biotech companies are racing for the vaccine to quell COVID-19. However, that’s not all that is driving this segment to increasingly higher levels of investment. Bioscience breakthroughs are advancing at a pace unmatched in history ever since the 1984 U.S. legislation disrupted the traditional drug development model by encouraging the manufacture of generics. This has prompted a transformation in the industry from the high market cap incumbents incurring the risks of internal pre-clinical R&D to a Mergers and Acquisitions model shifting the search for innovation to biotech startups. The Shift from Traditional Financing to M&A

Traditionally, biotech startups have turned to a limited number of sources to begin the search for large amounts of R&D capital needed to finally get their innovation to market.

- Grants and public funding from government, corporate and research organizations. While this is a highly prestigious avenue it is also the most competitive arena in which the search for initial funding is conducted.

- University funds – getting research started within universities has provided a degree of financial backing as well as access to valuable university resources.

- VCs – these sources carefully analyze and determine which startups provide the strongest potential for the highest return; while they also take a big enough share of the startup to make it worth their effort. They are particularly effective in later stage financing rounds as startups develop hard data.

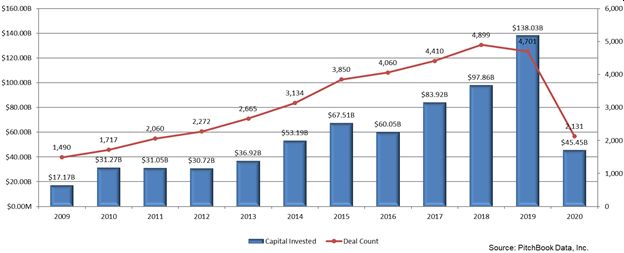

Tracking Total VC Activity in the Biotech Space - Private Investment by Biotech experts – this is the route being taken more frequently as biotech startups find themselves without a lot of hard data in order to support heavy initial capital outlays. This requires, of course, advisors and investors with a thorough understanding of the biotech space.

The Vital Role M&A Transactions Play

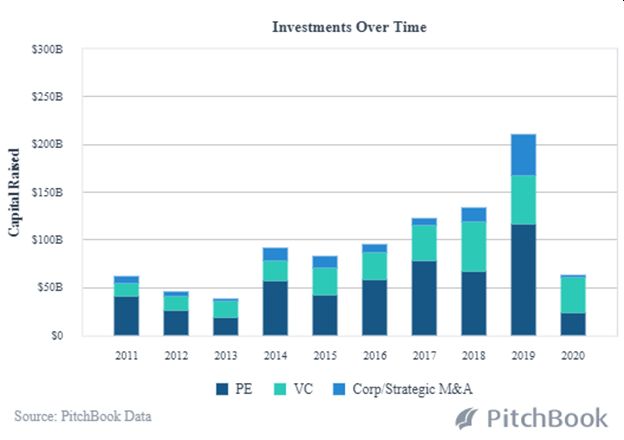

Due to its highly regulated environment and long product development timelines, and at a time when R&D costs continue to skyrocket at the large biopharmaceutical companies (up to a record setting $79.6 billion in 2018, as measured by Pharmaceutical Researchers and Manufacturers of America), Biotech investing has turned to greater VC and private investment involvement. And, that involvement is coming through the route of mergers and acquisitions. M&A activity, in fact, that exceeded $340 billion in 2019, the biggest year for M&A in the category since the firm Dealogic began tracking deals in 1995. Biotech journalists picking up on this branded 2019 The Year of the Mega-Merger (in biotechnology).

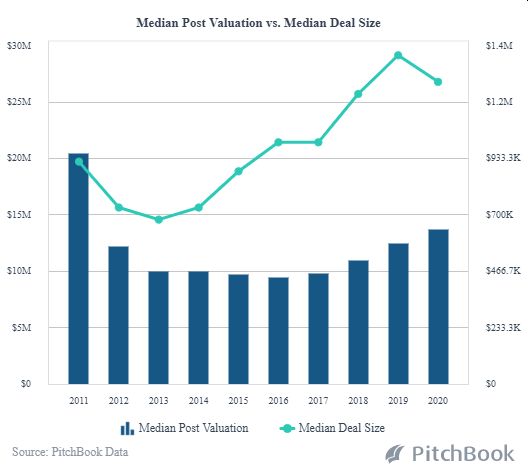

According to Pitchbook, VC funding in biotech and pharma startups more than tripled in the past decade – from $5 billion in 2009 to over $17 billion in 2019, with the median exit size of these biotech and pharma companies reaching an all-time high of $270.2 million that year. The VC deal value for healthcare startups jumped during that time from $9 billion to $30 billion in some 2,544 deals in the industry in 2019.

And VCs and PEs are meeting the need of Biotech companies in the most critical stage – Phase 1 critical trials.

Yet, our advice to biotech startups is that VC funding may not be the right course to take. In a demanding space like biotech obtaining VC funding is not an enviable task. Funding a biotech in a highly regulated industry is a complex challenge. Experienced advice is required on the costs associated with drug development, pre-clinical valuation and clinical trial testing. This makes private funding M&A deals for biotech and pharma companies a ready alternative for investors who are well aware of the amount of capital required to meet development and testing milestones. Then, once sufficient pre-clinical data is shown using angel and seed funding, founders are more likely to proceed along the fundraising timeline and raise early-stage VC rounds. The Shift from Traditional Financing to M&A

Guidance Toward the Right Choice

For our investor clients, here is the advice we provide as they assess the plethora of biotech opportunities that cross our desks:

- Patience – Startups with a therapeutic product must gather sufficient clinical trial data to convince regulators, such as the FDA, for clearance to go to market. Only at that point will the company begin generating revenue.

- The technology – critical, naturally, to thoroughly understand the technology and its place in the client’s investment strategy.

- Pre-Money Valuation – This is essential for the investor’s understanding of the equity stake being bought into.

- The team – how comfortable is the investor with the caliber and experience of the management team and how convincing is their dedication to change/improve people’s wellbeing? And, are they resilient?

- Credible funding plans – is there a clear and attainable path toward liquidity?

- Risk Assessment – what is the type of risk the investor is willing to take?

- Timing – is the investment prudent now before the onset of future risks?

- Exit – understand the company completely from their patent protection to the acumen of their management team to their exit strategy.

- Legal advice – consult with a law firm skilled in structuring legal documentation associated with the level of risk for this type of investment.

- A Competent Investment Advisory – preferably an advisory firm experienced in Biotech that is thoroughly familiar with the industry trends that will affect the future ROI.

In Summary

With the rapid pace of the creation of advanced techniques in the biotech industry, the intensity of capital needs has grown dramatically. Biotech entrepreneurs are faced with rapid burn rates while pre-clinical validation of a drug can drag on for a decade. In addition, investor expectations for early-stage biotech companies have risen in the footrace to solve mounting medical challenges. We advise our clients that as the industry races to solve some of the most pressing medical challenges, rigorous due diligence must be undertaken to ensure their capital in M&A transactions is being deployed in a manner mitigating the risk in a long-term exit strategy while optimizing the potential of maximum return. The Shift from Traditional Financing to M&A

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in highly regulated markets like Biotech, Healthtech, Pharma, CBD/Hemp, Cannabis and ancillary SaaS tech companies. We provide investors with thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+. Let’s talk about putting the power of this expertise and our network to work for you.