Into September the tide of M&A transactions in the cannabis industry continues to grow. Viridian Research reports 144 transactions YTD in 2021, compared to 32 in the same period last year. As consolidation has become “The Mantra of 2021,” as 420 Intel predicted, M&A transactions have grown in volume, size, valuation and significance to the industry.

Action in the Current Marketplace

Some of the most recent transactions of note:

- Marijuana Business Daily reported that two weeks ago TerrAscend Acquired Gage Growth in $545 million all-stock deal being the first of the major multi-state operators (MSOs) to begin consolidating the Michigan market – a market on track to become the second-largest legal cannabis state in the U.S.

- Another large-scale consolidation last week was Hydrofarm Holdings Group Inc. (NASDAQ: HYFM) acquired House & Garden Inc., Humboldt Wholesale, Allied Imports & Logistics, and South Coast Horticultural Supply Inc. (collectively to become “House & Garden”).

Investment source Benzinga reports the following:

- Cresco Labs $90 million acquisition of Cultivate

- Ayr Wellness $80 million acquisition of PA Natural Medicine

- The purchase of a $55 million license owned by Harvest Health and Recreation by Planet13 Holdings

- And Green Thumb Industries acquisition of Green Star Herbals for an undisclosed amount.

Biv.com reports that Ottawa-based Hexo Corp. (TSX:HEXO) is spending $235 million in an all-stock deal to acquire Vancouver’s Zenabis Global Inc. (TSX:ZENA). And Nanaimo-based Tilray Inc. (Nasdaq:TLRY) and Aphria Inc. closed a merger deal creating the country’s largest cannabis brand with 17% market share.

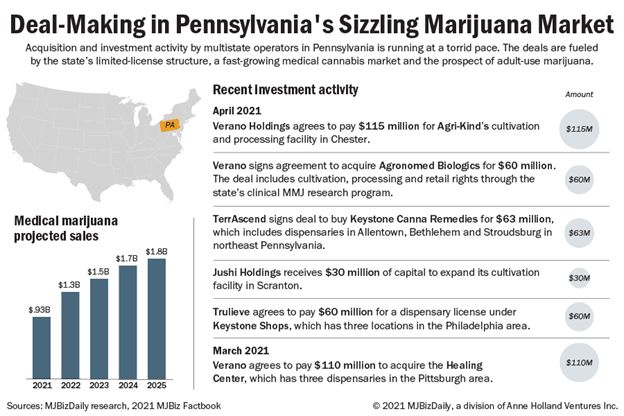

And, the word Marijuana Business Daily uses for the current M&A activity in Pennsylvania is “sizzling!” More than $400 million in M&A deals have been announced just since March alone. With the abounding growth of the Mid-Atlantic market local cannabis operators are selling out to large MSOs. Major MSOs active in the state are Chicago-based Green Thumb Industries, Cresco Labs, TerrAscend, Trulieve and Verano Holdings.

Driving Factors

Despite the abundance of money available to the large MSOs, most cannabis operators still have relatively few avenues to pursue raising capital – due the federal illegality of the industry. Currently legal cannabis companies are working in the peculiar situation of being fully compliant with state laws, but being completely at odds with federal legislation. All signs, though, point to the inevitability of full legal status as more enabling legislation – the SAFE Banking Act, the Marijuana Opportunity, Reinvestment and Expungement Act (MORE) among others – makes it’s way slowly through Congress. And substantiating the fact that consolidation will continue to be a driving force in the industry for some time to come MJBizDaily has found that the huge gap in valuation metrics between the largest market cap operators and smaller operators is what is prompting the growing volume of consolidations. They found:

Facing a significantly higher cost of capital makes growth more difficult, so companies with market caps less than $500 million increasingly will find it advantageous to combine with larger competitors to ensure ongoing development and to essentially share in the valuation arbitrage.

The Anatomy of an M&A Transaction in Cannabis

Most of what you have read above is not news to you. So, enough talk about the fact that so many transactions are and will continue to happen. Let’s get down to what does a transaction actually look like. Well, without actually naming one of our clients that has executed this successful M&A transaction, and with a “little” redaction, the following will reveal what we have found that leads to closing a win-win M&A deal in cannabis.

The SELLER

With Dispensaries in prominent cities throughout their state, the seller built a highly regarded reputation by their consumer education programs and the quality of the products they provided to the medical marijuana patients they served. Their aspiration was to achieve state licensing for not only provisioning centers, but also to become a vertically integrated operator qualifying for cultivation, processing, and adult- use licenses as well. The Seller’s objective was to be able to expand throughout their state ahead of the passage of adult-use in the state while retaining a majority ownership position in the final transaction in preparation for a potential RTO.

What we did for the Seller was to guide them through the full licensing process performing tasks for them varying from creating business plans for each of their separate operational entities, as was required by the state, to helping them produce pro formas, write personnel manuals and develop operational and security procedures. Once licensing was successfully achieved we then prepared the company for presentation to our network of investors for an M&A needed to enact their vertical integration plans. In that process we applied our vetting procedures to ensure the company met strict diligence requirements in order to find buyers who were the right fit. In that regard we performed the following services:

- Developed pro fomas for each business entity upon which a valuation for the company as a whole would be based

- Recommended the corporate structure for 280e and management purposes

- Made key personnel recommendations

- Set up the procedure for appointing an Advisory Board

- Prepared investor Pitch Deck and Executive Summary presentations

- Contacted our investor network and introduced the Seller to strategic Buyers

- And, as the funding discussions evolved into an M&A transaction, facilitated the negotiations between the parties throughout the entire process through closing

At each step we applied our stringent vetting process to ensure that the Seller only met with the most qualified buyers that were likely to be the right fit for the capital deployment objectives of both parties.

The BUYER

The buyer that emerged from our search was an established cannabis MSO operating in several states and was looking to the promise of the explosive growth in this state, on the verge of voting in adult-use, and was also interested in other surrounding states for expansion. The buyer had cash, well documented operational best practices and had valuable experience in other states that were transitioning from medical-only to recreational use. The Buyer’s objective: Expand its market coverage throughout this targeted state ahead of the passage of adult-use, while retaining a significant ownership position in any acquisition. (Uh oh, note the conflicting objectives between the Seller and the Buyer over ownership position. Read on for more about that.)

The DEAL:

Structuring the deal requires attention to every detail and patience as the due diligence process uncovers weaknesses that must be addressed to the satisfaction of both parties and to satisfy the state and municipality regulations and restrictions on mergers between in-state and out-of-state operators. From the arduous process and the posturing back and forth in the negotiation process we found that both parties were motivated and there was a logical fit. As the months rolled by, however, the inevitable conflict was brewing–the disagreement over the valuation and percentage of ownership. These issues became the main stumbling blocks of the various revenue/cashflow substantiation and deal-timing issues that surfaced during that courting process. Realizing a potentially deal-breaking showdown could come we helped both parties with the key element in any negotiation, building the personal relationships to build trust. Building the trust it takes to get over the hurdle of a seller losing control of all that the management team had worked so hard to build. This led to proposing a convertible note deal structure and credit facility that would allow the valuation issues to be established at a later date.

Finally, the structure of the deal was in place and the Buyer’s offer was on the table. The Seller would receive the much-needed infusion of expansion capital in the partnership they desired from the beginning of the process. A sizable portion of the purchase price was to be in cash, running counter to the trend at the time where stock was used to cover a disproportionate amount of the transaction. In addition, the management team of the Seller was to be given employment contracts to continue the successful operations for which they had been noted. The Buyer. Well, the Buyer did prevail after that relationship of trust between the parties was established and nurtured. The Buyer would, indeed, come away with the majority ownership stake in the newly formed entity.

To CLOSE, or NOT To CLOSE:

With all the pieces of the puzzle in place on the eve of closing the transaction it was now time for our team to relax, right? Well, NO. We discovered one last thing the lawyers for the parties had failed to do – take the basic step of setting up an escrow account to handle the exchange of paperwork and transfer of funds. Getting wind of this our Managing Partner swung into action and before the Seller and the Buyer even realized there was a major last-minute problem, a credible escrow company was secured and the closing proceeded without a hitch. Whew!

Conclusions from the Full Transaction Process:

So, what can we take away from this? Here are the principles our firm follows:

- The Vision of the Parties – all stakeholders to the M&A transaction must have a clear vision as to the direction toward profitability the marriage of the parties will take.

- Commitment – Once the decision is made that a Buyer’s objectives are better served by acquiring rather than taking the path of organic growth, all key management team members must fully buy into that direction.

- Prepare for Due Diligence – Sellers should be made fully aware of and be guided through the extensive due diligence investigation that will be required.

- Strategy and Execution – Buyers want a future plan they can build on for growth, a strong team, and a merging corporate culture that is a good fit.

- Time Kills Deals – so your advisors, lawyers, accountants and other stakeholders must realize that the price and terms of a deal don’t get better over time and negotiation exhaustion kills deals.

- The Only Thing Constant is Change – Target markets and target customers change rapidly over time. Fingers must be kept on the pulse of the marketplace for the intended goods and services of the merger so that expectations from the beginning of the process remain attainable at close.

- Competent Advice – a talented deal team with not only M&A experience, but also direct experience in cannabis is essential. Expectations for performance are important to clarify at the beginning of the process along with a clear understanding of the compensation the advisor will receive for the extensive services to be rendered.

What’s It Really Worth?

- Once it is confirmed that legal/compliance requirements are met, then the next major step is conducting a realistic valuation of the merged businesses. Your investment banking advisory should understand the idiosyncrasies of the cannabis industry in order to identify a valuation range that ensures the buyer is not overpaying and that the seller’s pro formas are verifiable and grounded in reality. Seeking Alpha reported on the SPAC Silver Spike Acquisition Corp. acquisition of Weedmaps, the widely use cannabis industry tech resource that provides dispensary locations and menus as well as other industry information. The firm was valued at $1.5 billion at an estimated $10 per share price, but early trading was at $24 per share which would equate to a $3.6 billion market cap. That huge valuation, the equivalent of 17x 2021 revenue, makes Seeking Alpha a little hesitant about the stock at this time. In a more sober transaction Merida Merger Corp. I announced the signing of a deal to acquire the cannabis industry information source Leafly. Leafly boasts of over 120 million annual visitors to their site and >10 million monthly active users. Reed Smith LLP reports that the valuation for Leafly was calculated as 5.9 x 2022 estimated revenue. This, they say, is within the range they have been seeing in cannabis M&A recently. And, we agree with their assessment.

Once the vetting process is completed the outreach process begins to all potential qualified acquirers. Our contact list numbers in the tens of thousands of PE firms, MSOs, Pubcos, HNW, Family Offices and other qualified investors. We contact them and introduce the opportunity with a redacted executive summary. For additional information they are required to sign our Non-disclosure agreement and then they’re invited to access the diligence locker with pitch deck and financials prior to having a Q&A call with the Sellers.

Investor Takeaway

In previous issues of The EDGE we have monitored the rising tide of cannabis industry Mergers & Acquisitions pointing out that: over 144 transactions occurred YTD in 2021, compared to 32 in the same period last year. The industry is at that stage between the growth phase and the beginning maturity which sparks consolidation.

As more sources of capital become available the trend we are seeing in M&A activity will most likely increase. This will enable MSOs to build market share and roll out into new markets. And, company management can now be measured by the financial results, of achieving substantial EBITDA and positive cash flow. So, smaller, single-state operators are advised to begin the necessary pipeline and diligence efforts now to be ready for consolidation opportunities where the window of opportunity can close quickly.

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A and non-dilutive debt financing.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.