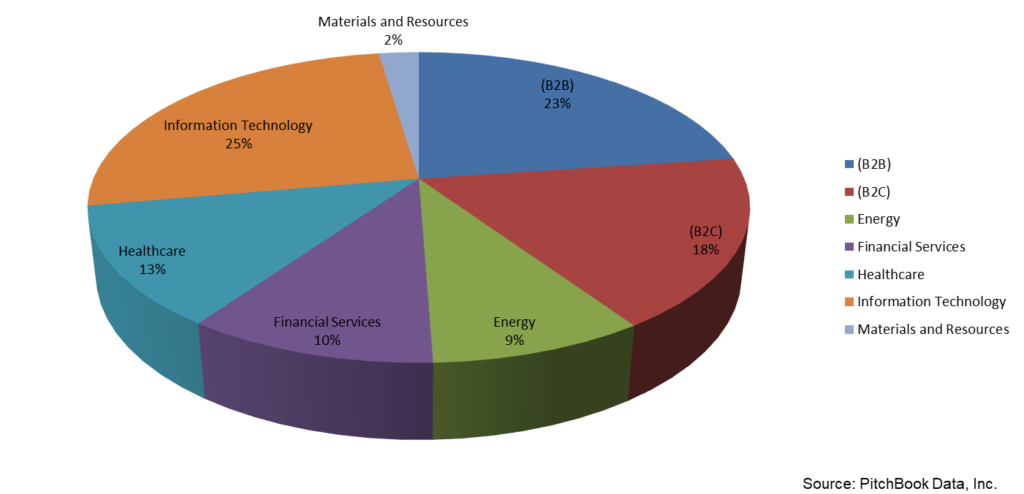

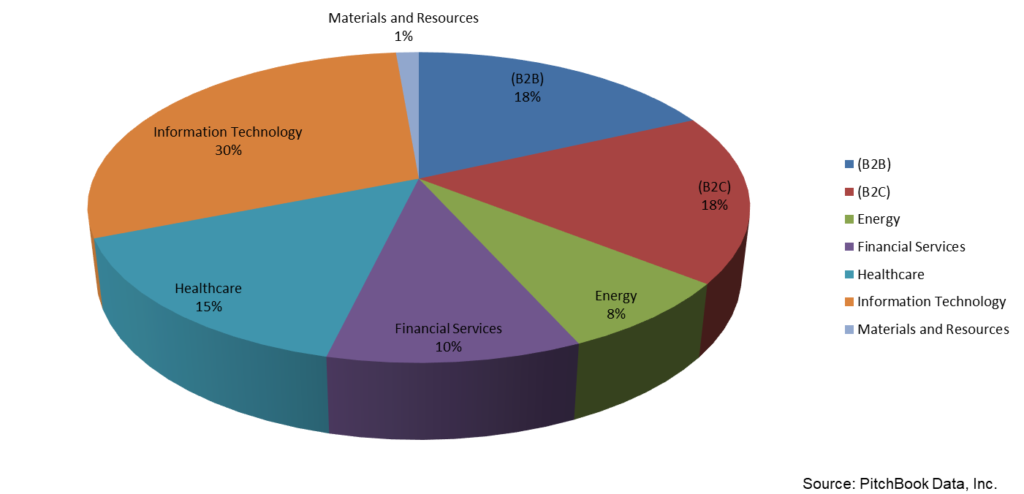

At the close of a year much more like the ringing in of the Apocalypse rather than a year of private investment opportunity certain sectors have remained strong. Industrials, chemicals, biopharma, and TMT sectors all saw a total value increases Q1 through Q3 over the same period last year. The breakdown of PE funding into major industry classifications to this point in time closely parallels VC investment. 2021 Investment Strategy from Lessons Learned in 2020

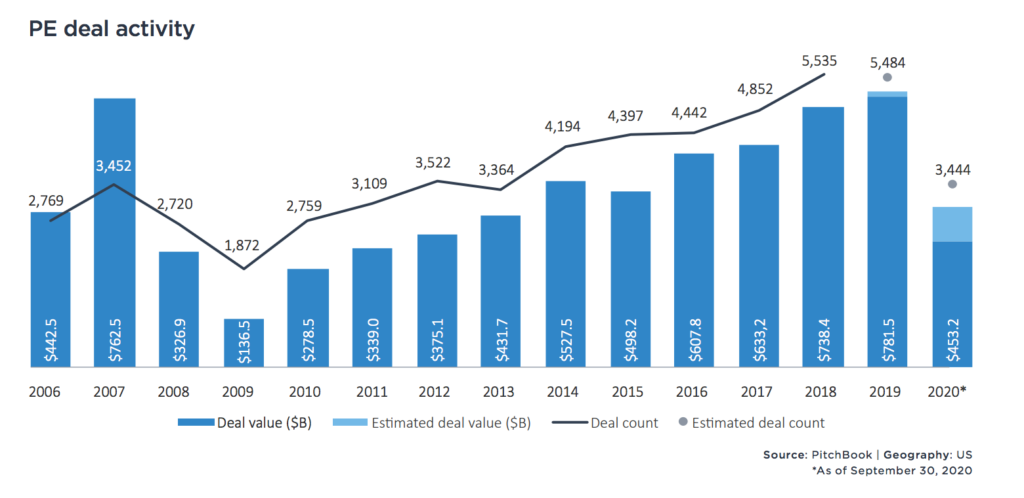

Of course, the onset of COVID-19 along with societal and political issues dealt a knock down punch to PE deals at the end of Q1. Investment activity heading into Q3, on the other hand, showed just how resilient PE deal making can be. Q1 was mainly unaffected by the pandemic. The near record-setting drop in the financial markets in Q2, however, saw only $116B raised according to Perqin data, the lowest since 2018, total raise of $110B. While Q3 jumped to 3,444 PE deals registered in the U.S. accounting for more than $450B. 2021 Investment Strategy from Lessons Learned in 2020

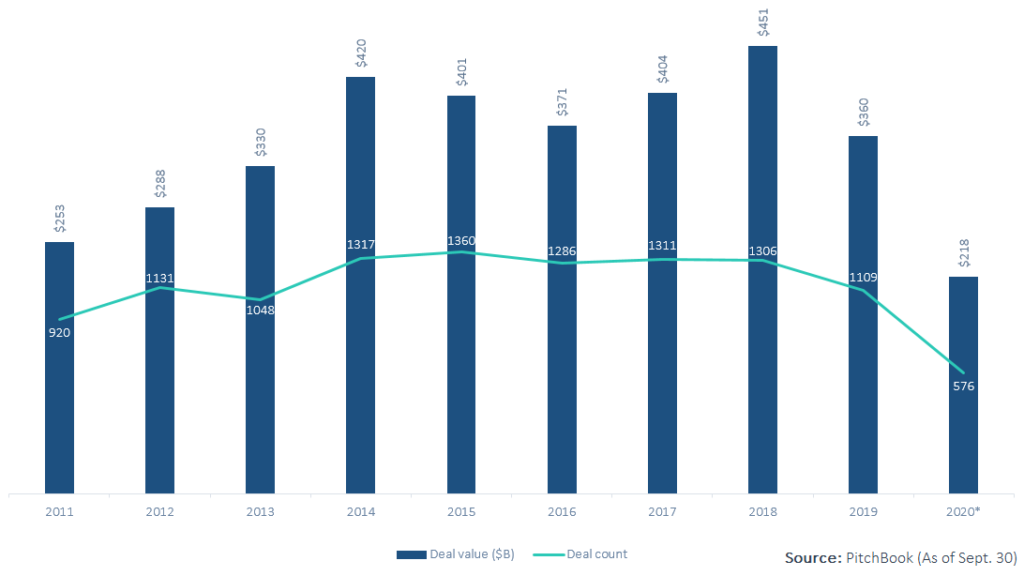

Another surprising development leading to elevated expectations of what 2021 may look like is that also in Q3, $233B of exit activity transpired. This dramatic increase from the previous quarter was the highest quarterly total for exits for the past several years.

The accumulating data is indicating that 2020 could be the shortest-lived bear market on record and the rising deal value in Q3 over the same period last year shows how well positioned the PE market is in the long-term to overcome the detrimental effects of the pandemic.

A Year of Transformational Investing

Accelerated transformational investing is the most conspicuous development in capital markets in the tumultuous year of 2020. In Q2 private equity experienced the worst of the pandemic to this point in time, at least, and employed as a defense a risk avoidance strategy. Buyout volumes globally dropped 40% compared to Q2, 2019. Previously established valuations were called into question during this time. And, even the mandate for “social distancing” complicated due diligence and the deal closing process. Lessons learned in this bizarre period set in motion trends that will resonate in portfolio strategies throughout the coming year. 2021 Investment Strategy from Lessons Learned in 2020

Digitization

A common thread that ran through the most resilient companies during the pandemic and all the other accompanying 2020 turmoil is the adoption of technology – digitalization of operations and customer-centric production and service. Those companies that had not optimized operations are now scrambling to find technology that will enhance the performance of existing assets.

The Emergence of Debt Financing

What has reached new heights in the face of the pandemic is the continued hockey stick growth of private credit. From a segment of PE funding worth around $40B in the U.S. in the last year of the dot-com bubble, 2000, the total today has reached over $800B. This now has become a common source of deal funding, particularly in the arena of leveraged buyouts. More than ever now, with little change in low interest rates being anticipated, the high cash yields in private debt are attracting investors to direct loans. 2021 Investment Strategy from Lessons Learned in 2020

Diversification

2020 substantiated the value of diversification. In many cases brands that held secure market share positions in their specialty found their market abruptly shut down, even regulated against. This has begun a quest for long-term viability of even the most popular brand names through diversification. In fact, as reported by S&P Global, in Q3 PE firms have, in fact, begun diversifying the area of focus of their portfolios from a laser-focus on stabilizing their existing portfolios, to making new selective investments “likely in order to take advantage of low-asset valuations in certain sectors,” the report states.

Brexit

Ramifications of other major market transformations around the globe became apparent in 2020. Of great significance is Brittan’s coming departure from the European Union. Planning for major adjustments began in earnest in 2020 for long-term strategic planning, financial and supply chain relationships, workforce requirements and product/service pricing across literally all British industries. How this will be accomplished will be one of the largest transformational developments throughout 2021.

The Substantiation of the Future of Blockchain

Blockchain, once only associated with the inscrutable beginnings of the cryptocurrency market, is becoming a strategic enterprise priority as stated by the majority of executives in Deloitte’s 2020 Global Blockchain Survey. This distributed system of recording and storing transaction records is already attracting millions of dollars of funding. According to a Digital Authority Partners report, blockchain in the healthcare market alone is expected to reach $890.5 million by 2023. Blockchain is being relied upon to solve the widespread problems of siloed data on interoperability and non-standardization in healthcare information systems – increasing the security and privacy of personal healthcare data.

More about where the smart money is headed in blockchain investments can be found at this link to the blog section of our Website in the article: Blockchain Brings Database Management to Healthcare.

Commitment to ESG

2020 saw PE firms making increasingly strong commitments to environmental, social, governance (ESG) policies in their investment strategies. A report in ThinkAdvisor finds that this is being done for reasons of practicality as well as social responsibility. A cornerstone objective of ESG, increasing of energy efficiency, carries over to resulting savings to the bottom line of business operational efficiency. That same report documents PE looking beyond first-order effects of investments for the implications on second- and third-order effects in the aftermath of the pandemic. One example of this from a McKinsey report is how investments in technologies like micromobility and autonomous vehicles will be affected by social distancing brought on by the pandemic. Another example is the role racial and gender equity is playing in the analysis of a prospect’s operating culture as well as its financial performance. 2021 Investment Strategy from Lessons Learned in 2020

Where is the Smart Money Headed in 2021?

So, what does this portend for smart money investments in 2021? Well, most traditional sources are still finding it difficult to forecast. Unanswered questions persist as 2021 approaches.

- As infection rates are rising once again, when will the country finally find its way out of the pandemic?

- Will a vaccine rebuild activity and confidence in the economy in the near future?

- What will the next economic stimulus be and what will the trade-off be from this one-time payment vs. the extension of unemployment benefits?

- What will the make-up of the U.S. Senate finally be – relating to how the Biden Administration’s tax plans will be affected?

- Biden’s plan would raise the corporate rate from 21 to 28% and the carried interest tax would be treated as income rather than capital gains. (Of course, we are all painfully aware that corporations don’t actually “pay” taxes anyway. Their obligations simply get passed on to consumers as price increases.) To this would be the added burden for those earning over $400K having taxable income of an extra 2.6%, for a total 39.6% tax rate.

The question on all our minds, will there be a deal surge to kickoff 2021? Well, there just may be an answer to that burning question in the rise in buyout activity in Q3 that we quoted earlier in this article. There is no shortage of PE dry powder, which Pitchbook estimates to be around $1.5 trillion. We know there will be winners regardless of the way the pandemic plays out. Not only certain drug makers will benefit from the COVID-19 vaccine, but also think about the enormous logistics task that will be needed to distribute the vaccine. And, major capital movement into the biopharma is by no means limited to the pursuit of the COVID-19 vaccine. This fast-paced industry encompasses a divergent array of segments that vary from pharmaceuticals and healthcare, to biotech, gene therapy and neuroscience which will continue to attract keen investor interest. In technology, look at the state-by-state legal struggles that the FAANG companies are facing and think about all the smaller tech companies poised to step in for a bigger piece of the pie than the giants allowed them in the past.

Investor Takeaway

In spite of the uncertainties as the tumultuous year 2020 comes to it disconcerting end, analysts such as the CEPRES investment platform are of the opinion that 2021 has all the potential of being the best year yet for the private markets. Successful deals can be made with firms that have advanced to the point of digitalizing to gain strategic advantage with improved operations, products and customer service delivery. At a time of continued uncertainty, however, it is not technology alone that will better position companies for future exit. The ability to rapidly assess and act upon adjacent markets, to diversify revenue streams, and to engage customers with a value proposition that encompasses a commitment to ESG, give a prospective investment opportunity the potential for outsized ROI. 2021 Investment Strategy from Lessons Learned in 2020

Guidance Into 2021 Investment Opportunities

High potential reward investments require an extensive vetting process. Before making recommendations to our clients about Seed or Series A, B rounds, we subject a prospect to our internal vetting regimen – in order to set investors’ expectations, ensuring they are not overpaying, and ensuring that the investment prospect has validated all the information in its data lockbox. Key issues examined are:

- The technology – critical, naturally, to thoroughly understand the technology and its place in the client’s investment strategy.

- The team – how comfortable is the investor with the caliber and experience of the management team and how convincing is their dedication to critical business as well as ESG issues? And, are they resilient?

- Revenue – are there high cash-flowing assets?

- Credible funding plans – is there a clear and attainable path toward growth/toward enhanced profitability?

- Regarding the potential for growth – what is their grasp on the secular trends in their marketplace?

- Risk Assessment – what is the type of risk the investor is willing to take?

- Timing – is investment prudent now before the onset of future risks?

- Exit – understand the company completely from their patent protection to the acumen of the management team to execute their planned exit strategy.

- Legal advice – consult with a law firm skilled in structuring legal documentation associated with the level of risk of the investment being contemplated.

- A Competent Investment Advisory – preferably an advisory thoroughly familiar with key industry trends that can introduce new opportunities mitigating risk that will affect the investor’s ROI.

How We can help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean Energy/ClimateTech, Cannabis and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.